Surgical Energy Generators Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Surgical Energy Generators Market is segmented By Product Type (Monopolar Generators, Bipolar Generators, Combination Generators), By Application (Car....

Surgical Energy Generators Market Size

Market Size in USD Mn

CAGR4.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.9% |

| Market Concentration | Low |

| Major Players | Medtronic, Olympus, CONMED Corporation, Symmetry Surgical Inc., Applied Medical Resources Corporation and Among Others. |

please let us know !

Surgical Energy Generators Market Analysis

The Global Surgical Energy Generators Market is estimated to be valued at USD 490.1 million in 2024 and is expected to reach USD 735.6 million by 2031, growing at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2031.

The market has been witnessing steady growth over the past few years driven by increasing surgical procedures globally and rise in demand for minimally invasive surgeries. Advancements in electrosurgical products with newer technologies such as bipolar, monopolar and ultrasonic generators are expanding the scope of surgeries that can be performed. Rise in chronic diseases and disorders necessitating surgical care along with aging population has resulted in higher number of surgical procedures. Preference for surgical energy generators over conventional electrosurgical cut/coagulation device is expected to continue supporting market growth. Manufacturers are investing in emerging markets to leverage opportunities for higher revenues. However, lengthy approval process and greater influx of affordable generics once patents expire may hamper market growth to some extent over the forecast period.

Surgical Energy Generators Market Trends

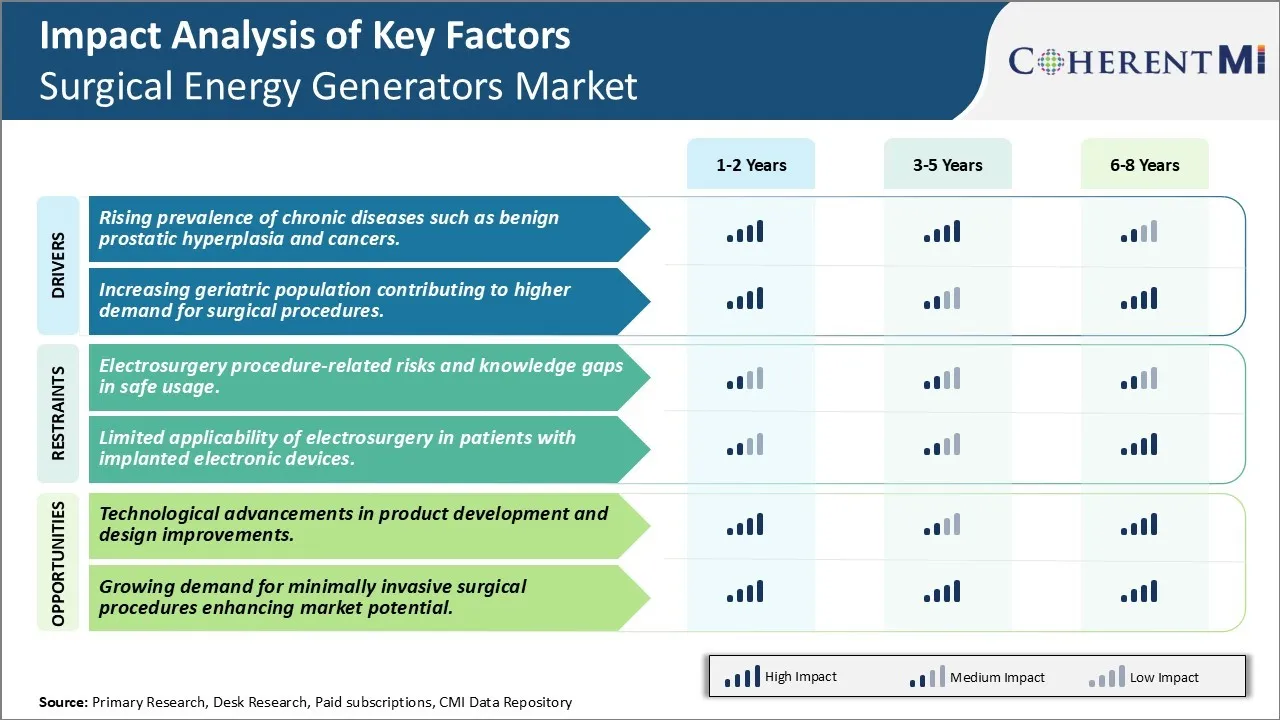

Market Driver - Rising Prevalence of Chronic Diseases Such as Benign Prostatic Hyperplasia and Cancers.

The growing occurrence of chronic illnesses around the world has significantly contributed to the demand for surgical energy generators. According to the latest WHO estimates, chronic diseases are responsible for nearly 71% of all deaths globally each year, with cancer being a leading cause. Chronic health conditions like benign prostatic hyperplasia also known as BPH is highly common in aging men. BPH often requires surgical procedures like a transurethral resection of the prostate or TURP surgery to remove enlarged prostate tissue blocking the urethra. TURP surgery utilizes specialized electrosurgical generators and tools for precisely cutting and coagulating prostate tissue.

The rising incidences of cancer worldwide is another important factor driving the adoption of surgical energy systems. Multiple cancer types including prostate, lung and colorectal cancer have high cancer mortality rates. This has led to an increase in surgical oncology procedures where electrosurgical generators play a vital role in tissue ablation and hemostasis. Moreover, prostate cancer rates are rising sharply in developing nations with growing aging demographics. This has translated into considerable demand for advanced energy devices across urology departments. The growing economic costs and disease burden of chronic illnesses is prompting healthcare systems to focus more on early cancer detection through screening as well as minimally invasive surgical therapies. This is positively impacting the sales of modern surgical generator equipment with enhanced accuracy, safety and usability profiles.

Market Driver - Increasing Geriatric Population Contributing to Higher Demand for Surgical Procedures

The rapid expansion of the elderly population globally presents substantial opportunities for surgical energy generators. As per UN estimates, the number of individuals aged 65 years and above is projected to more than double by 2050, reaching nearly 1.5 billion. Aging brings an increased risk for multiple chronic health issues as well as an overall decline in organ functions and tissue healing capacity. This means the geriatric demographic is more susceptible to conditions requiring surgical interventions. Procedures within urology, gynaecology and general surgery are regularly performed on older patients for issues like urinary incontinence, hernias and carcinomas. Surgical technologies allowing minimally invasive therapies are highly preferable for the elderly considering the associated benefits of less pain, scarring and quicker recovery times. Electrosurgical generators are dependable tools enabling precise dissection and homeostasis through advanced energy modalities. Their ability to perform targeted tissue ablation under direct visualization makes them suitable for procedures involving fragile or complicated anatomy in geriatric patients. Additionally, many government health programs are working to expand access to elective surgical procedures for age-related conditions in light of the fast-growing senior population worldwide. This development is expected to boost uptake of automated energy systems in hospitals and ambulatory care centres. Moreover, surgical innovation including bipolar and ultrasonic devices catering specifically to the needs of elderly patients will drive further adoption of these advanced energy generators.

Market Challenge - Electrosurgery Procedure-Related Risks and Knowledge Gaps in Safe Usage.

One of the key challenges faced by the surgical energy generators market is the risks associated with electrosurgery procedures and existing knowledge gaps regarding their safe clinical usage. Electrosurgery relies on the generation of heat through the application of high-frequency electrical currents to cut, coagulate, desiccate, or fulgurate tissue. However, this process can inadvertently cause thermal injury to adjacent healthy tissues if not performed prudently. There have also been reports of direct organ injury and other complications arising from electrosurgical device malfunctions. Procedural risks are further amplified in complex surgeries where visibility may be compromised. While training programs do exist, there remains a lack of standardized competency requirements and certification pathways across different geographies and medical specialties. Device manufacturers still have scope to enhance the usability and safety of their products through additional design safeguards and user-friendly interfaces. Comprehensive and repeated skills training coupled with improved regulation could help address existing gaps and mitigate risks to optimize clinical outcomes.

Market Opportunity: Technological Advancements in Product Development and Design Improvements.

The surgical energy generators market presents significant opportunities for players who invest in continuous technological innovation and product enhancements. Advancements in electrosurgical technology such as advanced bipolar modes, simultaneous cutting and sealing capabilities, intuitive user interfaces and device automation have the potential to improve surgical efficiencies while minimizing procedural risks. Miniaturization of device components allows for specialized electrosurgical tools suitable for minimally invasive procedures. The incorporation of robotics, artificial intelligence, and augmented reality into next-generation electrosurgical platforms could transform surgical workflows.

Design improvements including enhanced insulation, automated safety features and sensor technologies also help expand the clinical applications of existing devices. With rising demand for less invasive procedures, newer product categories such as ultrasonic, plasma-based and laser surgical systems also present lucrative prospects. Technology leaders who deliver differentiated solutions focused on safety, ease-of-use and clinical value addition stand to capture greater market share in the future.

Key winning strategies adopted by key players of Surgical Energy Generators Market

Focus on Product Innovation: Companies like Medtronic, Olympus, and Johnson & Johnson have successfully introduced innovative new surgical energy generators over the past five years that have enhanced surgical capabilities. For example, in 2021 Medtronic launched the Mini-Fragmentation System that utilizes innovative PlasmaKnife technology for precise soft tissue dissection with minimal thermal damage. This allowed the company to gain a competitive edge and capture additional market share.

