Robotic Platform Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Robotic Platform Market is segmented By Robot Type (Industrial Robots, Service Robots), By Deployment (Cloud, On-premise), By Type (Stationary, Mobile....

Robotic Platform Market Size

Market Size in USD Bn

CAGR7.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.1% |

| Market Concentration | High |

| Major Players | ABB LTD., Amazon.com, Inc., Google LLC, IBM Corporation, KUKA AG and Among Others. |

please let us know !

Robotic Platform Market Analysis

The Global Robotic Platform Market is estimated to be valued at USD 10.6 Bn in 2024 and is expected to reach USD 17.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. The widespread adoption of automation across industries such as manufacturing, healthcare, logistics and others is augmenting the demand for robotic platforms. Robotic platforms assist with various tasks like material handling, assembling, packaging and many more industrial tasks with more precision and efficiency than humans.

The robotic platform market is expected to witness significant growth in the forecast period due to rising labor costs and growing demand for enhanced productivity and quality. increasing investments by companies in automation to minimize human errors and scale operations is also driving the market. Moreover, the integration of artificial intelligence and IoT is making robotic platforms smarter and more collaborative, thereby enhancing their utility in more applications.

Robotic Platform Market Trends

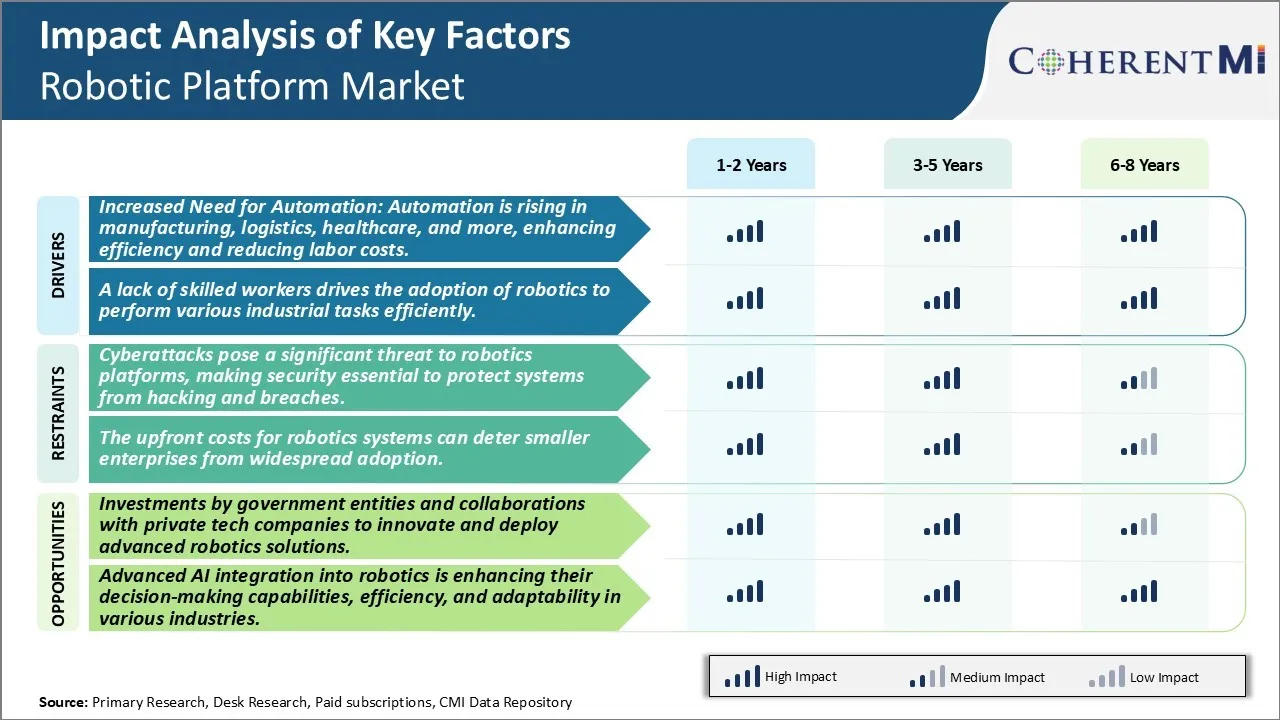

Market Driver - Automation is Rising in Manufacturing, Logistics, Healthcare, and More, Enhancing Efficiency and Reducing Labor Costs

