Stereotactic Surgery Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Stereotactic Surgery Devices Market is segmented By Product Type (Gamma Knife, Linear Particle Accelerators, Proton Therapy Systems, Stereotactic Syst....

Stereotactic Surgery Devices Market Size

Market Size in USD Bn

CAGR5.37%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.37% |

| Market Concentration | High |

| Major Players | Elekta AB, Accuray Inc., Ion Beam Application S.A., Mevion Medical Systems, Varian Medical Systems, Inc and Among Others. |

please let us know !

Stereotactic Surgery Devices Market Analysis

The Global Stereotactic Surgery Devices Market is estimated to be valued at USD 29.1 Bn in 2024 and is expected to reach USD 38.2 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.37% from 2024 to 2031. Stereotactic surgery devices are used in various minimally invasive surgeries of the brain and these devices help in precisely locating tumors and other lesions for effective treatment with procedures like radiosurgery and biopsy.

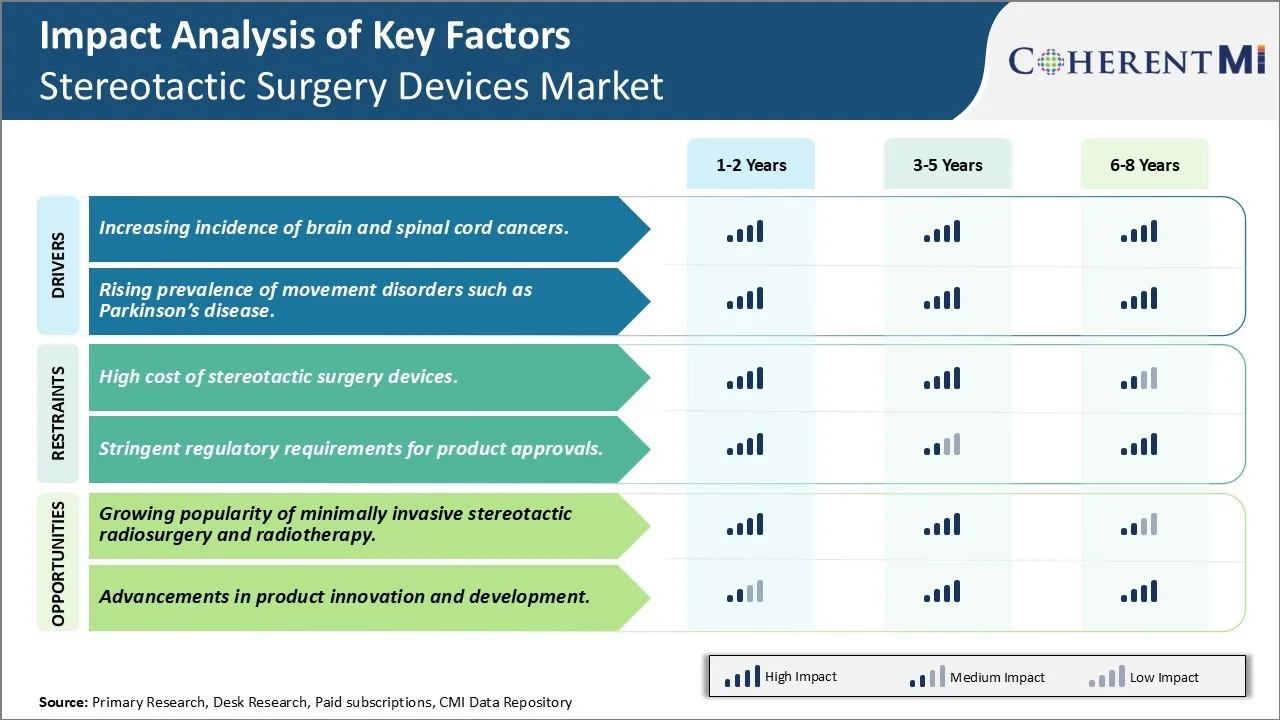

The stereotactic surgery devices market is expected to witness steady growth owing to the increasing incidence of brain tumors and other neurological disorders globally. As stereotactic surgery offers advantages like minimal invasiveness, reduced recovery time and hospital stay along with better precision, its adoption rate is increasing worldwide. Further technological advancements improving navigational abilities and efficiency are projected to drive the market during the forecast period.

Stereotactic Surgery Devices Market Trends

Market Driver - Increasing incidence of brain and spinal cord cancers.

The incidence rates of primary brain and spinal cord cancers have been rising steadily over the past few decades. While these cancers collectively account for only around 1-2% of all new cancer cases diagnosed each year in developed countries, the absolute number of new cases has grown substantially due to the aging and growth of the global population.

