澳大利亚汽车市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

澳大利亚汽车市场由附属产品(内部、外部)、零件(轮胎、织物、润滑剂、碰撞机体、耗尽部件、其他)、服务(一般汽车修理、汽车传输修理)组成。 本报告为上述各部分提供了价值(百万美元)。....

澳大利亚汽车市场 规模

市场规模(美元) Bn

复合年增长率3.73%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 3.73% |

| 市场集中度 | Medium |

| 主要参与者 | 登索公司, Hella KGaA Hueck & Co. (原始内容存档于2018-07-29)., 大陆AG, 德尔菲汽车公司, 亚足联 以及其他 |

请告诉我们!

澳大利亚汽车市场 分析

澳大利亚汽车后市市场估计价值 2024年9,884.6百万美元 预计将达到 1,9397.8美元 到2031年时以复合年增长率增长 (CAGR)从2024年到2031年占10.1%。

澳大利亚汽车后销业在过去几年里持续增长。 公路上的车辆数量稳步增加,产生了维修和保养需求。 此外,澳大利亚人持有车辆的时间更长,这增加了每辆汽车售后产品和服务的寿命价值。 旧车需要更多修理和更换零件,以驱动市场收入。 然而,较新的车辆采用先进的技术,通过远程数据采集分析进行预测性维修和维护。 这有助于减少意外故障。 后市场公司正注重通过改善供应链和后勤网络,加强客户经验,以确保澳大利亚全国及时提供零部件。 车辆泊车量和老旧车辆维修需求的增加,将在今后数年继续支持澳大利亚汽车后销市场的收入增长。

澳大利亚汽车市场 趋势

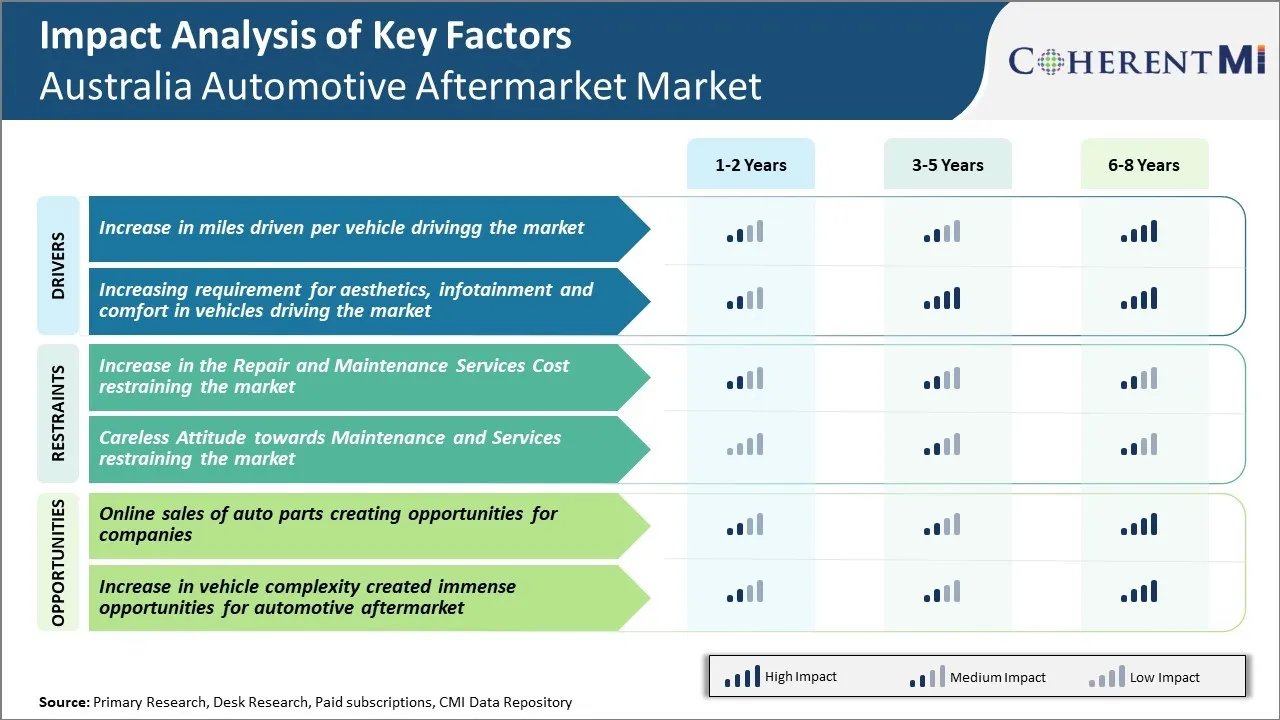

市场驱动力:

每辆驱动市场车辆的里程增加

由于住房可负担性问题,越来越多的人生活在远离工作场所和社会中心的地方,近年来,澳大利亚的车辆年均里程稳步增加。 车辆所有人必须每天开更长时间的通勤,这不可避免地导致轮胎、制动垫、皮带和软管等部件磨损更快。 此外,墨尔本和悉尼等城市的很大一部分人口定期进行周末长驱车,前往城市界限外的海滩和农村地区放松. 所有这一切都促成了澳大利亚目前平均每年近20 000公里的汽车,而五年前只有15 000公里。

年使用量的增加直接导致更换和维修需要更加频繁。 更多英里意味着需要例行更换的消耗性部件的降解速度更快,如制动垫或计时带等部件的寿命较短,必须在固定的公里间隔内更换。 即使对非消耗性部件来说,所覆盖的更多距离的累积效应也带来了它们的修复或替换周期。 震荡吸收器和悬浮灌木 可能持续了8-10年 平均车辆 现在开始失败 在6-7年的城市驾驶。 此外,自2010年代后期以来,由于价格高企和经济不确定性,新车的销售量明显下降,许多澳大利亚人将现有车辆拖住更长的时间,而不是升级。 这给现有的车辆停车场带来更大的压力,并相应导致对修理和维修服务的更多市场需求。

对市场驱动车辆的美学、娱乐和舒适性的需求日益增加

在过去十年中,可支配收入不断增加,澳大利亚消费者比以往任何时候都更加优先考虑乘车舒适、连接和定制功能。 司机越来越需要通过售后改造使其车辆的内外外观个性化。 安装闪闪发光的合金轮子,点锡窗,升级音响系统,并添加其他视觉定制,已日益成为城市许多人的主流爱好和激情. 同样,现代生活中始终存在的互联互通需求也驱动着工厂化的娱乐界面的增强. 诸如更大的触摸屏,司机助理技术,电话镜和后座娱乐套房等升级都是看到brisk需求的例子.

此外,澳大利亚人也更加重视目前车辆中的人类基因组和健康特征。 定制的座椅、按摩功能、空气电离器是目睹吸收率上升的例子。 因此,加强向流动舒适区运输的基本功能似乎是一个重要的推动因素。 与其他消费用具一样,车辆也成为形象、风格和个人表达的标志。 后市场参与者正在有效地利用这些不断演变的生活方式要求和情绪,通过专门的内部、外部个性化服务以及便利和福利增强技术。 这使得它们不仅能够满足典型的维修需要,而且还能够扩大到更高的幅度,选择性增强市场吸引寻求非必要产品的消费者。

市场挑战和机遇:

增加修理和维修服务 限制市场成本

澳大利亚汽车后销公司面临的主要挑战之一是维修和维护服务费用增加。 在过去几年中,澳大利亚的劳务、备件和修理及维修活动的总费用大幅增加。 根据我们的分析,在过去五年中,澳大利亚车辆的平均维修费增加了25%以上。 成本增加的主要原因是零部件价格上涨、劳动力成本提高、全球服务税和其他间接税增加。

成本的上升使车辆维修和保养活动对个别消费者和商业车队运营商来说更为昂贵。 随着成本的急剧上升,消费者正在推迟维修需求,或转向更便宜的替代品,如旧零件,以节省成本。 这对新备件的需求产生了不利影响。 商业车队运营商也发现难以说明增加维修预算的理由,从而可能降低维修和维护周期的频率。 成本的上升制约着澳大利亚汽车零部件和服务市场的进一步发展。 除非成本得到控制,否则这一趋势在今后几年中可能继续限制市场规模和收入潜力。

在线销售汽车零件为公司创造机会

澳大利亚汽车后市公司的一个重要机会是在线销售渠道的增长,特别是汽车零部件。 目前,澳大利亚只有大约15-18%的汽车零部件在网上销售,而其他发达的汽车市场则有25%以上。 然而,由于消费者越来越多地使用互联网和智能手机,在线渗透率正在迅速提高。 年轻人尤其比较舒服地在网上研究和购买汽车零件,而不是去实体商店。

引导这一机会的是在线平台为客户提供方便,以研究数千个部件的技术规格,阅读评论,在几分钟内进行价格比较并获得门阶交付. 建立有更好的搜索功能、方便移动和客户支持的强大在线销售渠道的公司完全可以利用这一增长趋势。 采用综合的在线和离线战略,使公司既能服务于技术较强的年轻客户,也能服务于仍然偏爱传统零售店的老客户。 总体而言,汽车零部件销售数字化转型和对在线采购的偏好增加,为那些做出正确投资并具有全方位战略的品牌提供了重大的市场机会。

