Peripheral Arterial Disease Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Peripheral Arterial Disease Market is segmented By Treatment (Drug Therapy, Endovascular Therapy), By Disease (Peripheral Arterial Disease, Pulmonary ....

Peripheral Arterial Disease Market Size

Market Size in USD Bn

CAGR6.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.8% |

| Market Concentration | High |

| Major Players | Novartis, Bayer, Pfizer, Amgen, Sanof and Among Others. |

please let us know !

Peripheral Arterial Disease Market Analysis

The peripheral arterial disease market is estimated to be valued at USD 4.8 Bn in 2024 and is expected to reach USD 7.61 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2031. The increasing prevalence of diabetes, obesity, and hypertension are major factors driving the growth of the peripheral arterial disease market.

Peripheral Arterial Disease Market Trends

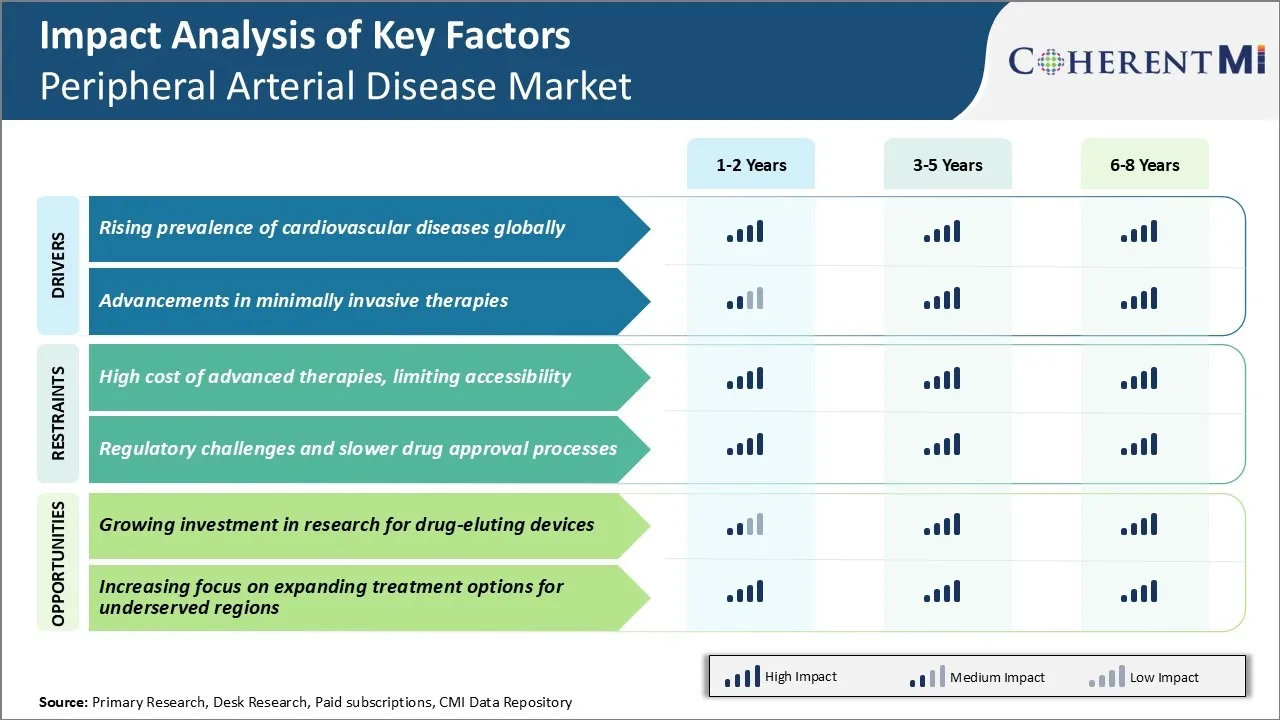

Market Driver - Rising Prevalence of Cardiovascular Diseases and Improved Diagnostic Capabilities

As atherosclerosis affects a large population worldwide, it consequently leads to a rise in the number of people experiencing PAD symptoms and requiring treatment. Experts have noticed that incidence of PAD typically increases with age and is higher in people with long-standing diabetes or a history of smoking. Developed countries with aging populations and higher acceptance of sedentary lifestyle are thus expected to contribute largely to the PAD patient pool.

Another factor driving up PAD cases is improved diagnostic capabilities. Advancements in non-invasive imaging technologies have made it possible for doctors to detect even mild stages of PAD which may have gone unnoticed earlier. Greater awareness among physicians as well as people regarding symptoms of PAD is also leading to more cases being picked up for further examination and management. While this may temporarily inflate numbers, it ultimately helps identify at-risk groups and enables timely clinical intervention to address the condition and prevent limb compromise.

