Carotid Artery Stent Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Carotid Artery Stent Market is segmented By Product Type (Self-Expanding Stents, Balloon Expandable Stents, Others), By End User (Hospitals & Clinics,....

Carotid Artery Stent Market Size

Market Size in USD Mn

CAGR3.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3.8% |

| Market Concentration | High |

| Major Players | Boston Scientific Corporation, Cordis, Medtronic, Terumo Europe NV, Silk Road Medical Inc. and Among Others. |

please let us know !

Carotid Artery Stent Market Analysis

The carotid artery stent market is estimated to be valued at USD 597.5 Mn in 2024 and is expected to reach USD 775.8 Mn by 2031, growing at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2031.

The market is expected to witness positive growth over the forecast period owing to the increasing prevalence of cardiovascular diseases worldwide. Various technological advancements in the field of vascular surgery along with new product launches are some major factors expected to boost the demand for carotid artery stents.

Carotid Artery Stent Market Trends

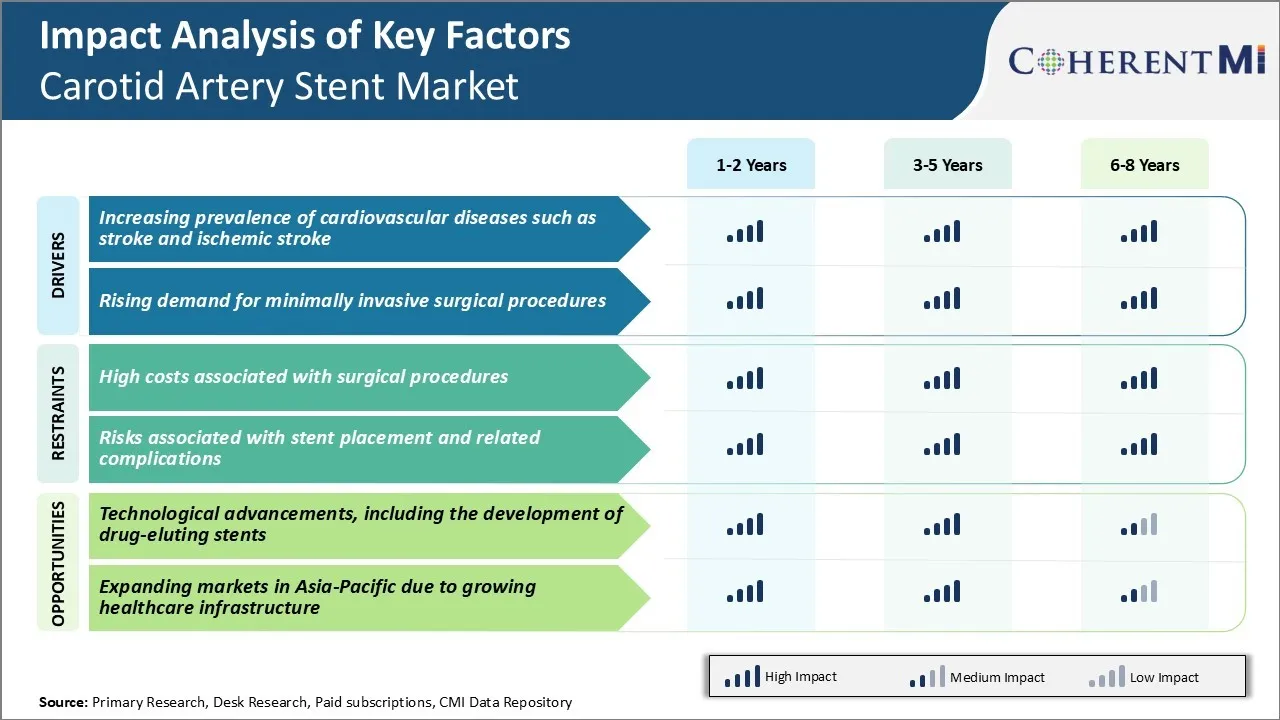

Market Driver - Increasing Prevalence of Cardiovascular Diseases such as Stroke and Ischemic Stroke

The carotid artery stent market is expected to gain significant traction in the coming years owing to the rising incidence of cardiovascular diseases across the globe. Among various cardiovascular conditions, the prevalence of ischemic stroke and transient ischemic attack is escalating at an alarming rate. As per WHO, 15 million people suffer from stroke worldwide each year, out of which 5 million people die and another 5 million are permanently disabled.

Ischemic strokes, which are caused due to blockage or narrowing of carotid arteries supplying blood to the brain, account for nearly 87% of total stroke cases. Some of the key risk factors responsible for high ischemic stroke incidence include obesity, physical inactivity, unhealthy diet, smoking, high blood pressure, diabetes, and older age. The risk spikes substantially among individuals with narrowed carotid arteries having 70-99% blockage.

