Clean Label Ingredients Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Clean Label Ingredients Market is segmented By Form (Powder, Liquid, Others), By Type (Natural Colors, Natural Flavors, Fruits & Vegetable Ingredients....

Clean Label Ingredients Market Size

Market Size in USD Bn

CAGR4.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.3% |

| Market Concentration | Medium |

| Major Players | Archer Daniels Midland, Cargill, Dupont De Nemours and Company, Kerry Group Plc, Tate & Lyle Plc and Among Others. |

please let us know !

Clean Label Ingredients Market Analysis

The Global Clean Label Ingredients Market is estimated to be valued at USD 131.4 Bn in 2024 and is expected to reach USD 199.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2031. Consumers are increasingly demanding food products with simple and easily recognizable ingredients, driving more food companies to opt for clean label ingredients in their formulations. The market is witnessing growing demand for clean label ingredients as consumers are becoming more health-conscious and are actively looking to reduce intake of additives and artificial ingredients in their diets. They are inclined towards ingredients that are natural, organic and ethically sourced. Many global food giants are catering to this consumer trend by focusing on clean label reforms and investing in research to find alternatives to artificial ingredients and preservatives. With consumers willing to pay premium prices for clean label products, more firms are expected to switch towards using natural colors, flavors and functional ingredients.

Clean Label Ingredients Market Trends

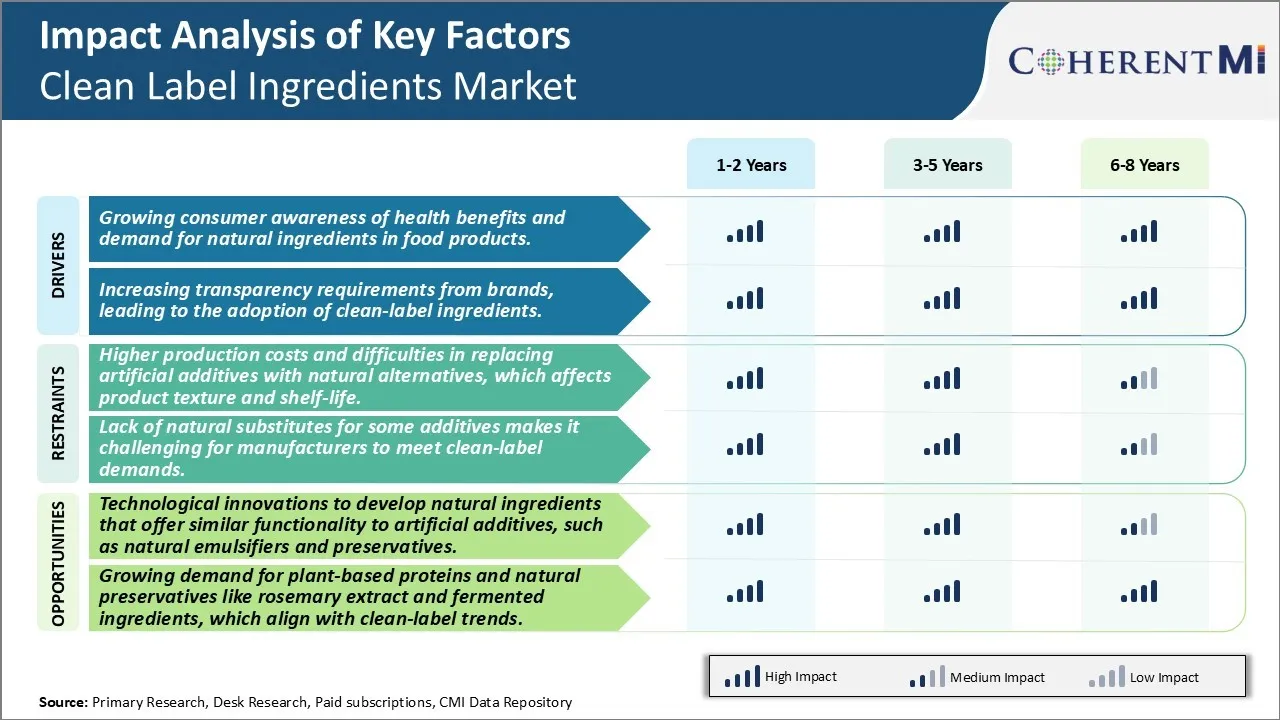

Market Driver - Growing Consumer Awareness of Health Benefits and High Demand for Natural Ingredients in Food Products

