Echocardiography Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Echocardiography Devices Market is segmented By Product (On-Platform, Portable), By Test (Transthoracic, Transesophageal, Stress, Others), By Technolo....

Echocardiography Devices Market Size

Market Size in USD Bn

CAGR5.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.8% |

| Market Concentration | Medium |

| Major Players | B. Braun Melsungen AG, Medtronic, BD (Becton, Dickinson and Company), Fresenius Kabi AG, Baxter and Among Others. |

please let us know !

Echocardiography Devices Market Analysis

The echocardiography devices market is estimated to be valued at USD 10.21 Bn in 2024 and is expected to reach USD 15.13 Bn billion by 2031, growing at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2031. Key factors driving the market growth include rising prevalence of cardiovascular diseases, increasing geriatric population, and technological advancements in echocardiography devices.

Echocardiography Devices Market Trends

Market Driver - Rising Prevalence of Cardiovascular Diseases Globally

A number of epidemiological studies have shown that cardiovascular diseases now account for over 30% of all deaths globally each year. If seen regionally, developed regions such as North America and Europe have historically witnessed a higher rate of cardiovascular patient pool due to aged population and lifestyle factors.

However, the developing parts of the world including Asia Pacific and Latin America are also experiencing a rapid rise in cardiovascular patient population driven by increasing life expectancy, growing adoption of unhealthy lifestyle and lack of awareness.

This substantial increase in cardiovascular patient volume has put immense pressure on the healthcare systems worldwide. There has been a growing need for advanced and non-invasive diagnostic modalities to efficiently diagnose and manage the cardiovascular conditions.

As echocardiography helps in early detection and better management of cardiovascular diseases, the growing prevalence of such diseases has directly contributed to higher demand for echocardiography devices across various healthcare settings.

With limited cardiologists and long wait times for tests, the role of echocardiography in triaging, diagnosis and monitoring cardiovascular patients has become more crucial than ever before. This has significantly driven the adoption of echocardiography devices globally.

Market Driver - Increasing Demand for Advanced Diagnostic Techniques in Cardiac Care

Healthcare providers and doctors have been continuously striving to identify advanced diagnostic solutions that can improve patient care, raise efficiency and lower healthcare costs. In the area of cardiology as well, there remains a strong emphasis on leveraging latest technologies for non-invasive evaluation of heart conditions. Factors like ageing population susceptible to cardiovascular problems, shorter hospital stays pushing demand for fast diagnosis, stringent reimbursement policies favoring outpatient care over hospitalization have all created favorable environment for newer cardiac diagnostic modalities.

Echocardiogram as a cardiac imaging technology has witnessed tremendous improvements over the years. Introduction of enhanced visualization techniques, automated analysis features, portable devices, stress-echo capabilities etc. have expanded clinical applications of echocardiography from basic morphologic assessment to sophisticated functional evaluation of heart mechanics. Advancements have enabled early and accurate diagnosis of conditions that were previously difficult to detect. This has found widespread acceptance among cardiologists and led to echocardiography replacing alternative tests in certain clinical scenarios.

Growing confidence in echocardiography driven diagnostic outcomes has augmented its demand across various hospital departments as well as physician offices. Moreover, factors such as favorable reimbursement for echocardiography, emphasis on preventive healthcare are contributing to the surging demand for advanced echocardiography systems and probes.

Market Challenge - Procedural Complications Associated with Invasive Echocardiography

One of the major challenges currently faced by the echocardiography devices market is the procedural complications associated with invasive echocardiography such as transesophageal echocardiography (TEE) and intracardiac echocardiography (ICE). Invasive echocardiographic procedures require the insertion of probes into the esophagus or through blood vessels into the heart which makes them more complex and riskier compared to conventional transthoracic echocardiography (TTE).

Some common complications of TEE include bleeding, infection, arrhythmias, and esophageal injury while ICE procedures carry risks of vessel damage, thrombosis and embolism. The possibility of such adverse events often discourages clinicians from recommending and patients from opting for invasive methods when conventional TTE is sufficient. This limits the uptake of advanced echocardiography technologies even in cases where they offer significant diagnostic advantages over external ultrasound imaging.

Addressing the safety concerns around invasive procedures through reduction of complication rates and development of minimally invasive techniques is thus a major challenge that needs to be overcome to boost the market potential of echocardiography devices.

Market Opportunity - Technological Advancements and New Product Developments in Echocardiography

The echocardiography devices market is presenting substantial opportunities for growth driven by ongoing technological advancements and new product developments in the field. Manufacturers are innovating novel echocardiography platforms integrating advanced ultrasound imaging technologies such as three-dimensional (3D), four-dimensional (4D) and transesophageal echocardiography (TEE). These new systems provide clinicians with clearer and more detailed dynamic images of the heart enabling more accurate diagnoses.

Simultaneously, industry players are also coming up with smaller and more flexible probes making procedures less invasive. The development of intracardiac echocardiography (ICE) systems has further expanded the clinical applications of echocardiography. Moreover, integration of artificial intelligence (AI) solutions for echocardiography imaging analysis and reporting is anticipated to revolutionize cardiac ultrasound procedures. Continued technological upgrades expanding the clinical utility of echocardiography thus present lucrative avenues for revenue growth in the coming years.

Key winning strategies adopted by key players of Echocardiography Devices Market

Strategic Acquisitions and Partnerships: Acquisitions have helped players expand their product portfolios and geographic presence. For example, in 2021, Philips acquired BioTelemetry Inc., a leading remote cardiac diagnostics company, for $2.8 billion. Similarly, GE Healthcare partnered with Arterys in 2018 to fully integrate Arterys' cardiac imaging software into GE's ultrasound systems.

Focus on Innovation: Leading players have consistently invested in R&D to launch innovative echo devices with advanced features. For example, in 2020, Siemens Healthineers launched its new ACUSON Sequoia ultrasound system with Premium Edition package. It featured new transducer technologies, automation tools and enhanced quantification capabilities.

Expansion in Emerging Markets: Players have focused on expanding their presence in high growth emerging markets like China, India through partnerships and local manufacturing. For instance, in 2018 Philips opened a new ultrasound manufacturing facility in India to cater to the South Asian market.

Competitive Pricing: Players often use competitive pricing strategies to penetrate price-sensitive markets or increase their market share. For example, since 2015, GE Healthcare has consistently lowered prices of its lower-end Vivid echocardiography systems to make them more affordable for small hospitals and private clinics. This helped GE gain over 15% market share in the basic echo devices segment by 2020.

Segmental Analysis of Echocardiography Devices Market

Insights, By Product: Technological Advancements Fuel On-Platform Segment Growth

In terms of product, on-platform devices contribute approximately 56.3% share of the market in 2024, owning to continuous technological innovations in platform-based echocardiography devices. Manufacturers are consistently upgrading platforms with improved computing power, high resolution imaging capabilities, and automated analytics tools. This enables clinicians to derive faster and more accurate cardiac assessments.

Platform systems also allow for seamless upgrades of transducers and software modules. Their fixed installation in healthcare facilities reduces set-up time compared to portable systems. Further, integrated cath lab and echocardiography capabilities on modern platforms provide one-stop intraoperative imaging solutions.

Insights, By Test: Transthoracic Emerges as the Standard of Care in Echocardiography Testing

In terms of test, transthoracic tests are estimated to account for 48.2% of the market share in 2024. It can be attributed to its non-invasive nature and ability to evaluate cardiac structures adequately in most adult patients. It remains the preferred first-line imaging modality for assessing ventricular dimensions, systolic and diastolic function.

Improvements in transducer technology have enabled high quality imaging of all cardiac views needed for clinical decision making. As a result, transthoracic echos are routinely used pre-and post- Cardiac procedures, during heart failure evaluation and for stress-induced ischemia assessment.

Insights, By Technology: Expanding Clinical Applications Fuel Adoption of 2D Technology

In terms of technology, the widespread use of 2D can be credited to its capacity to generate real-time anatomical images of the heart from different imaging planes. This allows clinicians to evaluate cardiac structures and function comprehensively during diagnosis. While 3D/4D provides better visualization of spatial relationships, 2D continues seeing strong demand due to its higher image resolution and real-time response. Further, as echocardiography becomes integral to an increasing number of interventional procedures, the ability of 2D to guide and monitor therapies is expanding its role in clinical workflows.

Additional Insights of Echocardiography Devices Market

- Rising use of echocardiography devices in diagnosing structural heart diseases due to increasing congenital cases.

- Positive impact of echocardiography in diagnosing COVID-19-related cardiac complications.

- Cardiovascular diseases remain the leading cause of death globally, with approximately 17.9 million deaths annually due to heart-related issues.

Competitive overview of Echocardiography Devices Market

The major players operating in the echocardiography devices market include B. Braun Melsungen AG, Medtronic, BD, Fresenius Kabi AG, Baxter, PROMECON GmbH, arcomed ag, Microport Scientific Corporation, Teleflex Incorporated, and Smiths Medical.

Echocardiography Devices Market Leaders

- B. Braun Melsungen AG

- Medtronic

- BD (Becton, Dickinson and Company)

- Fresenius Kabi AG

- Baxter

Echocardiography Devices Market - Competitive Rivalry, 2024

Echocardiography Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Echocardiography Devices Market

- In September 2021, Us2.ai received FDA clearance for Us2.v1, an automated decision support tool for echocardiography. Us2.ai is a company specializing in AI-powered solutions for echocardiography analysis, and they have been working towards regulatory approvals.

- In October 2020, GE Healthcare received FDA clearance for its Ultra Edition package on the Vivid series of cardiovascular ultrasound systems. This upgrade introduced AI-enhanced features aimed at improving imaging quality and workflow efficiency. The AI tools assist clinicians in automating measurements and reducing the time required for complex assessments, thereby enhancing diagnostic confidence and patient care in cardiovascular imaging.

Echocardiography Devices Market Segmentation

- By Product

- On-Platform

- Portable

- By Test

- Transthoracic

- Transesophageal

- Stress

- Others

- By Technology

- 2D

- 3D/4D

- Doppler Imaging

- By End User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the echocardiography devices market?

The echocardiography devices market is estimated to be valued at USD 10.21 Bn in 2024 and is expected to reach USD 15.13 Bn billion by 2031.

What are the key factors hampering the growth of the echocardiography devices market?

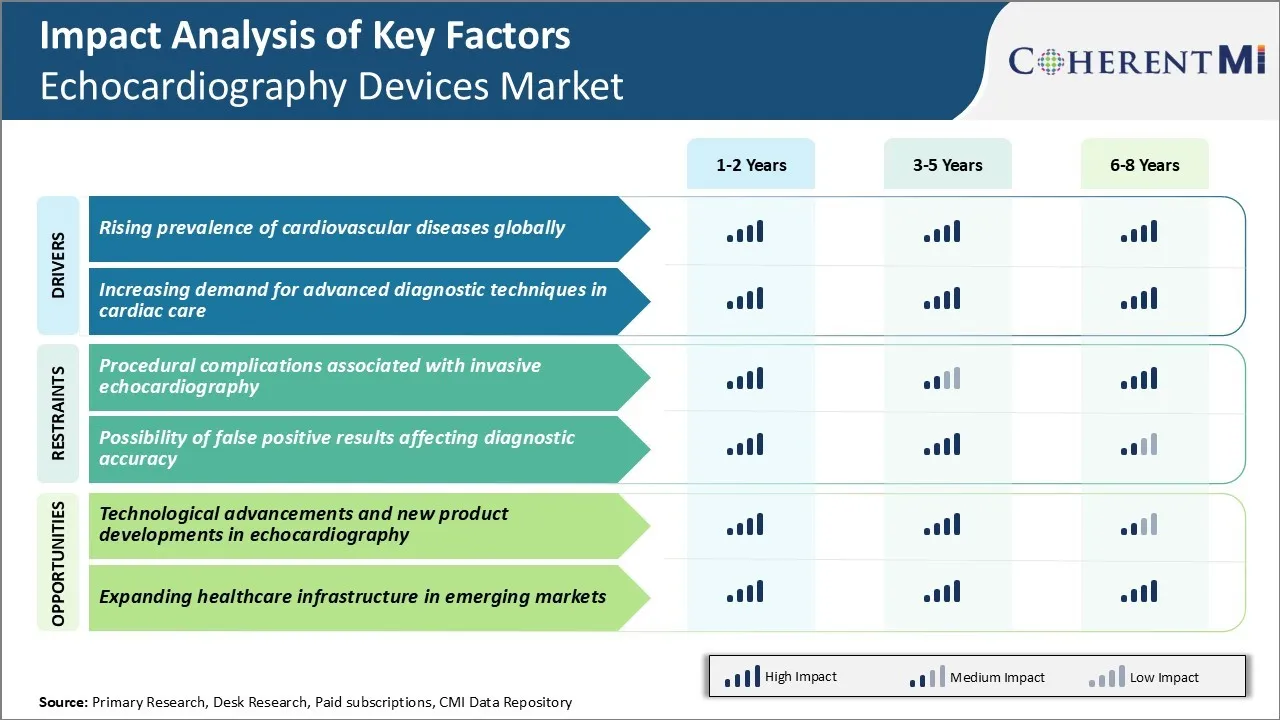

The procedural complications associated with invasive echocardiography and possibility of false positive results affecting diagnostic accuracy are the major factors hampering the growth of the echocardiography devices market.

What are the major factors driving the echocardiography devices market growth?

The rising prevalence of cardiovascular diseases globally and increasing demand for advanced diagnostic techniques in cardiac care are the major factors driving the echocardiography devices market.

Which is the leading product in the echocardiography devices market?

The leading product segment is on-platform.

Which are the major players operating in the echocardiography devices market?

B. Braun Melsungen AG, Medtronic, BD, Fresenius Kabi AG, Baxter, PROMECON GmbH, arcomed ag, Microport Scientific Corporation, Teleflex Incorporated, and Smiths Medical are the major players.

What will be the CAGR of the echocardiography devices market?

The CAGR of the echocardiography devices market is projected to be 5.8% from 2024-2031.