Drug Infusion System Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Drug Infusion System Market is segmented By Product (Syringe Infusion Systems, Elastomeric Infusion Systems, Large Volume Infusion Systems, Enteral In....

Drug Infusion System Market Size

Market Size in USD Bn

CAGR8.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.9% |

| Market Concentration | Medium |

| Major Players | B. Braun Melsungen AG, Medtronic, BD (Becton, Dickinson and Company), Fresenius Kabi AG, Baxter and Among Others. |

please let us know !

Drug Infusion System Market Analysis

The drug infusion system market is estimated to be valued at USD 12.77 Bn in 2024 and is expected to reach USD 25.15 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2031. The market has been driven by rising prevalence of chronic diseases and growing need for safety, accuracy, and personalized care in drug delivery.

Drug Infusion System Market Trends

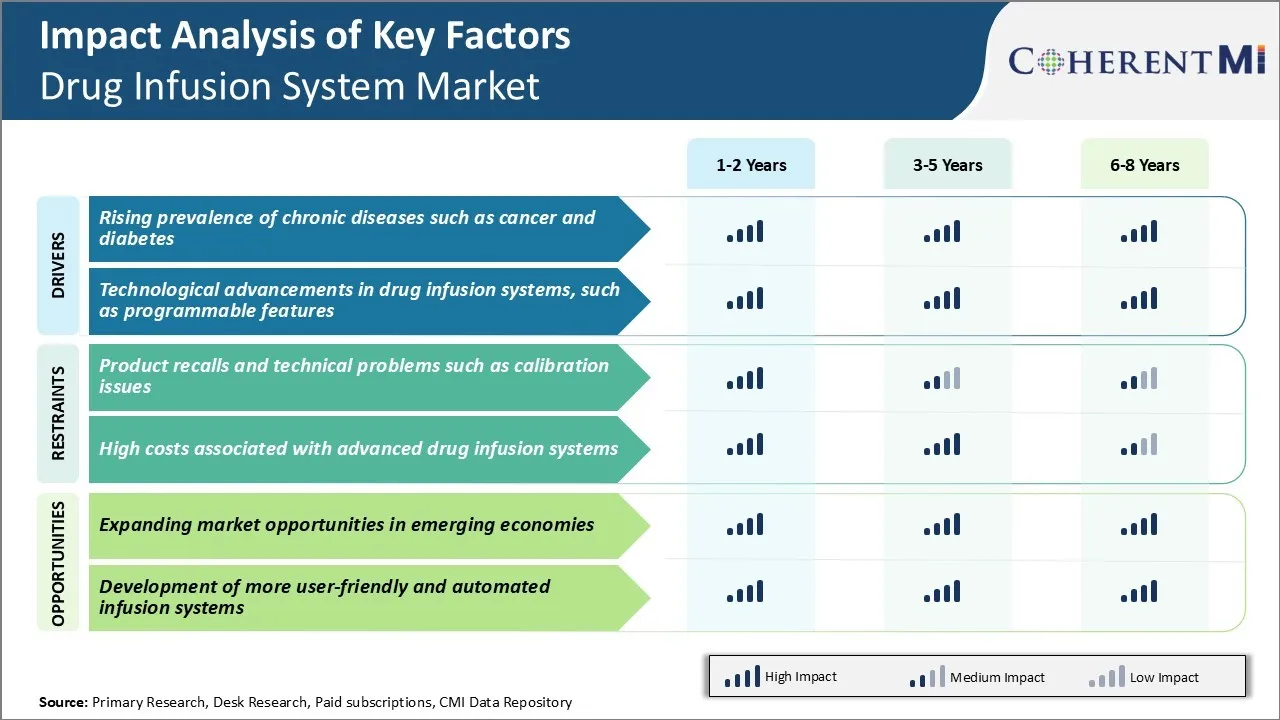

Market Driver - Rising Prevalence of Chronic Diseases such as Cancer and Diabetes

Cancer has witnessed a steep rise in incidence rates in the recent years. According to estimates by medical experts, nearly one in six deaths globally occur due to cancer. If preventive measures are not taken on priority, cancer cases are projected to rise tremendously in the future. Diabetes is another chronic condition that is affecting a vast population worldwide.

For patients undergoing chemotherapy or other complex IV drug therapies, the use of drug infusion systems ensures accurate and controlled delivery of medication as per the prescribed protocol. This is vital for achieving optimal therapeutic outcomes and minimizing systemic side effects in cancer treatment.

In diabetes care as well, continuous subcutaneous insulin infusion through pumps has proven to provide improved glycemic control compared to multiple daily injections. It allows flexible and adjustable insulin dosing based on an individual's changing requirements.

Drug infusion pumps enable home-based long-term care, which is more affordable for patients as well as providers. Overall, the substantial growth in chronic patient populations coupled with the indispensable benefits of drug infusion systems will majorly drive the demand for technologically advanced and user-friendly infusion devices going forward.

Market Driver - Technological Advancements in Drug Infusion Systems, such as Programmable Features

One of the key areas of innovation is enhanced programmability in infusion pumps. Earlier models mainly involved manual settings, which imposed the risks of human errors. However, today's digitally controlled infusion pumps are capable of complex, automated functionalities that were previously unimaginable.

Advanced programming options allow for customized multi-dose, multi-step or waveform delivery patterns tailored to a medication's pharmacokinetic properties and patient needs. Weight-based dosing, titration capabilities, customizable libraries of therapeutic protocols, precision and accuracy even at low flow rates are some technological strides pump developers have made possible through rigorous R&D investments.

In addition, built-in safety algorithms minimize potential dangers such as over/under-infusion by monitoring for occlusions and malfunctions in real-time. Connectivity with hospital information technology infrastructure through wireless integration has massively improved remote monitoring potential of infusion therapies.

Simultaneously, intuitive user-interface designs have elevated the ease of use for both patients and caregivers. Such sophisticated yet user-friendly programmability has played a pivotal role in expanding indications for pump-administered drugs. Overall, advanced programming and safety features constitute a key value proposition maximizing infusion pumps' benefits to clinical outcomes and health economics each year.

Market Challenge - Product Recalls and Technical Problems such as Calibration Issues

The drug infusion system market faces significant challenges due to frequent product recalls and technical problems encountered by manufacturers. A major issue plaguing the industry has been the high number of product recalls stemming from design flaws and safety concerns. Several drug infusion pumps have been recalled in recent years due to malfunctions that resulted in inaccurate dosage delivery. This has serious safety implications as improper dosages can cause severe harm.

Manufacturers are also struggling with frequent calibration issues in devices. Constant software updates and bug fixes are required to address anomalies in dosage readings. Such technical glitches shake consumer confidence in products and interrupt hospital workflow. It also results in additional costs to the manufacturer to fix issues and manage recalls. Overall, recalls and technical problems damage brand reputation and trust in the industry. To sustain long term growth, manufacturers must focus on stringent quality control and Rolls Royce reliability to minimize product failures.

Market Opportunity - Expanding Market Opportunities in Emerging Economies

The drug infusion system market has promising opportunities for expansion in emerging economies. Healthcare infrastructure and standards are steadily improving in developing nations of Asia, Latin America, Eastern Europe and Africa. With a surge in lifestyle diseases and rising medical costs, hospitals are making investments in advanced drug delivery platforms to enhance patient safety and outcomes. Emerging countries with large population bases like India, Brazil and Indonesia present a huge market potential.

As per our estimates, these regions will contribute over 30% of the global demand for drug infusion systems by 2025. Local manufacturers are also establishing operation to serve regional needs more efficiently. International players must devise low-cost models and tie-ups with regional partners to penetrate these lucrative emerging markets.

Additionally, improving health insurance penetration will further fuel demand. If targeted correctly, emerging economies can drive the next phase of growth for drug infusion system manufacturers globally.

Key winning strategies adopted by key players of Drug Infusion System Market

Product Innovation: Continuous innovation to develop cutting-edge products has helped players gain an edge. For example, in 2020, B. Braun launched Infusomat Space Volumetric infusion pump with advanced features like touch screen and intuitive software. This pump offered better control, customization and wireless connectivity capabilities.

Partnerships & Alliance: Forming strategic partnerships is a popular strategy. In 2017, Baxter entered a partnership with Microsoft to develop an Internet of Medical Things platform. This platform integrated Baxter's infusion pumps and monitors with Microsoft's Azure cloud services.

Regional Expansion: Expanding into high-growth emerging markets helped players tap new opportunities. For example, in 2018, ICU Medical entered the Indian market by setting up a manufacturing plant.

M&A Activity: Acquisitions are used to complement product portfolios and expand capabilities. In 2019, Becton, Dickinson and Company acquired C.R. Bard Inc., a major infusion therapy player with leading PORT-A-CATH products. This strengthened Becton's infusion product offerings.

