Foot Drop Treatment Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Foot Drop Treatment Devices Market is segmented By Product Type (Electrical Stimulator, Braces/Splints), By Application (Neuropathy, Muscle Disorders,....

Foot Drop Treatment Devices Market Size

Market Size in USD Bn

CAGR8.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.2% |

| Market Concentration | Medium |

| Major Players | Ottobock, Bioness Inc., AxioBionics, Accelerated Care Plus Corporation, Saebo, Inc. and Among Others. |

please let us know !

Foot Drop Treatment Devices Market Analysis

The foot drop treatment devices market is estimated to be valued at USD 2.59 Bn in 2024 and is expected to reach USD 4.5 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2031. The increasing incidence of neurological disorders and injuries are driving the demand for these devices. Technological advancements in devices like use of functional electric stimulation and 3D printed braces are further fueling the demand.

Foot Drop Treatment Devices Market Trends

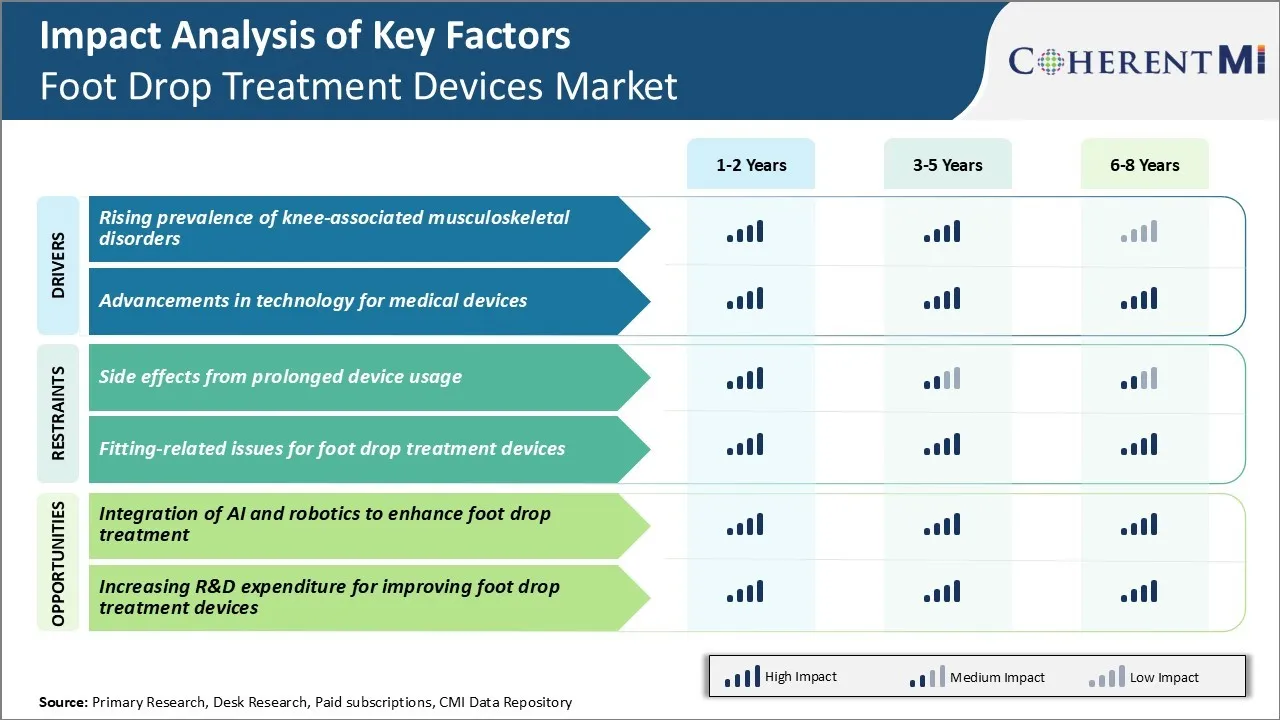

Market Driver - Rising Prevalence of Knee-associated Musculoskeletal Disorders

There has been a continuous rise in the prevalence of knee related musculoskeletal disorders over the past decade. Some of the common knee disorders witnessed are osteoarthritis, knee tendonitis, ligament injuries and neurological disorders that cause foot drop. With more people leading sedentary lifestyles due to urbanization and lack of physical activity, disorders like knee osteoarthritis are on the rise.

According to studies, knee osteoarthritis affects over 300 million people worldwide and by 2040 it is estimated that over 25% of the global population aged above 60 years will be living with this condition.

Rising obesity levels also contribute significantly to knee disorders. Carrying excess weight puts additional pressure on the knees over time damaging their cartilage and bones. Furthermore, diseases like diabetes that are growing at an alarming rate have contributed to neurological disorders causing foot drop.

People suffering from conditions like peroneal nerve palsy experience foot drop where they are unable to lift their foot properly while walking. This leads to an abnormal gait and increased risks of falling. With a growing geriatric population worldwide, that is more prone to such musculoskeletal ailments, the patient pool for foot drop treatment devices continues to expand rapidly.

Market Driver - Advancements in Technology for Medical Devices

Over the past few years, there have been meaningful innovations in foot drop treatment technologies. Early devices focused primarily on ankle foot orthoses to provide stability to the ankle joint. However, newer age devices leverage materials science, nanotechnology and digital technologies to provide superior treatment outcomes.

Advanced microprocessor-controlled ankle foot orthosis is able to sense the mechanics of natural gait and accordingly control ankle movement through sensors, processors and actuators. These smart orthoses have programmable swing and stance phase controls allowing customization based on patient needs.

3D printing technologies are also being increasingly used by device manufacturers to develop custom designed foot plates and braces. 3D scans of patient's feet and gait helps create implants tailored to their anatomy. This enhances comfort level and performance.

Some startups are also developing alternative solutions like wearable drop foot stimulators powered by efficient lithium-ion batteries. Such devices use neuromuscular electrical stimulation to induce dorsal flexion and improve gait symmetry without the need for mechanical orthoses. With continued digitization and use of AI, it is likely that future foot drop solutions will be more effective as well as easy to use.

Market Challenge - Side Effects from Prolonged Device Usage

One of the key challenges faced in the foot drop treatment devices market is the potential side effects arising from the prolonged usage of these devices. Foot drop treatment devices like ankle-foot orthoses (AFOs) and functional electrical stimulation (FES) devices need to be worn for several hours every day to effectively treat foot drop conditions.

However, prolonged and continuous device use can sometimes lead to skin irritation, soreness, and discomfort over the legs and feet of patients. This is especially true for rigid plastic AFOs that offer less flexibility compared to softer alternatives. The rubbing against the skin and pressure points caused by the device structure may cause redness, rashes or sores in patients who use them for many hours.

Device manufacturers need to focus on formulating softer materials, regular breaks in usage, and ergonomic designs to minimize such side effects from arising even with daily long-term device wear. Unaddressed discomfort or skin issues could potentially reduce patient compliance over time and negatively impact the foot drop treatment devices market potential.

Market Opportunity - Integration of AI and Robotics to Enhance Foot Drop Treatment

The integration of advanced technologies like artificial intelligence (AI) and robotics presents a major opportunity to enhance foot drop treatment options and drive the foot drop treatment devices market forward. For instance, AI-powered sensors and algorithms could allow future foot drop devices to closely monitor patient gait and offer real-time adjustments to joint angles, stiffness, and ankle positions accordingly. This could help optimize the level of correction and support on a dynamic, as-needed basis.

Similarly, robotic elements in ankle-foot orthoses and exoskeletons could provide powered assistance during swing phase activities. The combining of AI, sensors and actuators would help reduce foot drop symptoms more effectively than passive devices. It could also collect valuable patient data over time on treatment response and prognosis.

The convergence of these cutting-edge technologies stands to vastly improve treatment outcomes and patient experience with foot drop management. This presents a unique growth pathway for innovative device manufacturers.

Prescribers preferences of Foot Drop Treatment Devices Market

For mild cases, physical therapy is usually first-line to strengthen muscles in the leg and ankle. Exercises like ankle dorsiflexion stretches can help improve mobility.

As weakness worsens, prescribers often opt for ankle-foot orthosis (AFO) brace. Common brands prescribed are Hinged AFO by Össur and Dynamic AFO by Becker. These callipered plastic braces support the ankle and hold it in a neutral position during gait. For patients with more significant nerve damage, functional electrical stimulation (FES) may be introduced. The WalkAide device is a popular FES choice to stimulate the common peroneal nerve and induce muscle contraction during walking.

In advanced cases unresponsive to more conservative options, botulinum toxin injections are frequently used. For example, injecting Botox (onabotulinumtoxinA) into the gastrocnemius muscle relaxes it and reduces foot drop. Finally, for those with irreversible nerve damage but who are otherwise healthy, surgical options like tendon transfers may be considered to alter muscle function and improve mobility.

Additionally, comorbidities influence prescribing patterns. Younger patients with conditions like multiple sclerosis are more likely to try FES first due to its functional benefits, while older patients with peripheral neuropathy may opt straight for an AFO for safety.

Treatment Option Analysis of Foot Drop Treatment Devices Market

Foot drop has varying levels of severity that impact the appropriate treatment path. Mild cases can often be treated with brace devices like ankle-foot orthosis (AFO) that support the foot and ankle during gait. For moderate foot drop, injectable treatments may be considered. Botulinum toxin type A (Botox) injections into the calf muscles can temporarily weaken them and reduce abnormal tone, improving walking for 3-6 months.

More advanced cases may require neuromuscular electrical stimulation (NMES) devices like Bioness L300. These use mild electrical pulses to stimulate the peroneal nerve during walking, cueing the muscles to fire at the right times. NMES can significantly boost function and mobility whenbrace therapy isn't enough. For severe drop foot not responding to other options, surgery may be considered. Common procedures include anterior tibial tendon transfer, which uses this tendon to reinforce the muscles on the outside of the ankle for better lift.

The most advanced treatment is peripheral nerve stimulation (PNS) devices like Abbott's Infini. These use a small implant placed by the ankle to detect gait and selectively stimulate the deep peroneal nerve during swing phase.

Key winning strategies adopted by key players of Foot Drop Treatment Devices Market

Product innovation - Developing innovative products that can address unmet needs has helped players gain an edge. For example, Hanger Clinic launched the WalkAide brace in 2015 which uses functional electrical stimulation of the common peroneal nerve to help lift the foot during swing phase of gait.

Market expansion - Players have focused on expanding into new geographic regions to tap into untapped growth potential. For example, Bioness launched its L300 Plus system in Europe in 2018, gaining regulatory approval. It is now targeting other European and Asia Pacific markets.

Strategic partnerships and collaborations - Companies have partnered with hospitals, clinics and rehab centers to gain expertise in rehabilitation and also for customer reach. In 2019, Bioness partnered with several EMEA clinics to support clinical research and improve access to innovative solutions. These partnerships helped gain expertise in therapies and market penetration.

Strengthening digital capabilities - With rise in e-commerce and digital health, players have focused on strengthening their digital presence. Össur launched an extended warranty program in 2020 where users could enroll their device for an additional period online. It saw over 30% customers opting for the digital warranty. This enhanced customer loyalty and convenience.

Segmental Analysis of Foot Drop Treatment Devices Market

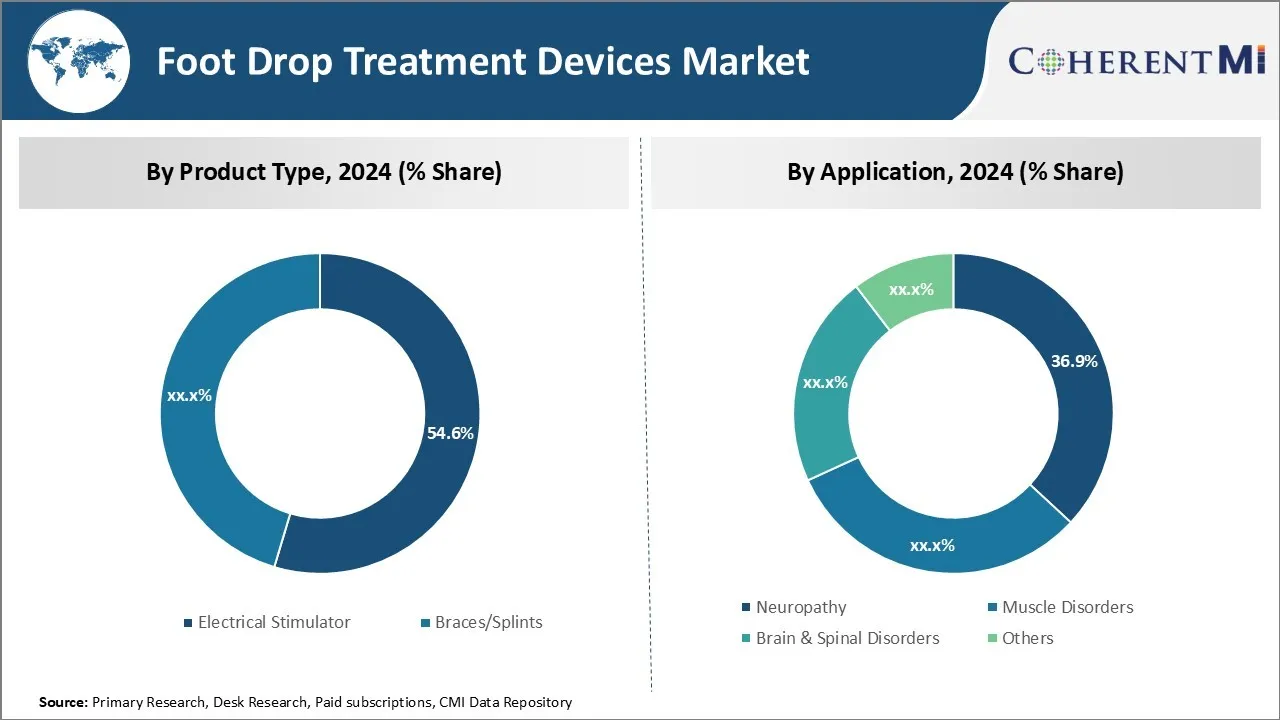

Insights, By Product Type: Growing Prevalence of Neurological Disorders and Muscle Related Issues Boost Demand

In terms of product type, electrical stimulators are projected to hold 54.6% market share in 2024, owing to its effectiveness in treating foot drop symptoms. Electrical stimulators help in delivering mild electrical pulses to the foot and lower leg muscles, which assists patients in lifting their foot while walking. The mild shocks counteract the effects of conditions that cause foot drop, such as multiple sclerosis, stroke, spinal cord injuries, and cerebral palsy.

As the prevalence of such neurological disorders and muscle injuries rises worldwide, the need for assistive devices like electrical stimulators is increasing substantially. Their non-invasive nature and portability make electrical stimulators a preferred choice over other foot drop treatment devices like braces.

With growing geriatric population who are prone to neurological conditions, and rising incidence of trauma injuries, the demand for effective home-based solutions like electrical stimulators is expected to keep surging in the coming years.

Insights, By Application: Rising Awareness Boosts Adoption in Neuropathy Patients

In terms of application, neuropathy is likely to consume 36.9% of share in the foot drop treatment devices market in 2024, primarily due to increasing awareness about foot drop and its treatment options. Neuropathy caused by diabetes, chemotherapy or other conditions is a major contributor to foot drop since it damages nerves in the legs and feet.

However, many neuropathy patients remain undiagnosed or do not associate symptoms like tripping to the condition. Various awareness campaigns by healthcare organizations and patient support groups are helping bring more neuropathy cases into the light. This is positively impacting the adoption of foot drop treatment solutions.

Additionally, doctors are more readily recommending devices like electrical stimulators and ankle foot orthosis to enable independent mobility in neuropathy-affected patients.

Insights, By End User: High Patient Volumes Render Hospitals Most Lucrative End User

In terms of end user, hospitals contribute the highest share in the foot drop treatment devices market, primarily owing to large patient numbers treated at these facilities. Many patients requiring surgeries or suffering from complex neurological conditions receive foot drop treatment devices during or after treatment at hospitals. The availability of advanced device options and expertise of physicians makes hospitals a reliable access point.

Additionally, higher budget availability makes hospitals an important sales channel. Although other end users like ambulant surgical centers and clinics are growing in some developing markets, hospitals across most regions command the major share in the overall foot drop treatment devices market currently due to the concentration of target patients and purchasing decisions.

Additional Insights of Foot Drop Treatment Devices Market

- Foot drop is commonly caused by conditions such as stroke and multiple sclerosis, which can weaken the ankle or disrupt the nerve pathways between the legs and brain. Devices like electrical stimulators help patients regain mobility by activating muscle movement through targeted impulses.

- According to the World Health Organization (WHO) 2022 report, 1.71 billion people globally suffer from musculoskeletal conditions. This statistic underscores the rising demand for foot drop treatment devices, especially among individuals dealing with knee-related conditions.

- The percentage of the global population aged 65 and above is expected to increase from 10% in 2022 to 16% by 2050, significantly contributing to the demand for treatment devices for age-related neuromuscular disorders.

