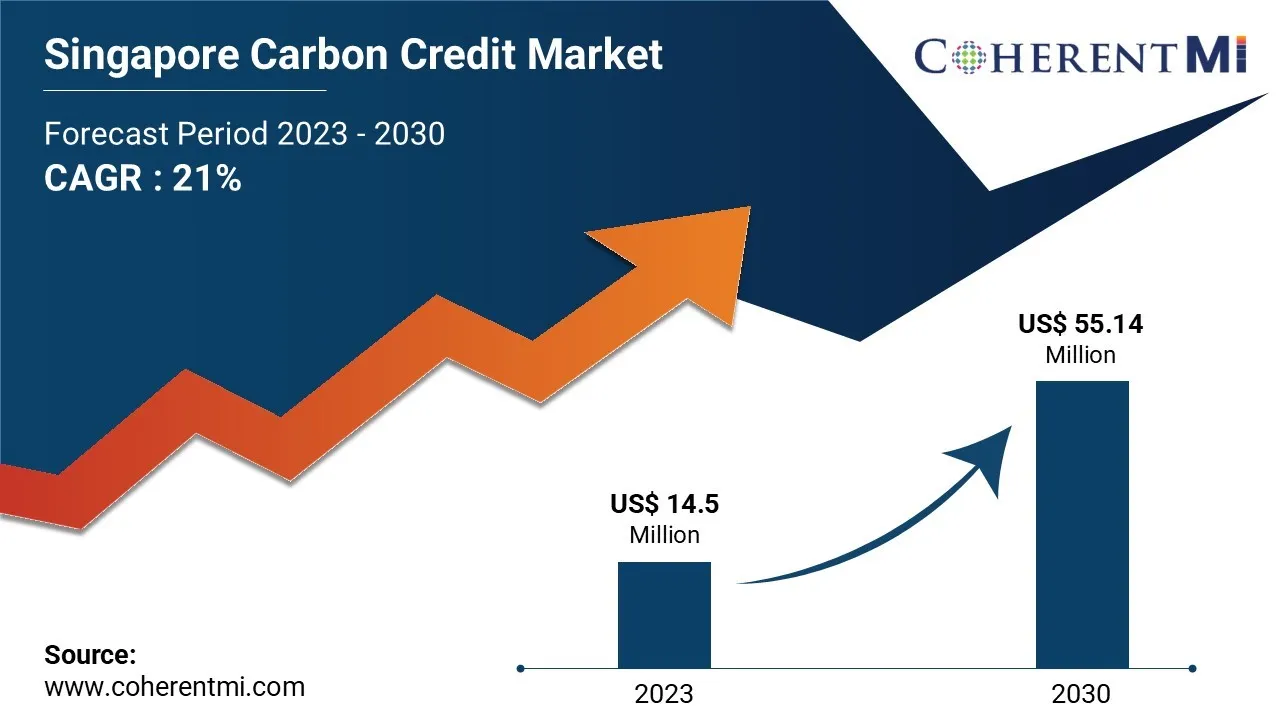

The Singapore carbon credit market is estimated to be valued at US$ 14.5 Mn in 2023 and is expected to exhibit a CAGR of 21% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Key Market Takeaways:

The Singapore carbon credit market is anticipated to witness a CAGR of 21% during the forecast period 2023-2030, owing to strong policy push for emission reductions and presence of high ambition net-zero targets.

- On the basis of project type, renewable energy segment is expected to hold a dominant position, accounting for over 60% market share owing to various solar and wind projects.

- By trading type, over the counter (OTC) segment is anticipated to be the major segment and expected to hold 60% market share owing to lower transaction costs.

- On the basis of end user, corporations’ segment is expected to dominate the market with over 50% share due to increasing focus on emission reductions across sectors.

Singapore Carbon Credit Market Report Coverage

|

Report Coverage |

Details |

|

Market Revenue in 2023 |

USD 14.5 Million |

|

Estimated Value by 2030 |

USD 55.14 Million |

|

Growth Rate |

Poised to grow at a CAGR of 21% |

|

Historical Data |

2018–2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Project Type, By Trading Type, By End User |

|

Geographies Covered |

Singapore |

|

Growth Drivers |

• Government Regulations to Reduce Emissions • Corporate Sustainability and Decarbonization Goals |

|

Restraints & Challenges |

• Challenges for Large-scale Local Offset Projects |

Market Dynamics:

Stringent regulations imposed by government agencies regarding carbon emissions and growing awareness about environmental protection are the major drivers of Singapore carbon credit market growth.

The Singapore government has set a target to reduce emissions by 36% from 2005 levels by 2030. Various industries are mandated to cap or cut their carbon emissions, which is increasing the demand for carbon credits.

Carbon trading is emerging as an effective and cost-efficient way to achieve emission reduction targets and get incentives for reducing greenhouse gases. This will further support growth of the Singapore carbon credit market.

Market Trends:

- Voluntary carbon offsetting through reforestation projects, renewable energy usage, and waste management initiatives is gaining traction in Singapore. Individuals and organizations are voluntarily offsetting their emissions by purchasing carbon credits to become carbon neutral. This emerging trend is fueling the Singapore carbon credit market growth.

- Implementation of blockchain technology is expected to bring more transparency and ensure the credibility of carbon offset projects. Some market players are exploring blockchain platforms to digitize carbon credits and facilitate trading in an efficient manner. This way, the adoption of innovative technologies will drive the Singapore carbon credit market expansion.

Market Opportunities:

- Renewable energy projects offer a major opportunity in the Singapore carbon credit market. The Singapore government has set ambitious targets of increasing renewable energy capacity to at least 2GW by 2030. Various solar and wind energy projects are being promoted to achieve this target, creating new opportunities for players in the Singapore carbon credit market.

- Energy efficiency upgrades in buildings and industry provide another key opportunity. Singapore imports over 95% of its energy needs. Improving energy efficiency can help lower emissions as well as energy import dependence. This presents an opportunity for energy service companies to undertake such projects and monetize the carbon reductions.

Competitor Insights

Key players in the Singapore carbon credit market include:

- Climate Impact X

- Carbon Credit Capital

- Carbonbay

- Southpole

- Triple Oxygen

- Carbon Neutral

- Credible Carbon

- GreenTec Capital

- Carbon Future

- Carbon Capital

- Carbon Equity

- Carbon Neutral Investments

- Green Business Certification Singapore

- Carbon Neutral Pte Ltd

- Sindicatum Renewable Energy

Recent Developments:

- In July 2024, the Singapore Economic Development Board (EDB) and the International Emissions Trading Association (IETA) launched SCMA, the nation's first platform aimed at facilitating access to high-quality carbon credits aligned with Article 6 of the Paris Agreement.

- In September 2024, GenZero partnered with Rwanda's Green Fund and the carbon certification body Gold Standard to develop projects generating carbon credits under Article 6 of the Paris Agreement.

Market Segmentation:

- By Project Type

- Renewable Energy

- Energy Efficiency

- Waste Management

- Forestry And Land Use

- Household Devices

- Fuel Switching

- Others

- By Trading Type

- Over the Counter

- Exchange Traded

- Merchandise

- Project Based

- Others (Futures, Options etc.)

- By End User

- Corporations

- Governments

- Broker & Exchange

- Project Developers

- Individuals

- Others (NGOs, Public Sector Agencies etc.)

- By Region:

- North America:

- U.S.

- Canada

- Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East:

- GCC Countries

- Israel

- Rest of Middle East

- Africa:

- South Africa

- North Africa

- Central Africa

- North America: