填充完成制造业市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

生物填充完成制造市场按产品类型划分(Viles,预填Syringes,Cartridges,Ampoules,其他(Bags,Bottles等)), 由分子类型(摩纳哥抗体、疫苗、蛋白质、百日咳、其他(细胞、基因治疗等)),按业务规模(大型制造、小型/特别制造),按最终用户(制药/药物公司、研究实验....

填充完成制造业市场 规模

市场规模(美元) Bn

复合年增长率7.5%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 7.5% |

| 市场集中度 | High |

| 主要参与者 | AbbVie 合同制造, 博埃林格·伊格尔海姆生物超能, 催化生物学, 伦扎, 武习生物学 以及其他 |

请告诉我们!

填充完成制造业市场 分析

生物填充完成制造 估计市场价值为: 2024年5.3亿美元 预计将达到 到2031年达到1,106亿美元以复合年增长率增长 2024年至2031年占7.4%。 。 。 由于主要区域对生物药品的需求不断增加,生物药品制造商越来越多地将填充品服务外包,这一市场正在稳步增长。

生物学填补制造业的趋势是积极的,预计增长将持续到2031年。 主要驱动因素包括生物学革命和全球慢性病发病率上升。 此外,能力限制和基础设施的缺乏促使制药公司将完成服务外包给专门的合同服务提供者。 这些动态可能维持需求,并在预测期间支持高预测的CAGR。