Now-a-days consumers are showing increasing interest towards the ingredients used in their food products. With growing health consciousness and awareness about various illnesses caused due to intake of artificial ingredients, people are opting for products which contain all natural and clean label ingredients. There is an underlying apprehension about long term implications of consuming artificial preservatives, colors, flavors and other additives. Due to easy access to information through internet, consumers are more informed about what goes in their food and how different ingredients can impact their health. This is driving greater scrutiny of labels and fueling demand for foods made from natural, whole and simple ingredients that are familiar and easily understandable.

As consumers select products based on ingredients, many food companies are focusing on cleanness of their label by removing artificial ingredients from their products. Startups in particular are catering to this segment of health-conscious consumers by providing products made from natural ingredients along with their associated health benefits. Millennials especially are keen to pay premium prices for food and beverages that are devoid of artificial additives. Natural products are being perceived as more wholesome and nourishing options, offering nutrients in their purest form. Various surveys also indicate that consumer preference for clean label is here to stay long-term irrespective of economic cycles.

Market Driver - Increasing Transparency Requirements from Brands, Leading to the Adoption of Clean-Label Ingredients

With rising health and environment consciousness, regulatory agencies globally are imposing stricter norms of marketing and labelling processed food products. Brands are facing pressure to disclose complete ingredients list along with specifics about processing methods used. There is a push for simplified labels that can be effortlessly understood by general public instead of long scientific names that mean little to consumers. At the same time, bans or restrictions are being levied on certain artificial food additives and colors after assessing their health impact from long term usage. Nations are also collaborating to mutually recognize each other’s labelling laws to eliminate discrepancies faced by multinational brands.

Amid growing regulations, companies are proactively switching to clean label formulations. They are removing contested substances from top-selling products and modifying recipes to replace artificial inputs with natural alternatives. This ensures brands remain compliant while meeting consumer demands for clarity and purity. Firms are also resorting to minimal processing like lowering heat treatments or avoiding drying techniques that require preservatives. Some competitors are even highlighting their “clean label” positioning as a unique selling point to gain market share. With evolving standards, companies must now consider cleanness of label as an integral part of their innovation strategy going forward.

While overhauling recipes leads to short term costs, brands are able to charges lightly higher prices for their clean label offerings. Once consumers observe tangible benefits, they tend to pay the extra premium for the assurance of high-quality natural ingredients and peace of mind regarding contents. As transparency becomes an industry imperative, brands large and small will continue shifting towards clean label solutions to satisfy authorities and consumers as well as fortify their brand image for sustained long-term growth.

Market Challenge - Higher Production Costs and Difficulties in Replacing Artificial Additives with Natural Alternatives, Which Affects Product Texture and Shelf-Life

One of the key challenges facing the clean label ingredients market is the higher production costs associated with utilizing natural alternatives to artificial additives. Transitioning to natural ingredients often requires significant reformulation efforts to identify suitable plant-based or mineral substitutes that can adequately mimic the texture, flavor, and preservation attributes of synthetic options. This reformulation process is time-consuming and labor-intensive, increasing R&D expenses for food companies. Furthermore, natural additives are typically more expensive to source and produce at commercial scales compared to artificial chemicals. The difficulties in replicating the functionality of artificial ingredients also impacts production throughput. Transitioning product lines to clean labels may necessitate new equipment purchases or facility modifications to adjust production workflows. These increased costs are eventually passed on to consumers in the form of higher prices, which can impact demand growth. Clean label products also have more stringent quality and shelf-life requirements that are challenging to consistently meet with natural ingredients that have more variable compositions and properties compared to artificial additives. This affects product texture and stability over extended storage periods.