Automation is rising significantly across various industries in order to enhance efficiency and reduce dependence on manual labor. Manufacturing has always leveraged robotics and automation solutions to streamline production processes. However, other sectors like logistics and healthcare are increasingly adopting these technologies. The need to minimize shipping delays and ensure accurate order fulfillment is prompting logistics companies to invest in robotic arms, autonomous vehicles, and other automated solutions for sorting, packaging, and material handling. Similarly, the rising labor costs and shortage of skilled nurses/caregivers are compelling healthcare providers to integrate robot-assisted surgery systems, rehabilitation equipment, and elderly-care robots.

The gains from automation are also evident in areas like e-commerce, where companies are automating various warehouse activities like inventory management, packaging, and delivery route optimization to cope with the surge in online orders during the pandemic. Furthermore, industries that require performing repetitive and hazardous tasks are swiftly automating those jobs. For instance, production lines involving welding or painting automobiles are now dominated by industrial robots. Their deployment has not only improved workplace safety but also increased production capacity and consistency in quality. Overall, the tangible benefits of automation in boosting productivity and reducing dependence on human labor are validated by measurable returns, encouraging more organizations across the global economy to incorporate robotic systems.

Market Driver : Lack of Skilled Workers Drives the Adoption of Robotics

Many industries worldwide are struggling with an acute shortage of workers with technical skills and expertise. While the average educational qualification of the workforce is rising globally, skilled technicians and engineers with experience in operating industrial machinery or programming automation solutions are still in short supply. This talent crunch presents operational challenges for manufacturers involved in metal fabrication, automotive production, food processing, and other such activities that require skilled human labor on the plant floor. Due to difficulties in recruiting and high turnover rates, companies end up losing valuable time and money while the production process remains disrupted.

To overcome this issue, there is a growing Open job roles and equip production lines with robotic systems that can perform tasks more efficiently as well as consistently without taking breaks. Robots do not require remuneration for overtime work or leaves and can seamlessly integrate with one another on a digitally connected factory floor. Their deployment can help establish a stable, optimized production workflow throughout the year while eliminating dependencies on an uncertain labor market. Furthermore, automated solutions continue advancing to take over more complex activities traditionally handled by skilled technicians on the shop floor. This expanding functional scope enhances the long-term prospects of robotics adoption as a substitute for human labor in manufacturing and other industrial operations struggling with workforce shortages.

Market Challenge - Cyberattacks Pose a Significant Threat to Robotics Platforms, Making Security Essential to Protect Systems from Hacking and Breaches

One of the major challenges faced by the robotic platform market is security threats posed by increasing cyberattacks. As robots continue to become more advanced and integrated with Internet of Things technologies, they are exposing a larger attack surface for hackers to exploit. Similar to how we see increasing threats targeting computer networks and industrial control systems, robotics platforms are also at risk of security breaches that could compromise sensitive data or disrupt operations. The complex software and network connectivity powering robots offers numerous potential vulnerabilities that can be leveraged by malicious actors. For example, ransomware or other malware could potentially disable robots or steal and encrypt crucial manufacturing data. Given how dependent many industries have become on robotics for automation needs, production downtimes due to cyber incidents could result in massive financial damages. Furthermore, sensitive corporate information collected by robots during their operational workflows may get stolen. This threatens both a company's proprietary technologies as well as customer privacy. To ensure public safety and trust in robotics, manufacturers must devote considerable focus towards bolstering defenses, implementing authentication protocols, conducting security audits, and facilitating prompt updates to address emerging threats. Overall, cybersecurity risks pose a fundamental challenge that requires intensive ongoing efforts to overcome as the robotics industry continues digital transformation.

Market Opportunity: Government and Private Sector Partnerships Present Opportunities

A major opportunity for the robotics platform market lies in collaborative initiatives between government entities and private technology companies. Several governments around the world have launched initiatives and projects focused on innovating and deploying advanced robotics solutions to address critical challenges. For example, funding is being invested to develop robotic assistants for elderly care, autonomous robots for public infrastructure maintenance and inspection, surgical robotic systems for hospitals, and drones or robotic vehicles for domains like agriculture, construction, and transportation logistics. Such large-scale government backed programs provide a massive impetus for robotics startups and established tech players to accelerate research and commercialization. They also help cover risks of developmental investments. Similarly, strategic partnerships between technology leaders and government contractors can help fast-track robotics adoption across key sectors. When the capabilities of private tech innovators are matched with the massive requirements and budgets of various government modernization programs, it creates fertile ground for collaborative robotics projects and new revenue opportunities. If leveraged effectively through multi-party alliances, government funding presents a major driver of market growth and technology advancement.

