Industrial Bulk Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Industrial Bulk Packaging Market is segmented By Product (Drums, IBC, Pails, Totes/Crates, Others), By Application (Chemicals & Pharmaceuticals, Food ....

Industrial Bulk Packaging Market Size

Market Size in USD Bn

CAGR4.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.8% |

| Market Concentration | Medium |

| Major Players | Grief, BWAY Corporation, Cleveland Steel Container, Composite Containers LLC, Eagle Manufacturing Company and Among Others. |

please let us know !

Industrial Bulk Packaging Market Analysis

The Global Industrial Bulk Packaging Market is estimated to be valued at USD 26.5 Bn in 2024 and is expected to reach USD 38.8 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2031.

The industrial bulk packaging market is expected to witness significant growth over the forecast period. Traditionally, drums were the primary choice for bulk packaging in industries such as chemicals, pharmaceuticals, and food and beverage. However, with growing awareness about environmental protection, industries are shifting towards reusable bulk containers. Rigid intermediate bulk containers (RIBCs) offer advantages such as reusable and returnable nature, ease of cleaning, and ability to store and transport bulk liquids and solids. Growing industrialization and global trade have increased the demand for efficient and sustainable bulk packaging solutions. Moreover, stringent safety and quality regulations regarding transportation and storage of hazardous chemicals are also driving the adoption of reliable industrial bulk containers.

Industrial Bulk Packaging Market Trends

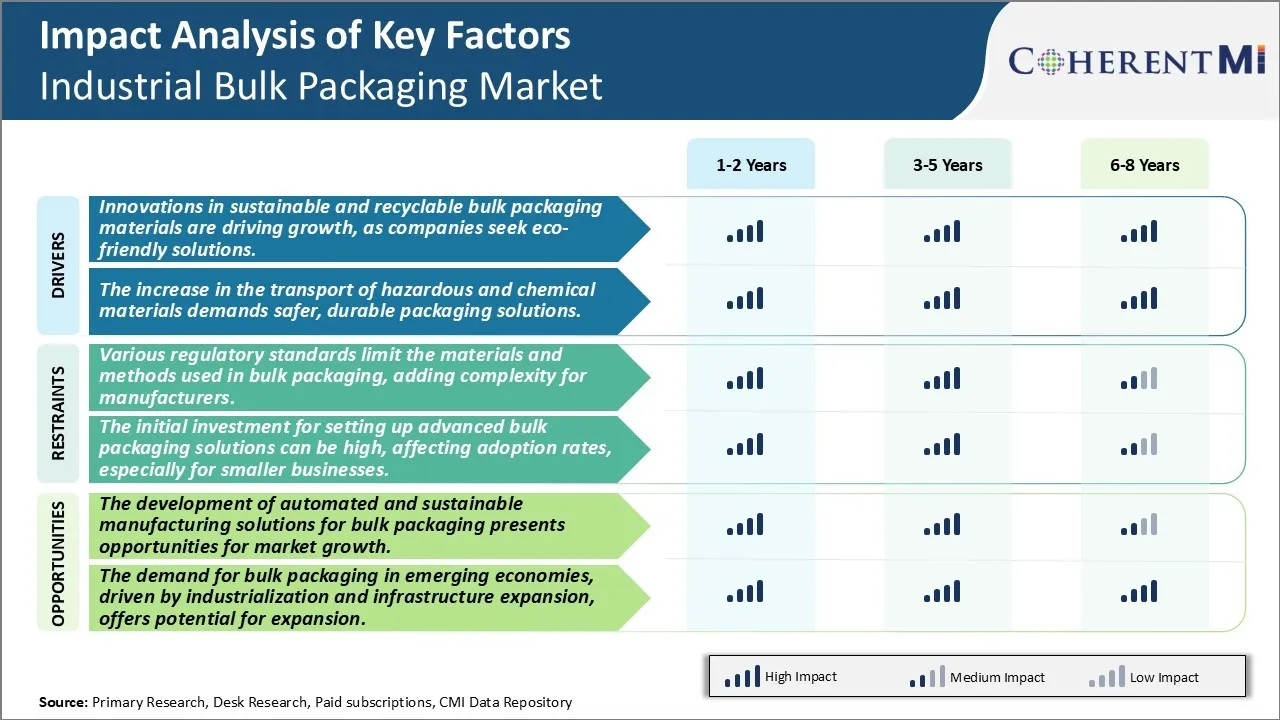

Market Driver - Innovations in Sustainable and Recyclable Bulk Packaging Materials are Driving Growth, as Companies Seek Eco-Friendly Solutions

