Paperboard Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Paperboard Packaging Market is segmented By Raw Material (Recycled Waste Paper, Fresh Source (Wood pulp, Others)), By Product (Folding Boxboard (FBB),....

Paperboard Packaging Market Size

Market Size in USD Bn

CAGR4.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.1% |

| Market Concentration | Medium |

| Major Players | Nippon Paper Industries Co., Ltd., Stora Enso, South African Pulp & Paper Industries, Mondi plc, ITC Limited and Among Others. |

please let us know !

Paperboard Packaging Market Analysis

The paperboard packaging market is estimated to be valued at USD 183.87 Bn in 2024 and is expected to reach USD 243.55 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2031. Demand in the paperboard packaging market is driven by the sustainable and eco-friendly properties of paperboard which has encouraged its substitution over plastics in the recent years.

Paperboard Packaging Market Trends

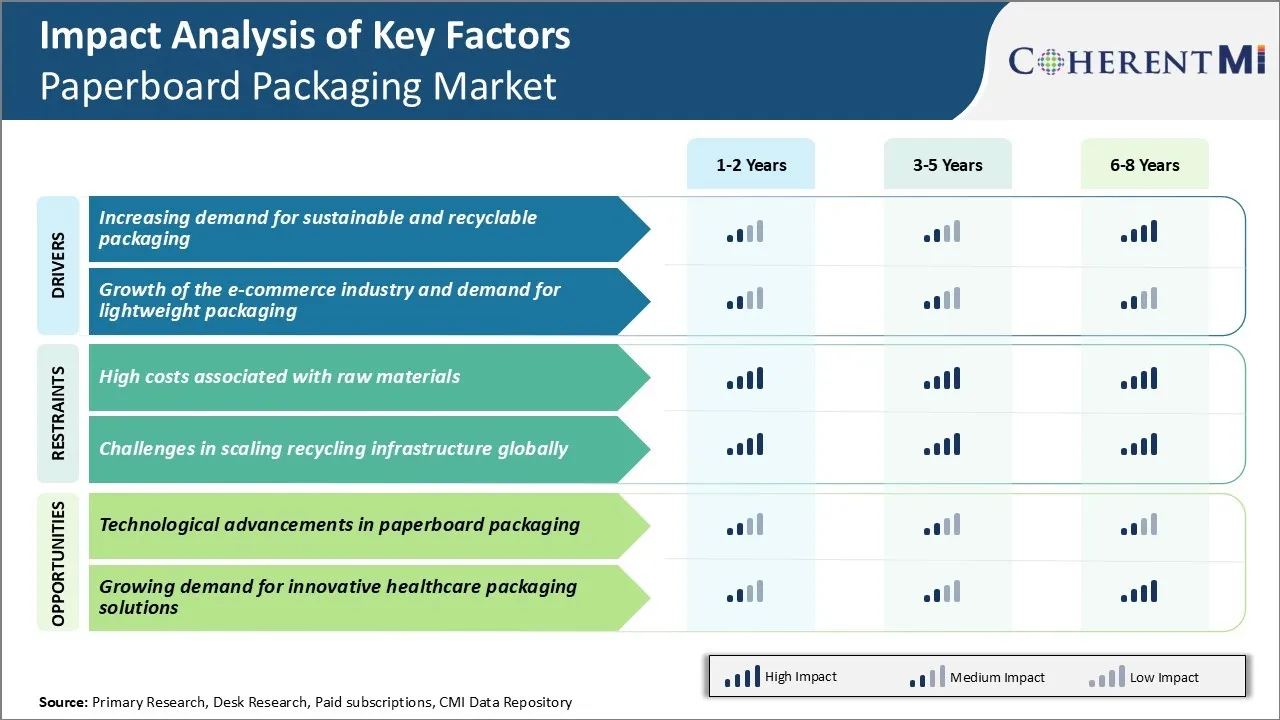

Market Driver - Rise of Sustainable and Recyclable Packaging

One of the major drivers fueling growth in the paperboard packaging market in the coming years is the increasing demand for sustainable and eco-friendly packaging materials. Paperboard is widely considered to be one of the most sustainable packaging choices as it comes from a renewable resource and is easily recyclable. Additionally, more and more brands are emphasizing their use of paperboard for packaging as consumers are willing to pay premium prices for products with sustainable packaging.

