Cardiac Resynchronization Therapy Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Cardiac Resynchronization Therapy Market is segmented By Product Type (CRT-Defibrillators, CRT-Pacemakers), By End User (Hospitals, Specialty Clinics,....

Cardiac Resynchronization Therapy Market Size

Market Size in USD Bn

CAGR6.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.4% |

| Market Concentration | High |

| Major Players | Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK, Microport Scientific Corporation and Among Others. |

please let us know !

Cardiac Resynchronization Therapy Market Analysis

The cardiac resynchronization therapy (CRT) market is estimated to be valued at USD 7.45 billion in 2024 and is expected to reach USD 10.83 billion by 2031, growing at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2031. Advancements in cardiac devices along with the rising geriatric population suffering from chronic heart conditions are major factors driving the growth of this market.

Cardiac Resynchronization Therapy Market Trends

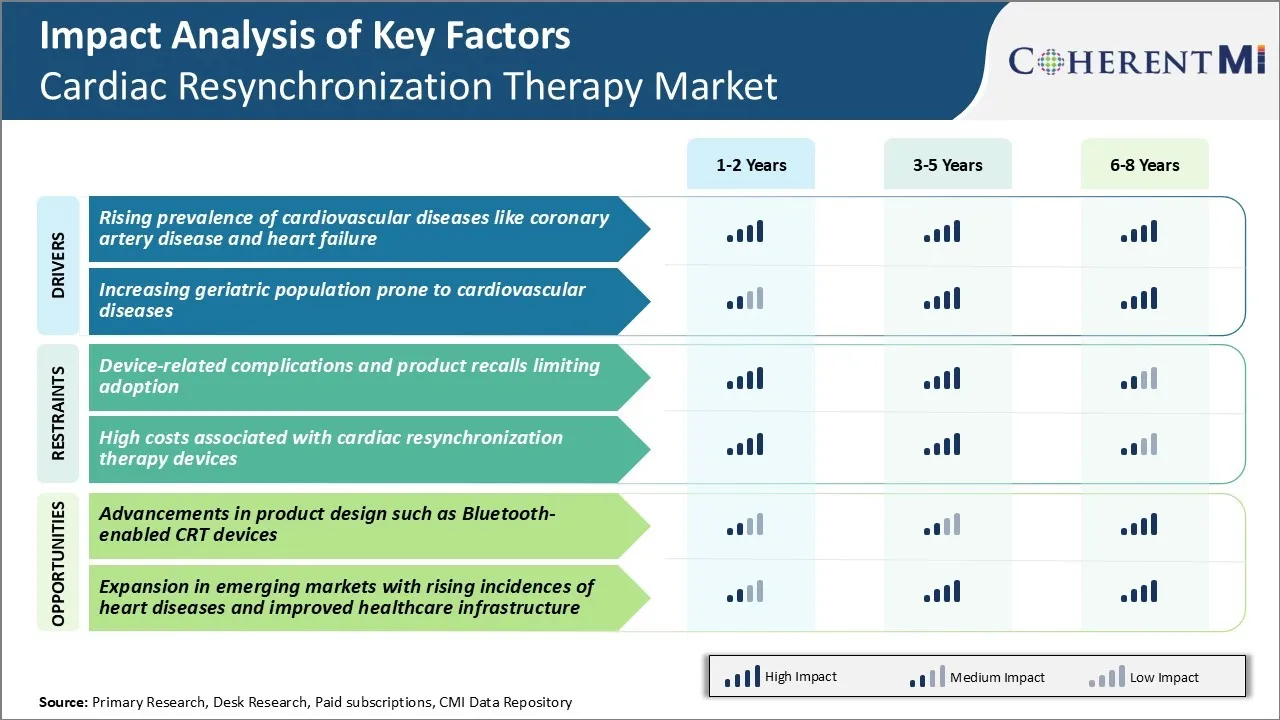

Market Driver - Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases such as coronary artery disease and heart failure is a major factor driving the demand for cardiac resynchronization therapy devices. Heart failure has reached epidemic proportions globally due to prolonged life expectancy and improved management of hypertension, myocardial infarction, and other heart conditions. It is estimated that over 64 million people suffer from heart failure worldwide.

Many of these patients have underlying conditions that disrupt the heart's natural conduction system and cause the heart to pump inefficiently. Cardiac resynchronization therapy effectively coordinates the contractions of the left and right ventricles through strategic placement of pacing leads and is an important treatment modality for heart failure patients with ventricular dysfunction and a widened QRS complex.

