Body Fat Measurement Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Body Fat Measurement Devices Market is segmented By Product (Bioelectrical Impedance Analyzer, Body Circumference Measurement Tapes, Dual-Energy X-Ray....

Body Fat Measurement Devices Market Size

Market Size in USD Mn

CAGR6.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.3% |

| Market Concentration | Medium |

| Major Players | RJL Systems, Tanita, OMRON Corporation, Withings, Dr Trust and Among Others |

please let us know !

Body Fat Measurement Devices Market Analysis

The body fat measurement devices market is estimated to be valued at USD 675.5 million in 2024 and is expected to reach USD 1,038 million by 2031, growing at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2031.

The demand for body fat measurement devices is growing significantly over the years. Factors such as increasing health awareness among people, rising obesity rates, and government initiatives to promote healthy lifestyles are fueling the adoption of these devices.

Body Fat Measurement Devices Market Trends

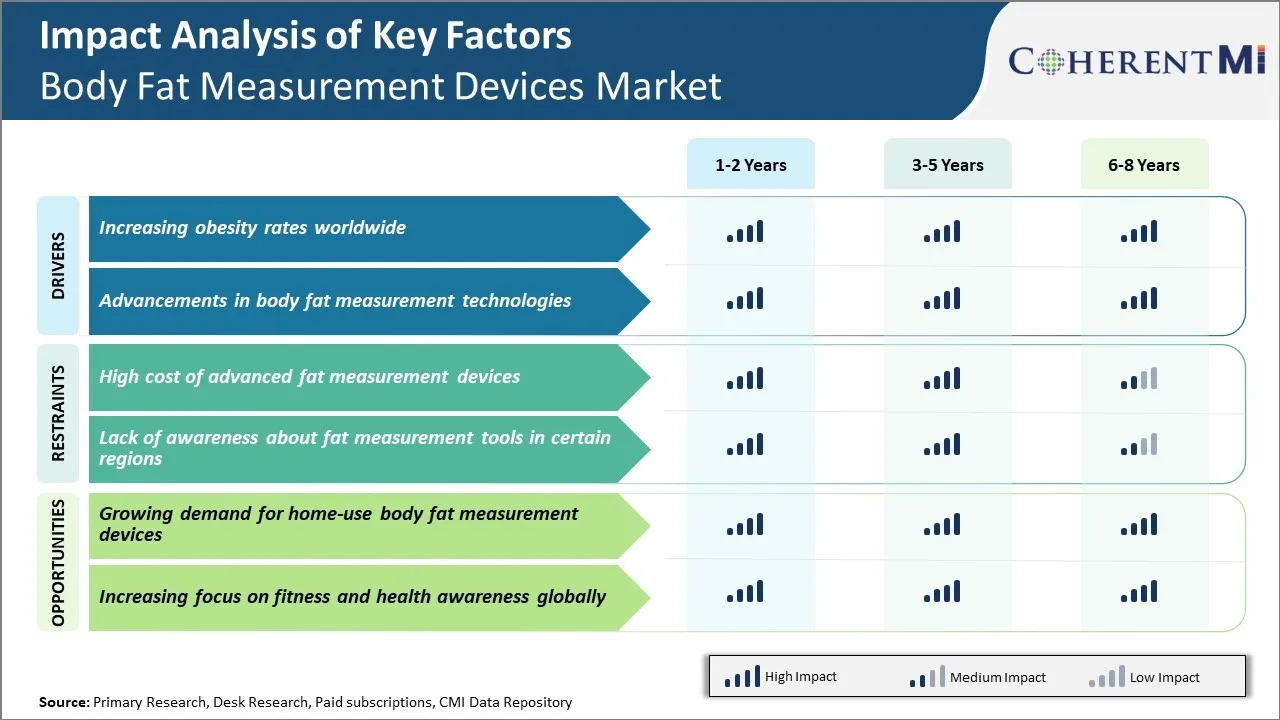

Market Driver - Increasing Obesity Rates Worldwide

Obesity has become a growing concern globally with rates rising at an alarming pace in past few decades. Excess body fat and weight puts significant stress on overall health and is a major risk factor for life-threatening conditions like diabetes, heart diseases and certain cancers. According to WHO, as of 2016, more than 1.9 billion adults were overweight out of which over 650 million were obese. If the current trends continue, the number of obese populations is expected to rise further over next year’s significantly impacting public healthcare systems.