分段分析 澳大利亚汽车市场

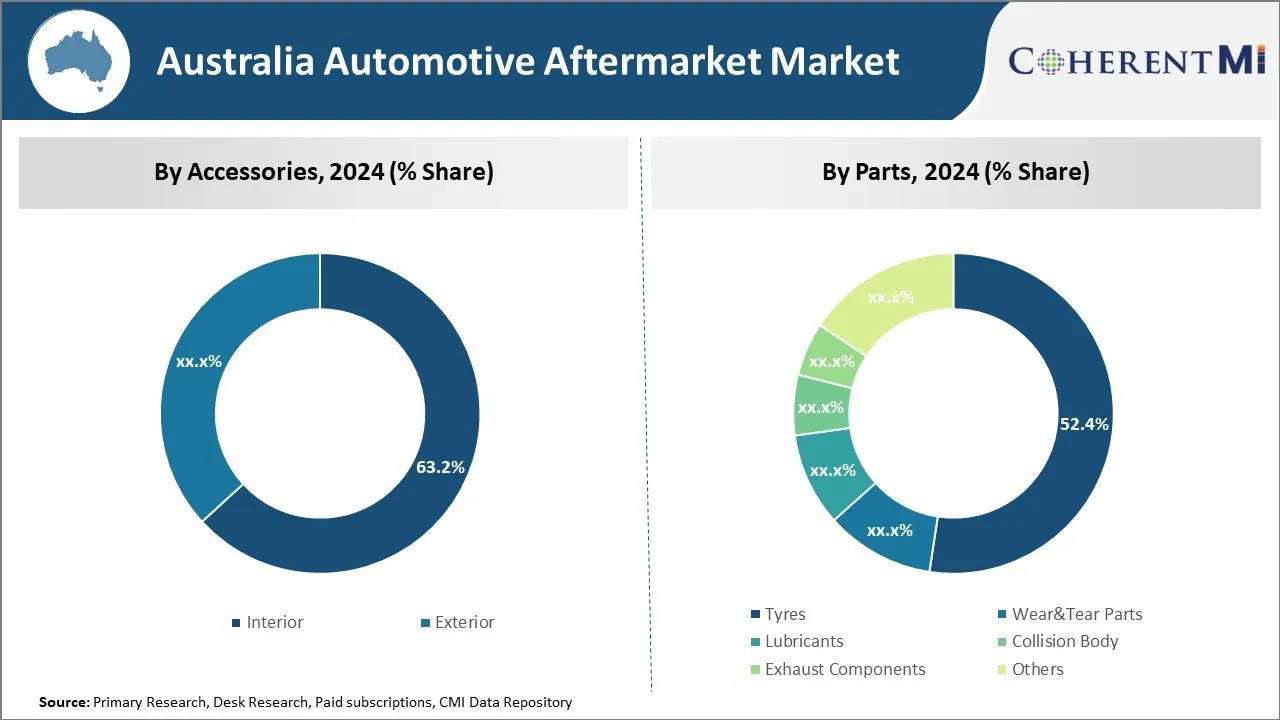

通过附属物的观察——舒适和舒适驱动的内部附属物

就附属公司而言,内地公司占市场份额的63.20%,使消费者在旅行时越来越注重舒适和便利。 内部配件,如座椅盖、地板垫、方向盘盖和破碎垫子,由于有助于保护车辆内部免遭污垢和磨损,因此变得非常流行。 澳大利亚人每年开很远的车程,希望车辆内部保持清洁、无刮伤和耐长途人工耐用。 内部配件呼吁这种耐久的需要,以及增加个性化的触摸。

消费者愿意花更多钱来购买高品质,富于特色的室内配件,这些配件将功能与美学融合在一起. 皮革和皮革材料比普通织物更受青睐,因为它们具有厚度。 带有加热和冷却功能的附着物对座椅具有进一步增强舒适性,特别是在极端天气期间. 制造商经常推出新的设计,以匹配不同的室内主题和汽车模型. 不断扩大的后销意味着买家有各种各样的风格,颜色和品牌可供选择.

