Advanced Non-Squamous and Squamous NSCLC Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Advanced Non-Squamous and Squamous NSCLC Market is segmented By Molecule Type (Monoclonal antibody, Small molecule, Peptide), By Treatment (Immunother....

Advanced Non-Squamous and Squamous NSCLC Market Size

Market Size in USD Bn

CAGR7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7% |

| Market Concentration | High |

| Major Players | AstraZeneca, Roche, Novartis, Pfizer, Bristol-Myers Squibb, Jiangsu Alphamab Biopharmaceuticals, Jiangsu HengRui Medicine and Among Others. |

please let us know !

Advanced Non-Squamous and Squamous NSCLC Market Analysis

The advanced non-squamous and squamous NSCLC market is estimated to be valued at USD 10.89 Bn in 2024 and is expected to reach USD 16.58 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7% from 2024 to 2031. This market has been witnessing steady growth over the past few years and this trend is expected to continue over the forecast period supported by increasing prevalence of lung cancer cases globally and growing demand for advanced and effective therapeutic options for treatment.

Advanced Non-Squamous and Squamous NSCLC Market Trends

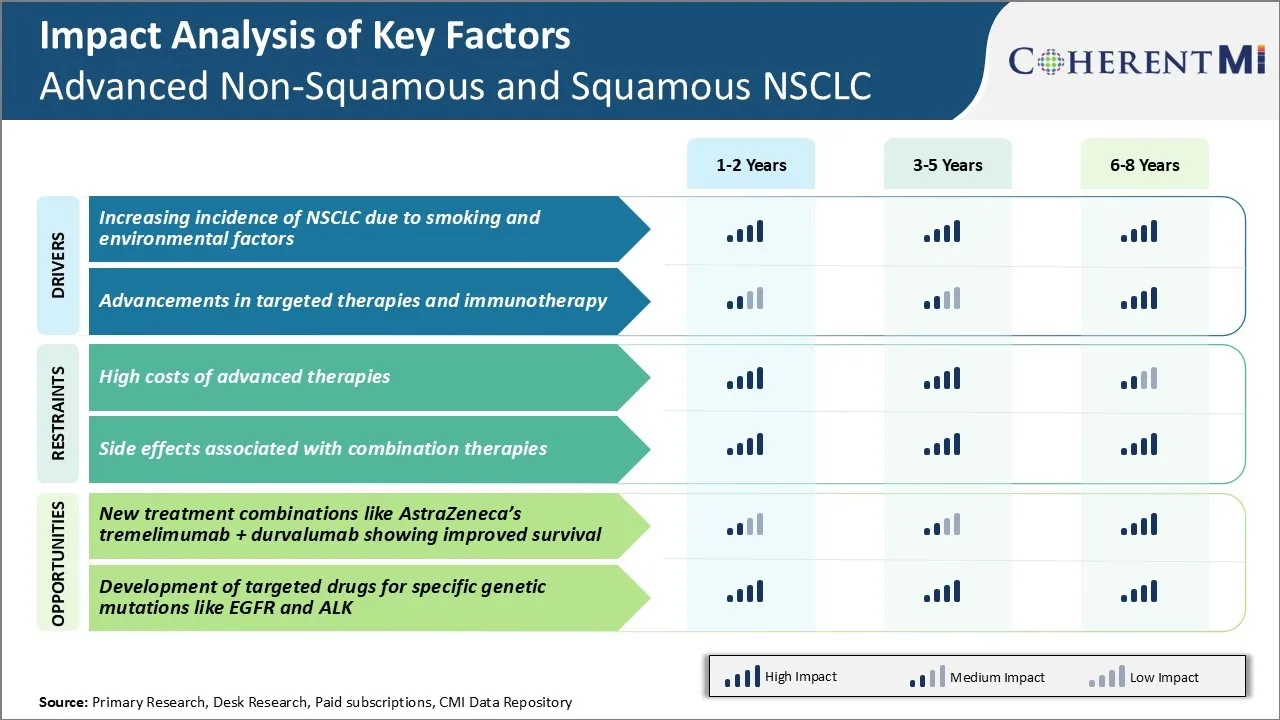

Market Driver - Higher Incidence of NSCLC due to Smoking and Environmental Risks

Lung cancer remains the foremost cause of cancer-associated mortality globally, and NSCLC accounts for approximately 80-85% of all lung cancer cases. Chronic exposure to cigarette smoke is the principal risk factor for the development of lung cancer. It is estimated that close to 90% of lung cancer deaths are caused due to tobacco smoking.

As per some recent epidemiological studies, the menace of air pollution has turned out to be an important environmental trigger for the development of lung cancers, especially in Asian countries where air quality is severely compromised. Areas with high levels of radon gas exposure in homes and workplaces have also witnessed elevated incidence of lung cancers. Workers in certain industries like mining, steel production, asbestos processing are at higher risk of lung cancer due to repeated inhalation of occupational lung carcinogens during their job tenure.

With continued urbanization and industrialization in emerging economies, exposure to outdoor and indoor air pollutants and toxic workplace atmospheres is likely to further propagate in the future, thereby fueling the rise of NSCLC cases.

Market Driver - Advancements in Targeted Therapies and Immunotherapy

Another prominent aspect bolstering the advanced non-squamous and squamous NSCLC market is the considerable progress made in the realm of targeted therapies and immunotherapy for lung malignancies. Traditionally, chemotherapy had been the mainstay of treatment for NSCLC patients.

However, over the past decade, there have been unprecedented advances in our understanding of cancer pathways and biological drivers of tumor growth. This has allowed researchers to identify novel molecular targets and develop matching targeted drugs that interfere with specific oncogenes or growth factor receptors critical for NSCLC cell proliferation and survival. Some examples include tyrosine kinase inhibitors blocking mutated forms of EGFR or ALK fusion proteins in selected patient subsets.

Additionally, immune checkpoint inhibitors unleashing the body's innate immune defenses have revolutionized lung cancer treatment. Drugs inhibiting PD-1/PD-L1 interaction and restoring anti-tumor immunity have shown durable responses and improved survival outcomes in advanced NSCLC, even after failure of chemotherapy and radiation. This has transformed NSCLC into one of the cancers most amenable to immunotherapy.

Wider availability and greater clinical use of these precision medicines and immunotherapies over the coming years will augment the advanced non-squamous and squamous NSCLC market size manifold.

Market Challenge - High Costs of Advanced Therapies

One of the key challenges facing the advanced Non-Squamous and Squamous NSCLC market is the high costs associated with newer, advanced therapies. As immunotherapy and targeted therapies become standard of care options for frontline and later line treatment of NSCLC, the cost of these therapies poses a significant hurdle.

Most immunotherapy regimens cost over $100,000 annually, with some combinations even exceeding $200,000 for a year of treatment. While these advanced options have demonstrated improved survival outcomes compared to traditional chemotherapy, generating a better overall value proposition, the short-term costs remain exceedingly high. This price tag places significant financial pressure on healthcare systems and private payers.

With an aging global population and increasing incidence of NSCLC cases, the total cost of treating NSCLC patients threatens to swell healthcare budgets. Drug manufacturers must look at innovative pricing strategies and value-based agreements to make these life-saving therapies more affordable and accessible to a wider segment of patients.

Market Opportunity - New Treatment Combinations Showing Improved Survival

One major opportunity emerging in the advanced Non-Squamous and Squamous NSCLC market is the development of novel treatment combinations demonstrating improved survival. A prime example is AstraZeneca’s immunotherapy combination of tremelimumab and durvalumab.