Governments and regulatory bodies across nations are encouraging the shift to sustainable materials through policies and directives. Manufacturers are hence compelled to develop packaging made from recyclable fibers like paperboard to adhere to these mandates.

With the world facing worsening environmental damages due to plastic waste, there is mounting pressure on industries to reduce reliance on single-use plastics and switch to sustainable alternatives like paperboard. Both regulatory pushes as well as consumer demand for eco-friendly options are steering the packaging sector towards recyclable materials like paperboard. This is fueling higher growth for paperboard packaging.

Market Driver - Booming E-Commerce and Demand for Lightweight Packaging

The exponentially rising prominence of online shopping and e-commerce is having a momentous effect on the packaging sector globally. More and more products are being sold through websites and apps instead of brick-and-mortar stores which requires protective, affordable, and lightweight packaging to maintain quality during shipping.

Paperboard fulfills the need for convenience and efficiency in packaging admirably as it offers durability for protecting products during deliveries. It is also more lightweight compared to materials like glass or plastic. This aids in keeping packaging costs low for shipping items long distances through carriers. Its compressibility allows easy storage and transport of stacks of folded boxes among many other efficiency advantages.

With global e-commerce projected to continue its stratospheric growth over the next decade, packaging suitable for the unique requirements of online retail will be crucial. Here paperboard is expected to be a key beneficiary given its ideal characteristics for lightweight and affordable protection of goods during shipments. This will sustain high demand and ensure ongoing growth opportunities for paperboard packaging market players in the booming e-commerce sector.

Market Challenge - High Costs Associated with Raw Materials

One of the key challenges faced by the paperboard packaging market is the high costs associated with raw materials. Paperboard is primarily made from wood pulp which comes from trees. The process of extracting wood pulp from trees and processing it into paperboard is a multi-step process that requires a significant number of raw materials and energy. The costs of procuring wood, processing it into pulp, and then manufacturing the pulp into paperboard continue to rise due to increasing global demand and supply chain constraints.

Additionally, fluctuations in commodity prices also affect the costs of wood pulp. With raw material costs accounting for a major part of the overall production costs, any increase in these costs puts pressure on the margins of paperboard packaging manufacturers. The rising raw material prices challenge the ability of packaging companies to price their products competitively in the paperboard packaging market. This can potentially limit the growth and profitability of paperboard packaging manufacturers.

Market Opportunity - Technological Advancements in Paperboard Packaging

One significant opportunity for the paperboard packaging market lies in the ongoing technological advancements in packaging materials and processes. Paperboard manufacturers are continuously innovating to develop novel grades of paperboard that are lighter in weight, provide better strength and barrier properties, and are more sustainable. For instance, the development of moisture resistant coated paperboards has enabled safer packaging of food and beverage products without compromising on barrier properties.

Similarly, nano-enabled paperboard offers enhanced strength without additional material usage. On the production front, automated packaging lines integrated with robotics, IoT, and data analytics are improving efficiencies. Advancements like digital printing and customization technologies allow for more versatile and targeted packaging designs.

The evolving customer demands for sustainable and smart paperboard packaging present a major opportunity for manufacturers to innovate differentiated products. Technological innovations help enhance paperboard attributes as well as efficiencies, thereby expanding market prospects.

Key winning strategies adopted by key players of Paperboard Packaging Market

Sustainability and eco-friendly packaging: Major players like International Paper, WestRock, KapStone etc have focused on developing sustainable and eco-friendly packaging solutions made from recycled paperboard. In 2015, International Paper launched a packaging line made from 100% recycled fiber. This helped boost its brand image as a sustainability leader and appeal to environment-conscious customers.

Mergers and acquisitions: Consolidation through M&A has been a strategy to gain market share and complement existing product portfolio. In 2018, WestRock acquired KapStone in a $4.9 billion deal, making it the biggest player in the market. This gave WestRock access to KapStone's core strengths in recycling and vertically integrated mill system on the West Coast.

Innovation and new product development: Continual innovation to meet evolving customer demands has helped companies grow. In 2019, Mondi introduced flexible and recyclable paper squeezable pouches and tubes for food products. This helped Mondi capitalize on the fast growing flexible paper packaging segment. Between 2018-2020, Mondi's packaging sales grew at a CAGR of 4.5% supported by its innovative products.

Focus on emerging markets: Companies have invested in expanding capacity in fast growing emerging markets like Asia and Latin America to tap opportunities. In 2020, International Paper invested $350 million to build a new containerboard mill in Indonesia. This strengthened IP's presence in South East Asia and ability to serve the region's growing demand.

