Joint Reconstruction Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Joint Reconstruction Devices Market is segmented By Joint Type (Knee Reconstruction, Hip Reconstruction, Shoulder Reconstruction, Others), By Techniqu....

Joint Reconstruction Devices Market Size

Market Size in USD Mn

CAGR6.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.1% |

| Market Concentration | Medium |

| Major Players | Medtronic, Zimmer Biomet, Stryker, Smith & Nephew PLC, Johnson & Johnson Services, Inc. and Among Others. |

please let us know !

Joint Reconstruction Devices Market Analysis

The joint reconstruction devices market is estimated to be valued at USD 18.50 Mn in 2024 and is expected to reach USD 27.88 Mn by 2031, growing at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2031. The rising global geriatric population, which is more susceptible to joint disorders like osteoarthritis, is the primary factor driving the demand for joint reconstruction devices.

Joint Reconstruction Devices Market Trends

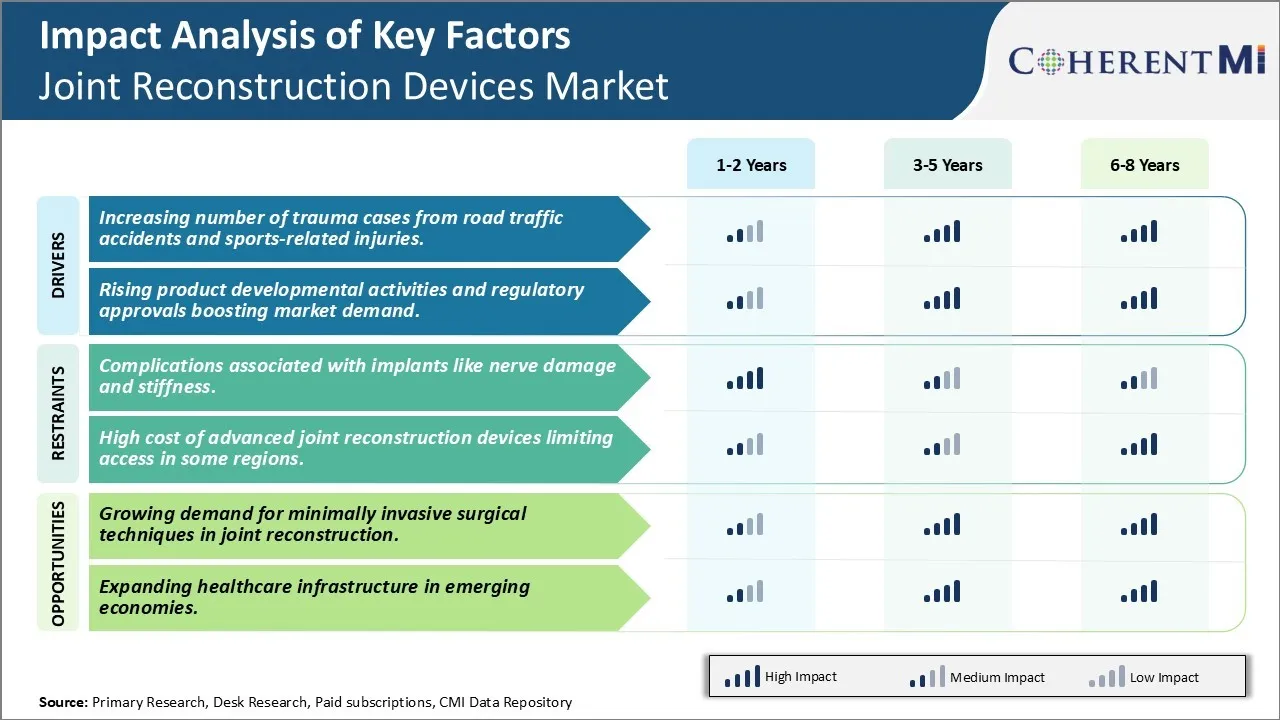

Market Driver - Increasing number of trauma cases from road traffic accidents and sports-related injuries

With rising purchasing power and hectic lifestyles, the number of vehicles on road as well as participation in sports activities has increased manifold over the past decade. Unfortunately, this has also led to a sharp rise in the number of trauma cases resulting from road accidents and sports injuries. As per recent estimates by WHO, road accidents account for around 1.35 million deaths globally each year. The agency also states that road traffic injuries are now the leading cause of death for children and young adults between 5–29 years of age.

Apart from lives lost, such accidents often result in severe injuries like fractures and ligament tears that require intensive surgical reconstruction and rehabilitation. Treatment of such complex traumas frequently involves the use of advanced joint reconstruction devices like knee replacement implants, shoulder arthroplasty systems and trauma fixation plates & screws. Additionally, more people are now taking part in contact and adventure sports which pose risks of joint dislocations or fractures. For example, the popularity of games like basketball, football, rugby etc. have increased the number of ligament tears and meniscal injuries that need repair with the help of devices like autografts and allografts.

Market Driver - Rising product developmental activities and regulatory approvals boosting market demand

With the joint reconstruction market demonstrating solid prospects, industry players are ramping up investments in R&D to develop advanced solutions matching the exacting needs of modern surgery. A glimpse of their product pipeline reveals a slew of novel, 3rd generation designs which offer reduction in surgery time, customized sizing options for diverse anatomies, bio-absorbable materials to remove the need for post-op implant removal etc. At the same time, regulatory bodies too have been expediting new product clearances to ensure timely availability of best-in-class treatment choices.

For instance, major companies recently received FDA approval for a new generation of ceramic-on-ceramic total hip replacements offering increased durability and less long-term wear. Similarly, another leading player gained U.S. marketing authorization for an innovative reverse shoulder system engineered to match the complex kinematics of ball-and-socket replacement. Apart from developing totally new solutions, firms are also continually upgrading existing implant designs using advanced technologies like 3D printing, Nano-modification and robotics. This helps enhance performance as well as manufacturability on an industrial scale.

Market Challenge - Complications associated with implants like nerve damage and stiffness

One of the major challenges faced by the joint reconstruction devices market is the complications associated with implants like nerve damage and stiffness. Implantation of devices for joint reconstruction often involves complex surgical procedures that carry risks of damaging nerves in close proximity. This can result in loss of sensation and movement in certain parts of the body. Nerve damage occurs in a small percentage of cases but can significantly impact the quality of life for patients.

Additionally, implants can sometimes lead to stiffness at the joint due to formation of scar tissue. While this issue is more common in traditional open surgeries, even minimally invasive procedures carry some risk of long-term stiffness. The synthetic materials used for implants may not exactly replicate natural joint movement and flexibility over extended periods. Both nerve damage and joint stiffness can require revision surgeries and cause financial burdens for patients. Device manufacturers continue working on newer implant designs and materials that minimize these postoperative complications to make joint reconstruction safer and more effective.

Market Opportunity - Growing demand for minimally invasive surgical techniques in joint reconstruction

One key opportunity for the joint reconstruction devices market is the growing demand for minimally invasive surgical techniques. Traditionally, joint replacement surgeries required making large incisions and extensive soft tissue dissection. This meant longer recovery times for patients, higher risk of complications, and greater costs for healthcare systems. However, newer devices that are compatible with minimally invasive approaches offer advantages like smaller incisions, less pain, shorter hospital stays, and faster return to normal activities. As patients and doctors alike become more aware of these benefits, minimally invasive joint reconstruction is seeing significantly higher uptake compared to traditional open surgeries. Leading manufacturers are actively innovating new implant product lines and surgical tools optimized for minimal access approaches. This shift towards minimally invasive techniques presents substantial market potential for joint device players that can offer comprehensive systems addressing this growing demand.

Key winning strategies adopted by key players of Joint Reconstruction Devices Market

Continuous innovation has helped players dominate the market and cater to the ever-evolving needs of surgeons and patients. For instance, in 2018, Johnson & Johnson launched the ATTUNE Total Knee System with advanced kinematics designed to mimic natural knee motion. Similar product launches by Zimmer Biomet, Stryker and Smith & Nephew have helped them gain market share.

Companies have strengthened their product portfolio and distribution networks through strategic acquisitions. For example, in 2019, Stryker acquired OrthoSpace to complement its hip and knee reconstruction portfolio. Zimmer Biomet acquired Knee Creations and Amedica to enhance its trauma and spine offerings. Such acquisitions expanded their addressable markets.

Players have focused on regional expansion plans to tap higher growth opportunities in emerging Asian and Latin American countries. For example, between 2015-2020, Johnson & Johnson doubled its sales in China through initiatives like partnerships with local hospitals. This strategy enabled over 10% annual growth compared to the global average of 5%.

Companies are investing heavily in digital technologies like robotics, 3D printing and AI to enhance surgical outcomes. For instance, Stryker's Mako robotic-arm assisted surgery system saw global procedural volumes grow by 25% in 2020. This has helped improve its positioning among surgeons.

Segmental Analysis of Joint Reconstruction Devices Market

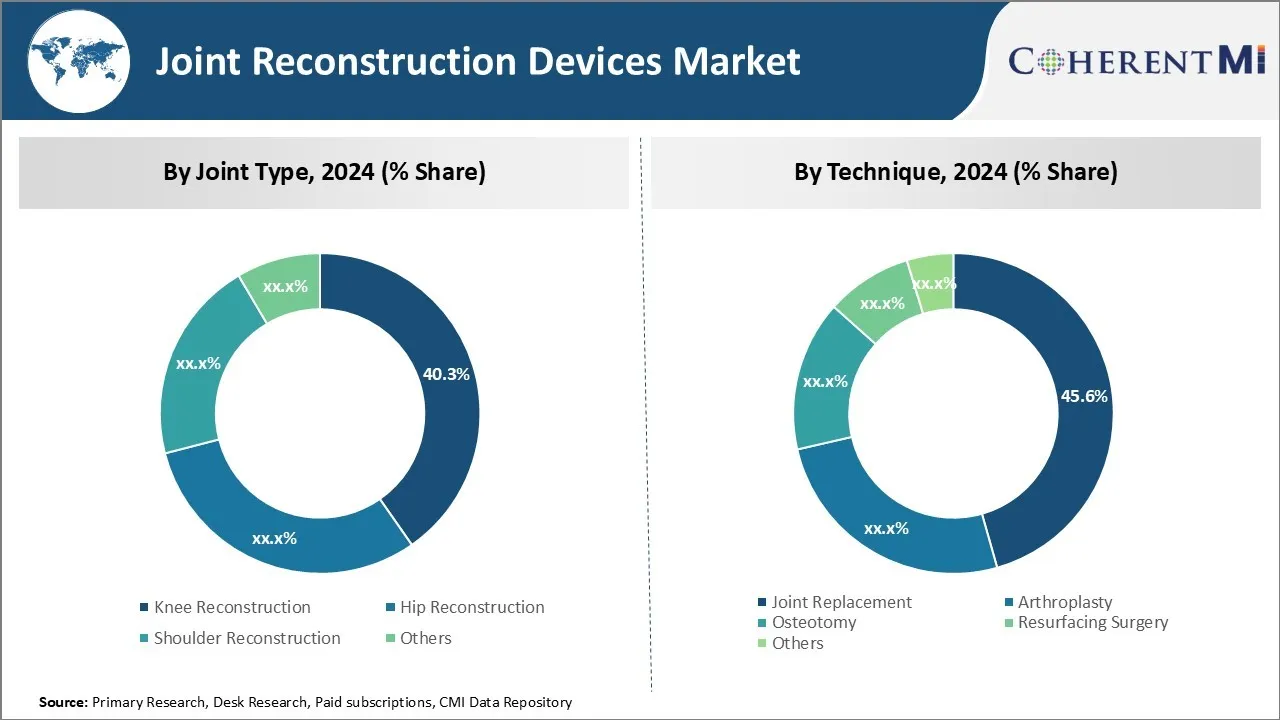

Insights, By Joint Type: Knee reconstruction contributes the highest share of the market owning to rising prevalence of knee injuries and arthritis

The knee reconstruction sub-segment currently holds the largest share of 40.3% in the joint reconstruction devices market due to the rising number of knee injuries as well as prevalence of knee arthritis among the growing geriatric population. Knee injuries are one of the most common musculoskeletal injuries, especially in sports activities that involve running, jumping or sudden changes in direction. With increasing participation in sports and recreational activities worldwide, the risk of knee ligament tears, fractures or dislocations continues to rise. Moreover, knee osteoarthritis has emerged as a major cause of disability. Advancing age is the most important risk factor for the development of knee osteoarthritis as aging leads to degradation of cartilage. According to statistics, knee osteoarthritis is projected to affect over 130 million people across the world by 2050. The increasing burden of knee injuries and arthritis is expected to drive the demand for knee reconstruction procedures involving partial or total knee replacement implants and other devices.