With growing health consciousness, more people are now taking preventive measures and are keeping a check on their weight and food intake. However, traditional methods of calculating obesity like using weighing scales and calculating BMI have their limitations and do not offer proper insight into body composition.

There is a need for more reliable and precise measurement solutions that can accurately determine not just weight but other important parameters like fat mass, muscle mass, bone mineral content and visceral fat levels. This trend has significantly boosted demand for technologically advanced, precise, and easy-to-use body fat analyzers and composition monitors in past years.

Market Driver - Advancements in Body Fat Measurement Technologies

Rapid technological progress has brought about tremendous improvements in devices that monitor various health stats including body fat levels. Earlier devices mostly provided generalized results but latest variants use multiple technologies in tandem to deliver highly accurate and detailed analysis of body composition.

Bioelectrical Impedance Analysis or BIA was one of earliest techniques used, however newer impedance-based analyzers incorporate multiple frequency signals and high-precision sensors to account for factors like gender, age, height that impact results. Advanced DEXA or DXA scans which use X-ray based measurements are now accessible as compact portable units offering precise bone density and extracellular/intracellular water readings.

Other emerging methods like 3D body scanning, air displacement plethysmography and infrared interaction are entering the market as well. Such solutions powered by AI can extract detailed metrics within seconds by just standing on a platform or wearing compatible clothing or accessories. Constant innovation is making these high-end clinical grade technologies available as mainstream affordable home-use devices.

Manufacturers are also focusing on form factor and making devices more convenient to use. Smart scales, tape measures, handheld analyzers, wearable trackers with body composition features have seen rapid adoption. Integration of these devices with fitness apps and health platforms allows centralized online monitoring of trends.

Market Challenge - High Cost of Advanced Fat Measurement Devices

One of the key challenges currently faced by the body fat measurement devices market is the high cost of advanced fat measurement devices. More sophisticated devices that provide highly accurate body composition analysis, such as DEXA scans and air displacement plethysmography devices, can frequently cost thousands of dollars. This high price point puts such devices out of reach for most ordinary consumers and limits their usage predominantly to clinical settings.

Even for gyms and fitness centers, the steep capital expenditure required to invest in advanced body composition analyzers may not always be feasible or justified. The high costs associated with R&D and production of such technically complex devices necessary to ensure very high precision are major factors contributing to their higher prices.

This inhibits greater penetration and widespread adoption of advanced fat measurement technologies among general population for personal health and fitness monitoring purposes. For the mass consumer segment, more affordable alternatives are often preferred even if they provide estimates with slightly lower accuracy.

Market Opportunity - Growing Demand for Home-use Body Fat Measurement Devices

One significant opportunity for players in the body fat measurement devices market lies in the growing demand for home-use devices for body composition monitoring. With rising health awareness and focus on fitness, many consumers want to easily track their body fat percentages and weight fluctuations from the comfort of their homes. This has resulted in higher demand for simple, affordable, and handy devices that can deliver reasonably accurate measurements without requiring visits to clinics or gyms.

Body fat scales, impedance meters, calipers, and tape-based devices have become increasingly popular as home-use options. Market leaders are innovating new product varieties within these categories tailored for residential settings with convenient features such as Bluetooth connectivity and app integration. The convenience and cost-effectiveness of home-use devices in comparison to clinical body composition analyzers are major factors fueling their increased adoption. This emerging segment holds much potential for continued growth and is attracting many new entrants as well as expansions by existing players in the industry.

Key winning strategies adopted by key players of Body Fat Measurement Devices Market

Focus on product innovation - Continuous innovation to meet evolving consumer needs has helped players maintain leadership. In 2020, Fitbit launched its new Aria Air scale that not only measures weight but also tracks body composition trends over time through segments like BMI, bone mass, body fat and muscle mass percentages. garmin also released index smart scale which provide in-depth body composition analysis including muscle mass, body water, and more. Such advanced products have boosted market share.

Target specific consumer segments - Strategic segmentation allows players to develop customized solutions. In 2018, Renpho launched its T9 smart scale focused on self-quantification needs of Millennials. The minimalist design and integration with Apple health kit made it popular. Similarly, Greater Goods launched BodyTrack scales in 2021 targeting budget-conscious wellness consumers with affordable and accurate devices.