方便自己安装是刺激内部附属销售的另一个因素。 大多数产品都附有详细的配装说明和安装解决方案,以便司机能够在没有专业帮助的情况下独立设置。 这节省了安装成本,并允许根据不断变化的需要或心情定制内部。 内部配件成为许多澳大利亚人的冲动

部分的洞察力 -- -- 可靠的性能驱动力

就零部件而言,轮胎因其在车辆性能和安全方面的关键作用而贡献了52.40%的份额。 澳大利亚的道路从高速公路到非公路,轮胎不断磨损。 它们的可靠功能是当务之急,司机需要定期更换。 虽然OEM轮胎是一种选择,但价格低廉的售后轮胎在不同的品牌、大小、胎面模式和价格点上都广泛存在。

轮胎技术也有所发展,采用了较新的化合物和线状设计,优化了各种地形的握力、里程和崎岖。 全季节和全地形轮胎的流行程度有所提高。 冲压式轮胎和自封式轮胎在穿孔后仍维持通货膨胀,从而增加方便。 客户还定期更换轮胎,以保持最佳发动机效率和制动能力。

机械和装配中心通过推荐适当的轮胎模型来配合车辆的使用情况以及重量和速度能力,发挥重要的作用。 它们的专门知识与轮胎制造商广泛的销售网络一道,确保了基本替代品永远供应不足。 这种方便的接触和关于适合个人需要的适当轮胎规格的知识注入使得这些轮胎成为其他部件的默认紧急购买。

以服务为目的的洞察力 - 价值服务驱动通用汽车修理

在By Services方面,通用汽车修理公司贡献最大,因为它们为共同问题提供了最有价值的解决办法。 与复杂的传动或电气问题不同,对刹车,休克吸收器,冷却和排气系统等部件的一般修理是可负担的和可以使用的. 有许多独立的车库,配备训练有素的技术人员,他们能够比经销商更廉价地迅速处理这种修理.

此外,一般维修有时可以因非关键用途而推迟,但仍建议进行定期维修,以尽量提高车辆使用寿命。 在小问题恶化之前解决小问题更具成本效益。 在线论坛也使得DIY爱好者更容易在经验丰富的用户指导下独立尝试基本修复. 这给价格带来了下行压力。

一般修理还允许车主根据预算灵活处理。 次要的补救可以独立安排,而不进行重大投资。 交易商为大修提供保修服务,为顾客提供在位置附近的多种负担得起的选择. 投资于维修通常比以后依赖一种主要服务更能提供长期价值。 这使一般修理成为多数车辆问题。

竞争概览 澳大利亚汽车市场

在美国赛车无人机市场运营的主要角色包括登索公司,Hella KGaA Hueck & Co.,大陆AG,Delphi Automotive,ACDelco,Faurecia SA,Magneti Marelli SpA,Robert Boosch GmbH,Aisin Seiki Co.,Ltd.,Bridestone Corporation.

澳大利亚汽车市场 领导者

- 登索公司

- Hella KGaA Hueck & Co. (原始内容存档于2018-07-29).

- 大陆AG

- 德尔菲汽车公司

- 亚足联

澳大利亚汽车市场 - 竞争对手

澳大利亚汽车市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 澳大利亚汽车市场

- 2023年7月,摩羯学会有限公司并修复了澳大利亚控股公司 有限公司签订了一项合资协议,将向澳大利亚和新西兰各地的修理商提供先进的汽车远程诊断服务

- 2024年4月,登索公司宣布MobiQ为汽车后市公司

- 2020年1月,大陆公司 推出汽车后销门户网站,将所有产品和服务信息捆绑在一起

澳大利亚汽车市场 细分

- 由附属

- 内部

- 外边

- 按部件

- 轮胎

- 穿戴部件( T)

- 润滑剂

- 碰撞体

- 耗尽组件

- 其他人员

- 服务

- 一般汽车修理

- 汽车传输修理

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

有哪些关键因素阻碍澳大利亚汽车后市场的增长?

维修和保养服务的增加限制了市场,对维修和服务采取了不小心的态度,限制了市场,这是阻碍澳大利亚汽车后市场增长的主要因素。

驱动澳大利亚汽车后市场增长的主要因素是什么?

每辆汽车行驶里程的增加和对美学、娱乐和舒适性的需求的增加是驱动澳大利亚汽车后市场的主要因素。

澳大利亚汽车后市市场的主要附属企业是什么?

主要的附属部分是内政。

谁是澳大利亚汽车市场的主要运营商?

Denso Corporation, Hela KGaA Hueck & Co., Continental AG, Delphi Automotive, ACDelco, Faurecia SA, Magneti Marelli SpA, Robert Boosch GmbH, Aisin Seiki Co., Ltd., Bridestone Corporation 是主要角色.

澳大利亚汽车市场CAGR将是什么?

澳大利亚汽车后市场CAGR预计从2024年-2031年达到10.1%。