Heart Pump Device Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Heart Pump Device Market is segmented By Product (Resting ECG Systems, Stress ECG Systems, Holter Monitors, Cardiopulmonary Stress Testing Systems), B....

Heart Pump Device Market Size

Market Size in USD Bn

CAGR15.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 15.6% |

| Market Concentration | High |

| Major Players | Abbott Laboratories, Medtronic, Johnson & Johnson Services, Inc., SynCardia Systems, LLC, Terumo Corporation and Among Others. |

please let us know !

Heart Pump Device Market Analysis

The heart pump device market is estimated to be valued at USD 2.74 Bn in 2024 and is expected to reach USD 7.56 Bn by 2031, growing at a compound annual growth rate (CAGR) of 15.6% from 2024 to 2031. The heart pump device market is expected to be driven by factors such as the rising geriatric population, growing prevalence of cardiovascular diseases, and technological advancements in heart pump devices in the coming years.

Heart Pump Device Market Trends

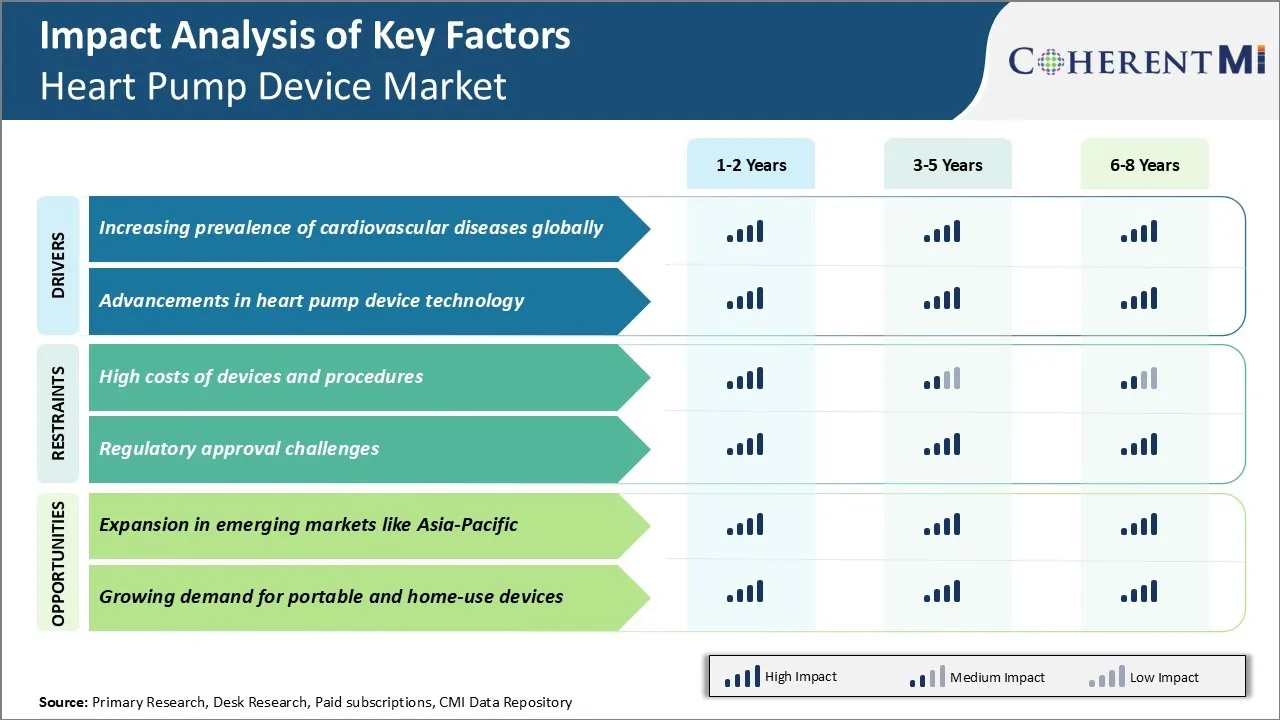

Market Driver - Increasing Prevalence of Cardiovascular Diseases Globally

The prevalence of cardiovascular diseases has been rising significantly across the world over the past few decades. It is estimated that cardiovascular diseases account for over 17 million deaths every year, which is equivalent to nearly one third of the total global deaths each year.

The primary reasons for the increasing burden of cardiovascular diseases include rapidly aging population, rising levels of obesity and unhealthy lifestyle habits such as smoking, lack of physical activity and unhealthy diet. Most developed countries have witnessed relatively higher prevalence of cardiovascular diseases as compared to developing nations.

However, developing countries have also started reporting substantial rise in cardiovascular conditions in the recent past owing to adoption of western lifestyle and reduced physical activity levels. Countries like India, China, Brazil have emerged as hotspots for heart diseases due to growing obesity, diabetes and related metabolic disorders.

This rising prevalence of cardiovascular patient pool has significantly augmented the demand for advanced heart pump devices globally. Countries with public healthcare systems are encouraging the usage of heart pumps to reduce healthcare costs associated with open heart surgeries and transplants.

Market Driver - Advancements in Heart Pump Device Technology

The heart pump device market has evolved remarkably over the past few decades courtesy ongoing research and development activities undertaken by leading medical device companies. Modern heart pumps can provide long term and even permanent mechanical support to failing hearts. Miniaturization of device components and development of less invasive surgical techniques have enabled heart pumps to be implanted via less traumatic procedures.

Continuous technological innovations have facilitated advancement from first generation pulsatile pumps to second and third generation small continuous flow pumps with improved durability and clinical outcomes. Cutting edge innovations such as development of wirelessly powered heart pumps, artificial hearts and use of biocompatible materials promises better quality of life for end users.

Researchers are working on making heart pumps more physiologic and self-regulating in resemblance to the native heart function. Advancement of percutaneous heart pumps as an alternative to open heart surgeries have further fueled the adoption rates, especially in developing countries. Partnerships between academic institutions and medical device leaders have quickened the pace of introducing nextgen heart pump solutions. Overall, constant technological evolution is positively impacting the clinical outlook of advanced heart failure patients worldwide.

Market Challenge - High Costs of Devices and Procedures

One of the major challenges faced by the heart pump device market is the high costs associated with these devices and procedures. Heart pump devices are mechanical circulatory support devices that are used either permanently or temporarily in people who have severe heart failure. These devices are complex to manufacture and require precise engineering and components which drive up their costs.

For instance, the average cost of Left Ventricular Assist Device (LVAD) implantation surgery in the United States ranges between $250,000 to $400,000. Even the costs of ongoing therapies and device replacements post-implantation add to the financial burden. This high price point puts these life-saving heart pump therapies out of reach for many patients and health systems across the world.

With healthcare budgets under pressure globally, the high device costs pose reimbursement and affordability challenges thereby restricting market growth prospects. Device manufacturers will need to focus on cost engineering and value engineering strategies to drive down costs and make these therapies more accessible to a wider patient base.

Market Opportunity – Expansion in Emerging Markets like Asia-Pacific

One of the key opportunities for the heart pump device market lies in the expansion potential in emerging markets across Asia-Pacific. The Asia-Pacific region consists of developing economies like India and China which are witnessing rapid economic growth and development of their healthcare infrastructures. With increasing incomes and awareness, cardiovascular diseases including heart failure are on the rise in these markets.

At the same time, there is a shortage of heart donors for transplantation in the region. This medical need along with improved access to healthcare presents a large patient pool seeking advanced heart failure treatment options like mechanical circulatory support devices. If device manufacturers can introduce more affordable product offerings tailored for these emerging markets, there is vast potential for market penetration.

Also, these countries offer lower costs of manufacturing which may allow companies to reduce device prices and target more price-sensitive customers. Overall, the Asia-Pacific region with its large cardiac patient population and unmet demand signifies major opportunities for future market revenues and growth.

Key winning strategies adopted by key players of Heart Pump Device Market

Focus on innovation and technological advancements: One of the most successful strategies adopted by market leaders has been continuous investment and focus on research and development to drive innovation. For instance, Abbott Laboratories invested over $1 billion in 2016 on R&D for heart failure and cardiovascular devices which helped them launch innovative ventricular assist devices like HeartMate 3.

Product differentiation: Medtronic set itself apart with the launch of HeartWare HVAD pump in 2012 - it was 40% smaller than other devices then and offered better hemocompatibility. This helped Medtronic capture over 25% of the VAD market within 2 years of release.

Partnering with hospitals and healthcare systems: Leaders like Abbott, Medtronic and Abbott actively partner with hospitals to assist with patient selection, training and technical support. This improves outcomes and eases adoption. For instance, Abbott's partnerships with over 600 hospitals since 2015 helped the HeartMate 3 gain 70% US market share within a year of launch.

Mergers and acquisitions: Companies supplement organic growth through strategic acquisitions. St. Jude Medical acquired Thoratec in 2015 to become a leader in left-ventricular assist devices. Similarly, Medtronic acquired Covidien in 2014, strengthening their position in arrhythmia treatment and heart failure management.

Segmental Analysis of Heart Pump Device Market

Insights, By Product: Convenience and Cost-effectiveness Lead to Resting ECG Systems Dominance

In terms of product, resting ECGs segment is expected to hold 35.2% share of the market in 2024, owing to their convenient portability and relatively lower cost of use compared to other systems in the segment. Resting ECG Systems can be easily transported between examination rooms or medical facilities, allowing physicians greater flexibility in administering electrocardiograms.

Their lightweight, compact designs do not restrict patients’ mobility during testing. From a financial perspective, Resting ECG Systems entail fewer overall expenses associated with buying, operating and maintaining the equipment over time. Hospitals and clinics are therefore able to perform a higher volume of ECG tests using Resting ECG Systems within constrained budgets.

Insights, By Type: Streamlined Usability Favors Single Lead Model

In terms of type, single lead heart pump devices are expected to account for 40.3% revenue share of the market in 2024, due to its simplified usability. Relative to multi-lead alternatives, the Single Lead model eliminates the need for technician or nurse assistance in applying numerous electrode patches or leads to the patient’s body. It only requires attachment of a single lead to obtain readable ECG readings, shortening test duration.