- A significant trend is the increasing focus on non-invasive treatments, with companies like Medtronic and Össur leading in the development of advanced devices that improve patient mobility and quality of life.

Competitive overview of Foot Drop Treatment Devices Market

The major players operating in the foot drop treatment devices market include Ottobock, Bioness Inc., AxioBionics, Accelerated Care Plus Corporation, Saebo, Inc., Boston Orthotics & Prosthetics, Turbomed Orthotics, Össur, Thrive Orthopedics, Allard USA Inc., NextStep Robotics, Finetech Medical, Arthrex, Inc., Evolution Devices, Narang Medical Limited, SCHECK & SIRESS, AliMed, The London Orthotics Consultancy Ltd, Access Prosthetics, and Spinal Solutions.

Foot Drop Treatment Devices Market Leaders

- Ottobock

- Bioness Inc.

- AxioBionics

- Accelerated Care Plus Corporation

- Saebo, Inc.

Foot Drop Treatment Devices Market - Competitive Rivalry, 2024

Foot Drop Treatment Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Foot Drop Treatment Devices Market

- In October 2023, Cionic secured an additional $12 million in Series A funding, bringing the total to $25 million. The funding round was led by L Catterton, with participation from new investor THVC and existing investors. The funds will be used to expand the adoption of the Cionic Neural Sleeve, a device designed to assist individuals with mobility impairments, such as those caused by multiple sclerosis, strokes, and cerebral palsy. This funding will also support further product development aimed at addressing broader mobility challenges.

- In November 2022, MyndTec Inc. launched its MyndStep(TM) device in North America, expanding its portfolio of functional electrical stimulation (FES) devices. The MyndStep is designed to provide ankle dorsiflexion for patients suffering from foot drop due to upper motor neuron injuries, such as strokes, spinal cord injuries, and traumatic brain injuries. This innovative product includes features like built-in sensors to detect gait events and precise stimulation to aid in normalizing walking patterns. It is available across the United States and Canada.

- In June 2022, Paragon 28 launched the Monkey Rings™ Circular External Fixation System, which was designed to assist in trauma, deformity correction, and limb salvage. The system uses external wires and screws to maintain the correct anatomical position while ensuring soft tissue preservation and allowing for adjustability and stability. This product expands Paragon 28’s portfolio, which already includes a range of solutions for foot and ankle conditions, contributing to the company's growth in the orthopedic device market.

- In March 2022, Cionic received FDA clearance for its Neural Sleeve, a leg-worn device designed to assist people with mobility issues, particularly those with foot drop and leg muscle weakness due to conditions like multiple sclerosis, stroke, and cerebral palsy. The Neural Sleeve uses functional electrical stimulation (FES) to improve gait by analyzing and predicting movement and providing real-time augmentation to help users walk more naturally and confidently.

Foot Drop Treatment Devices Market Segmentation

- By Product Type

- Electrical Stimulator

- Braces/Splints

- By Application

- Neuropathy

- Muscle Disorders

- Brain & Spinal Disorders

- Others

- By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Homecare Settings

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the foot drop treatment devices market?

The foot drop treatment devices market is estimated to be valued at USD 2.59 Bn in 2024 and is expected to reach USD 4.5 Bn by 2031.

What are the key factors hampering the growth of the foot drop treatment devices market?

The side effects from prolonged device usage and fitting-related issues for foot drop treatment devices are the major factors hampering the growth of the foot drop treatment devices market.

What are the major factors driving the foot drop treatment devices market growth?

The rising prevalence of knee-associated musculoskeletal disorders and advancements in technology for medical devices are the major factors driving the foot drop treatment devices market.

Which is the leading product type in the foot drop treatment devices market?

The leading product type segment is electrical stimulator.

Which are the major players operating in the foot drop treatment devices market?

Ottobock, Bioness Inc., AxioBionics, Accelerated Care Plus Corporation, Saebo, Inc., Boston Orthotics & Prosthetics, Turbomed Orthotics, Össur, Thrive Orthopedics, Allard USA Inc., NextStep Robotics, Finetech Medical, Arthrex, Inc., Evolution Devices, Narang Medical Limited, SCHECK & SIRESS, AliMed, The London Orthotics Consultancy Ltd, Access Prosthetics, and Spinal Solutions are the major players.

What will be the CAGR of the foot drop treatment devices market?

The CAGR of the foot drop treatment devices market is projected to be 8.2% from 2024-2031.