Early detection and treatment of such severe carotid artery stenosis cases are crucial to prevent debilitating and life-threatening ischemic strokes. The global burden of ischemic strokes and carotid artery diseases is expected to escalate going forward. This will certainly fuel the demand for carotid artery interventions including carotid stenting procedures over the forecast period.

Market Driver - Rising Demand for Minimally Invasive Surgical Procedures

Another prominent driver for this market is the rising preference for minimally invasive treatment options among patients and physicians. Traditionally, carotid endarterectomy was the gold standard surgical method to treat severe carotid artery stenosis. However, the procedure required general anesthesia and incision in the neck to access the carotid artery, thereby making it highly invasive in nature.

Post-operative complications associated with carotid endarterectomy drove the demand for minimally invasive alternatives. This has propelled the adoption of innovative endovascular techniques like carotid artery stenting which do not necessitate open surgery.

Carotid stenting is performed under local anesthesia through a small incision in the groin using catheter-based procedures. This translates to shorter hospital stay, quicker recovery time, reduced post-operative pain and lower risk of surgical site infections compared to carotid endarterectomy.

Moreover, stenting can be applied to high-risk patients who are not eligible for open surgery due to comorbidities. The minimally invasive nature and procedural advantages have positioned carotid artery stenting as an attractive alternative especially in elderly population with significant carotid artery obstruction. Hence, the growing demand for minimally traumatic interventions amongst providers as well as patients is serving as a high impact driver for carotid artery stent market.

Market Challenge - High Costs Associated with Surgical Procedures

One of the major challenges faced by the carotid artery stent market is the high costs associated with surgical procedures for treating carotid artery diseases. Carotid endarterectomy surgery is the current standard treatment option which requires significant hospital resources and has a long recovery time for patients. This makes the overall treatment expensive for both patients and the healthcare system.

The costs of surgery include fees for the surgical room, intensive care monitoring, extended hospital stay of usually 4-5 days, rehabilitation and loss of productivity during recovery. Additionally, surgical procedures are also associated with certain risks such as general anesthesia complications and postsurgical infections which can further drive up the costs of treatment.

High medical costs put financial pressure on patients and restrict accessibility to life-saving carotid artery treatments. This challenge of high procedure costs poses a major barrier to the growth of the carotid artery stent market.

Market Opportunity - Technological Advancements, Including the Development of Drug-Eluting Stents

One of the key opportunities for the carotid artery stent market lies in ongoing technological advancements. Multiple new product developments are expanding treatment options available to physicians. Significant research and development activities are focused on introducing innovative stent platform technologies, delivery systems and techniques.

For instance, there is strong ongoing research on developing drug-eluting carotid artery stents that can help reduce issues like restenosis and inflammation. Drug-eluting stents work by slowly releasing antithrombotic or other medications from the stent surface, aiding the healing process after implantation.

The successful development and approval of drug-eluting carotid stents can help minimize post-treatment complications and drive repeat procedures. Such stent innovations are expected to make carotid artery stenting a more viable and reliable alternative to surgery, boosting demand. This emerging opportunity stemming from technological advancements will help spur growth in the carotid artery stent market during the forecast period.

Key winning strategies adopted by key players of Carotid Artery Stent Market

Focus on Innovation: Innovation has been the prime strategy for major players to gain an edge in this market. In 2016, Boston Scientific rolled out the SpiderFX Embolic Protection Device with filter technology to capture and remove debris during carotid artery procedures to reduce risk of stroke. Similarly, Abbott introduced new arterial solutions like Ultimaster and Crown Pro stents that offer improved flexibility and conformability.

Strategic Acquisitions: Acquisitions have enabled companies to enhance their product portfolios and presence across key markets. For instance, in 2017, Merit Medical acquired Ellipsys Vascular to expand its footprint in the carotid stenting space.

Aggressive Marketing Strategies: Aggressive marketing campaigns have boosted brand awareness and sales volumes for leading brands. For example, Boston Scientific expanded its advertisements on medical conferences, digital channels, and print media after receiving FDA approval for SpiderFX in 2016. Abbott too ramped up its marketing network worldwide following new product launches. Targeted promotion has created pull for innovative solutions in the market.

Focus on Emerging Markets: As emerging nations witness a rise in lifestyle diseases, companies have prioritized these underpenetrated markets. In 2018, Medtronic commenced local carotid stent manufacturing in India through its Mysore facility, addressing primary access barriers.

Segmental Analysis of Carotid Artery Stent Market

Insights, By Product Type: Comfort and Ease of Installation Drives Self-Expanding Stents Dominance

In terms of product type, self-expanding stents is estimated to contribute 47.8% of the market share in 2024, owning to their superior comfort level and ease of installation. Self-expanding stents allow for minimally invasive procedures and cause less trauma to patients during implantation compared to other stent types. They have a mesh-like structure that can be compressed and inserted through a small nick in the skin.