Segmental Analysis of Paperboard Packaging Market

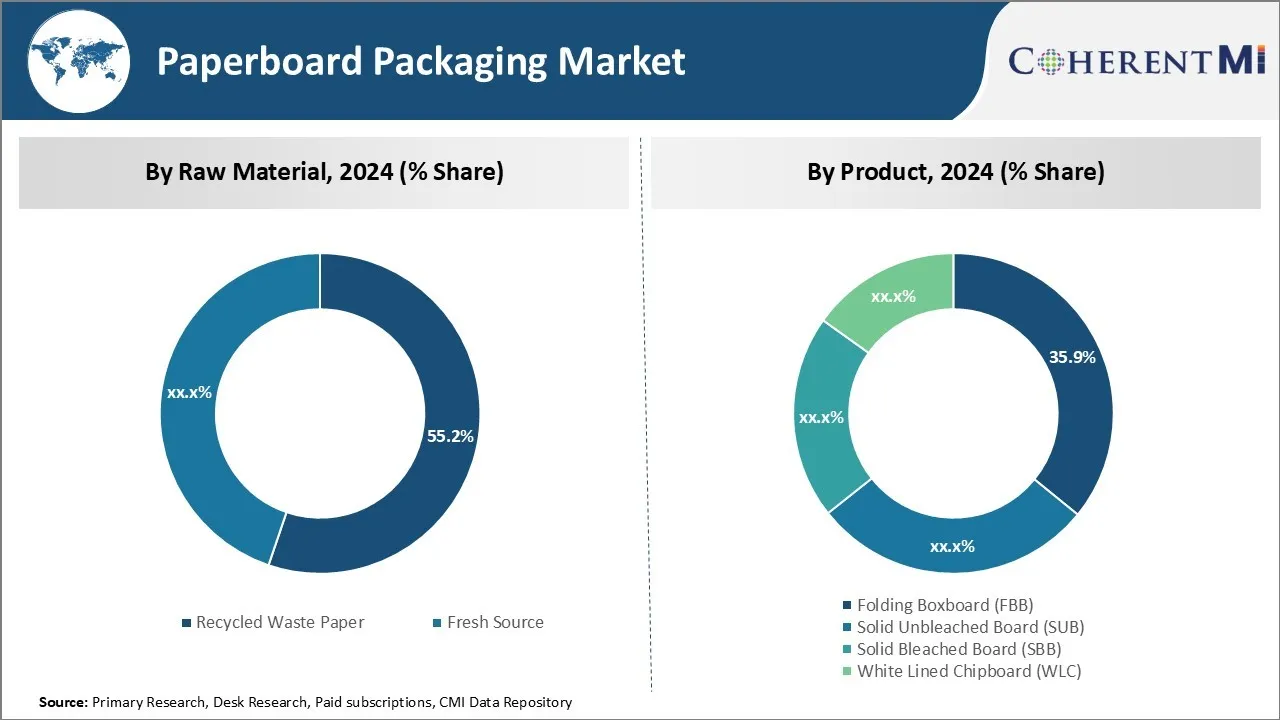

Insights, By Raw Material: Resource Circularity Drives Recycled Waste Paper Growth

In terms of raw material, recycled waste paper contributes 55.2% share of the paperboard packaging market owing to growing sustainability priorities and regulations favoring circular production methods. Recycled waste paper is attractive to both packaging manufacturers and brand owners as it reduces raw material costs.

Furthermore, landfill space constraints and bans on waste disposal in many countries encourage higher recycling rates of used paper products. The paperboard packaging market is optimizing their operations around recycled fiber sourcing in response to these trends. Brands are also pushing suppliers to incorporate recycled content to meet their own sustainability targets. Looking ahead, the segment expects to capture an even greater share through expanding collection and sorting infrastructure that improves the quality and yield of recovered fiber.

Insights, By Product: Consumer Convenience Boosts Folding Boxboard Demand

In terms of product, folding boxboard contributes 35.9% share of the paperboard packaging market in 2024. This is owing to its applicability across diverse product types. Folding boxboard offers advantages over other grades including lightweight construction for reduced shipping costs, dimensional stability for accurate printing and die-cutting, and foldability for creating compact packaging formats. Its strength and folding capabilities allow manufacturers to design boxes optimized for shipping, display, and ease of opening/closing by consumers.