Recent Phase 3 data from the MYSTIC trial showed that this dual checkpoint inhibitor regimen helped extend overall survival by close to 3 months compared to chemotherapy in frontline NSCLC treatment. At a median follow up of over 2 years, the combination delivered a 22% reduction in the risk of death. Such improvements in survival endpoints represent a turning point in NSCLC care.

As newer combinations like tremelimumab + durvalumab become integral first-line options, they have the potential to significantly prolong longevity while also enhancing quality of life for NSCLC patients. This success highlights immunotherapy combinations as a flourishing area that can drive sustained growth opportunities within the NSCLC therapeutics market.

Prescribers preferences of Advanced Non-Squamous and Squamous NSCLC Market

For first-line treatment of metastatic non-squamous NSCLC, immune checkpoint inhibitors have increasingly become the standard of care. CheckMate studies showed nivolumab (Opdivo) significantly improved survival versus docetaxel. In squamous NSCLC, Keytruda (pembrolizumab) and Tecentriq (atezolizumab) also demonstrated efficacy.

For those with EGFR mutations or ALK rearrangements, first-line tyrosine kinase inhibitors such as Tagrisso (osimertinib) for EGFR+ and Alecensa (alectinib) for ALK+ remain preferred. Their impressive response rates and milder profiles are attractive to prescribers.

For second-line non-squamous NSCLC following platinum-based chemotherapy, immunotherapy retains its prominence. Opdivo and Keytruda have benefited this patient segment in large randomized trials. Their ability to provide long-term survival makes them desirable options, despite potential immune-related side effects.

In squamous histology, docetaxel has long served as the standard second-line therapy. However, some physicians are exploring immunotherapies earlier given their activity seen even in smokers and poor PS individuals. Surprisingly, a small subset may still turn to single-agent gemcitabine or pemetrexed if toxicity is a major concern.

I hope this comprehensive yet detailed report provides useful insights into prescribers' treatment preferences based on disease subtypes, lines of therapy, and specific medication examples. Please let me know if any part of the analysis can be expanded further.

Treatment Option Analysis of Advanced Non-Squamous and Squamous NSCLC Market

Non-small cell lung cancer (NSCLC) can be categorized as advanced, non-squamous or squamous disease. For advanced non-squamous NSCLC, treatment depends on PD-L1 status and mutational profile.

For PD-L1>50%, first-line immunotherapy with pembrolizumab (Keytruda) monotherapy is preferred due to superior efficacy and tolerability versus platinum-based chemotherapy. For PD-L1 1-49%, chemotherapy plus pembrolizumab is recommended to improve outcomes. Common backbone regimens include carboplatin or cisplatin with pemetrexed for non-squamous histology.

Second-line options include docetaxel, nivolumab (Opdivo), ramucirumab (Cyramza) plus docetaxel or erlotinib (Tarceva) for EGFR mutations. For squamous NSCLC, first-line platinum-based doublet chemotherapy including carboplatin or cisplatin with gemcitabine, paclitaxel or docetaxel are standard.

Second-line options include docetaxel or nivolumab monotherapy. Immunotherapy with nivolumab or pembrolizumab are also alternatives for second-line treatment due to improved efficacy versus docetaxel. Chemotherapy backbones are chosen based on histology to maximize efficacy while minimizing toxicity. Immunotherapies offer improved overall survival and are becoming preferred options due to favorable safety profiles. Biomarker testing guides targeted therapies.

Key winning strategies adopted by key players of Advanced Non-Squamous and Squamous NSCLC Market

Product Innovation: One of the main strategies adopted by leading players like AstraZeneca and Roche has been continuous investments in R&D to develop novel targeted therapies. For example, in 2018 AstraZeneca received FDA approval for Tagrisso (osimertinib) as a first-line treatment for EGFR mutated NSCLC. Tagrisso has significantly improved survival rates compared to traditional chemo and become a standard first-line therapy. Its success led to growing market share for AstraZeneca.