Primary brain and spinal cord tumors arise from cells originating from the tissues of the brain and spinal cord. Unlike metastatic cancers, these tumors start and remain confined to the brain or spinal cord. The two most common types of primary brain cancer in adults are glioblastoma and meningioma, which respectively account for around 15% and 36% of all primary brain tumors. For children, the most frequent brain tumors are medulloblastomas, astrocytomas and ependymomas. Risk factors for developing brain and spinal cancers include age, genetic predispositions, exposure to radiation, and certain viral infections.

According to recent statistics, the age-adjusted incidence rates of malignant brain and spinal cord cancers have continuously risen over the past three decades in most parts of the world. In the United States itself, estimates indicate the number of new malignant brain cancer cases increased from around 23,000 in 2017 to over 24,000 in 2021. Projections show these incidence trends will continue going forward as well, largely driven by the increasingly aging global population profile. Additionally, improved diagnostic capabilities using methods like advanced brain imaging scans have led to more brain cancers being detected at earlier stages in recent years compared to the past.

With limited treatment options available for brain cancers, surgery remains one of the core modalities along with chemotherapy and radiation therapy in many cases. Here, minimally invasive neurosurgical procedures enabled by stereotactic technologies offer distinct advantages over conventional open surgeries, including smaller incisions, reduced trauma to normal brain tissues, faster recovery times and fewer complications. These benefits have made stereotactic techniques the standard of care for treating several types of brain tumors and other neurological disorders requiring intracranial access with high precision.

In view of the consistent upward trends witnessed in brain cancer incidence globally and the growing reliance on stereotactic surgical approaches, it can be expected that the rising disease burden will drive greater demand for stereotactic surgery devices and systems in the coming years. Neurosurgical centers are also expected to invest more in advanced stereotactic equipment to address this rising cancer caseload effectively while offering improved outcomes for patients.

Market Driver: Rising Prevalence of Movement Disorders like Parkinson's Disease

Movement disorders refer to a group of conditions characterized by problems with muscle movement. Among the more common forms is Parkinson's disease, a progressive neurodegenerative disorder that results from the loss of dopamine-producing neurons in the brain. Symptoms include tremors, stiffness, slowness of movement, balance problems and other motor complications. Although its causes are still not fully understood, risk factors include increasing age and possible genetic and environmental components.

Statistics indicate the incidence and prevalence of Parkinson's disease has been growing significantly worldwide due to aging populations and improved diagnostics. It is estimated that over 10 million people globally currently suffer from the disease, including over 1 million patients in the United States alone. Prevalence is directly linked to age, increasing the risk after around 60 years, and it is projected that Parkinson’s cases will continue multiplying in the coming decades. Other movement disorders exhibiting similar rising trends include essential tremor and dystonia.

For patients with advanced Parkinson's disease, deep brain stimulation (DBS) therapy delivered by implanting thin electrodes in the brain has emerged as an important treatment approach when medications become ineffective. Stereotactic neurosurgery is required to accurately place the electrode leads in targeted structures like the subthalamic nucleus or internal globus pallidus.

Market Challenge - High Cost of Stereotactic Surgery Devices Limits Further Developments.

One of the major challenges faced by the stereotactic surgery devices market is the high cost of these devices. Stereotactic surgery devices such as gamma knife devices, linear accelerator devices, cyber knife devices, proton beam therapy systems etc. are highly sophisticated machines that employ advanced robotics, imaging, and radiation technology to deliver targeted and minimally invasive treatment. Developing and manufacturing such complex medical devices requires heavy investment in R&D. As a result, the upfront capital cost of these devices is substantial, ranging from several millions to tens of millions of dollars. This high capital expenditure poses a significant barrier for many healthcare providers and facilities to purchase these devices. Moreover, the ongoing costs associated with operation, maintenance, repairs and software upgrades of these advanced devices are also quite high. The high equipment and maintenance costs have restricted widespread adoption of stereotactic surgery technologies especially in cost-sensitive markets. This cost challenge needs to be addressed in order to further propel growth in the stereotactic surgery devices market.

Market Opportunity- Growing Popularity of Minimally Invasive Stereotactic Radiosurgery and Radiotherapy.

One of the major opportunities for the stereotactic surgery devices market is the growing popularity and demand for minimally invasive stereotactic radiosurgery and radiotherapy procedures. Conventional cancer treatments such as whole brain radiation therapy are associated with severe side effects and risks. On the other hand, stereotactic radiosurgery and radiotherapy delivered through devices such as gamma knife, cyberknife allow targeted, high dose radiation to the tumor area while sparing the surrounding healthy tissues. This translates to superior clinical outcomes for patients in terms of local tumor control, fewer side effects, shorter hospital stay and faster recovery. The rising awareness about these benefits among patients as well as physicians has led to increasing preference for minimally invasive stereotactic procedures over traditional surgery or radiation therapy. In addition, aging population demographics, rising cancer incidence worldwide are all contributing to a growing need for effective stereotactic technologies. If device vendors focus on innovations to make these therapies more accessible through lower costs, it can further fuel the demand and adoption of stereotactic surgery globally.