A wide range of graphics and finishing options further boost folding boxboard’s popularity for premium and high-value products. Sustained growth in e-commerce is additionally fueling the need for robust, stackable shippers made from folding boxboard that prevents damage during transport. Leading players are constantly introducing new solutions made from folding boxboard to meet brand packaging specifications and volume filling requirements.

Insights, By Application: Sustenance and Convenience Drive Food & Beverages Growth

In terms of application, food & beverages contributes the highest share of the paperboard packaging market owing to the non-discretionary need for paperboard packaging in facilitating food distribution and retail. Cartons, boxes, and trays made of paperboard are preferred materials for their moisture resistance, printability, and ability to provide tamper evidence required by regulators.

Products designed specifically for food applications assure safety through greaseproof or waterproof barriers. The segment also benefits from changing consumer lifestyles that favor easy-to-handle, on-the-go snacking and meals replacing sit-down dining. Ready-to-eat food packaging capitalizes on paperboard’s potential for multipacks, resealability, aseptic formats, and microwave popcorn bags. With further innovation concentrating on branding opportunities and convenience metrics, paperboard packaging for food & beverages industry will sustain dominance.

Additional Insights of Paperboard Packaging Market

- Asia Pacific is the leading region in the global paperboard packaging market due to robust industrial growth, urbanization, and increased packaged food consumption. This growth is complemented by trends in sustainability, with companies replacing plastic with paper-based materials.

- E-commerce growth is pivotal, offering significant potential for secondary and tertiary paper packaging. The healthcare sector's demand, driven by innovative packaging for medical supplies, further underscores the expansion of paperboard packaging market.

Competitive overview of Paperboard Packaging Market

The major players operating in the paperboard packaging market include Nippon Paper Industries Co., Ltd., Stora Enso, South African Pulp & Paper Industries, Mondi plc, ITC Limited, Smurfit Kappa Group, Oji Holding Corporation, International Paper Group, and Svenska Cellulosa Aktiebolaget.

Paperboard Packaging Market Leaders

- Nippon Paper Industries Co., Ltd.

- Stora Enso

- South African Pulp & Paper Industries

- Mondi plc

- ITC Limited

Paperboard Packaging Market - Competitive Rivalry, 2024

Paperboard Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Paperboard Packaging Market

- In October 2024, Nippon Paper expanded its SPOPS business—a sustainable packaging solution that reduces plastic waste by utilizing paper packs made primarily from biomass—into the South Korean market. These efforts collectively contribute to improving recycling efficiency and enhancing competitiveness in the paperboard packaging market.

- In July 2024, Stora Enso secured a €435 million loan from the European Investment Bank to support its investment in the Oulu mill in Finland. In June 2023, Stora Enso planned restructuring actions to improve long-term competitiveness and profitability, including the closure of certain production units in Europe. These developments indicate the company's focus on strategic initiatives in Europe during that timeframe.

Paperboard Packaging Market Segmentation

- By Raw Material

- Recycled Waste Paper

- Fresh Source

- Wood pulp

- Others

- By Product

- Folding Boxboard (FBB)

- Solid Unbleached Board (SUB)

- Solid Bleached Board (SBB)

- White Lined Chipboard (WLC)

- By Application

- Food & Beverages

- Non-durable goods

- Durable goods

- Medical

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the paperboard packaging market?

The paperboard packaging market is estimated to be valued at USD 183.87 Bn in 2024 and is expected to reach USD 243.55 Bn by 2031.

What are the key factors hampering the growth of the paperboard packaging market?

High costs associated with raw materials and challenges in scaling recycling infrastructure globally are the major factors hampering the growth of the paperboard packaging market.

What are the major factors driving the paperboard packaging market growth?

Increasing demand for sustainable and recyclable packaging, growth of the e-commerce industry, and high demand for lightweight packaging are the major factors driving the paperboard packaging market.

Which is the leading raw material in the paperboard packaging market?

The leading raw material segment is recycled waste paper.

Which are the major players operating in the paperboard packaging market?

Nippon Paper Industries Co., Ltd., Stora Enso, South African Pulp & Paper Industries, Mondi plc, ITC Limited, Smurfit Kappa Group, Oji Holding Corporation, International Paper Group, and Svenska Cellulosa Aktiebolaget are the major players.

What will be the CAGR of the paperboard packaging market?

The CAGR of the paperboard packaging market is projected to be 4.1% from 2024-2031.