Market Opportunity: Technological Innovations to Develop Natural Ingredients That Offer Similar Functionality to Artificial Additives

A key opportunity for the growth of the clean label ingredients market lies in further technological innovations that facilitate the development of natural substitutes matching the attributes of artificial additives. Significant research investments are being made to identify plant-based formulations and processing methods to create clean label emulsifiers, preservatives, acidulants and other functional classes of ingredients. For example, novel extraction techniques and enzyme treatments are allowing for precise tailoring of natural polysaccharide compositions to achieve emulsification properties akin to synthetic emulsifiers. Likewise, combinations of natural antioxidants, antimicrobials and pH controllers are showing promise as shelf-life extending solutions with functionality on par with artificial preservatives. As the functionality gap between natural and artificial narrows, clean label products will become more seamlessly integrated into production lines with stable quality and shelf-life. This will accelerate mainstream adoption and drive significant market expansion.

Key winning strategies adopted by key players of Clean Label Ingredients Market

Focusing on Superior Quality and Natural Ingredients: Players have realized that consumer preference is shifting towards clean label foods with simple, natural ingredients they can recognize and pronounce. Brands like Cargill and Corbion have focused on sourcing high-quality natural ingredients and maintaining rigorous standards to deliver clean label products. For example, Cargill's clean label textured soy protein allows manufacturers to remove artificial ingredients.

Leveraging Consumer Research to Boost Innovation: Large players extensively research changing consumer sentiment to develop innovative clean label products.

Forming Strategic Partnerships for New Offerings: Companies partner with smaller, nimble firms to quickly commercialize clean label products co-developed using their expertise. For example, in 2018, Ingredion collaborated with Verdient Foods to launch Sustagrain, an ancient grain flour high in fiber and protein. Such partnerships allow access to on-trend ingredients without heavy R&D investment.

Expanding Clean Label Product Lines: Leading brands continuously expand their clean label portfolios across categories to provide a one-stop solution. For instance, Kerry Group launched clean label mayonnaises, dressings and sauces in 2016-17 after success with clean meat products. The wider selection boosts client stickiness.

Adopting Certification Programs: Certifications help convince consumers of a product's purity. For example, after adopting Non-GMO Project Verification, Cargill saw a double-digit growth for their Textured Soy Proteins in 2018. This boosted consumer confidence in their clean label credentials.

Segmental Analysis of Clean Label Ingredients Market

Insights, By Form, Convenience and Versatility Drive Powder Dominance

By Form, powder is expected to contribute 63.2% in 2024 owing to its convenience and versatility. Powder forms of clean label ingredients are highly portable and have a long shelf life, making them ideal for food manufacturers seeking to simplify supply chains and minimize spoilage. The dehydration process used to produce powdered ingredients concentrates flavors and extends usability compared to liquid or fresh alternatives. Powders can also be easily reconstituted with water or other liquids to deliver consistent performance across product batches. This allows food producers to achieve standardized recipes without compromising the clean label positioning of their products. Additionally, powdered ingredients blend seamlessly into crisp, dry food matrices like cookies, crackers and cereals, imparting flavors and characteristics without altering texture. Their dry particle structure permits precise dosing and micro-encapsulation that unlocks novel applications. As consumer demands for clean label products continue rising, powder will maintain its competitive edge through convenient handling, multi-purpose functionality and compatibility with diverse food formats.

Insights, By Type, Natural Colors’ Vivid Hues and Widespread Usage Drive Leadership

By Type, natural colors segment is expected to contribute the highest share of the market owing to their vivid hues and widespread product integration. Vibrant shades indexed to popular fruits and vegetables satisfy consumer perceptions of “natural”, motivating continual exploration and refinement of plant- and mineral-derived pigments. Paprika, spinach, beetroot and annatto offer brilliant reds, greens and oranges that are intrinsically popular in food. This satisfies a core clean label tenet as colors derived wholly from natural sources, versus synthetics. Equally crucial is natural colors’ ubiquitous inclusion across food categories from baked items to beverages. The versatility extends possible applications and targets increasingly discerning populations. Suppliers steadily expand color palettes like turmeric yellows and saffron reds catering to international tastes. Their accessibility and approval for packaged as well as fresh products fosters entrenchment as a mainstream clean label solution.

