Fermented Ingredients Market Size - Analysis

The market is witnessing significant growth driven by factors such as increasing awareness about gut health, popularity of fermented food and beverages among health-conscious consumers. Growth in the food and beverage industry has also fueled the demand for fermented ingredients. Further, advancements in fermentation technology and new product development are expected to generate lucrative opportunities for players in this market over the forecast period.

Market Size in USD Bn

CAGR14.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 14.3% |

| Market Concentration | High |

| Major Players | Chr. Hansen A/S, AngelYeast Co., Ltd., DuPont, Lonza, Lallemand Inc. and Among Others |

please let us know !

Fermented Ingredients Market Trends

With growing health awareness, consumers are becoming increasingly conscious about the ingredients in their food. There is a marked shift towards natural, minimally processed products that are clean-label and offer perceived health benefits. Fermented ingredients like yogurt, kefir, kimchi are appealing to consumers as they are derived from natural processes without the use of any artificial additives, preservatives or chemicals. People are wary of foods with long, chemical-sounding ingredients lists and favor products with short, easy-to-understand labels. Fermented foods fit well into the clean label trend as the fermentation process allows production of foods rich in nutrients through a natural method without the need for synthetic ingredients.

Probiotics refer to live microorganisms that when consumed in adequate amounts confer several health benefits. Research studies have established the role of gut microbiota and probiotic consumption in maintaining overall wellness and reducing risks of lifestyle diseases. With rising chronic health issues, people are looking to proactive management of gut and digestive health through diet. Fermented foods are emerging as an appealing option for everyday consumption of probiotics.

Market Challenge - Strict Regulatory Standards, Particularly in The U.S. And Europe, Impact the Entry of New Products

The fermented ingredients market is witnessing considerable opportunities due to the rising popularity of plant-based diets globally. Consumers are increasingly shifting towards vegan and sustainable food options driven by health, ethics and environmental concerns. Fermented plant-based ingredients provide alternatives to animal-derived products and satisfy this growing demand. Food companies have responded by launching a wide variety of vegan dairy and meat alternatives that use fermented plant proteins, such as those derived from soy, nuts and grains. The addition of these cultures enhances the taste and nutritional properties of vegan options. They help mimic textures of traditional products. The market has also observed innovation around herbs, vegetables and fruits that are naturally fermented. This expanding portfolio of plant-centered offerings presents lucrative opportunities for ingredient suppliers. The development of more natural preservation techniques further boosts appeal for health-conscious buyers. The trends of veganism and sustainability thus bode well for long term growth prospects of plant-based fermented ingredients.

Key winning strategies adopted by key players of Fermented Ingredients Market

Product Innovation and Development:

- Key players are heavily investing in R&D to create novel fermented products that cater to health-conscious consumers. Innovations include new fermentation techniques, cleaner labels, and plant-based ingredients.

- Companies like New Culture are using precision fermentation to create animal-free dairy alternatives, tapping into the growing vegan and sustainable food markets.

Strategic Partnerships and Collaborations:

- Collaborations with biotechnology firms and food manufacturers help streamline product development and scale up production, as seen with partnerships like New Culture and ADM.

- Partnerships with AI technology providers are being leveraged to improve production efficiency, optimize fermentation processes, and ensure product consistency.

- Collaborations with academic and research institutions are common for advancing fermentation technologies, particularly in developing new strains and processes.

- Expanding into high-growth markets, especially Asia Pacific and Europe, where demand for natural and fermented foods is increasing. For instance, many companies are setting up production facilities or partnering with local suppliers to strengthen their presence in these regions.

- Localized Production and Distribution: To cater to specific consumer preferences, companies are adapting product formulations and distribution channels to align with regional tastes and regulatory requirements.

- Emphasizing sustainable practices in ingredient sourcing, production, and packaging to appeal to eco-conscious consumers.

- Transparency in labeling, ensuring that products are free from synthetic additives and preservatives, is a major selling point for today’s health-aware consumers.