The reduced complexity also lowers the learning curve for medical professionals and the chances of operator errors. As an easier-to-use option, Single Lead appeals to healthcare providers with busy practices as well as individual or sports clinics.

Insights, By Modality Type: Portability Drives Demand for Wearables

In terms of modality type, portable contributes the highest share of the market owing to growing demand for Wearables. Powered by ongoing advances in miniaturization and prolonged battery life, Wearables can continuously monitor patients’ heart activity through compact, lightweight devices integrated into clothing or accessories such as watches and patches.

Their high degree of portability allows for remote monitoring capabilities beyond clinical settings. This enables flexible, long-term holter monitoring with minimal disruption to daily activities. Wearables also improve patient engagement and adherence through their user-friendly form factors. Driven by these conveniences, Wearables are seeing increased uptake among those requiring periodic or persistent heart monitoring.

Additional Insights of Heart Pump Device Market

The heart pump device market is driven by the global burden of cardiovascular diseases, which affects over 620 million people. Key risk factors include smoking, alcohol consumption, and obesity, all of which are prevalent in developed and developing regions.

Competitive overview of Heart Pump Device Market

The major players operating in the heart pump device market include Abbott Laboratories, Medtronic, Johnson & Johnson Services, Inc., SynCardia Systems, LLC, Terumo Corporation, Teleflex Incorporated, Berlin Heart, CARMAT, CorWave SA, Calon Cardio-Technology Ltd., NovaPump GmbH, Fresenius Medical Care AG & Co. KGaA, and Getinge AB.

Heart Pump Device Market Leaders

- Abbott Laboratories

- Medtronic

- Johnson & Johnson Services, Inc.

- SynCardia Systems, LLC

- Terumo Corporation

Heart Pump Device Market - Competitive Rivalry, 2024

Heart Pump Device Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Heart Pump Device Market

- In February 2022, AliveCor launched the KardiaMobile Card, a sleek and slim personal ECG (electrocardiogram) device designed to fit into a wallet like a standard credit card. This innovative device allows users to record medical-grade ECGs anytime and anywhere by simply placing their thumbs on the sensors. The introduction of the KardiaMobile Card is expected to significantly enhance consumer access to heart monitoring technology, facilitating early diagnosis and management of cardiac conditions. By providing a convenient and portable solution, AliveCor aims to empower individuals to take proactive steps in monitoring their heart health and sharing vital data with their healthcare providers.

- In January 2022, Royal Philips introduced the first comprehensive at-home 12-lead ECG solution specifically designed for decentralized clinical trials. This innovative solution aims to advance remote monitoring by enabling participants to record high-quality, clinical-grade ECG data from the comfort of their homes. The at-home 12-lead ECG system helps improve patient compliance and convenience, reduces the need for site visits, and enhances data accuracy and efficiency in clinical trials. By leveraging this technology, pharmaceutical companies and researchers can conduct more patient-centric studies, potentially accelerating the development of new therapies.

- In August 2021, Wellue launched an ECG Recorder with AI Analysis, providing enhanced diagnostic capabilities for home users. Wellue is known for producing a range of health monitoring devices, including ECG recorders and other cardiovascular monitoring equipment designed for home use. Some of their products incorporate advanced features like AI-driven analysis to help users interpret their health data more effectively.

- In July 2020, Medtronic's LINQ II cardiac monitor received FDA approval for two AI algorithms, improving heart rhythm abnormality detection. The LINQ II device incorporates advanced artificial intelligence (AI) algorithms designed to improve the detection of heart rhythm abnormalities. These AI enhancements allow for more accurate and efficient monitoring of conditions such as atrial fibrillation and other arrhythmias.

Heart Pump Device Market Segmentation

- By Product

- Resting ECG Systems

- Stress ECG Systems

- Holter Monitors

- Cardiopulmonary Stress Testing Systems

- By Type

- Single Lead

- 3-6 Lead

- 12-Lead

- By Modality Type

- Portable

- Stationary

- Wearables

- By End Users

- Hospitals

- Home-based Users

- Ambulatory Surgical Centers

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the heart pump device market?

The heart pump device market is estimated to be valued at USD 2.74 Bn in 2024 and is expected to reach USD 7.56 Bn by 2031.

What are the key factors hampering the growth of the heart pump device market?

The high costs of devices and procedures and regulatory approval challenges are the major factors hampering the growth of the heart pump device market.

What are the major factors driving the heart pump device market growth?

The increasing prevalence of cardiovascular diseases globally and advancements in heart pump device technology are the major factors driving the heart pump device market.

Which is the leading product in the heart pump device market?

The leading product segment is resting ECG systems.

Which are the major players operating in the heart pump device market?

Abbott Laboratories, Medtronic, Johnson & Johnson Services, Inc., SynCardia Systems, LLC, Terumo Corporation, Teleflex Incorporated, Berlin Heart, CARMAT, CorWave SA, Calon Cardio-Technology Ltd., NovaPump GmbH, Fresenius Medical Care AG & Co. KGaA, and Getinge AB are the major players.

What will be the CAGR of the heart pump device market?

The CAGR of the heart pump device market is projected to be 15.6% from 2024-2031.