Key winning strategies adopted by key players of Robotic Platform Market

Collaboration and Partnerships: Stryker has partnered with Medtronic to integrate flexible robotics capabilities into Medtronic's surgical tools and devices. This allows Stryker to expand its robotic offerings beyond orthopedic surgery applications. Intuitive Surgical has also formed several clinical partnerships to conduct training and research on advancing robotic surgery. Such collaborations helpplayers gain expertise, credentials, and market access.

Product Innovation: In 2021, DENSO launched WAVE, an open and modular robotic platform that allows businesses and developers to customize applications based on their needs. Its modular design with programmable joints and interchangeable end-effectors provides high flexibility. Similarly, Universal Robots launched its new collaborative Cobots in 2019 with intuitive programming and enhanced safety features. This expanded their industrial automation solutions. Continual innovation helps players attract new customers and applications.

Geographical Expansion: Between 2015-2020, Intuitive Surgical expanded its da Vinci Surgical Systems installed base internationally from 1,000+ systems to over 5,500. This has been a key factor fueling the 66% growth in its console and instrument sales. Similarly, after initially focusing on developed markets, companies like Mobile Industrial Robots are now actively targeting emerging markets in Asia and Latin America through partnerships and local manufacturing. This is increasing their global revenue footprint.

Strategic Acquisitions: In 2022, Stryker acquired Vocera Communications to combine care team communication capabilities with Stryker's MedSurg and Klein surgical robotic technologies. This will allow Stryker to provide an integrated operating room experience.

Segmental Analysis of Robotic Platform Market

Insights, By Robot Type, Rapid Technological Advancements Drive the Need for Industrial Robots

By Robot Type, Industrial Robots contributes 67.2% market share in 2024 owing to several factors. Industrial robots have seen immense technological advancements in the past decade with smarter software and more dexterous mechanical arms. Robots are now capable of performing complex tasks with high precision such as welding, painting, assembling and packaging. This has enabled their usage across several manufacturing sectors like automotive, electronics, food and beverages, chemicals etc. Manufacturers are increasingly adopting industrial robots as they help improve productivity, reduce costs and ensure product quality and consistency. Robotic arms require less space compared to humans and can work in hazardous environments without safety concerns. Their deployment has alleviated manufacturers from repetitive and dangerous jobs. Rapid innovations in robotics, artificial intelligence, vision systems and IoT have augmented the capabilities of industrial robots. Collaborative robots or cobots are working safely alongside humans without the need for safety cages. These technological developments have spurred demand for industrial robots from both large enterprises and SMEs.

Insights, By Deployment, Cloud Deployment Opens New Avenues for Robotic Platform Adoption

By Deployment, Cloud is expected to contribute 58.5% market share in 2024 owing to its various advantages. Cloud deployment allows robotic platforms to be accessed remotely via the internet without requiring infrastructure setup. It provides flexibility to organizations to scale robot fleets up or down according to changing needs. Cloud also removes the burden of frequent software updates and maintenance from end-users. Via cloud, robotic functionalities can be upgraded automatically with new features added over the air. This has proved beneficial for industries where processes are dynamic. Cloud deployment substantially reduces capital expenditure for organizations as they pay as per usage and need not invest heavily in hardware upfront. It has increased the affordability of robotic solutions, especially for budget-constrained SMEs. Robotic platforms on cloud can be centrally monitored and managed by operators from any location. Overall, cloud has enabled rapid and widespread adoption of robotics across geographies by addressing various challenges of on-premise deployment.