Focus on emerging markets - Growing health awareness in developing regions provides opportunities. In 2019, Nokia-owned Withings entered India and partnered with online retailers andfitness studios to push its connected devices. It gained a first-mover advantage. China-based Xiaomi also focuses on SE Asian and African markets through e-commerce channels and ties up with local gyms/clinics for increased outreach and repeat sales.

Segmental Analysis of Body Fat Measurement Devices Market

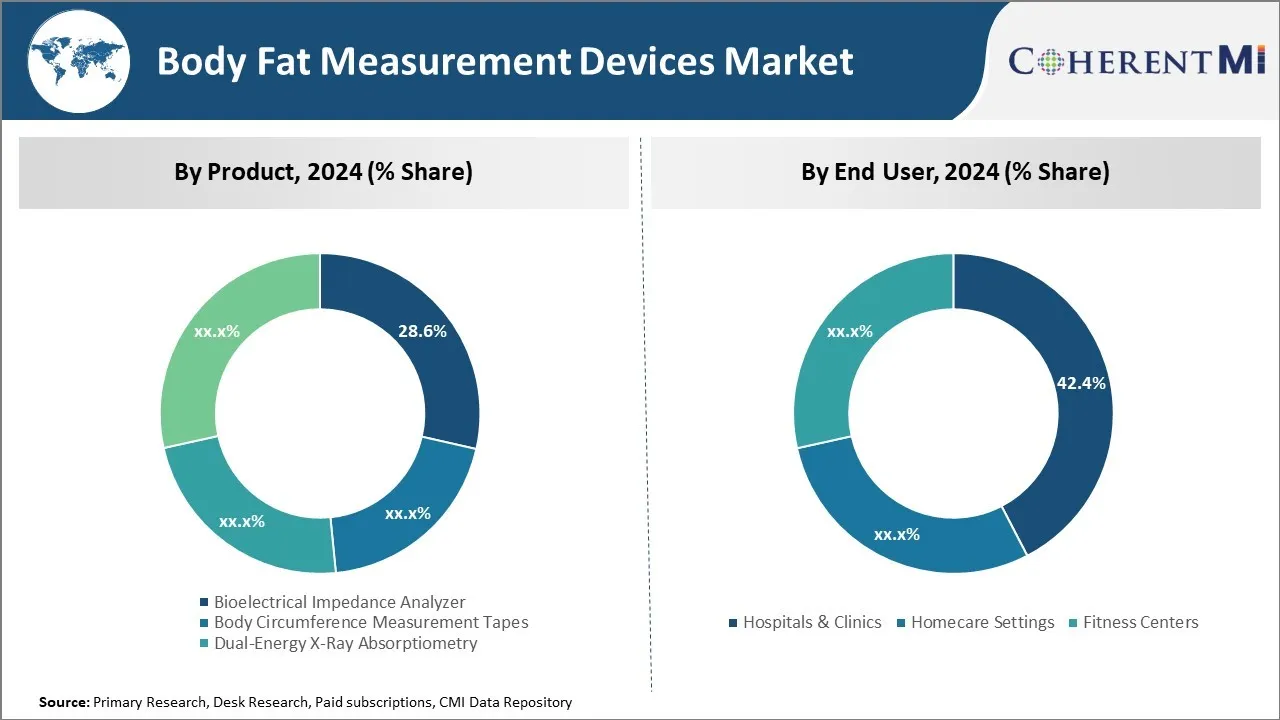

Insights, By Product: Bioelectrical Impedance Analyzer Remain High in Demand

In terms of product, bioelectrical impedance analyzer contributes the highest share of the market owning to its convenience and accuracy. The bioelectrical impedance analyzer segment dominates the body fat measurement devices market due to key advantages it offers over other product types.

Since the current encounters more resistance while passing through fat tissues compared to lean tissues, it can precisely calculate body fat percentage through simple wrist-to-ankle contact. This pain-free and quick analysis has made bioelectrical impedance analyzers highly convenient to use for both healthcare professionals and individuals.

Another major factor fuelling the growth of this segment is its high accuracy. Modern bioimpedance analyzers use multiple frequency points and clinically validated predictive equations to deliver body composition results with less than 3% error rate. They can separately quantify fat, fat-free mass, total body water and other metrics.

Various other advantages like portability, easy maintenance and automation have further increased the adoption of bioimpedance analyzers. Devices are now even available for personal use with smartphone connectivity. Manufacturers are also introducing novel technologies like segmental multi-frequency analysis that can detect subtle alterations in body water distribution. All these factors are strengthening the leadership of this segment in current times.