With increase in environmental concerns globally, companies are constantly pushing boundaries to develop sustainable packaging solutions for transporting goods in bulk. There is a strong push towards reducing plastic waste and investing in renewable resources. Biodegradable packaging made from agricultural residues like bagasse, wheat straw and husk have shown promise. Such materials can be processed similar to plastics but are gentler on the environment. Given the push for sustainability goals and net zero commitments, many consumer brands and industrial manufacturers are actively seeking packaging supplies that have lower carbon footprint over the product life cycle.

Innovators are experimenting with novel material formulations derived from agricultural by-products and food processing residue. For example, one startup has developed bags for bulk transport of seeds, fertilizers etc. using fully biodegradable films made from corn starch and cassava. As these break down without harming soil quality or releasing greenhouse gases, they are gaining popularity among farm sector buyers. Likewise, researchers are working on composite mixes of recycled paper pulp and polylactic acid derived from sugarcane or corn. Such materials provide adequate strength for shipping large volumes while ensuring recyclability. Supported by government incentives and green procurement policies, adoption of renewable packaging alternatives is growing across industries like food processing, mining, construction etc.

Another notable shift is towards reusable and refillable systems that utilize standardized containers. Major automotive part makers have launched pooling programs where sturdy IBCs or bulk bags are leased and extensively used before retirement. By reducing single-use packaging, these programs help lower material consumption and disposal costs. Technological advances like smart sensors and IoT devices are enhancing traceability of reusable totes in transit. This boosts their reuse potential before repairs or replacement. Overall, innovations providing eco-packaging solutions tailored to quantity demands of key industrial segments are fueling growth in the bulk packaging market.

Market Driver - The Increase in The Transport of Hazardous and Chemical Materials Demands Safer, Durable Packaging Solutions

With growing complexities in global supply chains, long distance shipments of hazardous materials have become commonplace. From chemicals and industrial gases to nuclear waste and minerals, a range of dangerous goods require specialized packaging to maintain safety standards. However, existing containment solutions have limitations regarding strength, leak resistance and damage tolerance under extreme conditions. Recognizing the stringent performance needs, packaging innovators are developing advanced material formulations and designs optimized for hazardous cargo transport.

One notable technology gaining ground is high-barrier multilayer plastics incorporating nanoclay particles. When nanoclays are interleaved between polymer sheets, their uneven edges and high aspect ratio act as absorption sites for contaminants while reinforcing structural integrity. Manufacturers are utilizing such nanocomposite formulations to produce IBCs, drums and bulk bags exhibiting high impermeability to liquids and gases even after impacts or cuts. Similarly, composites of specialty fibers like aramid, ultra-high molecular weight polyethylene and glass woven with epoxy resins result in packaging with unmatched puncture and cut resistance even in presence of aggressive chemicals.

Adoption of strong but lightweight composite structures has also enabled the use of reusable bulk containers for multiple shipment cycles. Advanced condition monitoring allows detecting even minute defects so that repairs can be scheduled well in advance. Telematics solutions provide real-time tracking of containers along with environmental data on exposure to temperature fluctuations, pressure changes and vibrations. This helps assess maintenance needs and validate conformance to transportation regulations over extended usage periods. As hazardous cargo transportation becomes more complex globally, demand for super-durable and smart packaging will continue to intensify in the coming years.

