Cerebrospinal Fluid Management Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Cerebrospinal Fluid Management Market is segmented By Product Type (Ventriculoperitoneal (VP) Shunts, Ventriculoatrial (VA) Shunts, Lumboperitoneal (L....

Cerebrospinal Fluid Management Market Size

Market Size in USD Bn

CAGR5.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.5% |

| Market Concentration | High |

| Major Players | Medtronic plc, Integra LifeSciences Corporation, B. Braun Melsungen AG, Sophysa, Spiegelberg GmbH & Co. KG and Among Others. |

please let us know !

Cerebrospinal Fluid Management Market Analysis

The cerebrospinal fluid management market is estimated to be valued at USD 1.58 Bn in 2024 and is expected to reach USD 2.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2031. Factors such as the increasing incidence of neurological disorders, rising geriatric population, and growing number of intensive care unit admissions are expected to fuel the demand for cerebrospinal fluid management procedures.

Cerebrospinal Fluid Management Market Trends

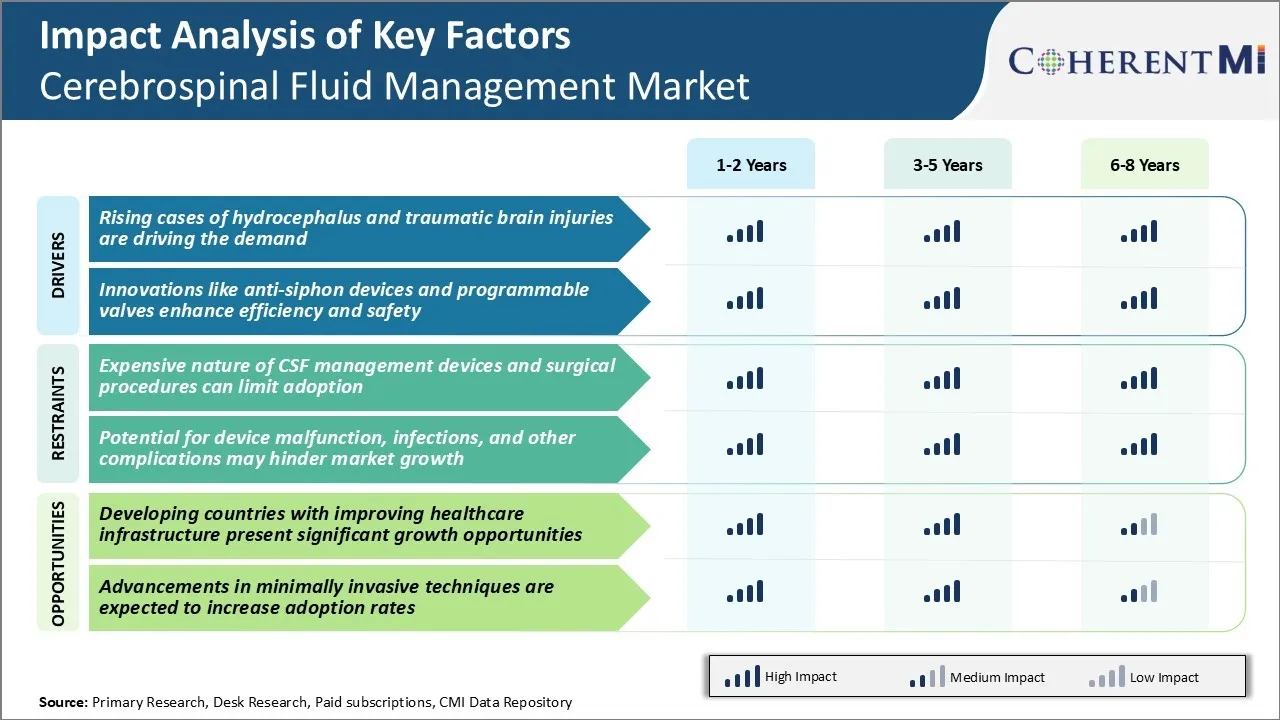

Market Driver - Rising Cases of Hydrocephalus and Traumatic Brain Injuries

The number of cases of hydrocephalus and traumatic brain injuries have been rising over the years. Traumatic brain injuries occur when a sudden trauma causes damage to the brain. The diagnosis and treatments for traumatic brain injuries and hydrocephalus usually requires cerebrospinal fluid management procedures like ventricular shunting which helps drain excess fluid from the brain.

The growing prevalence of neurological disorders and injuries is one of the primary factors escalating the need for effective management of cerebrospinal fluid. This is evident from the rising number of shunt insertion procedures taking place worldwide every year. For example, studies estimate that hydrocephalus affects 1 in every 500 live births and accounts for approximately 1% of the total health care costs for children in the US.

Meanwhile, traumatic brain injuries are a leading cause of death and disability globally, especially among children and young adults. With higher levels of urbanization and motorization in developing countries, the incidence of traumatic head injuries is also expected to surge significantly in the coming years. The substantial patient population undergoing long term cerebrospinal fluid treatment for these conditions has majorly boosted demand for cerebrospinal fluid (CSF) management options.

Market Driver - Innovations Like Anti-Siphon Devices and Programmable Valves Enhance Efficiency and Safety

Continuous innovation in CSF drainage technologies has played a vital role in addressing the needs of the growing patient pool needing long term cerebrospinal fluid management. Advancements like anti-siphon devices and programmable valves have optimized treatment outcomes while also raising the safety bar. Anti-siphon devices help prevent backflow or over drainage of CSF by imposing resistance when pressures fall below a set threshold. This reduces complications like collapsed ventricles or subdural hematomas associated with over drainage.

These innovations free patients and caregivers from the hassle of frequent invasive valve adjustments during follow ups. Programmable valves with advanced features like customizable flow settings and external control have granted doctors more accurate, flexible management of their patients' CSF dynamics over their lifespan. Their ability to automatically adapt to a patient's changing needs over time while avoiding over or under drainage has led to fewer revision surgeries and hospitalizations. Technologies like these are making CSF shunt systems increasingly effective at meeting diverse clinical needs long term with minimal side effects. This has encouraged greater uptake of state-of-the-art cerebrospinal fluid management devices. Constant engineering of shunt valves with new capabilities addresses the risk of treatment failure or complication with earlier products, further fueling market growth.

Market Challenge - Expensive Nature of CSF Management Devices and Surgical Procedures Can Limit Adoption

The cerebrospinal fluid management market is highly dependent on expensive medical devices and surgical procedures. Spinal drainage and shunt systems used for CSF drainage and diversion cost between $500-$1500 per device. These are indispensable medical devices without which many neurological disorders cannot be managed.

However, the high costs of such devices and routine surgical revisions of malfunctioning shunts pose a significant challenge for widespread adoption, especially in developing regions with budget constraints in the healthcare system. Many patients in underdeveloped and developing countries simply cannot afford expensive CSF management therapies due to lack of health insurance and limited out-of-pocket capacity.

This essentially deprives a large patient population access to life-saving CSF management treatments. Device manufacturers and healthcare systems need to collaborate to come up with innovative financing and funding mechanisms to make CSF management therapies more affordable and accessible.

Market Opportunity - Developing Countries with Improving Healthcare Infrastructure Present Significant Opportunities

The cerebrospinal fluid management market is poised to witness substantial growth opportunities in developing economies due to improving healthcare infrastructure and rising medical expenditures. Countries such as India, China, Brazil, Mexico and several nations in Africa are dedicatedly investing in healthcare reforms to strengthen primary care facilities and provide universal access to essential medical technologies. This includes increasing budget allocations for neurosurgical devices and imaging technologies that can support CSF drainage procedures.

Additionally, a largely untapped patient population with neurological disorders combined with a rapidly expanding medical device industry offers huge market potential for CSF management product manufacturers. Industry players can gain a competitive edge by strategizing local manufacturing operations, product localization, establishing strong distribution networks and collaborative engagement with private and public healthcare systems in developing markets.

Focus on emerging economies will be crucial for CSF management companies to tap high-growth revenue streams and cement their presence in a globally evolving market.

Key winning strategies adopted by key players of Cerebrospinal Fluid Management Market

Product Innovation - One of the most successful strategies adopted by leading players like Medtronic, Integra LifeSciences, B. Braun Melsungen AG, and Spiegelberg GmbH & Co. KG has been continuous investment in R&D to develop innovative product offerings. For instance, in 2017 Medtronic launched the CSF Flovent Drainage System which allows for high CSF drainage capacity under low pressures. Similarly, in 2019 B. Braun introduced EVA shunt valves with modified slit designs for enhanced flow regulation. Such innovative products have helped these companies gain market share by addressing unmet needs.

Focus on Minimally Invasive Techniques - With the goal of reducing risks of infections and complications, companies like Medtronic and Johnson & Johnson have focused on developing minimally invasive CSF management techniques. For example, in 2015 Medtronic received approval for the Integra Camino Bolt, a minimally invasive ICP monitor that can be implanted efficiently. This enabled reduced hospitalization time and helped boost Medtronic's revenues in the ICP monitoring segment.

Strategic Acquisitions - Players pursue strategic acquisitions to complement their product portfolios and expand geographically. For instance, in 2019 Medtronic acquired tibial nerve stimulation therapy provider Stimwave Technologies. This strengthened Medtronic's chronic pain management offerings.

Segmental Analysis of Cerebrospinal Fluid Management Market

Insights, By Product Type: Ease of Placement Drives Ventriculoperitoneal Shunt Dominance

In terms of product type, ventriculoperitoneal (VP) shunts is likely to account for 48.7% share of the market in 2024, owning to its minimally invasive placement procedure. VP shunts work by draining excess cerebrospinal fluid from the brain ventricles into the peritoneal cavity of the abdomen. Their placement requires only a small incision in the scalp and a peritoneal catheter inserted into the abdominal cavity. This simple two-point procedure makes VP shunts much easier and less risky to implant compared to other shunt types.

The technical challenges associated with multi-catheter shunts like Ventriculoarterial and Ventriculopleural designs have hindered their adoption compared to the well-established and surgeon preferred VP method. Many neurosurgeons are highly trained and experienced in placing VP shunts, contributing to their consistent reliability and lower risk of complications during and after surgery.

Their low barrier for use has made VP shunts the go-to standard of care for treating hydrocephalus and normal pressure hydrocephalus conditions. These advantages in surgical feasibility and path of least resistance have allowed VP shunts to capture the leading performance in the cerebrospinal fluid management devices market.

Insights, By End User: Hospitals Lead Utilization Driven by Availability of Resources

In terms of end user, in 2024, hospitals will probably hold 62.5% of the market share due to their concentration of specialized neurology resources. Complex cerebrospinal shunt implantation or revision surgeries require dedicated neurological operating rooms, specialized neurosurgery trained staff, intensive care capabilities, and multi-disciplinary neurology support services. The high acuity nature of hydrocephalus often necessitates around the clock postoperative monitoring as well. Most ambulatory surgery centers and clinics lack these robust inpatient care infrastructures, limiting their ability to handle the most difficult shunt cases.

While minor shunt adjustments may be performed outside of hospitals, all initial shunt placements and complex revision surgeries are routinely conducted in hospitals where multidisciplinary neurological teams are most readily assembled. The availability of on-call neurosurgeons, intensive care beds, advanced neuro-imaging technologies, and prompt access to additional specialist consultations if needed, drives hospitals' entrenched position as the primary users of CSF shunting devices. Their concentration of specialized resources will likely continue attracting the majority of complex shunt procedures in the future as well.

Insights, By Age Group: Pediatrics Commands Focus with Implications Across Lifespan

In terms of age group, pediatrics contributes the highest share of the market due to unique developmental considerations. Hydrocephalus affects children at their earliest and most formative stages of growth and learning. CSF shunting in infants and young children is further complicated by their small body size and ongoing anatomical changes.

However, early and effective management of raised intracranial pressure is crucial to prevent long-term neurological and cognitive deficits. Pediatric neurosurgeons place strong emphasis on shunt systems tailored for ideal pediatric headache and designed with revisions over a lifetime in mind. Their goal is to allow patients to achieve normal development without recurring shunt failures as their bodies grow.

Addressing the complex needs of pediatric hydrocephalus also drives parallel advances applicable to adult shunting as well. Overall, the outsized impact of hydrocephalus on young patients continues driving focused pediatrics priorities that accelerate innovation benefiting the entire CSF management field in the long-run.

Additional Insights of Cerebrospinal Fluid Management Market

- Hydrocephalus affects approximately 1 in every 1,000 newborns, making it a significant concern in pediatric neurosurgery.

- The rise in normal pressure hydrocephalus among the elderly contributes to market growth, as aging populations increase globally.

- North America dominates the cerebrospinal fluid management market, driven by high prevalence of conditions like congenital hydrocephalus, brain aneurysms, and traumatic brain injury, along with a well-established healthcare infrastructure.

Competitive overview of Cerebrospinal Fluid Management Market

The major players operating in the Cerebrospinal Fluid Management Market include Medtronic plc, Integra LifeSciences Corporation, B. Braun Melsungen AG, Sophysa, Spiegelberg GmbH & Co. KG, Möller Medical GmbH, Dispomedica GmbH, Phoenix Biomedical Corp., DePuy Synthes (Johnson & Johnson), and Natus Medical Incorporated.

Cerebrospinal Fluid Management Market Leaders

- Medtronic plc

- Integra LifeSciences Corporation

- B. Braun Melsungen AG

- Sophysa

- Spiegelberg GmbH & Co. KG

Cerebrospinal Fluid Management Market - Competitive Rivalry, 2024

Cerebrospinal Fluid Management Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Cerebrospinal Fluid Management Market

- In September 2023, B. Braun Melsungen AG introduced the MIETHKE proGAV® 2.0, an advanced gravitational valve system designed for the treatment of hydrocephalus. This valve aims to mimic natural cerebrospinal fluid (CSF) dynamics, helping to reduce the risk of over drainage and underdrainage. The proGAV® 2.0 features an adjustable gravitational unit and a tactile feedback mechanism, which allows for precise pressure adjustments according to the patient's body position, providing enhanced safety and comfort.

- In April 2023, Medtronic plc launched a new programmable CSF shunt system aimed at reducing over drainage complications in hydrocephalus patients. This innovation is expected to enhance patient outcomes and solidify Medtronic's market position. Medtronic's recent advancements include the StrataMR™ valves and shunts, which were cleared by the FDA and are part of the Strata family of adjustable valve systems designed for patients with hydrocephalus and cerebrospinal fluid (CSF) disorders.

- In July 2019, Integra LifeSciences Corporation acquired Arkis BioSciences Inc., expanding its portfolio in neurocritical care and offering advanced catheter solutions. This acquisition aimed to expand Integra's portfolio in neurocritical care by adding advanced catheter solutions, specifically the CerebroFlo® external ventricular drainage (EVD) catheter with Endexo® technology. The acquisition strengthened Integra’s offerings in neurocritical care and advanced catheter technology, enhancing its product range and global market reach.

Cerebrospinal Fluid Management Market Segmentation

- By Product Type

- Ventriculoperitoneal (VP) Shunts

- Ventriculoatrial (VA) Shunts

- Lumboperitoneal (LP) Shunts

- Ventriculopleural (VPL) Shunts

- By End User

- Hospitals

- Ambulatory Surgical Centers

- Neurological Clinics

- By Age Group

- Pediatrics

- Adults

- Neurological Clinics

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the cerebrospinal fluid management market?

The cerebrospinal fluid management market is estimated to be valued at USD 1.58 Bn in 2024 and is expected to reach USD 2.3 Bn by 2031.

What are the key factors hampering the growth of the Cerebrospinal Fluid Management Market?

The expensive nature of CSF management devices and surgical procedures can limit adoption. Furthermore, potential for device malfunction, infections, and other complications may hinder market growth. These two are among the major factors hampering the growth of the cerebrospinal fluid management market.

What are the major factors driving the cerebrospinal fluid management market growth?

The rising cases of hydrocephalus and traumatic brain injuries are driving the demand. Also, innovations like anti-siphon devices and programmable valves enhance efficiency and safety. These are among the major factors driving the cerebrospinal fluid management market.

Which is the leading product type in the cerebrospinal fluid management market?

The leading product type segment is ventriculoperitoneal (VP) shunts.

Which are the major players operating in the cerebrospinal fluid management market?

Medtronic plc, Integra LifeSciences Corporation, B. Braun Melsungen AG, Sophysa, Spiegelberg GmbH & Co. KG, Möller Medical GmbH, Dispomedica GmbH, Phoenix Biomedical Corp., DePuy Synthes (Johnson & Johnson), and Natus Medical Incorporated are the major players.

What will be the CAGR of the cerebrospinal fluid management market?

The CAGR of the cerebrospinal fluid management market is projected to be 5.5% from 2024-2031.