- Beyond food and beverages, fermented ingredients are being introduced into pharmaceuticals, cosmetics, and personal care products. This diversification allows companies to tap into various industries and reduce dependence on any single market.

- Developing multi-functional ingredients that serve diverse industries (e.g., amino acids for both nutraceuticals and cosmetics) expands the market reach of fermented ingredients.

- Leveraging e-commerce platforms and direct-to-consumer (D2C) models to make fermented ingredients more accessible to a broad audience, especially in the health and wellness segment.

- Using digital tools and AI-driven analytics to monitor consumer trends, allowing companies to swiftly respond to changing preferences and introduce new products based on real-time demand analysis.

Segmental Analysis of Fermented Ingredients Market

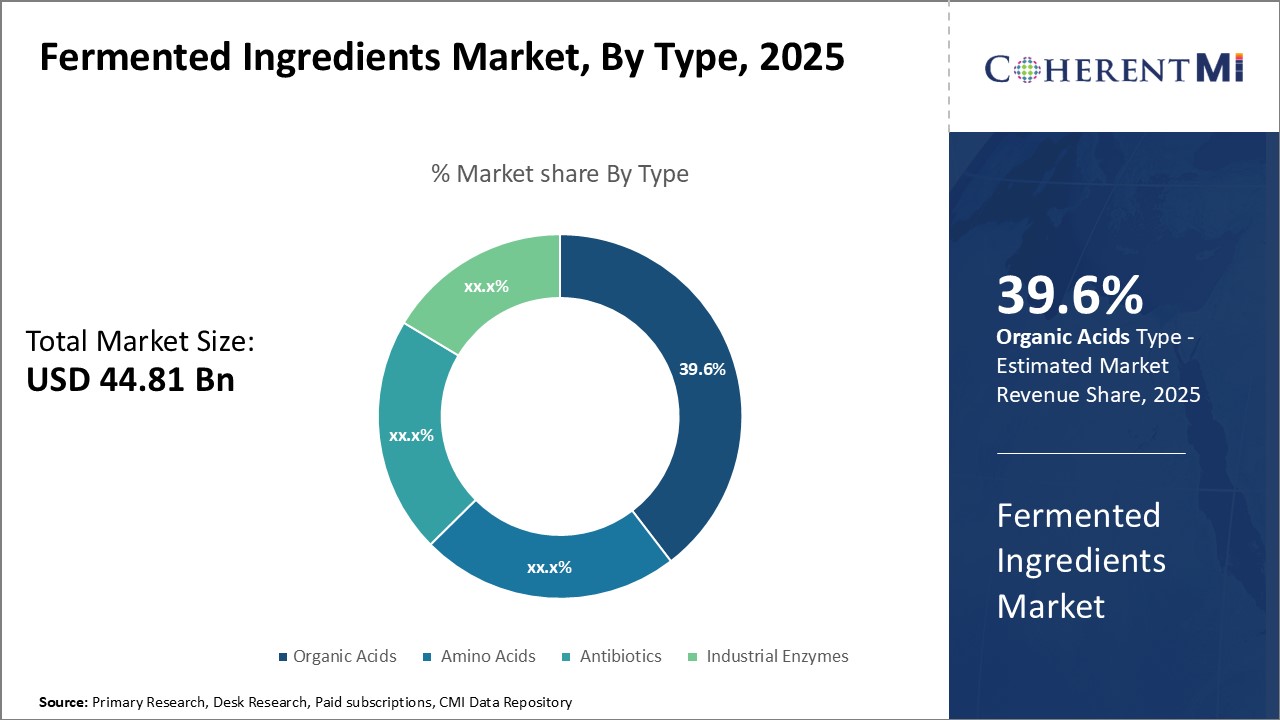

Insights, By Type, Organic Acids Meets Growing Demand for Natural Food Ingredients

Fermented organic acids help extend the shelf-life of foods without artificial preservatives. They inhibit the growth of harmful bacteria and prevent spoilage. In bakery products, organic acids help regulate acidity and leavening. In meat and dairy, they suppress pathogenic microorganisms. The growing processed food industry relies on organic acids to control pH and impart a tangy taste. Food manufacturers favor organic acid fermentation due to consistency in quality and taste.

