Non-Invasive Neurostimulation Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Non-Invasive Neurostimulation Devices Market is Segmented By Type of Stimulation Technology (TENS, TMS, EMS, Others), By Target Indication (Pain Manag....

Non-Invasive Neurostimulation Devices Market Size

Market Size in USD Bn

CAGR11.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 11.5% |

| Market Concentration | Medium |

| Major Players | AcuKnee, AxioBionics, BioMedical Life Systems, HiDow, CEFALY Technology and Among Others. |

please let us know !

Non-Invasive Neurostimulation Devices Market Analysis

The non-invasive neurostimulation devices market is estimated to be valued at USD 1.3 Bn in 2024 and is expected to reach USD 2.8 Bn by 2031, growing at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2031.

The non-invasive neurostimulation devices market is witnessing positive growth trends over the past few years. Factors such as rising geriatric population globally, growing prevalence of neurological disorders such as epilepsy, depression and migraine, and technological advancements in the neuromodulation field are expected to drive the demand for non-invasive neurostimulation devices in the coming years

Non-Invasive Neurostimulation Devices Market Trends

Market Driver - Increasing prevalence of neurological disorders

The growing prevalence of neurological disorders such as epilepsy, depression, Alzheimer's disease and migraine across the globe has led to increased demand for more effective treatment options. These conditions are not only increasing in incidence but are also becoming more common in the aging population. According to some estimates, over 50 million people worldwide suffer from epilepsy. Depression is one of the leading causes of disability, and over 300 million people are affected by it globally. Neurostimulation devices are gaining importance as they offer minimally invasive treatment alternatives to manage these conditions without the need for complex surgical procedures. Continuous advancements are helping Neurostimulation technology to emerge as a viable therapeutic option even for treatment resistant cases.

Devices such as transcranial magnetic stimulation (TMS) and transcranial current stimulation (TCS) are being widely tested for managing neurological and psychiatric disorders like depression, epilepsy and Alzheimer's with promising results. Studies show they are able to modulate brain activity and effectively reduce symptoms. As the full potential of such therapies is yet to be realized, more comprehensive research is further validating their clinical significance. This is motivating more healthcare providers as well as patients to consider these treatments. With growing market approval of non-invasive Neurostimulation systems, and establishment of favorable reimbursement policies, their adoption rates are likely to spike upwards. Rising economic burden of these conditions on patients is also creating demand for cost-effective options like neurostimulation. Overall, the increasing prevalence of neurological illnesses, coupled with advancements making such therapies more practical and affordable, is a key factor propelling the non-invasive neurostimulation market.

Market Driver - Advances in neurotechnology and neuroimaging

Rapid developments in inter-disciplinary fields of neuroscience, biotechnology and engineering are catalyzing innovation in neurostimulation devices. The past decade especially has witnessed major leaps, from refined transcranial magnetic stimulation methods to novel interfaces that can stimulate the brain non-invasively and with greater precision. Concurrently, neuroimaging tools have become far more sophisticated, opening up new possibilities to better understand brain physiology, connectivity and functional networks. Together, these advances are empowering researchers as well as manufacturers to transform design of neurostimulation systems. Real-time integration of multi-modal neuroimaging like MRI, MEG and EEG with specialized neurostimulation techniques allows targeted and personalized neuromodulation based on individual brain mapping. This move towards highly customized stimulation protocols tailored for each patient's unique needs, holds immense potential to improve therapeutic outcomes.

Advance neural interfaces which can bypass the scalp and skull are enabling stimulation of deep brain regions in a non-invasive way. Wireless, implantable devices with controlled drug-delivery are another emerging area. Progress in materials engineering is spawning novel stimulation electrode technologies like high-resolution multi-electrode grids and thread-based microelectrodes providing unprecedented stimulation precision. Combined with computational models of brain circuits, this is augmenting understanding of dose-response relationships and mechanisms of action. As technological capabilities multiplier, they are likely to give rise to a new class of neurostimulation systems with enhanced efficacy. Taken together, the relentless innovations occurring in domains of neurotechnology, neuroscience and brain imaging are fundamentally reshaping the paradigm of non-invasive neurostimulation, making it a vastly more effective therapeutic option.

Market Challenge - High cost of devices

The high cost of non-invasive neurostimulation devices poses a significant challenge for widespread adoption in the market. These devices require expensive upfront capital investments and have recurring costs associated with accessories, upgrades, and ongoing maintenance. Refurbished or rented equipment are not always an option depending on the specific therapy and clinical needs. Financing such an investment can be difficult for individual practitioners as well as for public and private healthcare facilities in developing countries or remote areas with budget constraints. This high expenditure deters many potential consumers and limits the pool of patients who can access these therapies. Device manufacturers need to explore strategies to drive down production costs through economies of scale, improved design efficiencies, and alternative manufacturing and distribution models to make these therapies more affordable over the long term without compromising on quality or efficacy. Partnerships with economic institutions or healthcare providers could help create innovative financing solutions to overcome the financial barriers posed by the high device costs.

Market Opportunity: Growing adoption in emerging markets

The non-invasive neurostimulation devices market sees significant opportunities in the growing adoption within emerging markets. As healthcare infrastructure and access expands in developing nations, there lies a vast untapped market for these therapies to address the rising burden of neurological, psychiatric and other chronic conditions. Local manufacturing partnerships, technology transfers and more accessible financing options could help established players penetrate newer geographies. Meanwhile, domestic companies in emerging hubs like India, China, Brazil etc. are gaining competence in innovating affordable indigenously designed solutions as well as production and distribution capabilities. The demand potential from cost-conscious yet sizable patient populations in these markets could drive volume growth and new innovations tailored for resource-restricted settings. If accessible properly while adhering to quality, these therapies have promise to vastly improve outcomes in emerging nations. Device companies need to devise novel market entry strategies to capitalize on this opportunity.

Key winning strategies adopted by key players of Non-Invasive Neurostimulation Devices Market

Continuous innovation to bring novel non-invasive neurostimulation devices has helped players gain an edge. For example, electroCore launched gammaCore in 2013, which was one of the first FDA-cleared prescription vagus nerve stimulation devices for treatment of cluster headaches and migraine. This helped them capture early market share. Similarly, Cefaly launched the Cefaly Acute migraine treatment device in 2017, which was the world's first FDA cleared external trigeminal nerve stimulation (e-TNS) device for migraine treatment.

Players have formed strategic partnerships with hospitals, clinics and pain management centers to uptake adoption of their devices and generate real-world evidence. For example, in 2018 electroCore partnered with the Cleveland Clinic to conduct clinical studies evaluating gammaCore for treatment of various pain conditions. This clinical validation helped gain physician confidence and increased gammaCore prescriptions.

Players invest heavily in sales and marketing activities to create awareness about non-invasive neurostimulation therapy and drive commercial adoption of their products. For example, electroCore expanded its U.S. sales team from 25 representatives in 2017 to over 75 in 2019 to cover key neurology accounts and drive gammaCore sales which grew 83% that year.

Players clearly position their non-invasive neurostimulation devices for specific neurological pain conditions like migraine, cluster headaches or fibromyalgia to differentiate and focus sales approaches. For example, Cefaly specifically markets its device for acute migraine treatment and has published clinical trial data showing 60% reduction in migraine attacks, which has helped drive solid revenue growth for the company.

Segmental Analysis of Non-Invasive Neurostimulation Devices Market

Insights, By Type of Stimulation Technology: Widespread effectiveness and accessibility of TENS

In terms of type of stimulation technology, TENS contributes the highest share of 35.7% in the market owing to its widespread effectiveness and accessibility. Transcutaneous electrical nerve stimulation (TENS) devices have proven highly effective in treating pain across a variety of conditions. TENS applies electrical pulses to pain-affected areas of the body through electrodes placed on the skin. This mimics the natural pain relief signals the body produces internally and helps override pain signals being sent to the brain.

The non-invasive nature of TENS therapy has helped drive its adoption. Patients can easily self-administer treatment at home using portable TENS devices, avoiding more costly visits to medical facilities. This makes TENS a convenient frontline treatment option compared to alternatives like spinal cord stimulation which require more complex implantation procedures.

Pain clinicians and physical therapists also favor recommending TENS devices due to their strong safety profile and low risk of side effects. When used as directed, TENS causes no tissue damage or systemic health issues. This allows TENS to be prescribed broadly for both acute and chronic pain types.

Leading TENS device manufacturers have contributed further to market growth by innovating new form factors focused on portability, easy application, and extended battery life. Sleek over-the-counter TENS units have fulfilled unmet demand for accessible self-care options. Clinically validated programs built into advanced prescription devices have also expanded appropriate use.

Solid insurance coverage of TENS therapy in most regions has further improved access and affordability relative to other neurostimulation modalities. This clinical validation and financial accessibility continue supporting TENS' position as the dominant stimulation technology segment.

Insights, By Type of Stimulation Technology: Widespread prevalence of various pain conditions

In terms of target indication, pain management sub-segment contributes the highest share of 40.2% in the market owing to the widespread prevalence of various pain conditions. Chronic and acute pain affect an immense global population annually. Common pain conditions treated include lower back pain, osteoarthritis, headaches, and injuries - all areas where non-invasive neurostimulation can provide pain relief options.

The sheer numbers facing the pain burden have galvanized efforts to develop new therapeutic approaches. This growing recognition of pain as a mainstream healthcare issue has contributed to local healthcare policies and guidelines increasingly supporting pain management treatments like TENS.

Neurostimulation devices are also appealing from both patient and provider standpoints due to fitting well within a multi-modal approach to pain care. As complementary therapies that can be combined with medications, exercise programs, and other conventional or alternative treatments, they address a clear need for additional options.

Device manufacturers have additionally found success by developing smaller, more patient-friendly form factors suitable for discreet wearing. These less bulky designs have encouraged more patients who may have hesitated due to social or self-image concerns to give neurostimulation therapies a try. With pain remaining one of the most common patient complaints worldwide, the sizable addressable population and influx of treatment-advancing innovations will likely continue making pain management the top target indication segment.

Additional Insights of Non-Invasive Neurostimulation Devices Market

- The report emphasizes the growing adoption of non-invasive neurostimulation devices due to their effectiveness in treating medication-resistant neurological disorders. Despite initial perceptions of being a last resort, these devices have gained popularity, particularly in developed regions like the US and Europe. The market is also witnessing significant partnerships and investments from start-ups and university spin-offs, ensuring sustained research momentum.

Competitive overview of Non-Invasive Neurostimulation Devices Market

The major players operating in the non-invasive neurostimulation devices market include AcuKnee, AxioBionics, BioMedical Life Systems, HiDow, CEFALY Technology, Natures Gate Tens, neuroCare, Neuroelectrics, Johari Medtech, OMRON Healthcare, RITM and SUNMAS.

Non-Invasive Neurostimulation Devices Market Leaders

- AcuKnee

- AxioBionics

- BioMedical Life Systems

- HiDow

- CEFALY Technology

Non-Invasive Neurostimulation Devices Market - Competitive Rivalry, 2024

Non-Invasive Neurostimulation Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Non-Invasive Neurostimulation Devices Market Segmentation

- By Type of Stimulation Technology

- TENS

- TMS

- EMS

- Others

- By Target Indication

- Pain Management

- Neurological Disorders

- Psychological Disorder

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

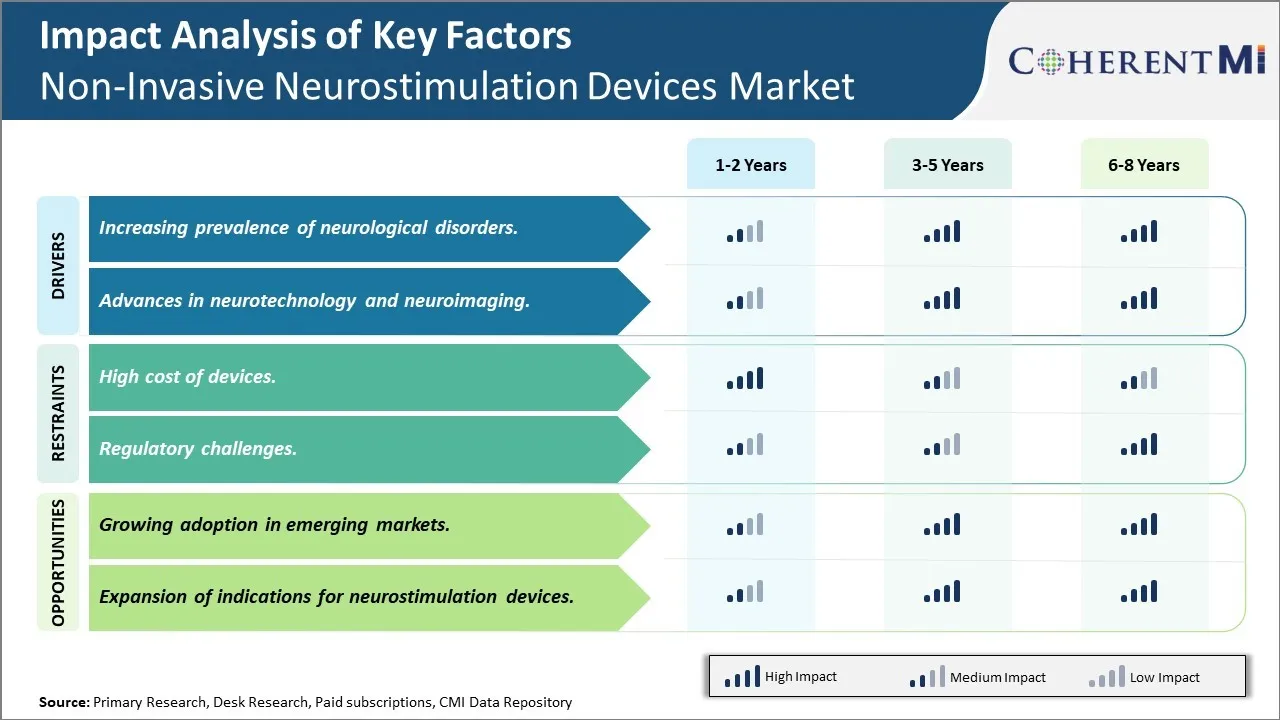

What are the key factors hampering the growth of the non-invasive neurostimulation devices market?

The high cost of devices. and regulatory challenges. are the major factor hampering the growth of the non-invasive neurostimulation devices market.

What are the major factors driving the non-invasive neurostimulation devices market growth?

The increasing prevalence of neurological disorders. and advances in neurotechnology and neuroimaging. are the major factor driving the non-invasive neurostimulation devices market.

Which is the leading Type Of Stimulation Technology in the non-invasive neurostimulation devices market?

The leading type of stimulation technology segment is TENS.

Which are the major players operating in the non-invasive neurostimulation devices market?

AcuKnee, AxioBionics, BioMedical Life Systems, HiDow, CEFALY Technology, Natures Gate Tens, neuroCare, Neuroelectrics, Johari Medtech, OMRON Healthcare, RITM, and SUNMAS are the major players.

What will be the CAGR of the non-invasive neurostimulation devices market?

The CAGR of the non-invasive neurostimulation devices market is projected to be 11.5% from 2024-2031.