Once in place, the mesh gently expands to its pre-formed shape to prop open the artery. This self-expanding functionality eliminates the need for complex mechanical deployment tools, reducing complications. It also enables these stents to conform well to the artery wall. Their flexible, scaffold-like design prevents pain and discomfort long after the procedure.

Insights, By End User: Proximity and Single-stage Treatment Attract Patients to Hospitals & Clinics

In terms of end user, hospitals & clinics is estimated to account for 55.3% of the market share in 2024, owing to their proximity to patients and ability to provide single-stage treatment. Most people perceive hospitals and clinics as more reliable and better equipped than other healthcare facilities. Their availability locally means quicker admittance and shorter waiting periods.

Integrating diagnostic and therapeutic capabilities under one roof allows providers in hospitals and clinics to diagnose, plan and perform carotid artery stenting in a single visit. This convenience encourages more patients to seek care at hospitals and clinics rather than having to visit multiple places.

Insights, By Technological Development: Superior Healing Benefits Drives Adoption of Drug-eluting Stents

In terms of by technological development, drug-eluting stents contributes the highest share of the market due to their distinct healing benefits over other stent types. Drug-eluting stents are coated with medication that controls cell overgrowth. They are able to release these drugs slowly and gradually over time to prevent scar tissues from growing back inside the artery. This allows them to offer better vessel patency or ability to remain open long-term.

Lesser chances of re-stenosis or re-blockage translates to improved healing outcomes for patients. Their therapeutic drug release mechanism promotes healthier inner lining formation compared to plain metal stents. The superior healing attributes of drug-eluting stents have made them the preferred technological solution among healthcare professionals.

Additional Insights of Carotid Artery Stent Market

- The introduction of technologically advanced stents, such as those that are bioabsorbable, reflects ongoing innovations aimed at improving patient outcomes. However, high procedure costs and potential risks associated with stent usage pose challenges to broader adoption.

- Key players continue to invest in product development and regulatory approvals, positioning themselves to capitalize on market opportunities. As the market evolves, ongoing R&D, strategic acquisitions, and product launches are expected to play pivotal roles in shaping the competitive landscape.

Competitive overview of Carotid Artery Stent Market

The major players operating in the Carotid Artery Stent Market include Boston Scientific Corporation, Cordis, Medtronic, Terumo Europe NV, and Silk Road Medical Inc.

Carotid Artery Stent Market Leaders

- Boston Scientific Corporation

- Cordis

- Medtronic

- Terumo Europe NV

- Silk Road Medical Inc.

Carotid Artery Stent Market - Competitive Rivalry, 2024

Carotid Artery Stent Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Carotid Artery Stent Market

- In October 2023, Boston Scientific Corporation received FDA approval for the Carotid WALLSTENT® Monorail® Endoprosthesis. This stent is designed for treating carotid artery disease in patients at high risk for surgery. The Carotid WALLSTENT Monorail system is known for its closed-cell design, which provides excellent lesion coverage and improves blood flow to the brain, making it a leading stenting option in Europe and other international markets. The approval enhances Boston Scientific’s market presence in the U.S. by providing a less invasive alternative to traditional surgery for carotid artery disease.

- In October 2022, Cordis acquired MedAlliance, a medical technology company known for its innovative drug-eluting balloon technology. This acquisition was part of Cordis's strategy to expand its cardiovascular and endovascular technology portfolio, enhancing its product offerings and capabilities in the carotid artery stent market.

Carotid Artery Stent Market Segmentation

- By Product Type

- Self-Expanding Stents

- Balloon Expandable Stents

- Others

- By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Cardiac Centers

- By Technological Development

- Drug-Eluting Stents

- Bioabsorbable Stents

- Biodegradable Stents

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the carotid artery stent market?

The carotid artery stent market is estimated to be valued at USD 597.5 million in 2024 and is expected to reach USD 775.8 million by 2031.

What are the key factors hampering the growth of the carotid artery stent market?

The high costs associated with surgical procedures and risks associated with stent placement and related complications are the major factors hampering the growth of the carotid artery stent market.

What are the major factors driving the carotid artery stent market growth?

The increasing prevalence of cardiovascular diseases such as stroke and ischemic stroke, and rising demand for minimally invasive surgical procedures are the major factors driving the carotid artery stent market.

Which is the leading product type in the carotid artery stent market?

The leading product type segment is self-expanding stents.

Which are the major players operating in the carotid artery stent market?

Boston Scientific Corporation, Cordis, Medtronic, Terumo Europe NV, and Silk Road Medical Inc. are the major players.

What will be the CAGR of the carotid artery stent market?

The CAGR of the carotid artery stent market is projected to be 3.8% from 2024-2031.