Insights, By End User: Hospitals & Clinics Contribute the Highest Share due to Need for Accurate Assessment

The hospitals and clinics segment has emerged as the major end-user group in the body fat measurement devices market. This is primarily owed to the rising importance of body composition testing in clinical decision making. Healthcare providers are increasingly relying on precise body fat estimation for nutritional assessment, evaluating treatment effectiveness, and diagnosing chronic conditions.

Metabolic disorders, cardiovascular diseases and other lifestyle-related illnesses often correlate to an individual's fat distribution and percentages. Therefore, inpatient and outpatient facilities prefer to use medically-grade tools for authoritative body composition analysis.

Devices available at hospitals and diagnostic clinics also offer higher accuracy levels as required for medical purposes. They incorporate stringent calibration protocols and are operated by trained professionals, eliminating human error. Segmental analyzers providing regional fat distribution maps add valuable clinical insights. Meanwhile, streamlining of measurements assists comparison studies for research.

Rapid technological advances further drive the medical segment. Novel imaging technologies enable tracking of real-time body composition changes with treatment. This ushers personalized care based on objective metrics beyond weight or BMI alone. Increasing healthcare spending and emphasis on preventive management also aid market growth. Overall, accurate needs of medical establishment fuel the largest share of this end-user category.

Additional Insights of Body Fat Measurement Devices Market

- WHO estimates by 2030, 47%, 35%, and 39% of the population in the US, UK, and Mexico respectively will be obese.

Competitive overview of Body Fat Measurement Devices Market

The major players operating in the Body Fat Measurement Devices Market include RJL Systems, Tanita, OMRON Corporation, Withings, Dr Trust, Hologic, Inc., seca, Bowers Group, ACCUFITNESS, LLC, and and COSMED.

Body Fat Measurement Devices Market Leaders

- RJL Systems

- Tanita

- OMRON Corporation

- Withings

- Dr Trust

Body Fat Measurement Devices Market - Competitive Rivalry

Body Fat Measurement Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Body Fat Measurement Devices Market

- In September 2020, Akern launched the BIA 101 BIVA® PRO bioimpedance analyzer. This device is designed to evaluate nutritional, muscular, and hydro-electrolytic status using advanced bioimpedance techniques. The BIA 101 BIVA PRO offers features like a 5-inch IPS display, optimized user workflow, and enhanced reliability in measurements, making it suitable for various fields, including sports, fitness, hospital nutrition, and pediatric care. The device also supports total body and regional bioimpedance analysis, allowing precise tracking of body composition and changes in specific muscle groups.

- In August 2022, Bodyport Inc. received FDA 510(k) clearance for its Bodyport Cardiac Scale. This device uses advanced sensors and algorithms to noninvasively measure key hemodynamic biomarkers, such as heart function and fluid status, through the feet when a person steps on the scale. It is particularly useful for patients with fluid management conditions like heart failure and kidney disease. By integrating seamlessly into daily routines, the scale transmits data to healthcare teams for efficient monitoring and personalized care.

Body Fat Measurement Devices Market Segmentation

- By Product

- Bioelectrical Impedance Analyzer

- Body Circumference Measurement Tapes

- Dual-Energy X-Ray Absorptiometry

- Skinfold Calipers

- By End User

- Hospitals & Clinics

- Homecare Settings

- Fitness Centers

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How big is the body fat measurement devices market?

The body fat measurement devices market is estimated to be valued at USD 675.5 million in 2024 and is expected to reach USD 1,038 million by 2031.

What are the key factors hampering the growth of the body fat measurement devices market?

The high cost of advanced fat measurement devices and lack of awareness about fat measurement tools in certain regions are the major factors hampering the growth of the body fat measurement devices market.

What are the major factors driving the body fat measurement devices market growth?

The increasing obesity rates worldwide and advancements in body fat measurement technologies are the major factors driving the body fat measurement devices market.

Which is the leading product in the body fat measurement devices market?

The leading product segment is bioelectrical impedance analyzer.

Which are the major players operating in the body fat measurement devices market?

RJL Systems, Tanita, OMRON Corporation, Withings, Dr Trust, Hologic, Inc., seca, Bowers Group, ACCUFITNESS, LLC, and COSMED are the major players.

What will be the CAGR of the body fat measurement devices market?

The CAGR of the body fat measurement devices market is projected to be 6.3% from 2024-2031.