Wet Pet Food Market Size - Analysis

The wet pet food market is expected to witness strong growth over the forecast period. Rising pet humanization trend and increasing nuclear families with dual-income households have boosted demand for high quality pet food including wet varieties. Busy lifestyles have also increased preference for easily serving wet foods. Furthermore, growing awareness about balanced nutrition and various health benefits of wet food over dry kibble is driving the market.

Market Size in USD Bn

CAGR14.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 14.3% |

| Market Concentration | High |

| Major Players | Chr. Hansen A/S, DuPont, AngelYeast Co., Ltd., Lallemand Inc., Lonza and Among Others |

please let us know !

Wet Pet Food Market Trends

As more and more consumers are becoming aware of the ingredients used in their food products and how those ingredients can impact their health, the demand for natural and clean-label pet food has significantly rose over the past few years. Pets are considered as part of the family by many households nowadays and people want only the best for their furry companions. Several studies have found links between certain artificial preservatives, colors, and flavors used in pet food with negative health issues in pets. This has scared consumers and reduce the trust in brands that use artificial or chemical-sounding ingredients in their products.

Consumers are also actively participating in online communities and researching best practices of feeding pets. This awareness helps them identify ingredients to avoid colors, flavors, preservatives and look for alternative options. Brands are formulating products grounded in nutritional science to meet these evolving needs. For example, instead of artificial preservatives, they are using natural preservatives like vitamin E or citric acid. Region-specific products customized for dogs and cats with nutritional needs pertaining to lifestyle and local environment are further helping gain consumer confidence.

Market Driver - Rising Awareness of Health Benefits of Fermented Products, Especially Probiotics

A probiotic-rich diet is especially important for pets that are prone to digestive issues like dogs and cats. It promotes absorption of nutrients and counteracts risks from antibiotics or situations of high stress. With progressive modern lifestyles, pets also face comparable health challenges as humans do because of factors like limited access to outdoors, processed packaged food lacking nutrients. Fermented ingredients fortify their gut in natural ways without any known side effects. Brands have capitalized on research studies to highlight probiotic credentials of their products. Innovations like fermenting specific meat varieties or adding probiotic supplements have given consumers more choices.

Market Challenge - Strict Regulatory Standards and Lengthy Approval Processes in Regions Like EU and the U.S.

The wet pet food market has an opportunity arising from the growing popularity of veganism and interest in more sustainable ingredients. As more owners adopt vegan or plant-based diets for themselves, they look for similar options for their pets that are nutritious as well as environmentally-friendly. Fermented plant proteins are gaining attention due to their ease of digestion and high nutritional value as an alternative to meat-based ingredients. Using strains of fungi and bacteria that break down plant material, manufacturers can create savory, meat-like textures from vegetables, grains and legumes that appeal to both cats and dogs. The production process enhances the protein and amino acid content as well. With ongoing consumer demand for vegan products, the fermentation of plant-based ingredients provides a meaningful opportunity for pet food brands to attract new customers seeking sustainable options without compromising on pet nutrition or taste.

Key winning strategies adopted by key players of Wet Pet Food Market

Product Innovation and Health-Focused Formulations:

- Companies are developing premium wet pet food products enriched with high-quality ingredients like lean meats, organic vegetables, and functional ingredients (e.g., probiotics, antioxidants, omega-3 fatty acids) to support pet health. This appeals to pet owners who prioritize health benefits, including digestion support, joint health, and immune function.

- Recognizing the growing trend toward grain-free diets, many brands are introducing grain-free, hypoallergenic formulations to cater to pets with specific dietary sensitivities and pet owners concerned about food allergies.

Sustainable and Ethical Sourcing:

- Key players are increasingly focusing on sustainable packaging solutions, such as recyclable, biodegradable, or reusable containers, in response to consumer demand for eco-friendly options.

- Many companies are ensuring that ingredients, particularly proteins, are sourced responsibly, emphasizing sustainable fisheries, humanely raised livestock, and organic farms. This aligns with consumer values around animal welfare and environmental sustainability.

E-Commerce Expansion and Direct-to-Consumer (DTC) Models:

- To ensure convenience and regular product delivery, companies are offering subscription-based models that allow pet owners to have wet pet food delivered to their doorsteps. This model also helps build brand loyalty and increases repeat purchases.

- Key players are investing in e-commerce platforms and digital marketing strategies, reaching consumers directly through company websites, social media, and targeted online ads. This expansion meets the growing demand for online shopping and allows companies to reach a broader audience.

These strategies enable wet pet food brands to cater to health-conscious, environmentally aware pet owners who value convenience and customization.