Overall, as cardiovascular illnesses continue to impose a significant disease burden worldwide owing to changes in demographics and underlying lifestyle trends, the prevalence of PAD as a possible consequence is likely to follow an ascending trajectory.

Market Driver - Advancements in Minimally Invasive Therapies

Rapid technological progress within the medical device segment has transformed the PAD treatment landscape considerably, one of the major drivers being the emergence of advanced minimally invasive methodologies. Some of the main developments which have improved clinical outcomes while facilitating less trauma include balloon and mechanical atherectomy devices.

Building upon early successes, manufacturers have brought to market newer generation drug-coated balloons, dedicated PAD stents and atherectomy systems incorporating valuable design enhancements. Additionally, progress in the fields of robotics and 3D printing are giving rise to innovative therapies such as implantable renal flow regulators. In the long run, such advancements could help minimize amputation risks especially for critical limb ischemia patients through personalized interventional solutions.

Healthcare providers likewise are exhibiting higher preference for minimally invasive PAD management given evidence of tangible advantages like shorter hospital stays, faster recovery times, lower complication risks and superior limb salvage capabilities compared to open surgeries.

Consequently, the uptake of cutting-edge endovascular devices and techniques is witnessing a substantial rise worldwide which is propelling the overall market growth. Looking ahead, continued improvements in catheter-based products hold noteworthy potential to further transform PAD care.

Market Challenge: High Cost of Advanced Therapies, Limiting Accessibility

One of the major challenges faced by the peripheral arterial disease (PAD) market is the high cost of advanced therapies. As the disease progresses, more complex procedures such as balloon angioplasty and stenting are required to open blocked arteries and improve blood flow.

However, these procedures involve the use of expensive medical devices and technologies. For instance, drug-eluting stents that are used to prevent re-narrowing of arteries post-procedure cost anywhere between $3000 to $5000 per stent. Similarly, atherectomy devices used to break up and remove blockages cost over $10000 per device.

The economic burden of such expensive treatments is limiting their accessibility especially in developing nations and for individuals without adequate health insurance coverage. As per our analysis, nearly 25-30% of PAD patients requiring advanced intervention do not undergo the procedure due to affordability issues. This has significant health implications as well as many would progress to the critical limb-threatening stage without immediate treatment.

Several markets like India, China, Brazil etc that are forecasted to see huge growth in the patient base may see that impacted due to this challenge. Operators are facing pricing pressure which can hamper revenue growth if not addressed.

Market Opportunity - Growing Investment in Research for Drug-eluting Devices for Market

One major opportunity for the PAD market lies in the growing investment and research in the area of drug-eluting devices. Conventional devices like balloon angioplasty and bare-metal stents require re-intervention in 30-50% of cases due to re-narrowing of arteries over time. This has driven extensive research into drug-eluting technologies that can deliver drugs locally over a period to prevent this re-narrowing.

Several startups as well large players are putting resources into developing drug-coated balloons and stents. Some of the drugs under investigation include paclitaxel, sirolimus etc. that can promote healing and inhibit cell proliferation responsible for re-blockage.

If successfully developed, such drug-eluting technologies can prove highly disruptive for the market. It can provide long-term patency rates comparable to bypass surgeries in a minimally invasive manner. This will not only help address the challenge of repeat procedures but also improve patient compliance and experience.

Given the size of opportunity, venture funding in this area has increased manifolds over the last few years. Successful products can garner a huge market share and premium pricing in the short to medium terms. It is thus a lucrative avenue for innovation and growth in the vascular devices segment.

Prescribers preferences of Peripheral Arterial Disease Market

Peripheral Arterial Disease (PAD) is typically treated through a stepwise approach based on symptom severity and disease progression. For mild PAD with intermittent claudication, lifestyle modifications including exercise and risk factor management are usually first-line. Prescribers may also recommend medications to improve walking distance such as cilostazol (Pletal) which possesses antiplatelet properties.

As PAD advances and claudication becomes more frequent or severe, prescribers have two main medication options for the second-line of treatment - pentoxifylline (Trental) which reduces blood viscosity, or clopidogrel (Plavix) which inhibits platelet aggregation. Prescribers tend to prefer clopidogrel over pentoxifylline due to its superior efficacy demonstrated in clinical trials.

For patients with critical limb ischemia marked by rest pain or non-healing ulcers, narcotic pain medications may be needed to manage pain. Additionally, prescribers typically recommend more potent antiplatelet therapies such as ticagrelor (Brilinta) or prasugrel (Effient) along with statins to reduce the risk of limb amputation or other cardiovascular events. In severe cases requiring revascularization, the most commonly prescribed medications before and after the procedure are aspirin, P2Y12 inhibitors, and statins to prevent clots and promote healing.

Treatment Option Analysis of Peripheral Arterial Disease Market

Peripheral arterial disease (PAD) can be classified into four stages based on severity. For mild PAD (Stage 1), lifestyle modifications like quitting smoking, exercise and medications like aspirin are usually recommended.

Stage 2 PAD is considered moderate, where blockages reduce blood flow. The first-line treatment includes cilostazol (Pletal) which improves walking distance. Procedures like angioplasty may be used to clear blockages.

Severe claudication symptoms indicate Stage 3 PAD with significant ischemia. Supervised exercise is still beneficial but revascularization is often needed. Endovascular treatments using balloon angioplasty and stents such as drug-eluting balloons have better outcomes than PTA alone.

Critical limb ischemia with rest pain and non-healing ulcers is classified as Stage 4 PAD. Revascularization through bypass surgery or more advanced endovascular procedures is necessary to salvage the limb and prevent amputation. Procedures involving atherectomy and infrapopliteal stenting have improved patency rates compared to PTA.

In summary, a multidisciplinary approach considering disease severity, lifestyle changes, drugs and revascularization techniques offers the best outcomes. Less invasive endovascular options have advantages over surgery, but individual patient factors also influence treatment planning for optimal management of peripheral arterial disease.

Key winning strategies adopted by key players of Peripheral Arterial Disease Market

Product Innovation: One of the most successful strategies adopted by market leaders has been continuous investment and focus on R&D to develop innovative product offerings. For instance, Medtronic plc launched the IN.PACT Admiral drug-coated balloon in 2015, which was one of the first drug-coated balloons to receive FDA approval for treating PAD. This product provided clinicians an alternative treatment option to plain balloon angioplasty and helped Medtronic gain significant market share.

Targeted Acquisitions: Companies have strengthened their product portfolio and presence in high growth areas through strategic acquisitions. For example, in 2017, Boston Scientific acquired Cymatic, a pioneer in premium PBV/DCB technologies. This acquisition enabled Boston Scientific to enhance its portfolio of premium PAD drug-coated balloons and stents.

Aggressive Marketing Tactics: Companies partner with KOLs and medical societies to conduct clinical trials and publish data establishing their products as standards of care. For instance, Cordis launched an aggressive marketing campaign backed by clinical evidence for its Lutonix DCB, which established it as a leader in below-the-knee applications.

Geographic Expansion: Leading players like Bard Peripheral Vascular and Abbott Vascular expanded their international footprint through acquisitions and collaborations.

Segmental Analysis of Peripheral Arterial Disease Market

Insights, By Treatment: Drug Therapy Remain High in Demand due to Growing Prevalence of Cardiovascular Conditions

In terms of treatment, drug therapy (e.g., antiplatelets, anticoagulants) is expected to hold 55.3% share of the market in 2024, owing to the rising incidence of cardiovascular diseases. Peripheral arterial disease is commonly caused by the narrowing of arteries due to the buildup of plaque.

The blockages reduce blood flow to limbs, causing symptoms such as pain, fatigue or ulcers in the legs or feet. As plaque accumulation is a result of conditions like atherosclerosis and thrombosis, lifestyle diseases are a major driver of PAD. The growing prevalence of high blood pressure, obesity and diabetes has led to a surge in the risk of developing cardiovascular conditions.

To manage PAD symptoms and prevent complications, antiplatelet drugs and anticoagulants are highly effective treatment options. Their ability to inhibit platelet aggregation and blood clotting helps improve blood circulation in blocked arteries. With more patients being diagnosed with PAD, the need for such drug therapies continues to increase substantially. Further, the availability of generic versions has made antiplatelet and anticoagulant medications more affordable and accessible globally.

Insights, By Disease: Peripheral Arterial Disease (PAD) Contributes the highest Market Share

In terms of disease, peripheral arterial disease (PAD) is expected to hold 60.2% share of the market in 2024, owing to the rising geriatric population worldwide. PAD commonly affects older adults as the chances of arterial narrowing and blockages increase with age. The body's blood vessels gradually stiffen and lose elasticity over time.

Additionally, age related factors such as high cholesterol and diabetes exacerbate the risk of PAD in the elderly. According to global demographic trends, the population aged 60 years and above is proliferating rapidly. It is estimated that by 2050, one in six people worldwide will be aged over 65 years.