Expanding Indications: Players like Merck have successfully expanded the approved indications of their existing drugs to target more patient segments. For example, in 2020 FDA approved Keytruda's use in combination with chemo as front-line therapy for patients with metastatic or recurrent non-squamous NSCLC. This significantly expanded Keytruda's addressable patient population and market potential.

Strategic Partnerships: To gain access to new drug candidates and technologies, Bristol-Myers Squibb partnered with other companies through joint R&D agreements and M&As. For example, in 2019 it acquired Celgene for $74 billion, gaining rights to the newly approved NSCLC drug Revlimid. This strengthened its oncology portfolio. It has led to Revlimid generating over $12 billion in global sales for Bristol-Myers Squibb since.

Segmental Analysis of Advanced Non-Squamous and Squamous NSCLC Market

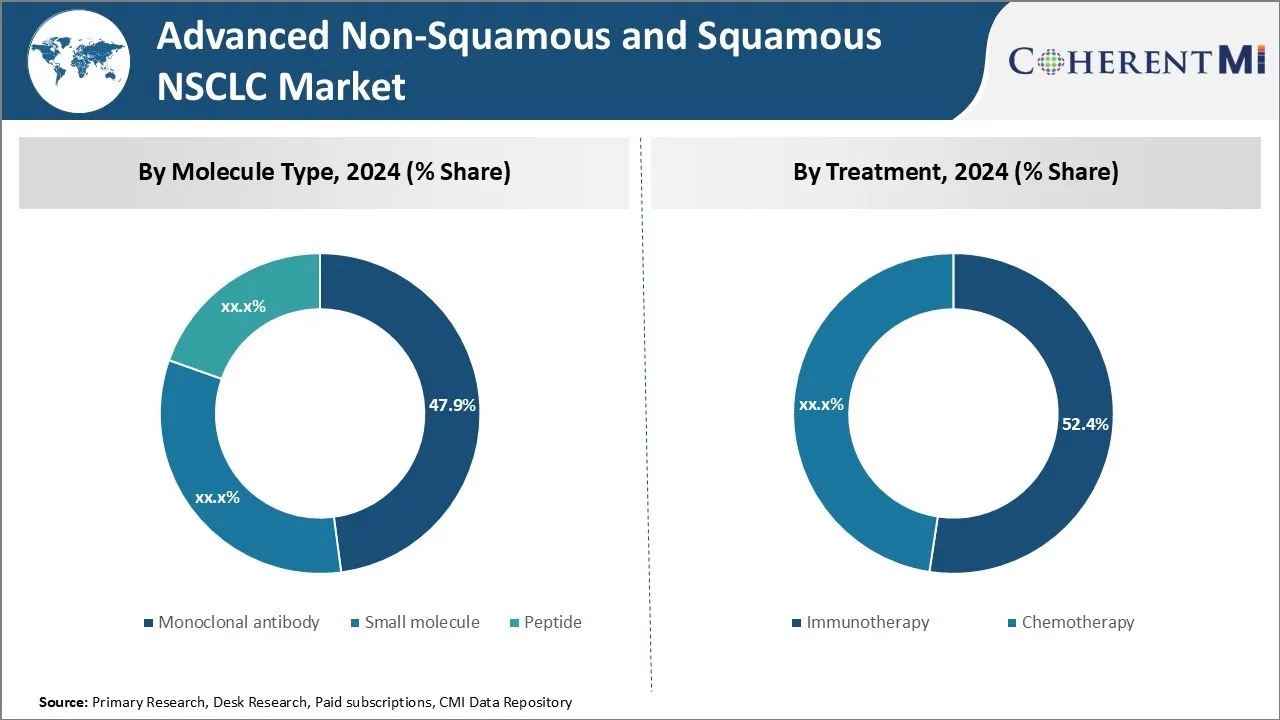

Insights, By Molecule Type: Targeted Therapeutics Dominate NSCLC Treatment Landscape

In terms of molecule type, monoclonal antibody is expected to hold 47.9% share of the market in 2024, owing to their targeted approach against specific molecules driving cancer progression. Monoclonal antibodies such as immunotherapy drugs like pembrolizumab (Keytruda) and nivolumab (Opdivo) have ushered in a new era of precision oncology.

