Stress Urinary Incontinence Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Stress Urinary Incontinence Devices Market is segmented By Product (Sling Systems, Vaginal Pessaries, Artificial Urinary Sphincters, Urethral Bulking ....

Stress Urinary Incontinence Devices Market Size

Market Size in USD Mn

CAGR6.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.9% |

| Market Concentration | High |

| Major Players | Boston Scientific Corporation, AscentX Medical Inc., Coloplast Corporation, Becton, Dickinson and Company, ConvaTec Group PLC and Among Others. |

please let us know !

Stress Urinary Incontinence Devices Market Analysis

The Global Stress Urinary Incontinence Devices Market is estimated to be valued at USD 780.1 Mn in 2024 and is expected to reach USD 1130.3 Mn by 2031, growing at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2031. The growing prevalence of urinary incontinence among the geriatric population coupled with the rising awareness and adoption of stress urinary incontinence devices treatment procedures are contributing to the growth of this market.

The market is witnessing positive trends such as the increasing demand for minimally invasive treatment procedures and technologically advanced products. Manufacturers are focusing on developing novel slings, implants and other treatment devices to address patient needs more effectively. However, lack of awareness regarding treatment options in developing nations and the high cost of sophisticated devices may restrain the market growth to some extent over the forecast period.

Stress Urinary Incontinence Devices Market Trends

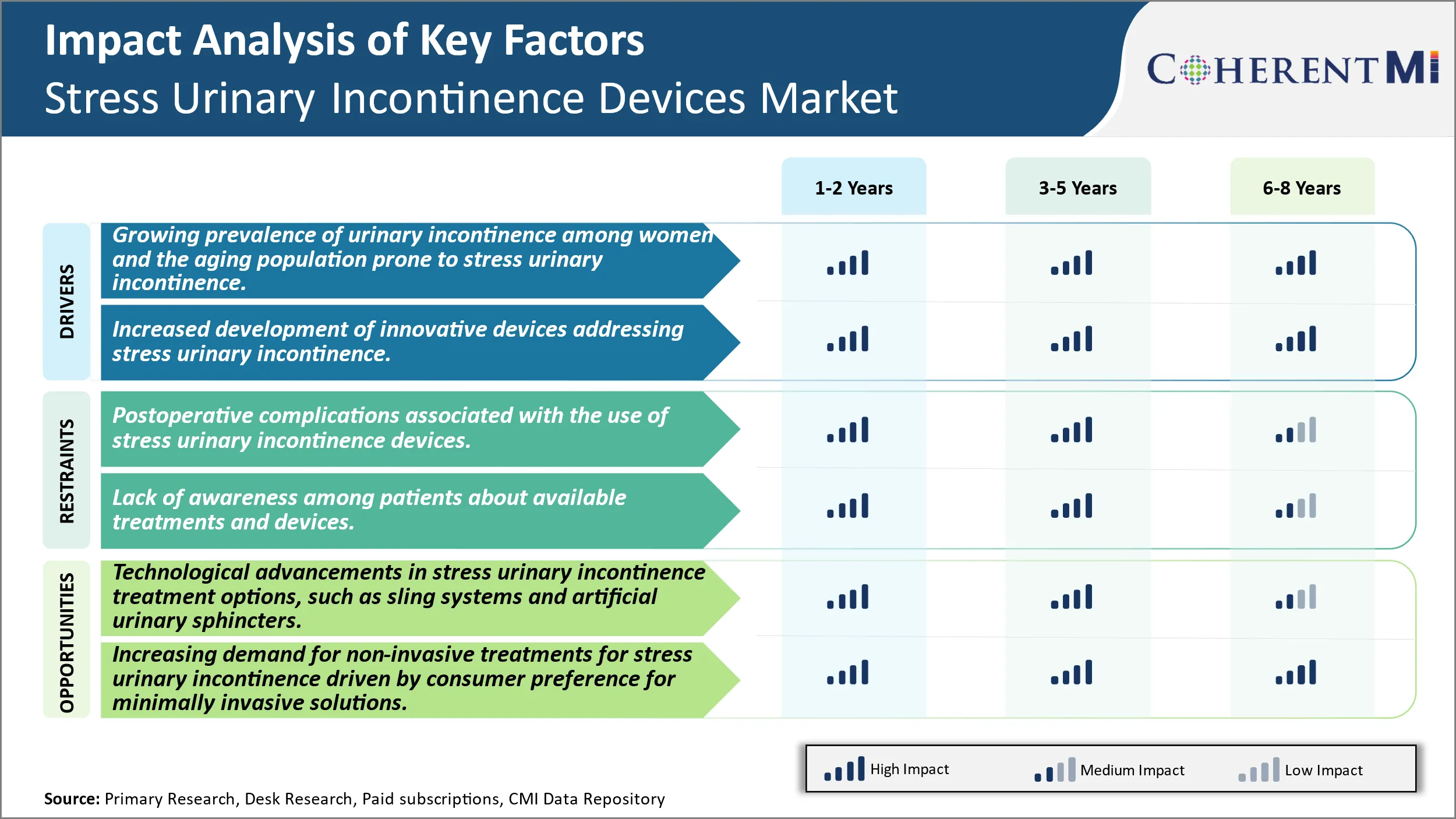

Market Driver - Growing Prevalence of Urinary Incontinence Among Women and the Aging Population Prone to Stress Urinary Incontinence Devices.

Urinary incontinence is a highly prevalent condition affecting millions of people globally, with women being more susceptible than men. Stress Urinary Incontinence Devices, one of the common types of incontinence, arises due to weakened pelvic floor muscles resulting in accidental leakage during physical activity like coughing, sneezing or exercise. Studies indicate that urinary incontinence is highly correlated with increasing age, with nearly 50% of older women impacted by some form of incontinence. The population worldwide is aging rapidly with the proportion of geriatric individuals over 65 years set to double from 7% to 16% between now and 2050. Thus, as life expectancy increases, so does the susceptibility to age-related medical conditions including stress urinary incontinence devices.

In addition, women are four times more likely to develop stress urinary incontinence devices compared to men due to physical changes during pregnancy and childbirth that weaken the pelvic floor muscles. Childbirth is one of the leading risk factors for incontinence in women as vaginal delivery puts immense pressure on these muscles. With female workforce participation increasing globally and women delaying childbirth, the number of births per woman has reduced in many nations. However, women who do opt for pregnancy are now more likely to experience urinary incontinence in later stages of life. Changing lifestyle factors are also contributing to this healthcare issue as obesity and smoking are correlated with increased risk.

