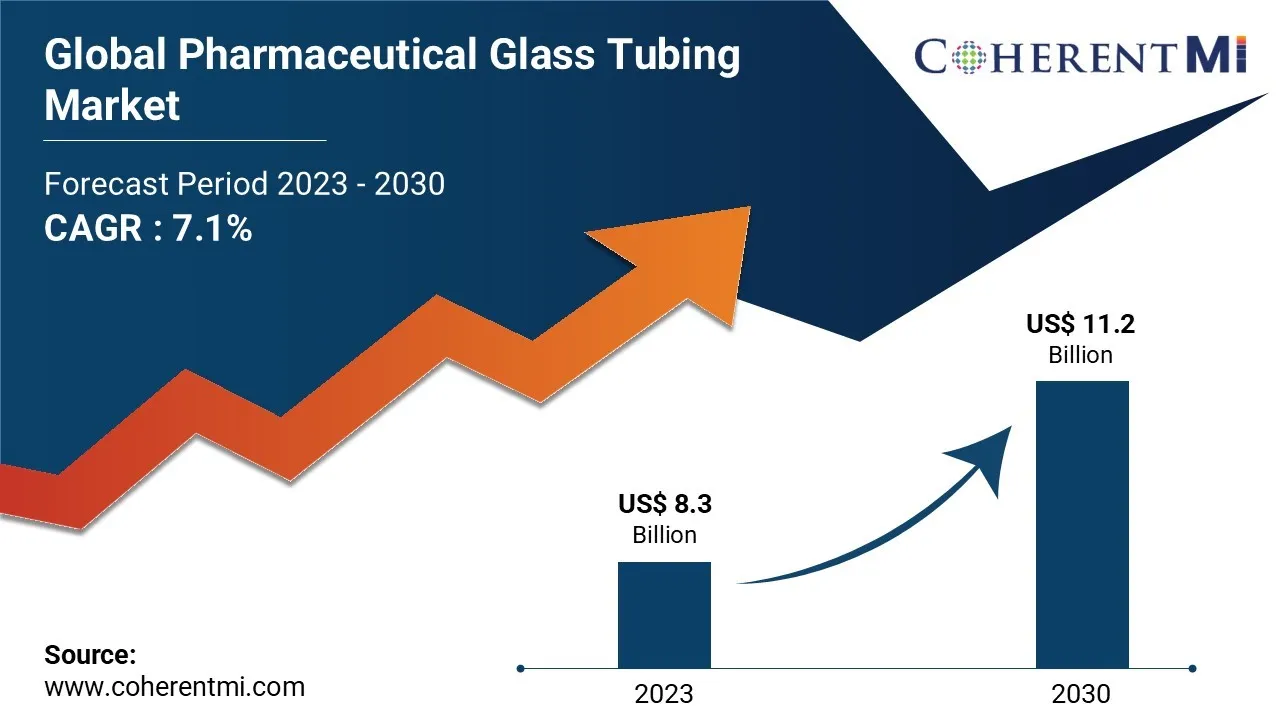

The pharmaceutical glass tubing market is estimated to be valued at US$ 8.3 Bn in 2023 and is expected to exhibit a CAGR of 7.1% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Key Market Takeaways:

The global pharmaceutical glass tubing market is anticipated to witness a CAGR of 7.1% during the forecast period 2023-2030, owing to increasing healthcare expenditure and stringent regulations.

- On the basis of product type, vials are expected to hold a dominant position, accounting for over 30% market share in 2023, owing to their widespread application in packaging parenteral drugs and vaccines.

- On the basis of end user, the pharmaceutical segment is expected to hold a dominant position over the forecast period, due to high demand for glass containers in pharmaceutical manufacturing.

- On the basis of distribution channel, distributors are expected to hold a dominant position over the forecast period, owing to their role in supplying glass tubing to pharmaceutical manufacturers and product filling stations.

- On the basis of manufacturing process, tubing is expected to hold a dominant position over the forecast period due to its high utilization in producing vials and cartridges.

- On the basis of region, North America is expected to hold a dominant position over the forecast period, due to presence of major pharmaceutical glass manufacturers and stringent regulatory environment.