Insights, By Type, Stationary Robots Dominate Due to Their Versatility in Industrial Settings

By Type, Stationary contributes the highest share of the market owing to their extensive usage in structured industrial environments. Stationary robots are fixed at designated workstations and outfitted for repetitive production tasks. They offer high precision and accuracy due to pre-defined range of motion. Since they do not require navigation software and mobility systems, stationary robots are less complex, economical and easier to program compared to mobile ones. Their operation is stable as they are not affected by dynamic factory or warehouse floors. Stationary robots have found widespread use in common industrial applications like palletizing, packaging, assembling, dispensing, welding etc. They integrate seamlessly within production lines and provide consistency in high volumes. Compared to humans, stationary robots can perform tasks 24/7 without breaks and fatigue. Their deployment has allowed industries to improve efficiency of plant layouts by reducing idle spaces and bottlenecks. Overall, versatility and total cost of ownership have supported the dominance of stationary robots in industrial markets.

Additional Insights of Robotic Platform Market

The robotic platform market is growing steadily due to increasing demands for automation across multiple sectors such as manufacturing, healthcare, logistics, and transportation. Robotics platforms provide immense benefits by improving operational efficiency, reducing human error, and cutting labor costs. With advancements in AI and machine learning, robots are becoming more intelligent, learning from their environments, and adapting to new tasks more effectively. The demand for autonomous mobile robots (AMRs) is rapidly increasing in e-commerce and logistics, where they assist in warehouse management and streamline operations. Additionally, cloud robotics is enabling easier data access and enhanced predictive analytics, further boosting the potential of robotic platforms. Key market drivers include the growing need for precision, labor shortages, and increased government funding for technological development. However, challenges such as data security risks and high deployment costs still pose barriers, especially for small and medium-sized enterprises. As the market expands, Asia Pacific is expected to be the fastest-growing market due to industrial growth and technology adoption.

Competitive overview of Robotic Platform Market

The major players operating in the Robotic Platform Market include ABB LTD., Amazon.com, Inc., Google LLC, IBM Corporation, KUKA AG, Clearpath Robotics, Cyberbotics, Microsoft, NVIDIA Corporation, Rethink Robotics, Universal Robots and Dassault Systemes.

Robotic Platform Market Leaders

- ABB LTD.

- Amazon.com, Inc.

- Google LLC

- IBM Corporation

- KUKA AG

Robotic Platform Market - Competitive Rivalry, 2024

Robotic Platform Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Robotic Platform Market

- In June 2024, ABB introduced its OmniCore control platform, focusing on AI and cloud integration to enhance robotics' adaptability and expand their use across various industries.

- In May 2023, Robocath launched R-One+, a robotic platform that enables interventional cardiologists to perform coronary angioplasties via a remote-control unit.

- In March 2024, IBM announced Robotic Process Automation version 23.0.15, which includes enhanced scheduling, workflow, and security management for advanced automation.

- In March 2024, Cognizant expanded its partnership with Google Cloud to leverage the Gemini platform for improved robotics and automation capabilities in software development.

Robotic Platform Market Segmentation

- By Robot Type

- Industrial Robots

- Service Robots

- By Deployment

- Cloud

- On-premise

- By Type

- Stationary

- Mobile

- By End-user

- Manufacturing

- Electrical & Electronics

- Automotive

- Pharmaceuticals

- Food & Beverages

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Robotic Platform Market?

The Global Robotic Platform Market is estimated to be valued at USD 10.6 bn in 2024 and is expected to reach USD 17.9 bn by 2031.

What will be the CAGR of the Robotic Platform Market?

The CAGR of the Robotic Platform Market is projected to be 7.1% from 2024 to 2031.

What are the major factors driving the Robotic Platform Market growth?

Automation is rising in manufacturing, logistics, healthcare, and more, enhancing efficiency and reducing labor costs, and the lack of skilled workers drives the adoption of robotics to perform various industrial tasks efficiently are the major factor driving the Robotic Platform Market.

What are the key factors hampering the growth of the Robotic Platform Market?

The cyberattacks pose a significant threat to robotics platforms, making security essential to protect systems from hacking and breaches. Upfront costs for robotics systems can deter smaller enterprises from widespread adoption are the major factors hampering the growth of the Robotic Platform Market.

Which is the leading Robot Type in the Robotic Platform Market?

The leading Robot Type segment is Industrial Robots.

Which are the major players operating in the Robotic Platform Market?

ABB LTD., Amazon.com, Inc., Google LLC, IBM Corporation, KUKA AG, Clearpath Robotics, Cyberbotics, Microsoft, NVIDIA Corporation, Rethink Robotics, Universal Robots, Dassault Systemes are the major players.