Market Driver- Increased Development of Innovative Devices Addressing Stress Urinary Incontinence Devices.

In response to the vast clinical need, medical technology companies have intensified R&D efforts towards developing novel treatment options for Stress Urinary Incontinence Devices that are less invasive and deliver improved outcomes over traditional approaches. One area witnessing significant innovation is in mid-urethral slings, which have emerged as the gold standard non-surgical treatment. Advanced sling designs using lighter, more comfortable meshes and tools allowing placement via smaller incisions are making these procedures much better tolerated. Similarly, single incision and mini slings that further reduce trauma are gaining popularity. Implantable devices like neuromodulation systems addressing incontinence at the nerve level through electrical stimulation are also demonstrating effectiveness equal to surgery in clinical trials and expanding treatment algorithms.

3D printing is enabling anatomically shaped implants tailored for individual patient anatomy. Absorbable meshes and scaffolds that degrade post-healing are being researched to prevent long-term foreign body reactions. Non-mesh mid-urethral implants inserted via minimally invasive means are in development stages. Beyond slings, alternative therapies under evaluation include injectable bulking agents to augment weakened tissue, stem cell therapies aimed at tissue regeneration as well as first-line devices for conservative management to delay or avoid surgery. Startups are contributing with disruptive ideas like a tiny implant to bolster urethral closure. Marketing approvals for several advanced incontinence devices in recent years underscores regulatory acceptance of novel technologies with clear advantages over existing solutions.

The excitement around new technological applications holds promise to fundamentally alter treatment landscapes and clinical guidelines by delivering solutions that are safer, easier to use, better tolerated with faster recovery.

Market Challenge - Postoperative Complications Associated with the Use of Stress Urinary Incontinence Devices.

The Stress Urinary Incontinence Devices market faces several challenges associated with postoperative complications from the use of various devices available to treat the condition. Devices like midurethral slings are among the most commonly used options, however, adverse events can occur in a significant percentage of patients. Complications ranging from urinary tract infections to erosions and perforations that damage neighbouring tissues have been reported. Dealing with resultant morbidities increases healthcare costs and adversely impacts patient well-being and outcomes. The risks also affect device uptake and limit the expandability of certain product lines. Manufacturers constant efforts to reduce complication rates through design and material improvements as well as ensure correct surgical techniques are followed. However, complications may never be completely eliminated given the nature of the procedures. Educating patients on potential side effects is also crucial but does not remove the challenge of negative publicity from published cases. Overall, balancing efficacy with safety remains a key priority and complications pose a threat to market expansion.