Insights, By Application, Authenticity and Innovation Drive Food Category Leadership

In terms of By Application, Food contributes the 29.7% market share in 2024 as clean label ingredients resonate strongly with perceptions of authenticity in this category. Consumers increasingly demand transparency into food contents and origins, motivated by health as well as branding authenticity. Clean label ingredients satisfy this ethos through natural traits indexed to familiar culinary traditions. Suppliers respond through customized blends recreating integral flavors in herb mixes, seasoning packets or broths. Meanwhile, clean label qualities fuel experimentation and fusion cuisine appealing to younger, diversity-seeking demographic groups. Ingredients grant flexibility experimenting with ethnic flavors, vegan/vegetarian options and novel textures. Cooking inspirations proliferate via online videos and blogs, influencing both at-home and foodservice trends. Natural colors and citrus/fruit juices also increase visual appeal and perceived nourishment of ready-to-eat or heat-and-eat food products. Their assimilation across higher-value fresh/organic segments locks in positioning. Together, authenticity and continuing innovation drive the food category’s leadership in clean label applications.

Additional Insights of Clean Label Ingredients Market

The clean-label ingredients market is expected to grow significantly over the next decade, driven by the increasing consumer preference for natural, minimally processed food products. Consumers are more health-conscious than ever, seeking transparency from food manufacturers. This trend is leading companies to replace artificial ingredients with natural alternatives, even as they face challenges in maintaining product taste, texture, and shelf-life. Innovation in natural preservatives, emulsifiers, and flavors is crucial for the market's expansion, as it allows manufacturers to maintain product quality without sacrificing clean-label integrity. The growth of plant-based foods, particularly in vegan and dairy-alternative segments, is also pushing the demand for clean-label ingredients. Technological advancements, such as AI, are further helping companies track consumer preferences and trends, ensuring they remain competitive in this rapidly evolving landscape. Overall, the market is set for continued expansion, especially in Europe and North America, where regulatory support and expectations are highest.

Competitive overview of Clean Label Ingredients Market

The major players operating in the Clean Label Ingredients Market include Archer Daniels Midland, Cargill, Dupont De Nemours and Company, Kerry Group Plc, Tate & Lyle Plc, Frutarom, Sensient Technologies, Ingredion Incorporated, Koninklijke DSM N.V. and Corbion Inc.

Clean Label Ingredients Market Leaders

- Archer Daniels Midland

- Cargill

- Dupont De Nemours and Company

- Kerry Group Plc

- Tate & Lyle Plc

Clean Label Ingredients Market - Competitive Rivalry, 2024

Clean Label Ingredients Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Clean Label Ingredients Market

- In April 2024, Cargill partnered with Voyage Foods to provide more sustainable alternatives to cocoa-based products, offering a vegan and allergen-free solution to bakery, ice cream, and confectionery industries.

- In August 2023, Kemin Industries inaugurated its first manufacturing facility in Missouri for producing the Proteus® line of clean-label functional proteins, improving product quality in the meat and poultry industry.

Clean Label Ingredients Market Segmentation

- By Form

- Powder

- Liquid

- Others

- By Type

- Natural Colors

- Natural Flavors

- Fruits & Vegetable Ingredients

- Starch & Sweeteners

- Others

- By Application

- Food

- Bakery

- Confectionery

- Processed Foods

- Pet Food

- By Distribution Channel

- B2B

- B2C

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Clean Label Ingredients Market?

The Global Clean Label Ingredients Market is estimated to be valued at USD 131.4 Bn in 2024 and is expected to reach USD 199.1 Bn by 2031.

What will be the CAGR of the Clean Label Ingredients Market?

The CAGR of the Clean Label Ingredients Market is projected to be 4.3% from 2024 to 2031.

What are the key factors hampering the growth of the Clean Label Ingredients Market?

The higher production costs and difficulties in replacing artificial additives with natural alternatives, which affects product texture and shelf-life and lack of natural substitutes for some additives makes it challenging for manufacturers to meet clean-label demands are the major factor hampering the growth of the Clean Label Ingredients Market.

What are the major factors driving the Clean Label Ingredients Market growth?

The growing consumer awareness of health benefits and demand for natural ingredients in food products and increasing transparency requirements from brands, leading to the adoption of clean-label ingredients. These are the major factors driving the Clean Label Ingredients Market.

Which is the leading Form in the Clean Label Ingredients Market?

The powder segment is the leading Form.

Which are the major players operating in the Clean Label Ingredients Market?

Archer Daniels Midland, Cargill, Dupont De Nemours and Company, Kerry Group Plc, Tate & Lyle Plc, Frutarom, Sensient Technologies, Ingredion Incorporated, Koninklijke DSM N.V., Corbion Inc. are the major players.