Focus on Clinician Education: Providing training and education to clinicians and healthcare professionals on new products, technologies and clinical practices improves customer engagement. For instance, B. Braun conducts several workshops, conferences and webinars annually in collaboration with medical bodies to create awareness about latest infusion therapies and protocols.

Segmental Analysis of Drug Infusion System Market

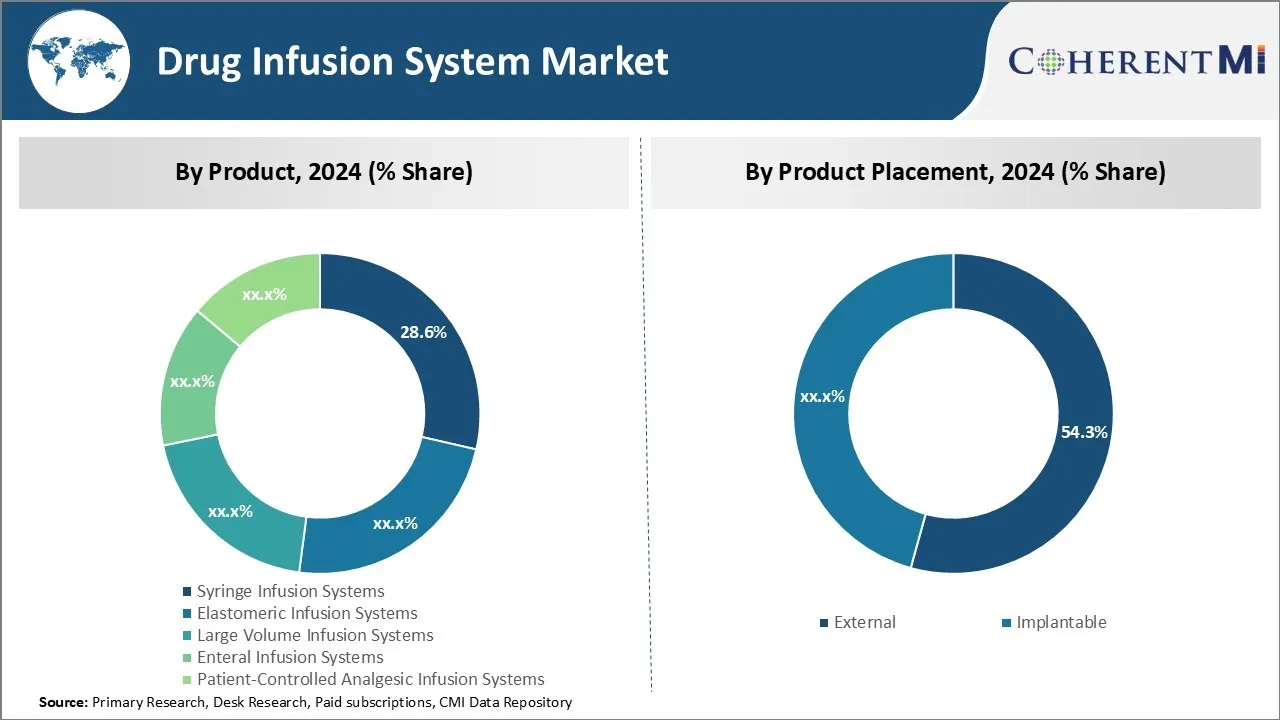

Insights, By Product: Affordability and Ease of Use Drive Syringe Infusion Systems Segment

In terms of product, syringe infusion systems are estimated to hold 28.6% of the market share in 2024, owing to their affordability and ease of use compared to other drug infusion systems. Syringe infusion systems offer a simple and cost-effective mechanism for continuously delivering medications intravenously to patients. They utilize a syringe plunger and barrel to contain and dispense drugs at a regulated rate. This design keeps production and material costs very low compared to more complex infusion pump technologies.

Additionally, syringe infusion systems are highly portable and do not require electricity or complicated programming to operate. Nurses and other medical staff can easily set the flow rate using a manual plunger control, making syringe systems very straightforward to use across various clinical settings. Their inherent simplicity has made syringe infusion systems a mainstay for basic outpatient and inpatient intravenous treatments requiring continuous low flow rate delivery.

Insights, By Product Placement: Portability Drives External Product Placement Segment

In terms of product placement, the external segment contributes the highest share due to the portability it offers patients. External drug infusion systems are highly portable as they are not surgically implanted inside the body. This allows patients receiving long-term infusion therapies flexibility in their daily activities.

