Novel Spectrometry Platforms Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Novel Spectrometry Platforms Market is Segmented By Type of Spectrometers (Atomic Absorption Spectrometer, Mass Spectrometer, Near Infrared Spectromet....

Novel Spectrometry Platforms Market Size

Market Size in USD Bn

CAGR8.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.4% |

| Market Concentration | High |

| Major Players | Bruker, JEOL, Metrohm, PerkinElmer, Shimadzu and Among Others. |

please let us know !

Novel Spectrometry Platforms Market Analysis

The novel spectrometry platforms market is estimated to be valued at USD 5.4 Bn in 2024 and is expected to reach USD 9.5 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2031. Increasing investments in drug discovery and high adoption of these platforms in various end-use industries such as biotechnology and pharmaceutical, environmental testing, and food and beverage testing are major factors driving significant revenue growth in this market.

The market is anticipated to witness lucrative opportunities during the forecast period owing to increasing demand for improved detection capabilities and high-throughput analysis. Continuous technological advancements to develop novel spectrometry platforms with enhanced efficiency, sensitivity and specificity are expected to boost the adoption across industries.

Novel Spectrometry Platforms Market Trends

Market Driver - Increasing adoption of advanced spectrometry techniques in pharmaceuticals

The pharmaceutical industry has seen significant advancements in drug development approaches over the past few decades. Researchers are now exploring complex disease pathways and developing highly targeted therapies. This has increased the need for advanced analytical instruments that can provide detailed insights into complex compounds. Traditionally, techniques like mass spectrometry and nuclear magnetic resonance were used for identification and characterization of molecules. However, with advancement in technologies, novel spectrometry platforms are being adopted that can push the boundaries of detection and quantification.

These novel platforms are proving transformative for several processes in drug development like drug discovery, quality control testing, and clinical trials. In the early discovery stage, tools like imaging mass spectrometry are allowing analyses of tissue slides to better understand disease pathogenesis at a molecular level. This helps identify new biological targets. As studies move to the preclinical stage, high-resolution mass spectrometry is evaluating lead candidates and studying their absorption, distribution, metabolism, and excretion profiles with high sensitivity. Moving into clinical trials, such instrumentation is ensuring compliance of investigational medications. Their ability to detect minute variations in molecular structure is valuable for examining bioavailability across different formulations.

Even after drug approval, spectrometry continues playing a vital role through impurity testing and stability assessments. Regulatory mandates are becoming more stringent with requirements of identifying unknown degradation products and controlling critical quality attributes tightly. Advanced platforms can address these mandates by detecting trace impurities and subtle changes over time with high reproducibility.

Market Driver - Growing demand for high-resolution and accurate analytical tools

Across various end-use industries, there is growing emphasis on quality, purity, and accuracy of analyses. This is evident from increasingly stringent regulatory guidelines and customer expectations of improved consistency. To address these challenges, industries are demanding analytical tools that can provide high-fidelity quantitative and qualitative results. Traditional spectrometry instruments have limitation in terms of resolution and reproducible detection of trace-level constituents. As a result, there is significant market pull for novel spectrometry platforms coming up with breakthrough capabilities.

One key industry witnessing this demand is the food and beverage sector. With rising health-consciousness, packaged food and ready-to-drink beverages are required to disclose detailed nutritional information. However, achieving this requires tools that can precisely decipher complex matrices and quantify macro/micronutrients. Similarly, as natural and organic products gain widespread popularity, authentication of ingredients right down to isotope level is important. Novel platforms fulfilling these analytical needs are thereby witnessing more adoption.

Even industries like semiconductors and electronics manufacturing are recognizing value from state-of-the-art spectrometry systems. Their ability to accurately examine atomic/molecular structures, detect minor contaminants, and verify compositions is helping boost quality control. It is especially important considering tight tolerances demanded in fabrication of advanced microelectronics. Likewise, in materials development, comprehending interaction between reactants with atomic specificity requires high-resolution spectroscopic analyses. All of these applications are fueling greater demand for precise and reproducible insights available from novel spectrometry innovations.

Market Challenge - High cost associated with novel spectrometry platforms

One of the key challenges currently faced by the novel spectrometry platforms market is the high cost associated with these advanced instruments. Novel spectrometry platforms such as hyperspectral imaging systems, miniature spectrometers, and laser-induced breakdown spectrometers offer cutting-edge capabilities for chemical analysis and spectroscopy.

However, the R&D costs required to develop such technologically sophisticated devices make these platforms significantly more expensive than traditional benchtop spectrometers. For example, a state-of-the-art hyperspectral camera can cost anywhere between $50,000 to $150,000 depending on its specifications and features. Similarly, a miniature laser-induced breakdown spectrometer with high resolution capabilities typically has a price tag of over $75,000. The high capital expenditure required has been a major hindrance for widespread adoption of novel spectrometry platforms, especially in cost-sensitive application areas and emerging markets. Many potential end-users such as SMEs in the chemical and materials industry, as well as research institutions, may find these advanced instruments financially prohibitive. The high production costs are also passed on to the consumers, making the technology inaccessible for certain point-of-need applications. Overcoming this challenge of high instrument cost is crucial to facilitate further growth of the novel spectrometry platforms industry.

Market Opportunity - Development of portable and miniaturized spectrometers

One significant opportunity for the novel spectrometry platforms market lies in the development of portable and miniaturized spectrometer devices. The conventional benchtop spectrometers currently used in various industries and analytical laboratories are often bulky, heavy instruments requiring dedicated lab space. However, there is a growing demand for compact, handheld spectroscopy tools that can be utilized across diverse on-site settings ranging from environmental monitoring and quality control to defense and security applications. The miniaturization of spectrometer technology using micro-optics, nanostructured materials and semiconductor fabrication has enabled the design of portable spectrometers weighing less than 1 kg with compact footprints. The emergence of 3D printing also supports the fabrication of miniature spectrometer modules.

Increased R&D towards developing affordable, reagent-free, battery-powered field-use spectrometers could open up a multitude of new use cases. This represents a major opportunity to expand the novel spectrometry platforms industry into point-of-need and on-field analysis markets. Progressive innovations in the domain of portable spectroscopy are likely to significantly disrupt existing applications and drive high revenue growth over the coming years.

Key winning strategies adopted by key players of Novel Spectrometry Platforms Market

Companies like Thermo Fisher Scientific, Waters Corporation, Bruker Corporation and Shimadzu Corporation have constantly invested in R&D to develop new and advanced spectrometry platforms. For example, in 2019, Waters launched the Waters= XevoTM G2-XS QToF system, a high-end mass spectrometry platform offering ultra-high resolution and accuracy for small molecule quantitative analysis. Such innovative new products have helped these companies gain market share.

Players have pursued strategic acquisitions to enhance their product portfolio and market reach. For example, in 2021, Thermo Fisher acquired PPD Inc., a provider of central laboratory services including mass spectrometry-based discovery and development services. This strengthened Thermo's position in the biopharma services market. Similarly, Waters acquired AB Sciex in 2019 to expand into clinical research and environmental testing segments.

Companies partner with research institutes, pharmaceutical companies and contract research organizations to ensure adoption of their new platforms. For example, in 2020 Shimadzu collaborated with the University of Manchester to install an ultrahigh resolution mass spectrometer for advanced structural characterization applications. Such collaborations help validate the technology and increase visibility.

Players are focusing on high growth regions like Asia Pacific, Middle East and Latin America by establishing local manufacturing plants and strengthening distribution networks. For example, Bruker expanded its presence in India significantly over 2015-2020 through a new production plant and collaborations with Research Institutes.

Segmental Analysis of Novel Spectrometry Platforms Market

Insights, By Type of Spectrometers: Versatility and affordable pricing of atomic absorption spectrometers

Atomic absorption spectrometers sub-segment contributes the highest share of 25.6% in the novel spectrometry platforms market in terms of type due to their versatility and affordable pricing. These instruments can analyze liquid or solid samples for a wide range of elemental constituents. Their popularity stems from the ability to perform rapid, multi-element analyses with limited sample preparation. This simplicity allows atomic absorption spectrometers to be utilized across various industries like pharmaceuticals, chemical processing, food and beverage testing, and more. Their flexibility has made them a workhorse platform for quality control testing applications that require frequent elemental checks.

Additionally, atomic absorption spectrometers offer dedicated configurations for trace metal analysis down to parts-per-billion concentration levels. This sensitivity enables applications in geochemistry, environmental monitoring and clinical toxicology. Further fueling their prominence is aggressive marketing of updated portable and benchtop models by prominent manufacturers. The compact form factor and ease-of-use of newer generations expand the instrument's reach to non-lab settings such as field sampling.

Insights, By Company Size: Customization is the major factor about small spectrometry firms

The small sub-segment generates the highest revenue share of 40.6% in the novel spectrometry platforms market when considering company size. Many innovative startups and entrepreneurial manufacturers operate within this category. They showcase flexibility in product development that matches emerging analysis needs. With fewer corporate layers, smaller companies can progress new system ideas and technologies to market at a faster pace than their larger counterparts.

A key strength of small spectrometry firms lies in customization. Having more direct customer interactions allows fine-tuning instruments according to specific application parameters. This personalized approach builds strong brand loyalty for the companies. Additionally, small operations aggressively employ niche marketing tactics on social media and in trade publications. Such targeted strategies help amplify their technological contributions beyond what scale alone could provide. Furthermore, some choose to specialize in product segments neglected by other players. This differentiation carves out sustaining business models.

Additional Insights of Novel Spectrometry Platforms Market

- Novel spectrometry platforms are emerging as a solution to the limitations of conventional spectrometers, such as lack of automation and reproducibility issues. Advanced technologies, including miniaturization and portability, have been integrated to enhance performance and throughput. The market has seen significant innovation in data processing and regulatory compliance, resulting in over 3,000 patents filed since 2018. The growing popularity is also reflected in over 60 global events organized since 2016, indicating a substantial growth trajectory for the market during the forecast period.