Unlike traditional chemotherapy agents, these drugs can selectively block immune checkpoints like PD-1/PD-L1 that tumor cells exploit to evade immune destruction. With minimal off-target toxicity compared to chemotherapy, they have demonstrated superior overall survival and durability of response.

Recent approvals of monoclonal antibodies in multiple settings of advanced NSCLC from both squamous and non-squamous histology have propelled their uptake. Additionally, the demand for companion diagnostics to identify patients most likely to benefit from these therapies has grown commensurately.

Insights, By Treatment: Immunotherapy Emerges as the Preferred NSCLC Treatment Approach

In terms of treatment, immunotherapy is projected to account for 52.4% share of the market in 2024, driven by its ability to harness the power of the immune system against cancer cells. Checkpoint inhibitors have transformed the treatment landscape by activating the patient's own immune cells allowing them to recognize and destroy cancerous cells. The success of checkpoint inhibitors as first-line as well as subsequent line therapy options has boosted their adoption rate.

Additionally, new data demonstrating improved survival and Quality of Life outcomes compared to chemotherapy has encouraged the preference for immunotherapy early in the treatment sequence. Their favorable toxicity profile compared to chemotherapy further augments patient and physician willingness to choose immunotherapy.

Insights, By Disease: Non-Squamous Cell Carcinoma Dominates the Market

In terms of disease, non-squamous cell carcinoma contributes the highest share of the market owing to its relatively higher prevalence rates compared to squamous cell carcinoma. Non-squamous cell carcinoma constitutes approximately 80-85% of all lung cancers and has been a major focus of clinical research and new drug development.

Several targeted therapies as well as immunotherapies have been approved preferentially or exclusively for patients with advanced or metastatic non-squamous cell carcinoma based on superior efficacy demonstrated in clinical trials. Availability of increased treatment options along with encouraging outcomes have supported higher adoption of these drugs for non-squamous cell carcinoma indication over squamous cell carcinoma, which has pushed its market share higher within the overall market.

Additional Insights of Advanced Non-Squamous and Squamous NSCLC Market

- NSCLC represents approximately 85% of all lung cancers, with squamous cell carcinoma comprising around 25-30% and non-squamous making up 70-75%. This distinction is vital for tailoring treatments, especially in advanced cases.

- The NSCLC market has seen major shifts, particularly with the growing use of combination immunotherapy. AstraZeneca’s durvalumab and Roche’s Tecentriq have set benchmarks in first-line treatment for advanced NSCLC, helping to improve patient survival rates in metastatic cases.

- Avoidable risk factors like smoking and exposure to environmental carcinogens are major contributors to NSCLC. Advanced stages of the disease exhibit more severe symptoms, impacting quality of life.

- FDA-approved targeted therapies for genetic mutations such as EGFR, ALK, ROS1, and others are central to personalized treatment.

- Treatment modalities vary between squamous and non-squamous NSCLC, including platinum-based chemotherapy and immune checkpoint inhibitors.

Competitive overview of Advanced Non-Squamous and Squamous NSCLC Market

The major players operating in the advanced non-squamous and squamous NSCLC market include AstraZeneca, Roche, Novartis, Pfizer, Bristol-Myers Squibb, Jiangsu Alphamab Biopharmaceuticals, and Jiangsu HengRui Medicine.