Pharmaceutical Glass Tubing Market Report Coverage

|

Report Coverage |

Details |

|

Market Revenue in 2023 |

USD 8.3 Billion |

|

Estimated Value by 2030 |

USD 11.2 Billion |

|

Growth Rate |

Poised to grow at a CAGR of 7.1% |

|

Historical Data |

2018–2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, By End User, By Distribution Channel, By Manufacturing Process |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Growth Drivers |

• Rising Demand for Injectable Pharmaceuticals • Growth of Biopharmaceutical Industry |

|

Restraints & Challenges |

• High Costs than Alternate Packaging |

Market Dynamics:

The growth of the pharmaceutical glass tubing market is majorly driven by the increasing demand for pharmaceutical packaging from the pharmaceutical industry. Pharmaceutical glass tubing is extensively used in packaging of pharmaceutical products such as caps and closures, cartridges, and ampoules owing to properties like chemical inertness, transparency, and sustainability.

Additionally, rising chronic diseases and increasing healthcare expenditure in emerging nations is further fueling the demand for pharmaceutical products, which in turn boosts the growth of pharmaceutical glass tubing market.

Market Trends:

- Borosilicate glass is widely adopted in the pharmaceutical glass tubing market owing to properties like high chemical resistance, low thermal expansion, and excellent thermal shock resistance. These properties make borosilicate glass tubes suitable for packaging highly active drugs.

- Manufacturers in the pharmaceutical glass tubing market are focusing on providing customized glass tubing as per requirements of end-use industries. Customized glass tubing with specified chemical composition, shape, and sizes are gaining popularity in the pharmaceutical packaging industry.

Market Opportunities:

- With an aging global population and increasing prevalence of chronic diseases, demand for parenteral drugs is growing. This is fueling the need for pharmaceutical glass tubing used to produce vials and cartridges for injectable drug delivery.

- Pharmaceutical companies are facing stricter regulations regarding contamination control in pharmaceutical packaging. Regulatory bodies like the FDA require glass containers for drugs to be free of particulates and defect-free. This is propelling drug manufacturers to use pharmaceutical glass tubing from quality-tested manufacturers.

Competitor Insights

Key players in the pharmaceutical glass tubing market include:

- Schott AG

- Nipro Pharma Corporation

- Corning Incorporated

- NEG Glass

- PreCision Glass & Packaging

- Shandong Pharmaceutical Glass Co., Ltd.

- Borosil Glass Works Ltd.

- Thermo Fisher Scientific

- Richland Glass

- Haldyn Glass Ltd.

- Duran Group GmbH

- Epax Systems

- Linuo Group Glass Products Co., Ltd.

- JSG Pharma

- Fushan Technology

- NAFEMS

- Saverglass Group

- Bormioli Rocco S.p.A.

- SGD S.A.

- Qorpak (Division of Berlin Packaging)

Recent Developments:

- In January 2024, SCHOTT reported a 4% increase in global sales, reaching €2.9 billion for the fiscal year 2022/23. This growth was primarily driven by products catering to the pharmaceutical, optics, and semiconductor industries.

- On June 8, 2023, Corning Incorporated and SGD Pharma announced a joint venture to open a new glass tubing facility in Telangana, India. This collaboration aims to expand pharmaceutical manufacturing in India and enables SGD Pharma to adopt Corning’s Velocity® Vial technology platform.

Market Segmentation:

- By Product Type

-

- Vials

- Ampoules

- Cartridges

- Syringes

- Bottles

- Others (Tubes, Rods, Stoppers etc.)

- By End User

-

- Pharmaceutical

- Biotechnology

- Diagnostics

- Chemical

- Others (Research, Forensics etc.)

- By Distribution Channel

-

- Direct Sales

- Distributors

- Online

- Others

- By Manufacturing Process

-

- Tubing

- Molding

- Extrusion

- Others

- By Region:

- North America:

- U.S.

- Canada

- Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East:

- GCC Countries

- Israel

- Rest of Middle East

- Africa:

- South Africa

- North Africa

- Central Africa

- North America: