Mitral Valve Annuloplasty Rings Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Mitral Valve Annuloplasty Rings Market is Segmented By Product Type (Rigid/Semi-rigid Rings, Flexible Rings, Partial Rings), By Ring Composition (Poly....

Mitral Valve Annuloplasty Rings Market Size

Market Size in USD Bn

CAGR5.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.3% |

| Market Concentration | High |

| Major Players | Abbott Laboratories, Medtronic plc, Edwards Lifesciences Corporation, LivaNova PLC, Braun Melsungen AG and Among Others. |

please let us know !

Mitral Valve Annuloplasty Rings Market Analysis

The Mitral Valve Annuloplasty Rings Market is estimated to be valued at USD 0.92 Billion in 2024 and is expected to reach USD 1.35 Billion by 2031, growing at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2031. The increasing prevalence of valvular heart diseases globally due to the rising geriatric population and the growth in technological advancements are expected to propel the demand for Mitral Valve Annuloplasty Rings over the forecast period.

The Mitral Valve Annuloplasty Rings Market is expected to witness positive growth over the next few years. Rising rates of mitral regurgitation due to the growing elderly population base are raising the demand for mitral valve repair surgeries. Additionally, the development of innovative repair devices such as flexible rings and undersized rings is fueling adoption. However, the high cost of surgeries and device complexity remain challenges to Market growth.

Mitral Valve Annuloplasty Rings Market Trends

Market Driver - Rising Prevalence of Heart Diseases

Heart disease has emerged as one of the leading causes of death and disability worldwide. The rising prevalence of unhealthy lifestyles such as lack of physical activity, smoking, excessive alcohol consumption and poor dietary habits have significantly contributed to the increasing incidence of cardiovascular diseases. According to WHO, cardiovascular diseases accounted for approximately 17.9 million deaths in 2019, representing 32% of all global deaths. Diseases affecting valves in the heart such as mitral regurgitation and mitral stenosis are also on the rise. The increasing geriatric population base prone to degenerative valve diseases also adds to the growing burden. As per some studies, more than 15 million people in the United States suffer from various heart valve diseases currently.

Mitral regurgitation, which affects the ability of the mitral valve to close properly and prevent blood from flowing backward from the left ventricle to the left atria, is one of the most common types of valvular heart diseases. Symptomatic severe mitral regurgitation requires surgery to repair or replace the mitral valve to prevent further complications. The rising incidence of mitral regurgitation has led to a substantial increase in the number of mitral valve repair and replacement surgeries performed globally. Mitral Valve Annuloplasty Rings are an integral part of these surgeries as they help reshape and stabilize the mitral valve annulus, thereby restoring the normal function of the mitral valve. So, the growing patient pool of heart valve diseases, especially mitral regurgitation, has fuelled the demand for Mitral Valve Annuloplasty Rings in recent years.

Technological Advancements in Valve Repair Devices

The mitral valve annuloplasty ring Market has witnessed significant technological innovations over the past few decades. Advancements in materials used for ring construction, ring design and delivery techniques have improved clinical outcomes and expanded the procedural options. Early rigid rings made from non-corrosive metals like stainless steel have now been replaced by flexible rings made of polymers, composites and decellularized pericardial tissues. The newer rings conform better to the dynamic annulus and mimic the natural flexibility of mitral valve for improved haemodynamics. Besides, advanced designs like asymmetric and saddle-shaped rings have enabled repair of more complex valve abnormalities with greater success.

Innovations have also occurred in ring delivery systems. Traditionally, rings required an open-heart surgical approach but newer transcatheter delivery options using catheters and guidewires have emerged. Minimally-invasive procedures using these innovative delivery platforms are associated with reduced recovery times, hospital stay and costs. Some companies have also developed fully-automated robotic systems integrated with advanced visualization tools to facilitate precise placement of rings. Such technological marvels are set to transform mitral valve therapies. Newer studies evaluating the long-term performance of technologically advanced rings will further boost physician and patient confidence in valve repair procedures. The continuous introduction of novel products with superior performance attributes will sustain Market growth in the near future.

Market Challenge - High Cost of Devices

One of the major challenges faced by the Mitral Valve Annuloplasty Rings Market is the high cost of the devices. Mitral Valve Annuloplasty Rings are classified as Class III medical devices by the FDA, which requires extensive clinical evaluation. This makes the approval process long and expensive. Device manufacturers need to invest heavily in R&D to develop new and innovative ring designs. Clinical trials involving a large patient cohort need to be conducted to test the safety and efficacy of these devices. The stringent regulatory requirements significantly drive up the development costs. Once approved, the high manufacturing costs associated with making these custom-fitted biocompatible rings from medical-grade materials are passed on to healthcare providers and patients. The high price of the devices is a major barrier for their widespread adoption, especially in developing Markets with cost containment pressures. This cost challenge threatens the growth potential of the Mitral Valve Annuloplasty Rings Market. Device makers need to explore ways to reduce production costs through process optimization and scaling up operations, in order to make these life-saving devices accessible to more patients.

Market opportunities - Development of Bioabsorbable Rings

One of the key opportunities for the Mitral Valve Annuloplasty Rings Market is the development of fully bioabsorbable ring designs. Currently, most annuloplasty rings used in surgeries are made of permanent materials like woven polyester that must remain in the body lifelong. This raises concerns about potential long-term complications, restricts cardiac imaging follow-ups, and requires additional surgery for removal if needed. Bioabsorbable rings made from materials that safely disintegrate in the body over time could address these issues. Considerable research efforts are ongoing to develop rings with degradation properties matched to tissue healing. Once approved, bioabsorbable rings may curb reoperation rates and improve treatment outcomes. They can expand access to annuloplasty therapy in younger patient groups. This innovative product category represents a major growth avenue for Market players. Success in commercializing fully absorbable mitral therapies can lead to significant gains in Market share and help counter pricing pressures from cost-sensitive Markets.

Key winning strategies adopted by key players of Mitral Valve Annuloplasty Rings Market

Product innovation has been a major winning strategy adopted by Market leaders. Edwards Lifesciences launched the MitraClip device in 2013, which is a catheter-based mitral valve repair system used to treat mitral regurgitation. This was a breakthrough innovation as it provided a minimally invasive alternative to open-heart surgery. It has since become the Market-leading device and helped Edwards gain a large Market share. Medtronic also launched its Annular Adjustment device in 2015 to compete in this space.

Geographic expansion into emerging Markets has been another strategy used. Edwards aggressively expanded MitraClip availability across Markets like China, India and Latin America in recent years in order to tap into high growth opportunities. This helped drive strong double-digit sales growth. Other players like Abbott and Venus Medtech have also strengthened their international distribution networks across Asia Pacific and Latin America.

M&A activity was seen as another pathway for growth. Abbott acquired St. Jude Medical in 2017 for $23 billion, gaining its portfolio of tissue heart valves and annuloplasty products. This diversified Abbott's structural heart portfolio. Similarly, Edwards acquired Harpoon Medical in 2020, adding percutaneous tricuspid repair capabilities to its portfolio. These deals helped players expand their product offerings to treat multiple valve diseases.

Partnerships were also formed. For example, Venus Medtech partnered with major hospitals across Europe and Asia to conduct clinical trials and gain expertise. This helped establish its scientific credentials early on. Boston Scientific collaborated with Edwards to co-Market the MitraClip device globally using their combined sales forces. Such partnerships aided commercialization and Market access.

Segmental Analysis of Mitral Valve Annuloplasty Rings Market

Insights, By Product Type: - Procedural advantages drive adoption of Rigid/Semi-rigid Rings

In terms of By Product Type, Rigid/Semi-rigid Rings contributes the highest share of the Market owning to their procedural advantages over other ring types. Rigid/Semi-rigid Rings are typically made of metallic alloys which make them durable and long-lasting. Their rigid structure facilitates more precise implantation and allows surgeons to achieve consistent and predictable annular remodeling. Many studies have found Rigid/Semi-rigid Rings to be effective in correcting mitral regurgitation and restoring normal leaflet coaptation. They offer stability during the healing process and reduce the risk of ring dehiscence or migration. Their rigidity also simplifies the surgical technique as it eliminates the need for complex sizing adjustments. These benefits have made Rigid/Semi-rigid Rings the preferred choice for treating both functional and degenerative mitral regurgitation.

Insights, By Ring Composition - Polymeric material support enhances biocompatibility

In terms of By Ring Composition, Polymeric Rings contributes the highest share of the Market owing to the material advantages of polymers. Polymeric Rings are typically constructed of thermosetting plastic or silicone which mimics the elastic properties of the native mitral valve annulus. The flexible, compliant nature of polymers reduces stress on heart tissues and improves hemodynamic performance. Additionally, polymeric materials have excellent biocompatibility features like non-thrombogenicity and corrosion resistance. This helps avoid complications such as platelet activation, immune response and ring degradation. The biostable characteristics of reinforced polymers also enable Polymeric Rings to maintain structural integrity over the long-term. Advances in polymer science have further optimized material properties to balance flexibility with required mechanical behavior. Collectively, these material benefits have supported the increased demand for Polymeric Rings.

Insights, By End user - Concentrated treatment sites drive hospital adoption

In terms of By End user, Hospitals contributes the highest share of the Market as they represent the major sites where mitral valve repair and replacement surgeries are performed. Hospitals have specialized cardiac units equipped with advanced infrastructure, equipment and trained cardiothoracic surgeons to conduct mitral annuloplasty procedures. They also offer a host of associated services under one roof including diagnostic tests, intensive care, physiotherapy and follow-up consultations. This integrated delivery model enhances coordination of critical care. Moreover, hospitals can leverage their scale to procure annuloplasty rings from multiple manufacturers at competitive costs. The concentration of cardiac patients and treatments within hospitals enables standardization of clinical pathways and skills building among surgical teams. These factors have positioned hospitals as the preferred locations for annuloplasty surgery.

Competitive overview of Mitral Valve Annuloplasty Rings Market

The major players operating in the Mitral Valve Annuloplasty Rings Market include Micro Interventional Devices, Inc., Valcare Medical, Affluent Medical, Cryolife, Inc., Labcor Laboratórios Ltda., Colibri Heart Valve, LLC, Lepu Medical Technology (Beijing) Co., Ltd., Braile Biomédica, Endovalve Inc., Cardio Medical GmbH, Biointegral Surgical, Inc., Cardiac Dimensions, Inc., Mardil Medical, Inc., Mitralign, Inc. and Leman Cardiovascular SA.

Mitral Valve Annuloplasty Rings Market Leaders

- Abbott Laboratories

- Medtronic plc

- Edwards Lifesciences Corporation

- LivaNova PLC

- Braun Melsungen AG

Mitral Valve Annuloplasty Rings Market - Competitive Rivalry, 2024

Mitral Valve Annuloplasty Rings Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Mitral Valve Annuloplasty Rings Market

- On July 2024, Affluent Medical has secured US$ 16.3 million in deals with Edwards Lifesciences for its Kalios adjustable mitral annulus and valve technology. Edwards will pay US$ 5.44 million for an exclusive option to acquire Kephalios, Affluent’s subsidiary supporting the Kalios ring, contingent on clinical study results. Affluent will continue to manage development during the option period.

- In January 2021,Valcare Medical Ltd. has completed its first-in-human transseptal delivery of the AMEND annuloplasty ring at Schulich Heart Centre, Toronto. The AMEND device, a D-shaped semi-rigid ring, aims to simplify and improve mitral valve repair through catheter-based procedures.

Mitral Valve Annuloplasty Rings Market Segmentation

- By Product Type

- Rigid/Semi-rigid Rings

- Flexible Rings

- Partial Rings

- By Ring Composition

- Polymeric Rings

- Metallic Rings

- Combination Rings

- By End user

- Hospitals

- Cardiac Specialty Clinics

- Ambulatory Surgical Centers

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Mitral Valve Annuloplasty Rings Market?