Segmental Analysis of Wet Pet Food Market

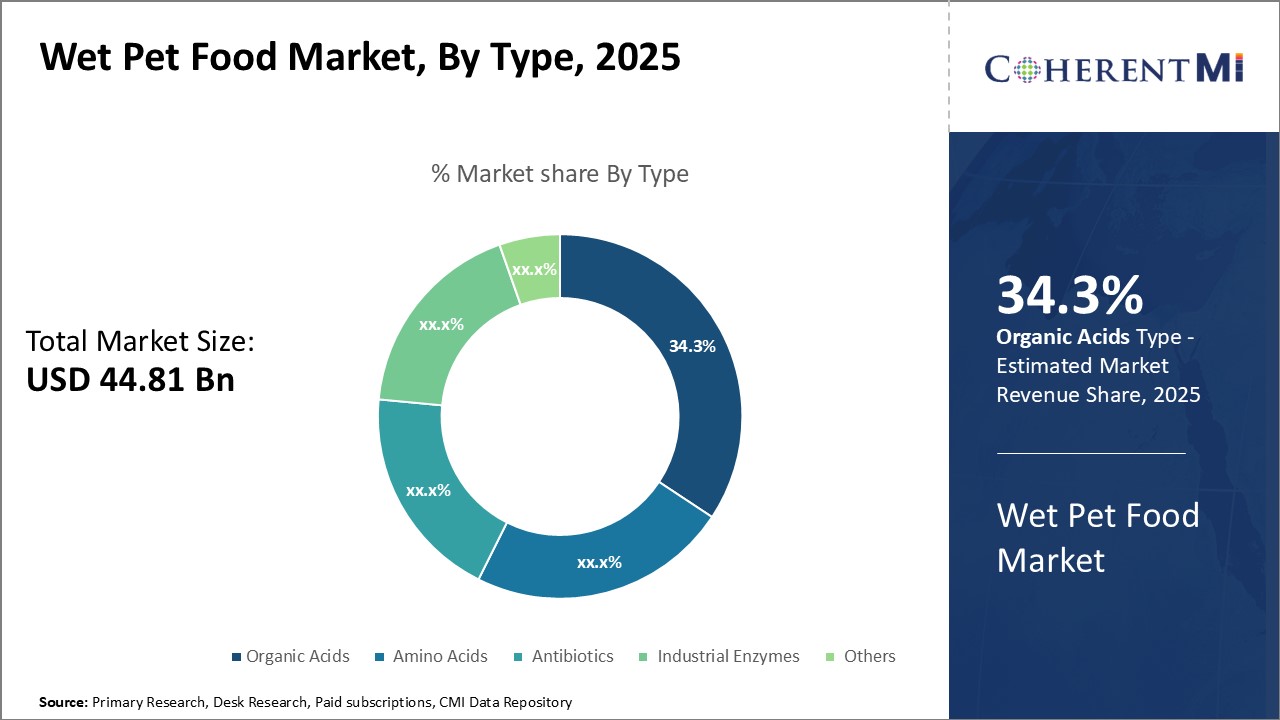

Insights, By Type, Superior Nutritional Benefits Drive Organic Acids Demand

Insights, By Type, Superior Nutritional Benefits Drive Organic Acids DemandBy Type, Organic Acids are projected to contribute 34.3% in 2025 owing to their numerous nutritional benefits. Organic acids serve as an important source of energy, building blocks and precursors for many biological molecules. They play a critical role in many metabolic pathways and are involved in cellular signaling and cellular communication. Some of the key organic acids used in pet food include citric acid, lactic acid, and acetic acid.

The nutritional superiority of organic acids compared to mineral or synthetic acidulants is a major driver for their increased use in pet food formulations. Research shows organic acids derived from natural sources lead to better nutrient bioavailability and feed efficiency in pets. This translates to improved growth, health and wellness. As pet owners become more educated about the link between nutrition, diet and overall pet wellbeing, the demand for high quality, natural ingredients like organic acids in wet pet foods will continue rising. Leading pet food brands are actively marketing products with clean labels featuring recognizable organic acids to tap into this consumer trend.

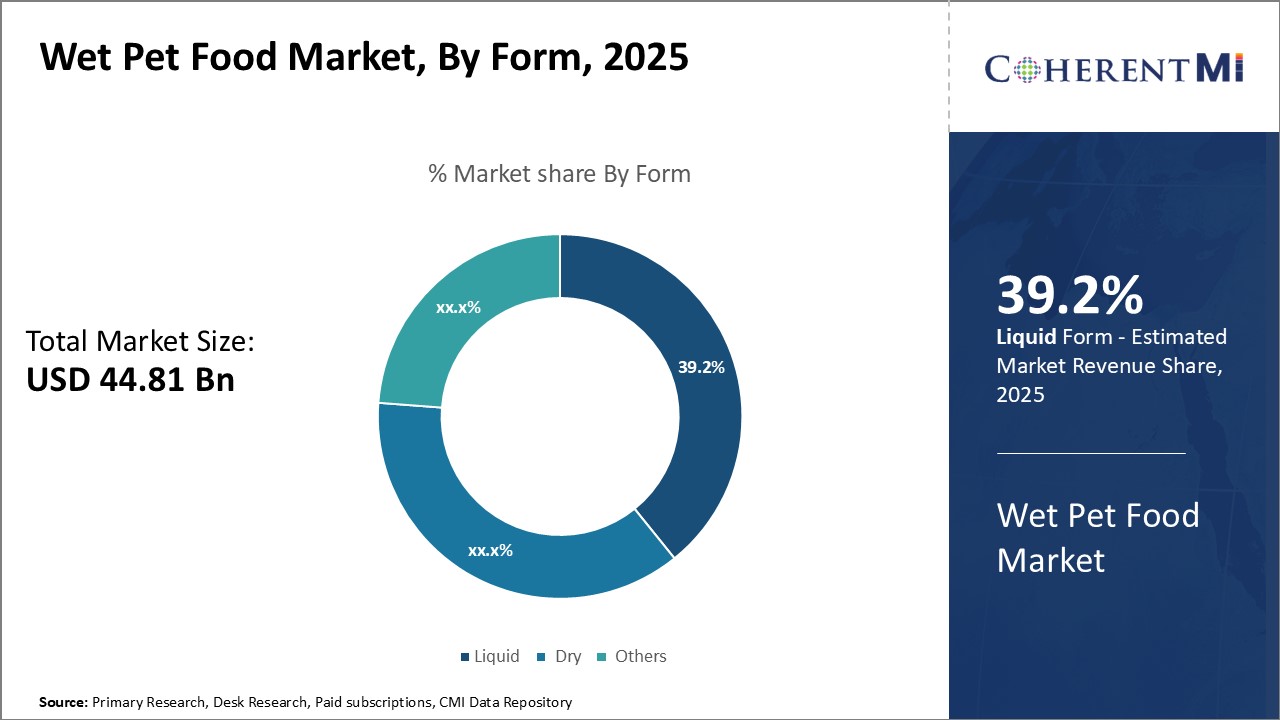

By Form, the Liquid segment is projected to contribute 39.2% in 2025 owing to its superiority in delivering nutrition and maximizing palatability. Liquid pet food is highly digestible as it does not require mastication like dry kibble. This makes it the preferred form for senior, sick or convalescing pets with weak jaws or poor chewing abilities. Liquids are also suitable for puppies and kittens transitioning to solid food as it mimics the texture of milk.

As pet owners dedicate more attention and budget towards nutrition, liquids cater well to demand for convenient, premium formulated diets. While dry kibble remains popular for cost and storability, liquids are gaining household penetration backed by perceptions of superior nourishment. Top brands strategize on liquid product lines targeted for specific life stages, activities or health goals. Convenience stores now stock a variety of chilled, pouch format liquid meals meeting on-the-go feeding needs.

Insights, By Process, Continuous Mode Maximizes Resource Yield in Fermentation

This provides several operational efficiencies over batch fermentation where the substrate and microbes are introduced together for fermentation in one batch followed by harvest. Continuous mode allows constant, predictable product formation matched to demand schedules. Microbial cells are retained within the fermentor for longer durations, enhancing cell density and overall reaction rates. It leverages bioengineering principles to maintain ideal operational parameters like pH, temperature and nutrition supply for peak microbial performance.

Additional Insights of Wet Pet Food Market

The fermented ingredients market is experiencing significant growth as consumers increasingly seek natural, organic products with health benefits. Key segments include organic acids and amino acids, which are essential in food preservation and nutrition. Market growth is bolstered by the adoption of clean-label products, plant-based ingredients, and the expanding use of fermentation in personal care and pharmaceuticals. Innovations in AI and fermentation technology are enhancing product quality and efficiency, supporting diverse applications in the food, pharmaceutical, and biofuel sectors. Overall, the market’s growth trajectory is driven by consumer awareness of health benefits, demand for sustainable ingredients, and regulatory support promoting natural products.

Competitive overview of Wet Pet Food Market

The major players operating in the Wet Pet Food Market include Chr. Hansen A/S, DuPont, AngelYeast Co., Ltd., Lallemand Inc., Lonza, Vander Mill, LLC, Citizen Cider LLC, Indiacocoa, Red Boat and Squid.

Wet Pet Food Market Leaders

- Chr. Hansen A/S

- DuPont

- AngelYeast Co., Ltd.

- Lallemand Inc.

- Lonza

Wet Pet Food Market - Competitive Rivalry

Wet Pet Food Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Wet Pet Food Market

- In October 2023, New Culture announced plans to launch vegan mozzarella cheese made with precision fermentation, aiming to replicate traditional mozzarella using animal-free casein, following a successful funding round of USD 25 million.