Advanced Non-Squamous and Squamous NSCLC Market Leaders

- AstraZeneca

- Roche

- Novartis

- Pfizer

- Bristol-Myers Squibb

- Jiangsu Alphamab Biopharmaceuticals

- Jiangsu HengRui Medicine

Advanced Non-Squamous and Squamous NSCLC Market - Competitive Rivalry, 2024

Advanced Non-Squamous and Squamous NSCLC Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Advanced Non-Squamous and Squamous NSCLC Market

- In October 2024, AstraZeneca announced positive data from the Phase III POSEIDON trial. This trial evaluated the combination of tremelimumab, durvalumab, and chemotherapy for the treatment of metastatic non-small cell lung cancer (NSCLC). The results showed a significant improvement in overall survival (OS) for patients treated with this combination compared to chemotherapy alone. The combination therapy was particularly effective in enhancing survival outcomes in this patient group, marking an important step forward in NSCLC treatment.

- Roche has launched additional studies for Tecentriq (atezolizumab) in combination therapies to strengthen its position in the non-small cell lung cancer (NSCLC) immunotherapy market. For example, Roche's IMpower130 and IMpower150 studies demonstrated the effectiveness of Tecentriq when combined with chemotherapy and other agents like Avastin (bevacizumab). These studies showed improvements in overall survival (OS) and progression-free survival (PFS), which are key measures in lung cancer treatment. The success of these trials has helped Tecentriq solidify its role as a foundational therapy for NSCLC and further expanded its use in various combination regimens.

- Erfonrilimab (KN-046) by Jiangsu Alphamab Biopharmaceuticals is currently undergoing a Phase III clinical trial as a bispecific antibody targeting both PD-L1 and CTLA-4 for advanced squamous non-small cell lung cancer (NSCLC). The trial, known as ENREACH-LUNG-01, is a multicenter, randomized, double-blind, placebo-controlled study designed to assess the safety and efficacy of KN-046 in combination with chemotherapy for patients with unresectable or metastatic squamous NSCLC.

- Pyrotinib developed by Jiangsu Hengrui Medicine is currently in Phase III trials for treating HER2-positive advanced solid tumors, including non-squamous non-small cell lung cancer (NSCLC). The ongoing PYRAMID-1 (NCT04447118) Phase III trial aims to confirm its benefit in progression-free survival (PFS) compared to docetaxel in patients with advanced NSCLC harboring HER2 mutations. Pyrotinib is an oral, irreversible pan-HER tyrosine kinase inhibitor that has shown potential in treating various HER2-mutated cancers, including breast and lung cancers.

Advanced Non-Squamous and Squamous NSCLC Market Segmentation

- By Molecule Type

- Monoclonal antibody

- Small molecule

- Peptide

- By Treatment

- Immunotherapy

- Chemotherapy

- By Disease

- Non-Squamous Cell Carcinoma

- Squamous Cell Carcinoma

- By Route of Administration

- Oral

- Subcutaneous

- Intravitreal

- Intramuscular

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the advanced non-squamous and squamous NSCLC market?

The advanced non-squamous and squamous NSCLC market is estimated to be valued at USD 10.89 Bn in 2024 and is expected to reach USD 16.58 Bn by 2031.

What are the key factors hampering the growth of the advanced non-squamous and squamous NSCLC market?

High costs of advanced therapies and side effects associated with combination therapies are the major factors hampering the growth of the advanced non-squamous and squamous NSCLC market.

What are the major factors driving the advanced non-squamous and squamous NSCLC market growth?

Increasing incidence of NSCLC due to smoking and environmental factors and advancements in targeted therapies and immunotherapy are the major factors driving the advanced non-squamous and squamous NSCLC market.

Which is the leading Molecule Type in the advanced non-squamous and squamous NSCLC market?

The leading Molecule Type segment is Monoclonal antibody.

Which are the major players operating in the advanced non-squamous and squamous NSCLC market?

AstraZeneca, Roche, Novartis, Pfizer, Bristol-Myers Squibb, Jiangsu Alphamab Biopharmaceuticals, and Jiangsu HengRui Medicine are the major players.

What will be the CAGR of the advanced non-squamous and squamous NSCLC market?

The CAGR of the advanced non-squamous and squamous NSCLC market is projected to be 7% from 2024-2031.