Market Challenge - Various Regulatory Standards Limit the Materials and Methods Used in Bulk Packaging, Adding Complexity for Manufacturers

Various regulatory standards limit the materials and methods used in bulk packaging, adding complexity for manufacturers. Different jurisdictions impose different restrictions on acceptable materials for dry and liquid products, as well as barrier requirements and closure specifications designed to ensure safety and product integrity during transport. Complying with these standards involves significant research and testing for packaging designers to ensure their solutions meet all applicable rules. Additionally, standards are constantly evolving as new research highlights different environmental or health impacts. This forces manufacturers to continually monitor changes and update their product designs proactively to maintain compliance. The scale of the bulk packaging industry means even minor adjustments can involve lengthy requalification procedures across supply chains. Such regulatory hurdles increase business costs for stakeholders and make it harder to expand into new markets or rapidly commercialize innovative packaging technologies. However, protecting public safety and the environment remains important, placing regulatory authorities in a difficult position of balancing these priorities with commercial interests.

Market Opportunity - Automated Manufacturing Creates an Opportunity for Market Growth

The development of automated and sustainable manufacturing solutions for bulk packaging presents opportunities for market growth. Adapting production lines with robotics and digital fabrication equipment allows standardized components to be mass-produced more efficiently. This leads to lower unit costs while maintaining stringent quality control. Automation further supports customization at scale through flexible modular design and on-demand printing/assembly techniques. Digitally managing fabrication data also enables easier regulatory compliance reporting. Meanwhile, the use of recycled/recyclable materials in automated manufacturing supports trends toward Circular Economy business models and packaging ecologically fit for a low-carbon future. Developing cost-effective and scalable automation serves bulk packaging producers, product brand owners, and other supply chain actors through competitive pricing, fast design iteration, and sustainability benefits. It positions the industry for continued long-term growth addressing demands across numerous markets like chemicals, food and agriculture which rely on solutions for efficient bulk transport and storage in line with environmental protection goals.

Key winning strategies adopted by key players of Industrial Bulk Packaging Market

- Mergers and Acquisitions: Companies like Greif, Inc. and Berry Global have acquired other firms to strengthen their portfolio and expand their presence in specific regions and sectors. For example, Greif acquired Centurion Container LLC, enhancing its intermediate bulk container (IBC) capabilities

- Sustainability Initiatives: A growing focus on eco-friendly and recyclable packaging materials is driving innovation. Pakka Limited introduced compostable flexible packaging in India, while companies like UFlex and Pluss Advanced Technologies launched sustainable, temperature-controlled packaging solutions for sectors such as pharmaceuticals

- Technological Advancements: Innovations in packaging technologies are becoming prominent. For example, Emmeci S.p.A. launched an automated, mold-less packaging machine (OD500 R), providing efficient and sustainable solutions for high-quality reusable products. This focus on technology is aimed at improving operational efficiency and reducing environmental impact.

Segmental Analysis of Industrial Bulk Packaging Market

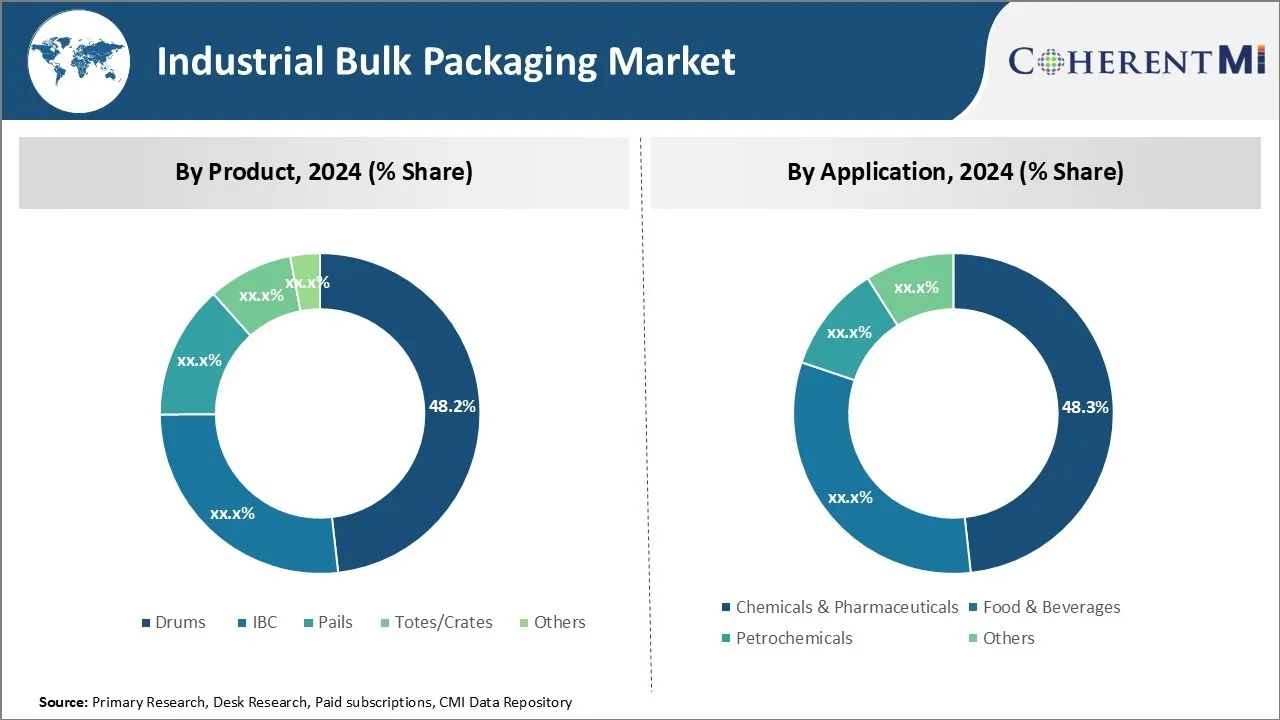

Insights, By Product, Drums Accounted for a Significant Market Share in 2024

By Product, Drums contributes the highest share of the market owing to its versatility and cost-effectiveness. It is projected to account for a market share of 48.2% in 2024. Drums make up the largest share of the industrial bulk packaging market due to factors centered around their versatility and cost benefits. Drum packaging is suitable for a wide range of liquid and dry bulk materials, making it the go-to solution for many industrial applications. Whether chemicals, oils, solvents, or other fluids, drums provide effective containment during transport or storage. Their cylindrical shape packs efficiently into trucks and warehouses to maximize space usage.

Moreover, drums are a reusable and recyclable format, lowering costs over time compared to single-use alternatives. Proper maintenance extends drum lifespan through multiple product transfers or shipments. Many drums are constructed of metal which is highly durable, protecting contents from damage during handling. Plastic and fiber drums offer lighter weight options for non-hazardous materials. All drum styles feature tight-fitting removable lids to reliably seal contents.

Customization further expands drum applications. Optional accessories incorporate pumps, spigots, or compressed air lines to simplify filling and emptying. Liners interior coatings prevent corrosion and contain certain product types. External labeling adheres to regulatory packaging, handling, and safety standards. Contract fillers provide one-stop drum services for companies without those capabilities in-house. The combination of wide material compatibility and value-driven economics cements drums as the leading product segment.

Insights, By Application, Chemicals & Pharmaceuticals Drives Highest Market Share for Industrial Bulk Packaging Applications

By Application, the chemicals and pharmaceuticals are expected to account for 48.3% in 2024. The chemicals and pharmaceuticals end-use industries represent the biggest consumers of industrial bulk packaging. Strict storage and transportation regulations to maintain product quality and ensure safety mandate specialized containment solutions. Toxic, volatile, or reactive substances require carefully engineered packaging with seals, vents, grounding, and pressure relief mechanisms.

Facilities producing, processing, and distributing chemicals rely on assorted tank and intermediate bulk container (IBC) styles. Raw material and waste transport necessitates tough, chemically-resistant totes, drums, and pails. Liquid handling leverages various sized portable tanks and rigid intermediate containers from 500-3000L capacities. Complex supply chains splitting, mixing, and reformulating components depend on consistent packaging standards.