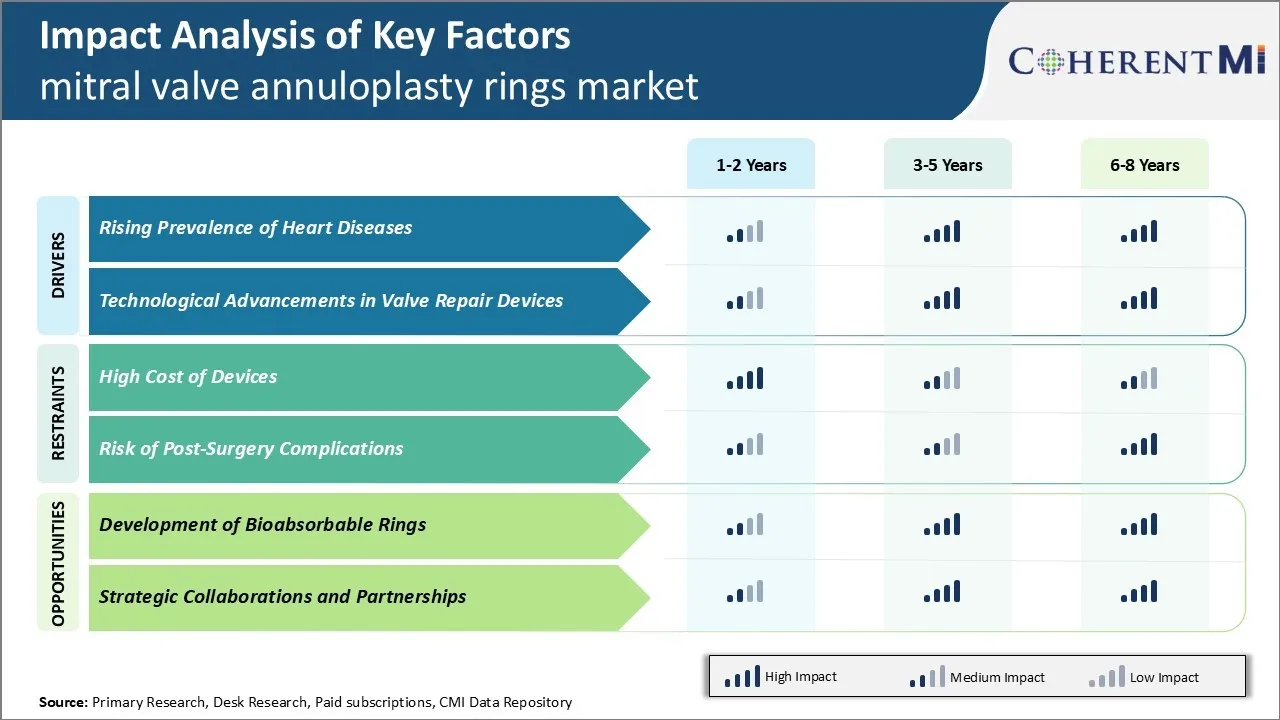

The high cost of devices and risk of post-surgery complications are the major factor hampering the growth of the Mitral Valve Annuloplasty Rings Market.

What are the major factors driving the Mitral Valve Annuloplasty Rings Market growth?

The rising prevalence of heart diseases and technological advancements in valve repair devices are the major factor driving the Mitral Valve Annuloplasty Rings Market.

Which is the leading Product Type in the Mitral Valve Annuloplasty Rings Market?

The leading Product Type segment is Rigid/Semi-rigid Rings.

Which are the major players operating in the Mitral Valve Annuloplasty Rings Market?

Micro Interventional Devices, Inc., Valcare Medical, Affluent Medical, Cryolife, Inc., Labcor Laboratórios Ltda., Colibri Heart Valve, LLC, Lepu Medical Technology (Beijing) Co., Ltd., Braile Biomédica, Endovalve Inc., Cardio Medical GmbH, Biointegral Surgical, Inc., Cardiac Dimensions, Inc., Mardil Medical, Inc., Mitralign, Inc., Leman Cardiovascular SA are the major players.

What will be the CAGR of the Mitral Valve Annuloplasty Rings Market?

The CAGR of the Mitral Valve Annuloplasty Rings Market is projected to be 5.3% from 2024-2031.