Device companies have responded with innovative technological advancements such as contact force sensing leads, automated programming algorithms, and wireless communication capabilities that further augment the benefits of CRT. Greater awareness among physicians and patients alike about the therapeutic potential of this technology for symptomatic heart failure has spurred demand.

Looking ahead, as the prevalence of underlying heart conditions rises in tandem with aging demographics, the market for cardiac resynchronization therapy is poised for steady growth.

Market Driver - Increasing Geriatric Population Prone to Cardiovascular Diseases

Advanced age is a major risk factor for cardiovascular diseases since the chances of developing conditions like coronary artery disease, heart failure, and arrhythmias increase substantially with each passing decade after 60 years of age. Of note, over 50% of heart failure cases occur in individuals aged 70 years and above.

Moreover, co-morbidities such as hypertension and diabetes that often accompany old age can further aggravate cardiac issues. As life expectancy continues growing globally due to healthcare improvements, the proportion of elderly individuals prone to heart problems is growing commensurately.

In most countries, the 65+ demographic is the fastest growing segment of the population. This demographic expansion of the geriatric segment is anticipated to fuel the burden of cardiac illnesses in the coming years. Elderly patients also tend to have worsening cardiac function over time necessitating device upgrades. The advanced age-related frailty also means that even mild forms of heart disease severely impact quality of life in older persons. Cardiac resynchronization therapy improves ventricular synchrony and symptoms in this high-risk group, helping them maintain independence longer. Its life enhancing benefits have made it an attractive option for the sizable base of elderly cardiac patients.

Market Challenge - Device-related Complications and Product Recalls Limiting Adoption

One of the major challenges faced in the cardiac resynchronization therapy market has been complications arising from device-related issues and product recalls. CRT devices are known to have risks of lead dislodgment and perforation, which may require surgical intervention for correction.

The leads and devices themselves can fail and malfunction over time. Such mechanical failures and device-related adverse events have created a negative perception about the reliability and safety of these systems. This is a significant deterrent for doctors recommending CRT and for patients considering the therapy.

In recent years, some manufacturers have also issued large-scale recalls of their CRT devices owing to defects detected. Mass product withdrawals erode customer trust in the technology and brand image. It also disrupts the treatment of existing patients who may need replacement devices.

Addressing the underlying engineering and design flaws effectively has been a challenge. Unless product quality improves and complications are minimized, widespread physician and patient acceptance of CRT will remain limited going forward.

Market Opportunity - Advancements in Product Design such as Bluetooth-enabled CRT Devices

One of the major opportunities in the cardiac resynchronization therapy market lies in advancements in product design. Companies have been investing heavily in research and development to make CRT devices more reliable, safer and user-friendly.

A promising innovation is the emergence of Bluetooth-enabled cardiac devices that allow remote monitoring of patients' health status. This enables quicker diagnosis of device-related issues without requiring in-clinic follow-ups.

Doctors can track the performance and functioning of implantable systems in real-time. They can detect potential problems early on and resolve any technical glitches remotely via programming. This spares patients unnecessary hospital visits or re-operations.

Bluetooth technology also facilitates automatic wireless data transfer to physician portals for review. Overall, the shift to smart, internet-of-things integrated devices could help reduce complications and improve access to quality post-implant care. It also enhances the value proposition of CRT to doctors, payers as well as patients significantly. This presents lucrative opportunities for industry players to showcase technology leadership.

Key winning strategies adopted by key players of Cardiac Resynchronization Therapy Market

Product Innovation: Developing advanced and innovative CRT devices has helped players gain an edge. In 2018, Medtronic launched its Azure CRT-P pacemaker with AdaptivCRT technology which automatically adjusts left ventricular pacing sites based on daily patient activity levels. This ensured optimal heart synchronization and better outcomes.

Geographical Expansion: Expanding to emerging markets helped increase market share. In 2015, Medtronic entered markets like India, Middle East and Africa to drive CRT penetration rates through training programs for clinicians. This enhanced access to life-saving CRT therapy.

Mergers & Acquisitions: Strategic M&A helped bolster product portfolios. In 2020, Boston Scientific acquired Preventice to add mobile cardiac monitoring solutions to its CRT portfolio. This enabled Patient management across the continuum of care. Similarly, Medtronics' acquisition of Covidien in 2015 strengthened its diagnostic and monitoring device offerings along with implantable devices. The integrated product suites drove higher procedure volumes and revenue growth.