Insights, By Technique: Joint replacement contributes the highest share of the joint reconstruction devices market owing to advantages over alternative techniques

Among the different techniques for joint reconstruction, joint replacement surgery accounts for the largest revenue share of 45.6%. Joint replacement involves removing the damaged cartilage and bone and replacing them with artificial implants. This segment gains higher preference over other techniques due to the significant advantages it provides. Joint replacement can totally eliminate pain and restore full mobility to the joint, allowing patients to resume normal daily activities. Unlike alternative techniques such as osteotomy and resurfacing that only modify the damaged bone and cartilage, joint replacement offers a more definitive treatment for end-stage joint disease. The implants used in joint replacement are highly durable and designed to last 15-20 years for most patients. Furthermore, joint replacement surgery is a minimally invasive procedure with faster recovery times compared to complex revision procedures. With continuous technology advancement, robotics-assisted joint replacements are also improving outcomes of the surgery. Due to these advantages, joint replacement is expected to remain the procedure of choice for managing severe joint deterioration.

Additional Insights of Joint Reconstruction Devices Market

The joint reconstruction devices market is poised for substantial growth due to increasing trauma cases, rising sports injuries, and technological advancements in joint reconstruction techniques. The market is driven by significant demand for knee, hip, and shoulder reconstruction devices, bolstered by advancements in prosthetic materials and minimally invasive surgical methods. North America dominates the market due to high instances of bone-related conditions and the presence of major industry players. The region's robust healthcare infrastructure and supportive reimbursement policies further enhance market expansion.

Competitive overview of Joint Reconstruction Devices Market

The major players operating in the joint reconstruction devices market include Zimmer Biomet, Stryker, Medtronic, Smith & Nephew PLC, Johnson & Johnson Services, Inc., NuVasive, Inc., CONMED Corporation, DJO, LLC, MicroPort Scientific Corporation, Globus Medical, Arthrex, Inc., Corin Group, Integra LifeSciences, OMNIlife science, Inc., Exactech, Inc., B. Braun Melsungen AG, and Medacta International.

Joint Reconstruction Devices Market Leaders

- Medtronic

- Zimmer Biomet

- Stryker

- Smith & Nephew PLC

- Johnson & Johnson Services, Inc.

Joint Reconstruction Devices Market - Competitive Rivalry, 2024

Joint Reconstruction Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Joint Reconstruction Devices Market

- In August 2021, Zimmer Biomet and Canary Medical received FDA approval for Persona IQ for total knee replacement surgery, marking a significant technological advancement in knee reconstruction.

- In May 2021, Orthofix Medical launched the OSCAR PRO Ultrasonic Arthroplasty Revision System in the US and Europe, enhancing revision arthroplasty capabilities.

- In May 2021, CONFORMIS, Inc. received FDA clearance for its Identity Imprint Knee Replacement System, expanding their knee replacement product portfolio.

- In January 2021, DePuy Synthes received FDA approval for its VELYS robotic-assisted solution for knee surgeries, integrating advanced robotics in joint reconstruction.

Joint Reconstruction Devices Market Segmentation

- By Joint Type

- Knee Reconstruction

- Hip Reconstruction

- Shoulder Reconstruction

- Others

- By Technique

- Joint Replacement

- Arthroplasty

- Osteotomy

- Resurfacing Surgery

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the joint reconstruction devices market?

The joint reconstruction devices market is estimated to be valued at USD 18.50 Mn in 2024 and is expected to reach USD 27.88 Mn by 2031.

What are the key factors hampering the growth of the joint reconstruction devices market?

The complications associated with implants like nerve damage and stiffness and high cost of advanced joint reconstruction devices limiting access in some regions are the major factors hampering the growth of the joint reconstruction devices market.

What are the major factors driving the joint reconstruction devices market growth?

The increasing number of trauma cases from road traffic accidents and sports-related injuries and rising product developmental activities and regulatory approvals boosting market demand are the major factors driving the joint reconstruction devices market.

Which is the leading joint type in the joint reconstruction devices market?

The leading joint type segment is knee reconstruction.

Which are the major players operating in the joint reconstruction devices market?

Zimmer Biomet, Stryker, Medtronic, Smith & Nephew PLC, Johnson & Johnson Services, Inc., NuVasive, Inc., CONMED Corporation, DJO, LLC, MicroPort Scientific Corporation, Globus Medical, Arthrex, Inc., Corin Group, Integra LifeSciences, OMNIlife science, Inc., Exactech, Inc., B. Braun Melsungen AG, and Medacta International are the major players.

What will be the CAGR of the joint reconstruction devices market?

The CAGR of the joint reconstruction devices market is projected to be 6.1% from 2024-2031.