With external pumps, patients can ambulate freely and perform normal tasks without being physically tethered to medical equipment. The portability of external systems improves quality of life for patients requiring frequent or round-the-clock medication administration. It also enables convenient outpatient treatments and hospital discharges. The non-invasive nature of external systems also reduces health risks compared to implantable alternatives.

Insights, By Portability: Fixed Systems Dominate Due to Setting-Specific Optimization

In terms of portability, fixed drug infusion systems contribute the highest share owing to their optimization for specific clinical settings. Unlike portable pumps, fixed infusion systems are not intended to transport with the patient. Instead, they are permanently installed alongside specialized medical equipment in dedicated clinical areas like hospital ICUs, ER rooms, and perioperative suites.

Fixed systems integrate seamlessly with facility infrastructure including medical gas pipelines, electrical systems, and centralized monitoring capabilities. Their size and customizability allow for designing advanced features optimal for high-acuity patients. Furthermore, built-in safeguards and redundant components on fixed pumps offer the highest level of safety assurance needed in critical care environments.

The setting-specific design of fixed systems has made them the standard for acute care facilities where mobility is less important than delivery control and monitoring capabilities.

Additional Insights of Drug Infusion System Market

- North America is projected to dominate the market due to a well-established healthcare system and high prevalence of chronic diseases like cancer and diabetes.

- Approximately 60% of hospitals in Europe have upgraded to the latest infusion systems within the past two years.

Competitive overview of Drug Infusion System Market

The major players operating in the Drug Infusion System Market include B. Braun Melsungen AG, Medtronic, BD, Fresenius Kabi AG, Baxter, PROMECON GmbH, arcomed ag, Microport Scientific Corporation, Teleflex Incorporated, and Smiths Medical.

Drug Infusion System Market Leaders

- B. Braun Melsungen AG

- Medtronic

- BD (Becton, Dickinson and Company)

- Fresenius Kabi AG

- Baxter

Drug Infusion System Market - Competitive Rivalry, 2024

Drug Infusion System Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Drug Infusion System Market

- In September 2020, B. Braun Melsungen AG received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its SpaceStation MRI system. This clearance allows for the use of the company's Space® infusion pumps within magnetic resonance imaging (MRI) suites. The integration of these infusion pumps enhances drug delivery capabilities during MRI procedures, improving patient care by enabling continuous infusion without interrupting the imaging process. This development represents a significant advancement in medical technology, facilitating safer and more efficient treatments in clinical settings.

- In May 2020, Baxter International received CE mark approval and regulatory approval from Australia’s Therapeutic Goods Administration (TGA) for the Evo IQ Syringe Infusion System. This system is designed to deliver small volumes of medications and other fluids to patients in a controlled manner, enhancing infusion therapy options for different patient populations.

Drug Infusion System Market Segmentation

- By Product

- Syringe Infusion Systems

- Elastomeric Infusion Systems

- Large Volume Infusion Systems

- Enteral Infusion Systems

- Patient-Controlled Analgesic Infusion Systems

- Insulin Pumps

- Others

- By Product Placement

- External

- Implantable

- By Portability

- Fixed

- Ambulatory

- By Application

- Oncotherapy

- Diabetes

- Analgesia

- Nutrition

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the drug infusion system market?

The drug infusion system market is estimated to be valued at USD 12.77 Bn in 2024 and is expected to reach USD 25.15 Bn by 2031.

What are the key factors hampering the growth of the drug infusion system market?

The product recalls and technical problems such as calibration issues and high costs associated with advanced drug infusion systems are the major factors hampering the growth of the drug infusion system market.

What are the major factors driving the drug infusion system market growth?

The rising prevalence of chronic diseases such as cancer and diabetes and technological advancements in drug infusion systems, such as programmable features are the major factors driving the drug infusion system market.

Which is the leading product in the drug infusion system market?

The leading product segment is syringe infusion systems.

Which are the major players operating in the drug infusion system market?

B. Braun Melsungen AG, Medtronic, BD, Fresenius Kabi AG, Baxter, PROMECON GmbH, arcomed ag, Microport Scientific Corporation, Teleflex Incorporated, and Smiths Medical are the major players.

What will be the CAGR of the drug infusion system market?

The CAGR of the drug infusion system market is projected to be 8.9% from 2024-2031.