Focus on Value-Based Care: Players partnered with healthcare systems focusing on value-based care and outcomes-based reimbursement. Abbott partnered with Wellcare in 2020 to deploy digital health and CRT remote monitoring solutions for Medicaid patients with heart failure. This reduced hospital readmissions and costs through proactive patient management.

Segmental Analysis of Cardiac Resynchronization Therapy Market

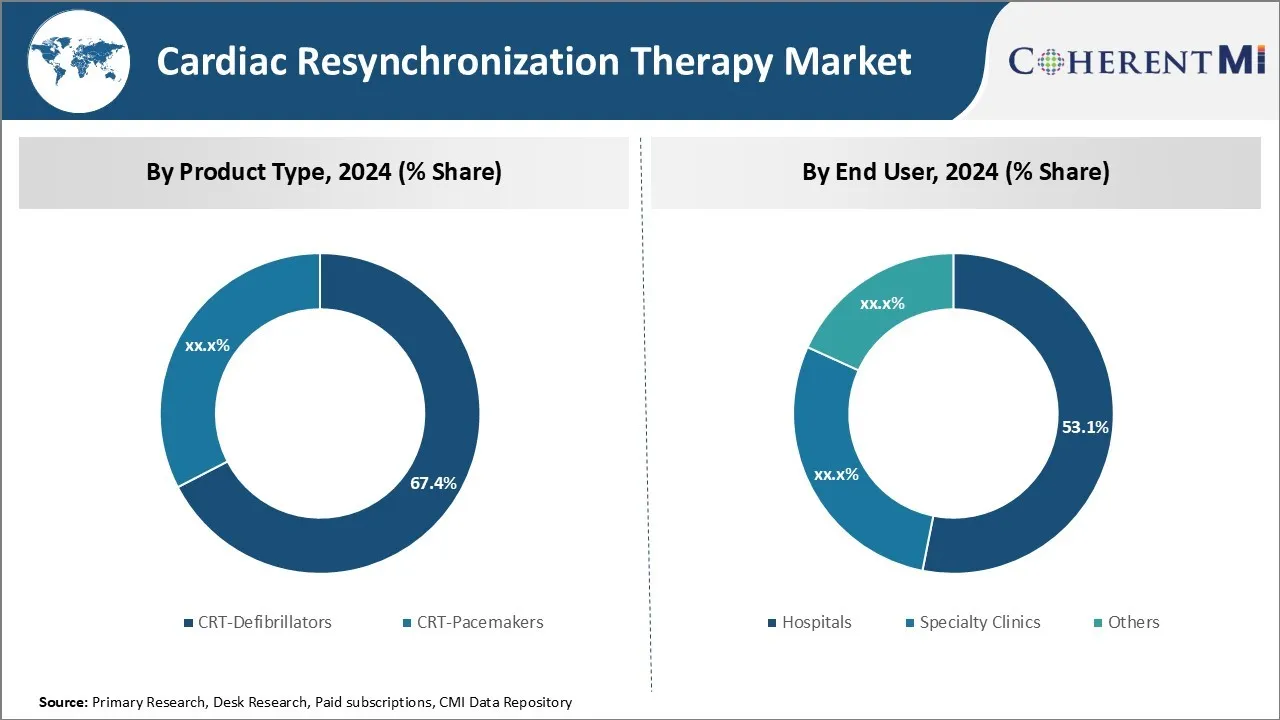

Insights, By Product Type: CRT defibrillators Maintain Highest Market Share Owning to Their Advanced Features

The cardiac resynchronization therapy market is segmented based on product type into CRT defibrillators and CRT pacemakers. CRT defibrillators account for the highest share of this market owing to their advanced features.

CRT defibrillators provide the benefits of both CRT and implantable cardioverter-defibrillators (ICDs). ICDs help treat potentially life-threatening abnormal heart rhythms with electric shocks, while CRT helps improve the heart's pumping efficiency through synchronized contraction of both lower chambers of the heart. CRT defibrillators can deliver pacing pulses to both lower chambers of the heart, which helps improve their synchronized contractions. They also monitor the heart for abnormal rhythms and deliver electric shocks as needed to restore a normal rhythm.