Market Opportunity- Technological Advancements in Stress Urinary Incontinence Devices Treatment Options, Such as Sling Systems and Artificial Urinary Sphincters.

The Stress Urinary Incontinence Devices market has seen considerable opportunities arise from ongoing technological advancements in treatment portfolio. Devices such as midurethral sling systems and artificial urinary sphincters have evolved significantly over the past decades. New sling designs, meshes, anchors and improved delivery systems aim to shorter surgical times and learning curves while enhancing clinical outcomes. Similarly, artificial urinary sphincters now offer enhanced designs, controls, materials and customization benefiting a wider pool of patients. Such innovations present chances for manufacturers to revitalise existing product lines as well as launch newer formats capitalising on clinical evidence. The digital revolution has also supported the development of minimally invasive and robot-assisted solutions creating revenue streams. Going forward, the arrival of bioabsorbable implants, stem-cell based therapies or neuromodulation options could totally transform the market landscape. Overall, sustained R&D on device functionality, biomaterials and delivery platforms ensures constant scope for market growth driven by superior clinical propositions.

Key winning strategies adopted by key players of Stress Urinary Incontinence Devices Market

Product Innovation: Players have focused on developing novel and improved products to treat SUI. In 2017, Boston Scientific launched the Solyx Single-Incision Sling System, an improved mid-urethral sling featuring a pre-shaped trocar tip and self-anchoring delivery system. Clinical studies found it achieved similar cure rates as traditional slings with less postoperative pain and faster recovery times. This helped Boston Scientific gain a larger market share.

Strategic Acquisitions: Companies have bolstered their SUI portfolio and capabilities through strategic M&A. In 2018, Coloplast acquired Innovatec Medical, adding their Adjustable continence therapy (ProACT) implant to treat stress, mixed and mild overactive bladder incontinence. This novel non-surgical option expanded Coloplast's treatment offerings.

Aggressive Marketing: Players devote significant resources to educate physicians and patients about SUI prevalence and available solutions through various marketing channels. Between 2014-2018, Boston Scientific and Ethicon doubled their medical sales representatives, allowing for more frequent physician engagement and faster adoption of their sling products. As a result, their combined market share grew from 35% to over 50% in that period.

Partnerships: Companies partner with surgeons to develop and validate new technologies, enhancing clinical acceptance. For example, Caldera Medical's Contour Transendermal AntiStress Urinary Incontinence Devices Implant was developed in collaboration with surgeons. Positive 5-year clinical trial results published in NEJM in 2019 led to FDA approval and rapid adoption by physicians.

This analysis highlights successful strategies like innovation, M&A, marketing investments and partnerships that have helped players gain leadership in the competitive SUI market by expanding treatment options and physician relationships. Data-backed examples provide context on the measurable business impacts of such strategies.