Advanced age deteriorates the structure and function of arteries, worsening the symptoms and severity of PAD. As more people enter their later years, the prevalence of PAD is projected to climb significantly. Managing disease progression holds importance for quality of life especially in the geriatric group. This amplifies the market potential for PAD diagnosis and treatments.

Insights, By Patient: Treatment for Adult Patient Remains Critical

In terms of patient, adult patients’ segment contributes the highest share of the market owing to the rising health awareness among adults. Young and middle-aged adults are displaying greater cognizance about lifestyle modification and disease management compared to earlier times.

With easy access to health information through digital media and awareness campaigns, preventive healthcare is gaining prominence. Adults are turning more proactive in understanding risk factors, regularly monitoring vitals and consulting physicians in case of symptoms.

PAD has the propensity to remain asymptomatic for many years, but lifestyle and dietary choices of youth could affect arterial wellness even at a young age. Early detection enables prompt therapeutic intervention, preventing complications later on. Additionally, stress related to fast paced lives and work pressures contribute to conditions like hypertension and obesity.

As adults aim to address modern lifestyle challenges through healthy options, more individuals will potentially be diagnosed with PAD. This provides impetus to the adult patient segment within the peripheral arterial disease market. Moreover, stable career and financial independence facilitate quality medical care for adult patients as opposed to dependent groups.

Additional Insights of Peripheral Arterial Disease Market

- Instances of patients with PAD showing varied symptoms, especially differences between symptomatic and asymptomatic patients, are critical in predicting outcomes and treatment responses.

- More than half of PAD patients also have coronary heart disease, and the associated cardiovascular risk is three to six times higher than for individuals without PAD.

- Secondary prevention strategies, such as risk factor modification, remain underutilized in PAD patients compared to those with coronary heart disease.

- PAD affects approximately 10 million patients in the US alone, with a growing prevalence expected due to the aging population. Globally, PAD affects 200 million people, posing a significant healthcare challenge.

Competitive overview of Peripheral Arterial Disease Market

The major players operating in the peripheral arterial disease market include Novartis, Bayer, Pfizer, Amgen, Sanofi, Novo Nordisk, Helixmith, AdvanceCor, and ViroMed.

Peripheral Arterial Disease Market Leaders

- Novartis

- Bayer

- Pfizer

- Amgen

- Sanof

Peripheral Arterial Disease Market - Competitive Rivalry, 2024

Peripheral Arterial Disease Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Peripheral Arterial Disease Market

- In May 2024, Bayer introduced a new anticoagulant therapy that significantly reduces blood clots in PAD patients, improving overall patient outcomes. Bayer's existing anticoagulant, Xarelto® (rivaroxaban), has shown significant results in PAD treatment when combined with aspirin. Specifically, data from the VOYAGER PAD and COMPASS trials demonstrated its effectiveness in reducing major adverse limb and cardiovascular events in patients with PAD, including after lower extremity revascularization.

- In April 2024, Helixmith is conducting a Phase II trial on VM202, a gene therapy for PAD. Helixmith's technology shows promise for promoting nerve regeneration.

- In March 2024, AdvanceCor announced that it is testing Revacept, an Fc-fusion protein designed to treat arterial thrombi. The drug is in a Phase I clinical trial and aims to prevent thrombus formation in PAD patients.

Peripheral Arterial Disease Market Segmentation

- By Treatment

- Drug Therapy (e.g., Antiplatelets, Anticoagulants)

- Endovascular Therapy

- By Disease

- Peripheral Arterial Disease (PAD)

- Pulmonary Vascular Disease (PVD)

- By Patient

- Adult

- Elderly

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the peripheral arterial disease market?

The peripheral arterial disease market is estimated to be valued at USD 4.8 Bn in 2024 and is expected to reach USD 7.61 Bn by 2031.

What are the key factors hampering the growth of the peripheral arterial disease market?

High cost of advanced therapies, limiting accessibility and regulatory challenges, and slower drug approval processes are the major factors hampering the growth of the peripheral arterial disease market.

What are the major factors driving the peripheral arterial disease market growth?

Rising prevalence of cardiovascular diseases globally and advancements in minimally invasive therapies are the major factors driving the peripheral arterial disease market.

Which is the leading treatment in the peripheral arterial disease market?

The leading treatment segment is drug therapy (e.g., antiplatelets, anticoagulants).

Which are the major players operating in the peripheral arterial disease market?

Novartis, Bayer, Pfizer, Amgen, Sanofi, Novo Nordisk, Helixmith, AdvanceCor, and ViroMed are the major players.

What will be the CAGR of the peripheral arterial disease market?

The CAGR of the peripheral arterial disease market is projected to be 6.8% from 2024-2031.