- In October 2023, De Novo Foodlabs commercialized NanoFerrin, a nature-identical lactoferrin alternative, targeting health-conscious consumers with an affordable and sustainable solution.

Wet Pet Food Market Segmentation

- By Type

- Organic Acids

- Amino Acids

- Antibiotics

- Industrial Enzymes

- Others

- By Form

- Liquid

- Dry

- Others

- By Process

- Continuous Fermentation

- Batch Fermentation

- Anaerobic Fermentation

- Aerobic Fermentation

- By Application

- Feed

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How Big is the Wet Pet Food Market?

The Global Wet Pet Food Market is estimated to be valued at USD 44.81 bn in 2025 and is expected to reach USD 114.21 bn by 2032.

What will be the CAGR of the Wet Pet Food Market?

The CAGR of the Wet Pet Food Market is projected to be 14.1% from 2024 to 2031.

What are the major factors driving the Wet Pet Food Market growth?

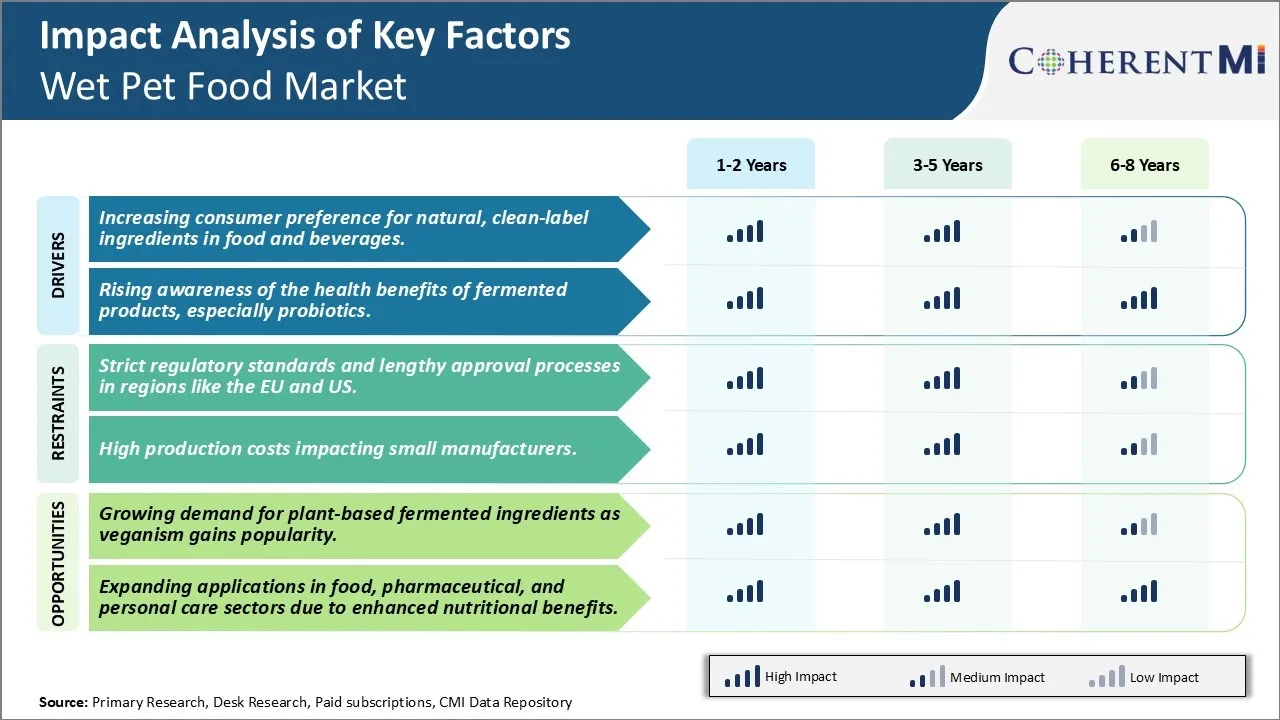

The increasing consumer preference for natural, clean-label ingredients in food and beverages. and rising awareness of the health benefits of fermented products, especially probiotics are the major factors driving the Wet Pet Food Market.

What are the key factors hampering the growth of the Wet Pet Food Market?

The strict regulatory standards and lengthy approval processes in regions like the EU and the U.S. and high production costs impacting small manufacturers are the major factors hampering the growth of the Wet Pet Food Market.

Which is the leading Type in the Wet Pet Food Market?

Organic Acids are the leading Type segment.

Which are the major players operating in the Wet Pet Food Market?

Chr. Hansen A/S, DuPont, AngelYeast Co., Ltd., Lallemand Inc., Lonza, Vander Mill, LLC, Citizen Cider LLC, Indiacocoa, Red Boat, Squid are the major players.