填充完成制造业市场 趋势

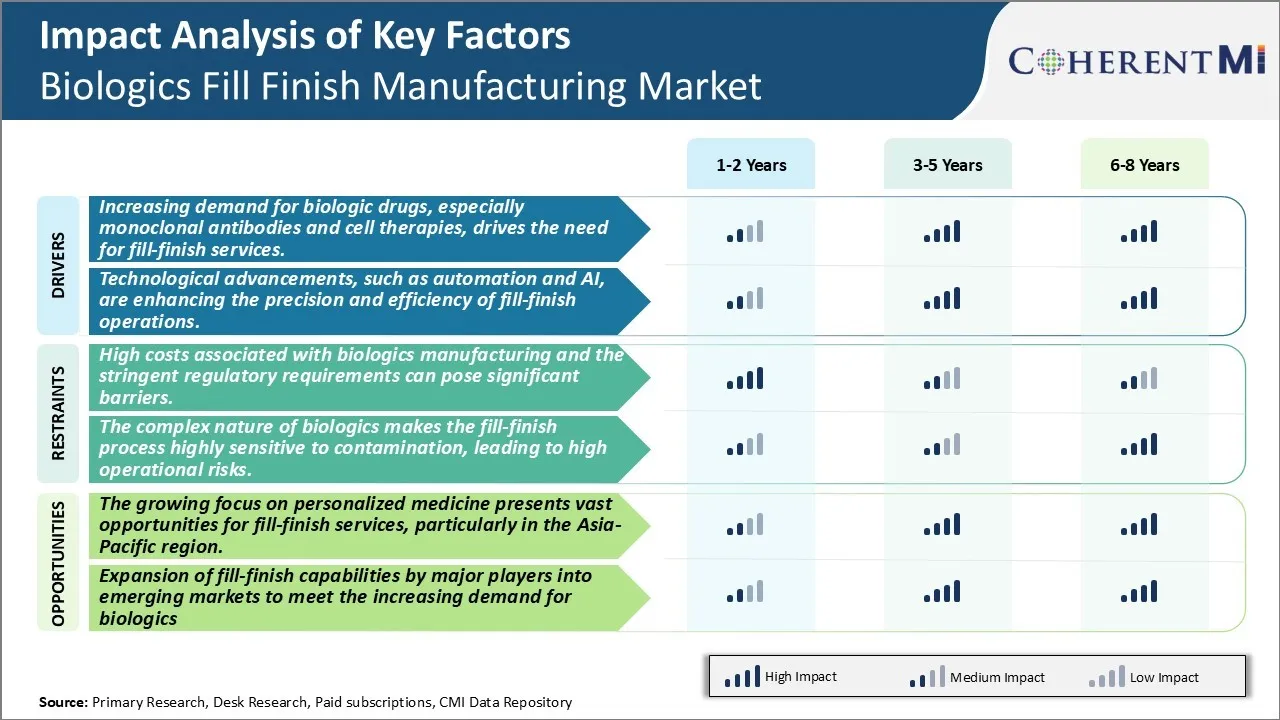

市场驱动力 -- -- 对生物药物,特别是对单克隆抗体和细胞疗法的需求日益增加,因此需要填充服务。

由于对单克隆抗体和细胞疗法等先进生物药物的需求不断增长,生物学填补了制造业的市场。 生物学因其高度的特异性和疗效,使得各种慢性和危及生命的疾病的治疗发生了革命性的变化. 随着研究不断发现新的治疗目标和先进的治疗方法,新生物学实体的发展正在迅速发展. 在过去十年中,生物学一直主导着FDA的核准编号,抗体是最普遍的被批准的生物学模式. 这些复杂的生物药物需要细致的制造过程和专门的填充服务,以确保最高质量和安全。 填充剂被认为是生物制品生产的最后关键阶段,在包装、标签和分销的消毒条件下,药物物质被加工并装入容器。 随着生物学审批的不断增加和对个性化处理方案的需求增加,填充式承包商面临着扩大业务规模和优化生产流程以满足商业供应需求的巨大压力。 制造商还需要专门的设备、设施和技术诀窍来处理不同方式的加工,如抗体药物聚合物、基因疗法和病毒病媒。 这推动了由完成的首席管理官进行大量投资,以扩大其能力。 一些值得注意的扩展项目包括建立新的化粪池套房,配备最先进的隔离器和自动化系统。

作为有希望的治疗途径的细胞和基因疗法的扩散,进一步突出了建立健全的填充式基础设施的必要性。 这些新型疗法依靠复杂的制造工艺和由于使用活生物物质而在配方填充过程中的严格环境控制. 它们的填充法需要强化生物抑制和清洁室设施,以防止微生物污染. 此外,由于这些先进模式的储存寿命短,而且体质贫瘠,因此需要在临床试验地点附近建立集中的填充设施,以便进行即时制造。 由于细胞和基因疗法更接近商业化,其大规模市场生产将紧张现有的填充能力,刺激对专业服务提供者的需求。

填充式操作的技术转换

生物学填补了制造业的尾声,正在实现技术升级,使人工工艺自动化,并提高精度,以应对日益增长的治疗复杂性和生产力要求。 先进自动化设备的应用以及人工智能和物业互联网(IIoT)等数字化趋势正在重塑填充式工作流程.

自动化可以比常规方法更严格地进行流程控制,减少人的错误. 主要填充者正在采用机器人进行高速瓶和注射器的处理、检查、标签和包装。 这提高了线路效率和准确性,同时释放了运营商去完成增值任务. 装有自动重量或体积检查站的液体填充器在经过验证的条件下,可以进行每小时数百或数千个集装箱的同质填充. 同样,利用机器学习的机器人视觉检查系统也被用来实时筛选装满的容器,以查明缺陷,降低拒绝率,提高设备的总体效能。

数字技术也在简化批量记录管理、数据收集和质量监督。 IIoT传感器有利于对关键过程参数进行远程监测,为预测维护和过程优化提供实时数据. 对历史制造数据集的AI动力分析有助于先发制人地预测故障和斑点异常. 使用可通过移动设备获取的电子批次记录可提高透明度、速度和合规性。 利用数字双胞胎进行设备和流程验证研究的虚拟化进一步加快了制造地点之间的技术转让,因为治疗方法在全球范围得到了推广。 这种先进技术不仅提升了填充质量,而且使合同服务更具成本竞争力,推动继续采用。