Segmental Analysis of Stress Urinary Incontinence Devices Market

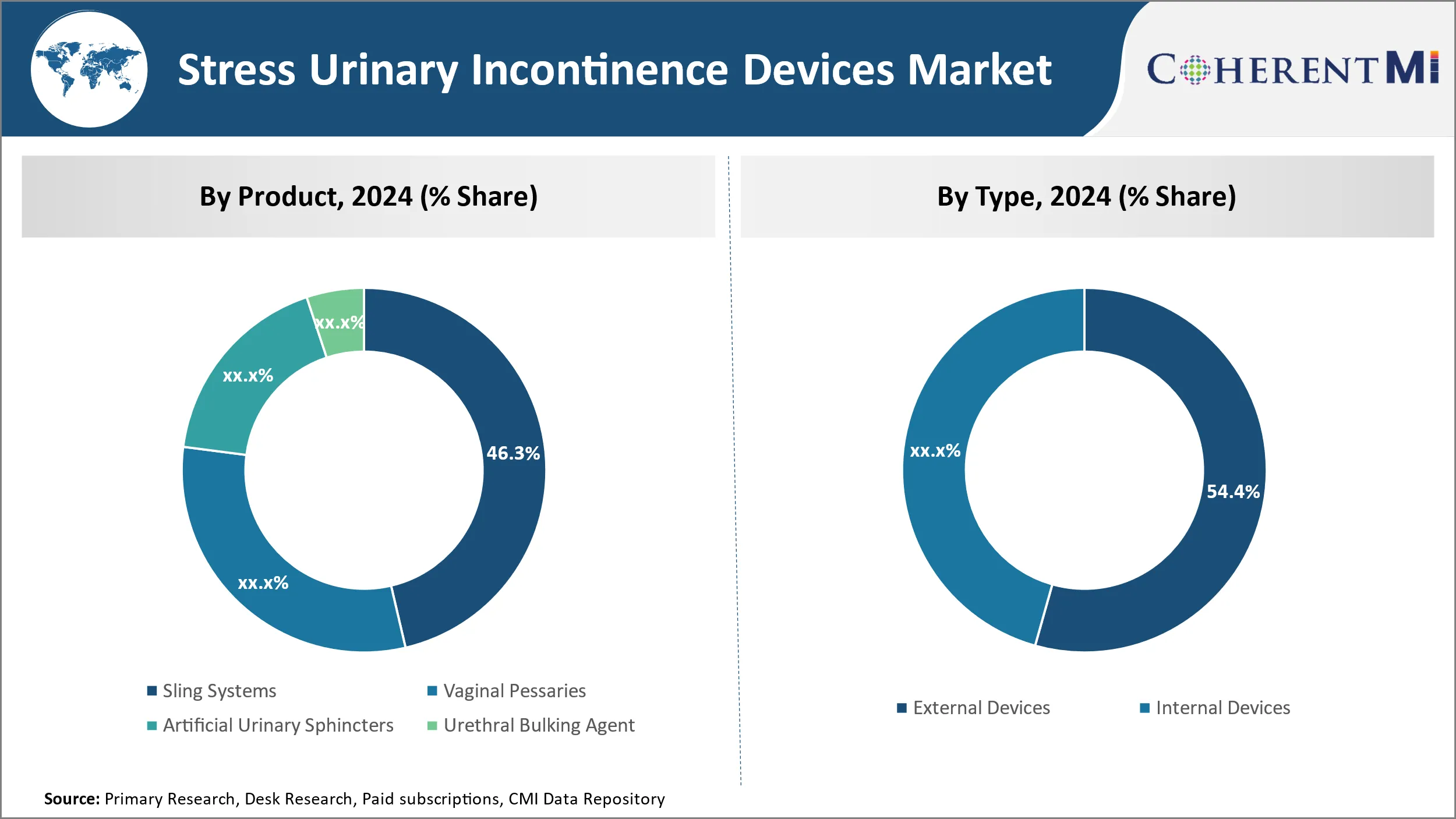

Insights, By Product, Convenience and Effectiveness Drive Sling Systems Dominance in the Forecast Period.

In terms of By Product, Sling Systems contributes the highest share of the Stress Urinary Incontinence Devices market owning to their convenience and effectiveness. Sling systems are minimally invasive procedures that do not require cutting or damaging of tissues like the vagina or urethra. This makes them appealing to both patients and physicians alike due to the reduced recovery time and risk of complications compared to alternative treatments.

Sling systems work by providing gentle, constant support to the urethra from underneath. This support lifts and improves the alignment of the urethra to help prevent accidental leaks during moments of increased abdominal pressure like coughing, sneezing, or exercise. The sling mimics the body's natural support structures and does not require ongoing adjustments once implanted. Different sling materials like synthetic mesh or patient's own tissues offer customizable options to best suit each patient's situation.

Their convenient same-day placement and quick recovery also means less time away from normal activities and work. Sling procedures are often performed on an outpatient basis which further adds to their appeal over inpatient surgeries. The minimal invasion and fast healing have helped sling systems become the standard first-line treatment recommended by doctors. Constant innovation in sling design, placement methods and mesh technologies additionally contribute to their high patient satisfaction and prevalence over alternative products.

Insights, By Type, External Devices Dominate Due to Ease. The Segment is Expected to Grow in the Forecast Period.

By type, external devices are expected to contribute the highest share 54.4% in 2024 due to their non-invasive nature and simplicity of use. External devices like absorbent pads and protective underwear are worn externally and provide on-the-go protection without the need for surgery or being permanently attached.

Compared to internal devices which often require implantation inside the body, external options avoid any risks associated with medical procedures and long-term discomfort or complications. Patients therefore tend to choose external solutions as the first line of defense, especially for mild to moderate cases. Their temporary and removable nature also means external devices provide safe recourse for those not yet ready for or wishing to avoid invasive therapies.

The convenience of simply slipping into protective garments and carrying extra pads makes external management discrete and hassle-free. This ease of use on busy daily schedules is a key driver of preference over internal devices requiring adjustment, catheterization or ongoing medical oversight. Constant product improvements have further enhanced adsorption, discretion and comfort levels of external pads, underwear and guards, solidifying their popularity.

Insights, By End-user, Hospitals Are Expected to Dominate in the Forecast Period.