This dual-function of CRT defibrillators makes them a preferred choice over CRT-pacemakers for treating heart failure patients who are also at high risk of developing lethal heart rhythms. The advanced monitoring and treatment capabilities offered by CRT defibrillators help improve patient outcomes and quality of life more effectively compared to CRT pacemakers alone. Technological advancements have made CRT defibrillators more reliable and easier to implant as well. These advantages continue to drive the higher adoption of CRT defibrillators over CRT pacemakers.

Insights, By End User: Hospitals Contributes to Highest Market Share owing to Better Care Management Capabilities and Skilled Physicians

The cardiac resynchronization therapy market is segmented based on end user into hospitals, specialty clinics, and others. Hospitals account for the highest share of this market owing to their ability to offer better care management to heart failure patients undergoing CRT.

Heart failure is a complex chronic condition that requires specialized long-term care. Hospitals have skilled cardiologists, electrophysiologists, cardiac surgeons, and dedicated heart failure teams to handle all aspects of care, from evaluation and treatment planning to device implantation, programming, and ongoing management. They also have advanced diagnostic capabilities like echocardiography and cardiac MRI that help optimize device settings.

Moreover, complications may occur during or after a CRT procedure that require immediate treatment or hospitalization. Hospitals are best equipped to handle any emergencies and provide intensive post-procedure care. They can closely monitor patients through in-hospital device checks and follow-ups.

The teamed approach involving multi-disciplinary care provides better coordination of treatment and improves clinical outcomes for heart failure patients. This, along with the availability of all medical resources under one roof, has made hospitals the preferred destination for CRT procedures.

Competitive overview of Cardiac Resynchronization Therapy Market

The major players operating in the cardiac resynchronization therapy market include Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK, EBR Systems, Inc., Microport Scientific Corporation, and MEDICO S.p.A..

Cardiac Resynchronization Therapy Market Leaders

- Medtronic

- Abbott

- Boston Scientific Corporation

- BIOTRONIK

- Microport Scientific Corporation

Cardiac Resynchronization Therapy Market - Competitive Rivalry, 2024

Cardiac Resynchronization Therapy Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Cardiac Resynchronization Therapy Market

- In July 2020, Abbott received FDA approval for its next-generation Gallant™ implantable cardioverter defibrillator (ICD) and cardiac resynchronization therapy defibrillator (CRT-D) devices. These devices feature Bluetooth connectivity, which enhances patient monitoring and management through continuous remote monitoring. The devices are compatible with a smartphone app, myMerlinPulse™, which allows for better communication between patients and healthcare providers, helping to manage cardiac arrhythmias and heart failure more effectively.

- In February 2020, Medtronic received CE mark approval for its cardiac resynchronization therapy defibrillators (CRT-Ds), which included advanced features like the AdaptivCRT and EffectivCRT algorithms. These algorithms were designed to improve heart failure treatment by enhancing the synchronization and efficiency of the devices. The AdaptivCRT algorithm helps optimize pacing based on individual patient needs, and the EffectivCRT feature monitors the effectiveness of the pacing in real-time, ensuring better outcomes for patients.

Cardiac Resynchronization Therapy Market Segmentation

- By Product Type

- CRT-Defibrillators

- CRT-Pacemakers

- By End User

- Hospitals

- Specialty Clinics

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the cardiac resynchronization therapy market?

The cardiac resynchronization therapy (CRT) market is estimated to be valued at USD 7.45 billion in 2024 and is expected to reach USD 10.83 billion by 2031.

What are the key factors hampering the growth of the cardiac resynchronization therapy market?

The device-related complications and product recalls, and high costs associated with cardiac resynchronization therapy devices are the major factors hampering the growth of the cardiac resynchronization therapy market.

What are the major factors driving the cardiac resynchronization therapy market growth?

The rising prevalence of cardiovascular diseases like coronary artery disease and heart failure, and increasing geriatric population prone to cardiovascular diseases are the major factors driving the cardiac resynchronization therapy market.

Which is the leading product type in the cardiac resynchronization therapy market?

The leading product type segment is CRT-defibrillators.

Which are the major players operating in the cardiac resynchronization therapy market?

Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK, EBR Systems, Inc., Microport Scientific Corporation, and MEDICO S.p.A. are the major players.

What will be the CAGR of the cardiac resynchronization therapy market?

The CAGR of the cardiac resynchronization therapy market is projected to be 6.4% from 2024-2031.