市场挑战----与生物制品制造有关的高成本和严格的监管要求可构成重大障碍。

由于生物制品生产成本高昂,以及严格的监管要求,生物制品填补了制造业的成品市场面临重大挑战。 生物药物物质由活细胞和生物体产生,使其制造过程远比传统的小分子药物复杂. 生活细胞必须经过培养,并仔细控制条件,以确保产品的统一和安全。 这种复杂的制造过程需要大量投资设施、专门设备和高技能的劳动力。 此外,从发展到管理批准和商业生产,需要两到四年的时间。 林业发展局等机构的严格监管规范进一步抬高了成本。 设施和程序必须经过验证,以达到计算机总电联标准,并配有详细的文件和定期检查。 任何改变都需要重新确认,增加时间和费用负担。 还必须对质量控制测试进行大量投资,以确保生物学在保存期内的治疗和免疫质量。 达到所有这些监管合规要求,使生物制品制造成为公司的一项高昂开支。

市场机会: 日益注重个性化药物为填充服务带来大量机会,特别是在亚太区域

生物学填补了完成的制造业市场,准备利用因日益重视个性化药品而产生的大量机会。 个性化疗法根据个人的基因特征量身定做治疗,以改善治疗结果. 它们需要较小的生产量以满足目标病人子集的需要。 这种需求转移到具有弹性填充能力的专门合同服务提供者。 特别是,亚太是一个巨大的未开发的填充服务市场。 该区域拥有60%以上的全球人口,医疗保健开支不断增加。 然而,高额资本投资阻止了当地制药公司建立自己的填充能力。 这为国际合同组织通过合资或收购在新兴的亚太市场建立设施提供了机会。 此外,有利的监管环境和廉价技术劳动力的提供提高了亚太的吸引力。 不断发展的个性化医药部门,加上亚太对填充能力的需求未得到满足,为服务公司在未来几年提供了巨大的增长潜力。

处方者偏好 填充完成制造业市场

对于早期的NA,处方通常依赖Ibuprofen(Advil)或Neproxen(Aleve)等场外疼痛药物来管理轻微症状. 然而,对于症状较严重的患者,准则建议用疾病改变抗风药(DMADs)作为一线治疗. 甲酸甲酯因其具有双重抗炎和免疫调节特性,经常是DMARD的首选. 品牌名称包括Rheumatrex.

如果患者对甲状腺素反应不当或无法容忍,处方者往往会转而使用另一种常规的DMAD,如氟虫氨酸(Arava)或磺胺(Azulfidine). 对于进步性疾病,引入了针对肿瘤坏死因子(TNF)抑制等特定机制的生物学DMADs. 常见的选择包括infliximab(Remicade),etanercept(Enbrel)和adalimumab(Humira).

除药物治疗外,开处方者在确定最佳治疗方法时,还考虑到非药物因素,如疾病严重性、生活方式、并发症、费用和保险。 一般来说,随着疾病发展到后期,治疗方法变得更加激进,需要额外的治疗线来控制症状和保护共同的完整性.

治疗方案分析 填充完成制造业市场

肺癌一般分为四个主要阶段: 第一阶段至第四阶段——视肿瘤大小和扩散情况而定。 适当的治疗取决于癌症的阶段。

对于早期(Stage I-II)非小细胞肺癌(NSC),手术往往是主要治疗方法,可能治疗. 选择包括输卵管切除术(去除肺叶),肺切除术(全肺),或切除术(叶片). 对于不能接受手术的病人,可使用立体辐射疗法(SBRT)精确地提供高剂量辐射。

对于更先进的本地化NSC(Stage III),标准治疗通常是化疗和辐射疗法的结合. 常见的化疗药物包括含有丙plat或卡宝白素等药物的铂基双胞胎,结合其他剂如和平克西尔,pemixed,gemcitabine或vinorbine. 同时进行的化疗提供生存福利,而不是连续治疗。