Key winning strategies adopted by key players of Stereotactic Surgery Devices Market

Product Innovation - Leading players such as Elekta AB, Accuracy Inc., and Zimmer Biomet have focused on continuous innovation in stereotactic surgery devices to deliver advanced precision and improved patient outcomes. For example, in 2022 Elekta launched its Leksell Gamma Knife Icon, featuring Icon Vision technology that combines robotic positioning with advanced imaging for real-time stereotactic accuracy. Clinical studies have shown Icon to increase targeting precision by 50% compared to previous Gamma Knife systems. This innovative new system allows Elekta to charge premium prices and strengthen its market leadership position.

Partnerships & Collaborations - Players partner with hospitals, medical centers, and clinical experts to advance their technology, conduct joint research, and drive clinical adoption. For example, in 2020 Zimmer Biomet partnered with leading neurosurgeons to develop the Rosa One neuronavigation platform for cranial procedures. Early clinical data showed 30% reduction in procedure time compared to traditional frame-based methods. This partnership allowed Zimmer Biomet to validate the platform's benefits and gain prestigious physician endorsements that accelerated commercial sales.

Geographic Expansion - Given the large unmet need for minimally invasive brain surgery globally, companies focus on expanding into new international markets. For example, in 2018 Accuracy Inc. partnered with distributors to launch its Pinpoint robotic stereotactic platform in major European and Asian countries. By 2022, over 40 Pinpoint systems had been installed outside of the U.S., allowing Accuracy Inc. to diversify its revenue stream and gain a significant share in emerging international stereotactic surgery markets.

These proven strategies of innovation, partnerships, and global expansion have enabled companies like Elekta, Zimmer Biomet and Accuracy Inc. to achieve continuous growth and strengthen their leadership positions in the stereotactic surgery.

Segmental Analysis of Stereotactic Surgery Devices Market

Insights, By Product Type: Gamma Knife is Poised to Dominate in the Forecast Period.

By Product Type, Gamma Knife contributes the highest share of the market at 33.40% in 2024 owing to its minimally invasive nature and precision targeting capabilities. Gamma Knife devices have seen increased adoption rates in recent years due to their ability to treat tumors and other abnormalities with sub-millimeter accuracy. By utilizing highly focused beams of gamma radiation that converge on a target volume, Gamma Knife is able to target tissue with extreme precision while minimizing exposure to surrounding healthy areas. This non-invasive treatment approach alleviates many of the risks associated with open surgery such as blood loss, infection, and long recovery times.

Hospitals and clinicians favor Gamma Knife over alternative radiosurgery options due to its reproducible precision. The system utilizes a customized head frame to immobilize the patient's head and aim multiple cobalt-60 sources, ensuring targeted radiation is delivered to the exact location each time. This consistency and accuracy provide physicians confidence in Gamma Knife's abilities to effectively treat even complex cases.

Government initiatives in several countries focusing on minimally invasive procedures have also driven the uptake of Gamma Knife systems. Relatively short treatment durations of Gamma Knife procedures reduce hospital resource burden compared to invasive alternatives. This has made Gamma Knife a cost-effective first-line option for a variety of radiosurgery indications like tumors, vascular malformations, and trigeminal neuralgia.

Leading Gamma Knife manufacturers have further expanded the technology's clinical applications through ongoing innovations. Newer models feature enhanced imaging guidance and automated positioning capabilities for increased treatment planning precision. Additional research validating Gamma Knife's use in larger tumor volumes and more complex cases continues to grow its acceptable scope of treatments performed.

Insights, By Application, The Need for Advanced Infrastructure Empowers Hospitals to Procure Medical Equipment and Devices.

By Application, hospitals contribute the highest market share of 58.60% in 2024. It is driven by growing cancer incidence rates and demand for specialty care. Rising cancer prevalence globally has significantly impacted the diagnostic and treatment volumes handled by hospitals. As stereotactic radiosurgery techniques like Gamma Knife prove effective for numerous tumor types, hospitals have boosted their radiotherapy infrastructure to meet demand. Institutional reimbursements for stereotactic procedures also make hospitals financially viable care settings for these highly specialized treatments.