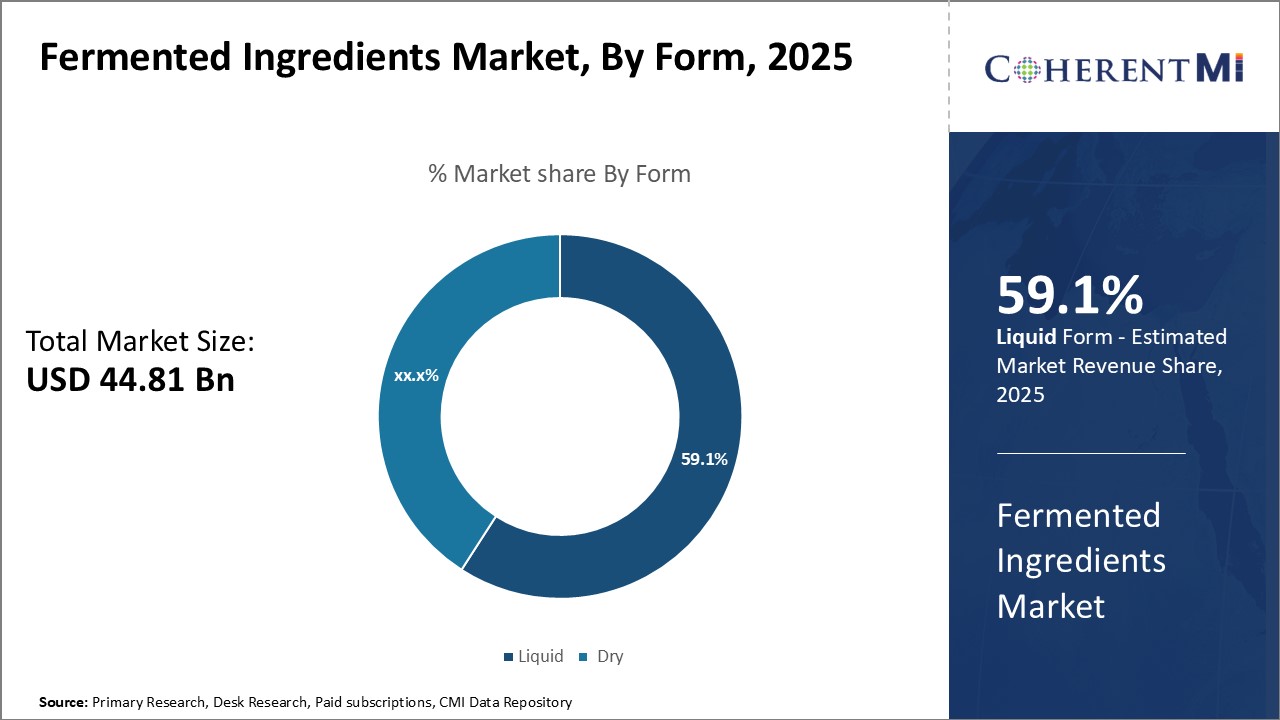

Insights, By Form, Liquid Form Dominates Owing to its Advantages

Insights, By Form, Liquid Form Dominates Owing to its AdvantagesBy Form, the liquid form of fermented ingredients is expected to account for 59.1% in 2025 for its advantages in handling and application over dry form. Liquid ingredients are diluted to the required concentration and easily blended or mixed into formulations. This improves process efficiency in food, beverage, pharma and other manufacturing industries.

The liquid segment has grown owing to therapeutic applications of metabolites produced via fermentation. Amino acids, vitamins and other bioactives find increasing usage in dietary supplements, infant formulas and clinical nutrition. Their stability and solubility in liquid eco-friendly delivery systems boosts bioavailability. Liquid fermented ingredients minimize oxygen exposure risks during storage and transportation compared to dry powders. Overall, ease of application and handling drives continued preference for liquid over dry fermented products.