对于元静脉疗法或晚期NSC(Stage IV),如果手术不是一种选择,则基于铂的化疗仍然是第一线. 选项包括cisplatin/carboplatin等单剂或cisplatin/pemixed等双剂. 为了维护,通常只使用pemixed. 不幸的是,第四阶段的NSCLC只有5%的5年存活率。 然而,分子定向疗法或免疫疗法可能提供额外的选择。

报告概述了国家科学研究中心的不同阶段,并根据不同阶段,从手术和辐射到化疗和定向疗法,提出了治疗选择建议。

关键参与者采用的关键制胜策略 填充完成制造业市场

合同制造: 许多主要的填充/完成服务供应商采用了合同制造战略,以满足生物技术公司日益增长的需求。 例如,Lonza是最大的CMO公司之一,从合同制造中获得50%以上的医药和生物技术收入。 这使得生物技术公司在生产外包的同时,可以专注于药物开发.

扩大填充/完成能力: 为了获得更多的市场份额,玩家正在稳步扩大其制造能力。 2018年,眼镜蛇生物学公司投资1亿美元,将病毒病媒生产能力翻一番. 同样,IDT Biologyka在2017-19年间新增了6条生产线. 武田于2019年通过希雷收购获得了大型设施.

地理扩展: 主要角色正在通过新的设施在全球扩大足迹,以满足区域客户的需求。 例如,加泰罗尼亚公司在2018年投资2.5亿美元,在印第安纳州布卢明顿建立了20万平方英尺的设施,为美国市场服务. 去年,三星生物公司在韩国仁川开设了一家工厂,增加了39万升的生物制造能力.

技术进步: 采用尖端技术有助于企业吸引更多的企业。 例如,Fujifilm在2018年收购了Irvine Science的细胞银行设施,以提高其基因和细胞治疗能力. Lonza在2018年实施了超高容量的吹气封装系统,减少了填充时间的倍数. 这些创新有助于制造更复杂的产品。

伙伴关系和收购: 战略联系和收购有助于加强专门知识和能力。 例如,Thermo Fisher在2019年以17亿美元收购了布拉默生物公司,以获得重要的病毒病媒专业知识和客户.