Beyond oncology, hospitals also utilize stereotactic radiosurgery devices to manage vascular malformations, functional disorders, and other neurosurgical conditions. With advanced neurosurgical facilities and multi-disciplinary staff, hospitals offer comprehensive management of complex cases requiring stereotactic intervention. They provide a "one-stop-shop" for patient care through integrated diagnostic testing, surgery, therapy, and follow-up visits.

The concentration of stereotactic expertise, specialized devices, and supporting clinical infrastructure enable hospitals to efficiently perform high case volumes. Robust hospital networks can also effectively organize and regulate the workflow of expensive radiosurgery resources. Ambulatory centers lack such comprehensive facilities and economies of scale for stereotactic solutions, restricting their ability to cater to neurosurgical indications.

The growing aging population susceptible to neurodegenerative and brain disorders will further increase demand met predominantly by hospitals. With their patient-centric approach and concentration of advanced technologies, hospitals are well-positioned to best harness benefits of stereotactic devices for disease management.

Additional Insights of Stereotactic Surgery Devices Market

The stereotactic surgery devices market is experiencing growth driven by the rising incidence of brain and spinal cord cancers, and the increasing prevalence of movement disorders such as Parkinson’s disease. Stereotactic surgery offers significant advantages, such as targeting surgically inaccessible lesions and offering minimally invasive treatment options for complex conditions like brain tumors and neurological disorders. However, challenges such as high costs and stringent regulatory environments may hamper broader market adoption. North America is projected to dominate the market due to advanced healthcare infrastructure, a growing elderly population, and rising awareness of stereotactic treatment options. As the market evolves, key players are expected to continue focusing on technological innovations and expanding their product portfolios to capture emerging opportunities.

Competitive overview of Stereotactic Surgery Devices Market

The major players operating in the Stereotactic Surgery Devices Market include Elekta AB, Accuray Inc., Ion Beam Application S.A., Mevion Medical Systems, Varian Medical Systems, Inc, Inomed Medizintechnik GmbH, Adeor Medical AG, Bramsys Indústria e Comércio Ltda., Micromar Ind. E Com. LTDA, Mizuho Medical Co. Ltd., Shinva Medical Instrument co., Ltd, Panacea Medical Technologies Pvt. Ltd., Sumitomo Heavy Industries, Ltd and Hitachi Co. Ltd.

Stereotactic Surgery Devices Market Leaders

- Elekta AB

- Accuray Inc.

- Ion Beam Application S.A.

- Mevion Medical Systems

- Varian Medical Systems, Inc

Stereotactic Surgery Devices Market - Competitive Rivalry, 2024

Stereotactic Surgery Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Stereotactic Surgery Devices Market

- October 2021: Ion Beam Applications SA launched the first online platform dedicated to proton therapy, enhancing accessibility to proton therapy information globally.

- June 2021: NaviNetics Inc received premarket product approval from the US FDA for the NaviNeticsD1 Stereotactic System, improving stereotactic surgical options.

- June 2021: Elekta AB received US FDA approval for the Elekta harmony radiation therapy system, expanding their range of linear accelerator-based treatment options.

Stereotactic Surgery Devices Market Segmentation

- By Product Type

- Gamma Knife

- Linear Particle Accelerators

- Proton Therapy Systems

- Stereotactic Systems

- By Application

- Hospitals

- Ambulatory Surgical Centers

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Stereotactic Surgery Devices Market?

The Global Stereotactic Surgery Devices Market is expected to value at USD 29.1 Billion and reach USD 38.2 Billion by 2031.

What will be the CAGR of the Stereotactic Surgery Devices Market?

The CAGR of the Stereotactic Surgery Devices Market is projected to be 5.37% from 2024-2031.

What are the major factors driving the Stereotactic Surgery Devices Market growth?

The increasing incidence of brain and spinal cord cancers. and rising prevalence of movement disorders such as parkinson’s disease are the major factor driving the Stereotactic Surgery Devices Market.

What are the key factors hampering the growth of the Stereotactic Surgery Devices Market?

The high cost of stereotactic surgery devices and stringent regulatory requirements for product approvals are the major factor hampering the growth of the Stereotactic Surgery Devices Market.

Which is the leading Product Type in the Stereotactic Surgery Devices Market?

Linear Particle Accelerators is the leading product type segment.

Which are the major players operating in the Stereotactic Surgery Devices Market?

Elekta AB, Accuray Inc., Ion Beam Application S.A., Mevion Medical Systems, Varian Medical Systems, Inc, Inomed Medizintechnik GmbH, Adeor Medical AG, Bramsys Indústria e Comércio Ltda., Micromar Ind. E Com. LTDA, Mizuho Medical Co. Ltd., Shinva Medical Instrument co., Ltd, Panacea Medical Technologies Pvt. Ltd., Sumitomo Heavy Industries, Ltd, Hitachi Co. Ltd are the major players.