Insights, By Process, Continuous Fermentation Steadily Replaces Batch Processing

Continuous fermentation maintains a steady state with uninterrupted substrate feed and product harvest. It maximizes space, energy and labor utilization for a more compact plant footprint and higher asset turnover. Careful control of pH, temperature and substrate-to-microorganism ratios achieves stable and consistent quality over long runs. Continuous fermentation mitigates risks of contamination between batches for highly controlled sterile environments.

Additional Insights of Fermented Ingredients Market

The fermented ingredients market is rapidly expanding as consumers increasingly value health-promoting, natural ingredients. Functional foods and beverages drive growth, particularly as clean-label and probiotic-rich products gain traction. Fermented ingredients are integral to achieving these health benefits, with organic acids and amino acids in high demand for their roles in food preservation and nutrition. Technological advancements in fermentation and AI-driven process optimization enhance product quality, enabling manufacturers to meet consumer expectations for sustainable and efficient production. Europe and Asia Pacific lead the market, with robust growth seen in the demand for fermented ingredients across food, pharmaceutical, and nutraceutical applications. This shift is bolstered by regulatory support and innovations, making fermented ingredients central to the future of health-focused dietary solutions.

Competitive overview of Fermented Ingredients Market

The major players operating in the Fermented Ingredients Market include Chr. Hansen A/S, AngelYeast Co., Ltd., DuPont, Lonza, Lallemand Inc., Vander Mill, LLC, Citizen Cider LLC, Indiacocoa, Red Boat and Squid.

Fermented Ingredients Market Leaders

- Chr. Hansen A/S

- AngelYeast Co., Ltd.

- DuPont

- Lonza

- Lallemand Inc.

Fermented Ingredients Market - Competitive Rivalry

Fermented Ingredients Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Fermented Ingredients Market

- In October 2023, New Culture announced plans for vegan mozzarella using precision fermentation, backed by USD 25 million Series A funding, in partnership with ADM.

- In October 2023, De Novo Foodlabs commercialized NanoFerrin, a sustainable, nature-identical alternative to lactoferrin, positioning it as a more affordable and sustainable option to traditional animal-derived lactoferrin.

Fermented Ingredients Market Segmentation

- By Type

- Organic Acids

- Amino Acids

- Antibiotics

- Industrial Enzymes

- By Form

- Liquid

- Dry

- By Process

- Continuous Fermentation

- Batch Fermentation

- Anaerobic Fermentation

- Aerobic Fermentation

- By Application

- Feed

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Paper

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How Big is the Fermented Ingredients Market?

The Global Fermented Ingredients Market is estimated to be valued at USD 44.81 Bn in 2025 and is expected to reach USD 114.21 Bn by 2032.

What will be the CAGR of the Fermented Ingredients Market?

The CAGR of the Fermented Ingredients Market is projected to be 14.1% from 2024 to 2031.

What are the major factors driving the Fermented Ingredients Market growth?

The growing consumer preference for natural, clean-label products, especially in food and beverages and increasing demand for probiotics, driven by the health benefits of gut-friendly fermented products are the major factors driving the Fermented Ingredients Market.

What are the key factors hampering the growth of the Fermented Ingredients Market?

The strict regulatory standards, particularly in the U.S. and Europe, that impact the entry of new products and high costs and bureaucratic challenges in securing regulatory approvals, affecting smaller manufacturers are the major factors hampering the growth of the Fermented Ingredients Market.

Which is the leading Type in the Fermented Ingredients Market?

Organic Acids are the leading Type segment.

Which are the major players operating in the Fermented Ingredients Market?

Chr. Hansen A/S, AngelYeast Co., Ltd., DuPont, Lonza, Lallemand Inc., Vander Mill, LLC, Citizen Cider LLC, Indiacocoa, Red Boat, Squid are the major players.