分段分析 填充完成制造业市场

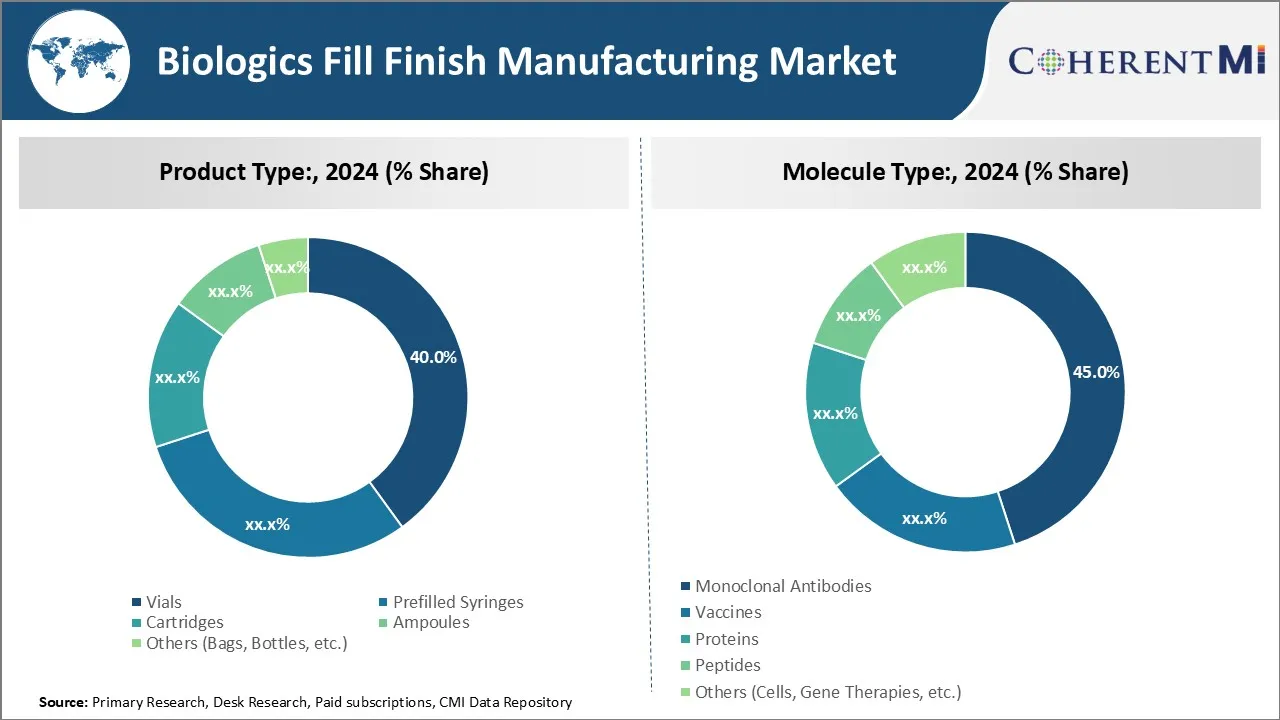

产品类型:-对具有成本效益的交付驱动力产品部分的需求日益增加

在产品类型方面: 货币在市场中所占的份额最高,因此其普遍采用率和成本效益作为一种交付机制。 与预先填充的注射器等替代品相比,Vials较易制造,并以低廉的成本提供大量的包装效果. 它们的单位成本低,使瓶子适合包装用于慢性疗法的高容量生物记录。 出售的生物制品有相当大一部分是用于经常或长期施药,从而增加了对成本效益高的瓶子的需求。 医院和药店也更喜欢瓶装包装,因为与弹匣或预装注射器相比,储存空间和处理费用较低。 一些药物配方技术还能够最大限度地增加药物瓶装量,进一步提高其经济吸引力。 问题可能会继续受到欢迎,特别是在对成本敏感度至关重要的发展中市场。 接受率提高,加上能够降低处理支出,将继续促进在预测期间完成生物学填充的瓶装。

分子类型数字 :- 主要单体抗体驱动单体抗体部分生长

在分子类型方面: 抗体贡献市场最高份额. 这可归因于近几十年来的开创性研究,该研究将单克隆抗体确立为治疗各种癌症和自体免疫障碍的支柱。 大量单克隆抗体已经商业化, 更多的药物研发正在进行。 这些成果大大改善了临床结果,同时获得高销售额。 它们在生物学收入方面的支配地位确保了制造能力始终面向单克隆抗体。 创新者mAbs的填充完成也吸引了CDMOs的精密解决方案. 显性微分的专利过期将看到生物类似物进一步推进这一段。 总体而言,单克隆抗体的广泛应用范围和商业成功使它们成为生物学中最突出的分子类填充完成.

按业务规模 - 扩大外包和优化成本,推动大规模制造业增长

就业务规模而言,生物填充制造市场被分割成大规模制造和小规模/专门制造。 由于生物制药公司越来越多地外包生物加工活动,大型制造业占市场份额最高。 专门从事大规模填充工作的合同开发和制造组织能够实现规模经济,使新药和普通药销售商的成本最大化。 这使外包成为保持利润率的有吸引力的战略。 此外,对先进生产技术的严格管理要求有利于大型设备和综合设施,而不是小型业务。 扩大或建立生物生产场地所涉及的资源需要和资本开支也使大型专业供应商的需求受到影响。 随着生物管道逐渐成熟成为高销售品牌,将更多地依赖CDMOs的大型工厂跟上日益增长的商业需求,同时尽量减少单位成本。 这有助于巩固大型制造业在生物领域占据的重要位置。