By end-user, hospitals are expected to contribute the highest share of the stress urinary incontinence devices market owning to their ability to provide integrated treatment under one roof. Being medical institutions, hospitals have all the required expertise, infrastructure and technologies consolidated to handle the complete care needs of incontinence patients.

They offer multidisciplinary teams of specialists like urologists, nurses, physiotherapists and psychologists to provide comprehensive evaluation, customized treatment planning and coordinated therapy across different departments. The variety of diagnostic tests, surgical options, therapy sessions and follow-ups available at a single location provides convenience and increases compliance for patients daunted by consulting different caregivers separately.

Hospitals additionally house advanced equipment like urodynamics machines essential for accurate diagnosis and complex surgical facilities for innovative incontinence procedures. Inpatient care further aids recovery after major therapies by monitored administration of medications and intensive physiotherapy regimes difficult to consistently accomplish at home.

Centralization of world-class care attracts even complex and high-risk patients, allowing hospitals to build expertise that consolidates their leadership in Stress Urinary Incontinence Devices management. Government programs additionally channel public funding towards hospitals, strengthening their high market contribution.

Additional Insights of Stress Urinary Incontinence Devices Market

The Stress Urinary Incontinence Devices market is projected to grow significantly, driven by rising prevalence among the elderly and female populations. The increasing focus on non-invasive and minimally invasive treatments has led to the introduction of innovative products like sling systems and vaginal pessaries. Aging populations across the globe, especially women aged 41 and older, are at a higher risk of Stress Urinary Incontinence Devices due to weakened pelvic floors. Companies like Boston Scientific and Coloplast are continuously developing new technologies and devices, which are expected to gain greater market penetration. Additionally, improving reimbursement policies and heightened awareness campaigns on urinary health are enhancing the adoption of these devices. The combination of rising patient demand, ongoing product innovations, and supportive regulatory environments positions this market for steady growth over the next decade. However, challenges such as limited awareness in certain regions and postoperative complications may hinder broader adoption.

Competitive overview of Stress Urinary Incontinence Devices Market

The major players operating in the Stress Urinary Incontinence Devices Market include Boston Scientific Corporation, AscentX Medical Inc., Coloplast Corporation, Becton, Dickinson and Company, ConvaTec Group PLC, Ethicon US, LLC (Johnson & Johnson), Cook Medical Inc., Teleflex Incorporated, Caldera Medical Inc., Prosurg, Inc., Laborie and InControl Medical.

Stress Urinary Incontinence Devices Market Leaders

- Boston Scientific Corporation

- AscentX Medical Inc.

- Coloplast Corporation

- Becton, Dickinson and Company

- ConvaTec Group PLC

Stress Urinary Incontinence Devices Market - Competitive Rivalry, 2024

Stress Urinary Incontinence Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Stress Urinary Incontinence Devices Market Segmentation

- By Product

- Sling Systems

- Vaginal Pessaries

- Artificial Urinary Sphincters

- Urethral Bulking Agent

- By Type

- External Devices

- Internal Devices

- By End-User

- Hospitals

- Ambulatory Centers

- Specialty Clinics

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Stress Urinary Incontinence Devices Market?

The Global Stress Urinary Incontinence Devices Market is estimated to be valued at USD 780.1 Mn in 2024 and is expected to reach USD 1130.3 Mn by 2031.

What will be the CAGR of the Stress Urinary Incontinence Devices Market?

The CAGR of the Stress Urinary Incontinence Devices Market is projected to be 6.9% from 2024 to 2031.

What are the major factors driving the Stress Urinary Incontinence Devices Market growth?

The growing prevalence of urinary incontinence among women and the aging population prone to Stress Urinary Incontinence Devices. and increased development of innovative devices addressing Stress Urinary Incontinence Devices. are the major factor driving the Stress Urinary Incontinence Devices Market.

What are the key factors hampering the growth of the Stress Urinary Incontinence Devices Market?

The postoperative complications associated with the use of stress urinary incontinence devices and lack of awareness among patients about available treatments and devices. These are the major factor hampering the growth of the Stress Urinary Incontinence Devices Market.

Which is the leading Product in the Stress Urinary Incontinence Devices Market?

Sling systems are the leading Product segments.

Which are the major players operating in the Stress Urinary Incontinence Devices Market?

Boston Scientific Corporation, AscentX Medical Inc., Coloplast Corporation, Becton, Dickinson and Company, ConvaTec Group PLC, Ethicon US, LLC (Johnson & Johnson), Cook Medical Inc., Teleflex Incorporated, Caldera Medical Inc., Prosurg, Inc., Laborie, InControl Medical are the major players.