Similarly, pharmaceutical manufacturers depend on drums, totes and custom IBCs/totes to transfer active ingredients, solvents, and mixtures between production steps. Final product is drummed or pailed for shipment to filling lines. Strict compliance with cGMP protocols and tamper evidence protects intellectual property and brand reputation. Global medical product distribution channels stringently manage package integrity.

Additional Insights of Industrial Bulk Packaging Market

The industrial bulk packaging market is expanding due to increasing industrialization, especially in the Asia-Pacific region. Rising demand for safe and efficient packaging in sectors such as chemicals, food, and pharmaceuticals drives market growth. The adoption of sustainable packaging materials is an essential trend, with manufacturers focusing on recyclable and reusable options. Regulatory frameworks, especially in developed countries, mandate compliance with environmental standards, prompting companies to innovate in sustainable packaging. In North America, the market benefits from advanced logistics infrastructure and is supported by strong strategic partnerships.

Competitive overview of Industrial Bulk Packaging Market

The major players operating in the Industrial Bulk Packaging Market include Grief, BWAY Corporation, Cleveland Steel Container, Composite Containers LLC, Eagle Manufacturing Company, Hoover Ferguson Group, Inc., International Paper, Myers Container, Time Technoplast Ltd. and Peninsula Drums.

Industrial Bulk Packaging Market Leaders

- Grief

- BWAY Corporation

- Cleveland Steel Container

- Composite Containers LLC

- Eagle Manufacturing Company

Industrial Bulk Packaging Market - Competitive Rivalry, 2024

Industrial Bulk Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Industrial Bulk Packaging Market

- In June 2024, Coveris partnered with Interzero to enhance plastic recycling and waste management for packaging. This partnership advances circular economy goals by offering closed-loop solutions.

- In June 2024, Parkside introduced recyclable metallized barrier paper for non-food and food packaging applications, supporting sustainable solutions in sectors like healthcare and snacks.

- In June 2024, Univation Technologies launched the UNIGILITY Tubular High-Pressure Polyethylene Process Technology, aiding in the production of eco-friendly, durable packaging for food and industrial uses.

- In March 2024, Gravis announced its new brand identity, becoming North America's largest engineered bulk transportation packaging provider by merging six top industries to strengthen its supply chain expertise.

Industrial Bulk Packaging Market Segmentation

- By Product

- Drums

- IBC

- Pails

- Totes/Crates

- Others

- By Application

- Chemicals & Pharmaceuticals

- Food & Beverages

- Petrochemicals

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Industrial Bulk Packaging Market?

The Global Industrial Bulk Packaging Market is estimated to be valued at USD 26.5 Bn in 2024 and is expected to reach USD 38.8 Bn by 2031.

What will be the CAGR of the Industrial Bulk Packaging Market?

The CAGR of the Industrial Bulk Packaging Market is projected to be 4.8% from 2024 to 2031.

What are the major factors driving the Industrial Bulk Packaging Market growth?

The innovations in sustainable and recyclable bulk packaging materials are driving growth, as companies seek eco-friendly solutions. and the increase in the transport of hazardous and chemical materials demands safer, durable packaging solutions are the major factors driving the Industrial Bulk Packaging Market.

What are the key factors hampering the growth of the Industrial Bulk Packaging Market?

The various regulatory standards limit the materials and methods used in bulk packaging, adding complexity for manufacturers. and the initial investment for setting up advanced bulk packaging solutions can be high, affecting adoption rates, especially for smaller businesses are the major factors hampering the growth of the Industrial Bulk Packaging Market.

Which is the leading Product in the Industrial Bulk Packaging Market?

Drums are the leading Product segment.

Which are the major players operating in the Industrial Bulk Packaging Market?

Grief, BWAY Corporation, Cleveland Steel Container, Composite Containers LLC, Eagle Manufacturing Company, Hoover Ferguson Group, Inc., International Paper, Myers Container, Time Technoplast Ltd., Peninsula Drums are the major players.