附加见解 填充完成制造业市场

由于对单克隆抗体以及细胞和基因疗法等生物疗法的需求不断增加,生物成品填充市场正在迅速演变。 随着这些疗法的复杂性增加,对先进的填充能力的需求也会增加,这种能力能够确保这些产品的安全和功效。 预计市场将大幅增长,2024年至2035年CAGR为7.5%,到2035年达到116亿美元. 这一增长得到了技术进步的支持,例如自动化和人工智能在制造过程中的结合,这些都有助于公司提高效率和减少污染风险. 市场的特点是,大型和中型角色混合在一起,主要公司扩大能力,以满足日益增长的全球需求,特别是在亚太区域,预计亚太区域是增长最快的市场。 然而,市场也面临各种挑战,包括高昂的运营成本和严格的监管要求,这可能影响到增长的速度。

竞争概览 填充完成制造业市场

经营生物填充制造市场的主要角色包括:武仙生物,龙扎,加泰罗尼亚生物,Boehringer Ingelheim BioXcellence,AbbVie Contract Manufacturing,Charles River,Evonik,Sandoz,Patheon Pharma Service,Recipharm,Pierre Fabre,Fresenius Kabi,GSK,Asymchem,Hetero,Syngene和WACKER.

填充完成制造业市场 领导者

- AbbVie 合同制造

- 博埃林格·伊格尔海姆生物超能

- 催化生物学

- 伦扎

- 武习生物学

填充完成制造业市场 - 竞争对手

填充完成制造业市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 填充完成制造业市场

- 2024年1月:亚伯 Vie Contract Manufacturing扩展了其生物制造能力,在新加坡投资2.23亿美元,增强了其全球足迹.

- 2023年10月:隆扎在位于瑞士施泰因的设施中为抗体组药物的临床和商业供应添加了新的填充线,提高了容量.

- 2023年9月:Recipharm与Ahead Therapeutics合作,为脂纳米粒子提供工艺开发和制造服务,提升其在生物市场的地位.

- 2023年6月:Catalent Biologics扩展了其OneBio®套件,以包括更广泛的生物学模式,包括mRNA和细胞及基因疗法,显示了其对创新的承诺.

- 2023年5月:Patheon在新加坡安装了一条自动化脓疫苗填充线,反映了其对亚太地区的战略重点.

填充完成制造业市场 细分

- 产品类型 :

- 拨号

- 预填的 Syringes

- 纸盒

- 炸弹

- 其他(桶、瓶等)

- 分子类型 :

- 单曲 抗体

- 疫苗

- 蛋白质

- 浸泡剂

- 其他(手机、基因治疗等)

- 按业务规模

- 大规模制造

- 小规模/专门制造业

- 按终端用户

- 药品/药品 公司

- 研究实验室

- 学术机构

- 其他(政府机构、诊所等)

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

哪些关键因素阻碍生物填充制造市场的增长?

与生物制品制造有关的高昂成本和严格的监管要求可能构成重大障碍。 生物学的复杂性使填充过程对污染高度敏感,导致作业风险高。 是阻碍生物填充制造市场增长的主要因素。

驱动生物填充制造业市场增长的主要因素是什么?

对生物药物,特别是单克隆抗体和细胞疗法的需求不断增加,因此需要填充服务。 自动化和AI等技术进步正在提高填充作业的精度和效率。 是推动生物填充制造市场的主要因素。

哪种是主要产品类型:生物填充制造市场?

主要产品类型:段是Vials.

哪些主要角色在生物填充制造市场运作?

WuXi Biologics, Lonza, Catalent Biologics, Boehringer Ingelheim BioXcellence, AbbVie Contract Manufacturing, Charles River, Evonik, Sandoz, Patheon Pharma Services, Recipharm, Pierre Fabre, Fresenius Kabi, GSK, Asymchem, Hetero, Syngene, WACKER是主要角色.

生物填充制造市场的CAGR是什么?

生物填充制造市场的CAGR预计从2024年-2031年达到7.4%。