Competitive overview of Novel Spectrometry Platforms Market

The major players operating in the novel spectrometry platforms market include Thermo Fisher Scientific, Waters, Bruker, JEOL, Metrohm, PerkinElmer, and Shimadzu.

Novel Spectrometry Platforms Market Leaders

- Bruker

- JEOL

- Metrohm

- PerkinElmer

- Shimadzu

Novel Spectrometry Platforms Market - Competitive Rivalry, 2024

Novel Spectrometry Platforms Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Novel Spectrometry Platforms Market

- In June 2023, Bruker launched Novel EVOQ DART-TQ+ for Chromatography-Free Mass Spectrometry to improve workflows in food/beverage, forensic/toxicology, and environmental analysis.

- In June 2023, Thermo Fisher Scientific introduced Thermo Scientific Orbitrap Astral mass spectrometer to enhance biological discovery.

Novel Spectrometry Platforms Market Segmentation

- By Type of Spectrometers

- Atomic Absorption Spectrometer

- Mass Spectrometer

- Near Infrared Spectrometer

- Nuclear Magnetic Resonance Spectrometer

- Raman Spectrometer

- X-Ray Fluorescence Spectrometer

- By Company Size

- Small

- Mid-Sized

- Large

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the novel spectrometry platforms market?

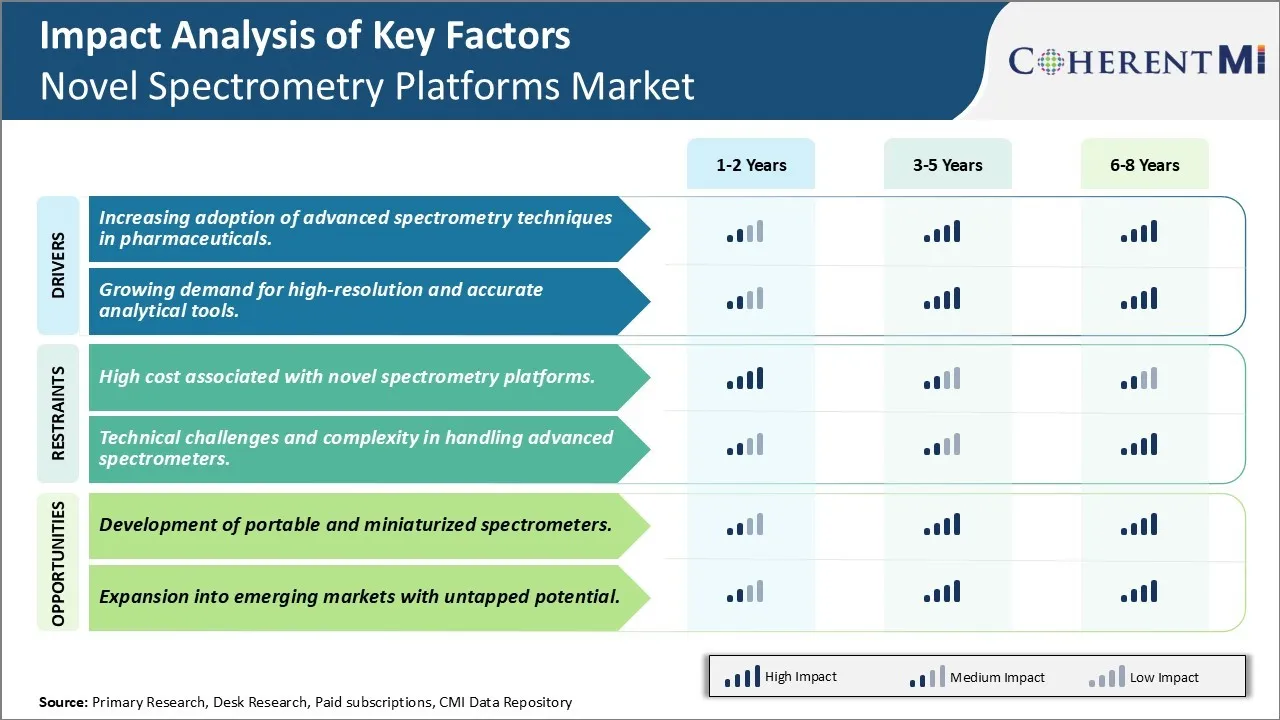

The high cost associated with novel spectrometry platforms and technical challenges and complexity in handling advanced spectrometers are the major factors hampering the growth of the novel spectrometry platforms market.

What are the major factors driving the novel spectrometry platforms market growth?

The increasing adoption of advanced spectrometry techniques in pharmaceuticals and growing demand for high-resolution and accurate analytical tools are the major factors driving the novel spectrometry platforms market.

Which is the leading Type of Spectrometers in the novel spectrometry platforms market?

The leading Type of Spectrometers segment is Mass Spectrometer.

Which are the major players operating in the novel spectrometry platforms market?

Thermo Fisher Scientific, Waters, Bruker, JEOL, Metrohm, PerkinElmer, and Shimadzu are the major players.

What will be the CAGR of the novel spectrometry platforms market?

The CAGR of the novel spectrometry platforms market is projected to be 8.4% from 2024-2031.