Strategic Acquisitions: Many large players have strengthened their portfolio and market position through strategic acquisitions of emerging companies developing new energy technologies. For example, in 2019 Ethicon (part of Johnson & Johnson Medical Devices) acquired Megadyne Medical, adding the company's electrosurgical tools and generators to its existing offering. This expanded Ethicon's product range and capabilities in this high-growth segment.

Expanding Into New Applications and Specialties: Leveraging their core competencies in energy-based devices, leaders like Olympus and Boston Scientific have strategically expanded into new medical specialties like urology, gynecology and orthopedics that increasingly utilize advanced energy technologies. This helped drive additional procedure volume and revenues from existing surgeon customers as well as capture share from competitors with narrower portfolios.

Focus on Emerging Markets: With mature markets in North America and Western Europe near saturation, companies have invested aggressively in developing economies that are expected to be major growth drivers. For example, Johnson & Johnson opened five new manufacturing plants in India and China near key hospital clusters in the last decade. This helped the company tap into the fast-growing energy device demand from these regions ahead of competition.

These are some successful strategies backed by real world examples that have helped top players in surgical energy generators gain competitive advantage and increase their market share over the past 5-7 years.

Segmental Analysis of Surgical Energy Generators Market

Insights, By Product Type, Adoption of Minimally Invasive Surgeries Drives Growth of Monopolar Generators.

By Product Type, monopolar generators contribute the highest share at 37.60% in 2024 owing to their high versatility and extensive usage in minimally invasive surgeries. Monopolar generators are compatible with monopolar electrosurgical instruments that allow focused energy delivery to tissues. They find widespread application in laparoscopic and endoscopic procedures due to advantages such as precision cutting and ability to seal and divide blood vessels. The increasing preference for minimally invasive surgeries over traditional open surgeries can be attributed to benefits such as smaller incisions, reduced postoperative pain and complications, shorter hospital stay, and faster recovery times. With growing prominence of laparoscopy in many surgical specialties including bariatrics, gynecology and urology, demand for monopolar generators is expected to rise substantially.

Insights, By Application, Rising Cardiology Cases Boost Cardiology Segment.

By Application, the cardiology segment holds the highest share at 25.70% in 2024 due to growing incidence of cardiovascular diseases globally. According to WHO, these diseases are the number one cause of death across the world. Surgical energy generators find widespread application in various cardiac surgeries and procedures including coronary artery bypass grafting, valve repair/replacement, cardiac ablation, and treatment of arrhythmias. Factors such as rising prevalence of atherosclerosis, hypertension, diabetes and obesity are contributing to the increasing cardiac caseload. Coupled with technological advancements in cardiac ablation and catheter-based surgeries, this is creating high demand for surgical energy generators to deliver precise therapeutic energy for cardiac tissue dissection and hemostasis.

Insights, By End-user, Concentrated Surgical Procedures Drive Hospital Adoption.

In terms of By End User, the hospital segment holds the highest share in the surgical energy generators market owing to concentration of surgical procedures in hospitals. The majority of complex surgeries requiring specialized energy devices are carried out in hospitals which are equipped with advanced healthcare infrastructure and skilled surgeons. Hospitals also treat the highest volume of patients undergoing surgery for both elective and emergency conditions. Moreover, availability of favorable reimbursement policies for hospital-based surgical treatments compared to ambulatory surgical centers influences patient visits to hospitals. With increasing healthcare burden, more number of hospitals are stocking advanced energy generators to enable a wide range of general surgical procedures with greater efficiency and safety. This steadily drives the growth of the hospital end user segment.

Additional Insights of Surgical Energy Generators Market

The surgical energy generators market is projected to grow steadily due to the increasing prevalence of chronic diseases and the rising geriatric population. Electrosurgery, which utilizes high-frequency electrical currents to cut or coagulate tissue, is commonly employed in various surgical procedures such as cardiology, gynecology, and orthopedic surgeries. The market's growth is supported by technological advancements that improve the efficiency and safety of these devices. However, challenges such as risks associated with electrosurgery procedures and knowledge gaps in the safe use of energy-based devices may hinder market expansion. The presence of well-established healthcare infrastructure, especially in North America, and supportive reimbursement programs further bolster the market outlook. The acquisition of key companies and new product launches are expected to play a pivotal role in shaping the competitive landscape, driving growth during the forecast period.

Competitive overview of Surgical Energy Generators Market

The major players operating in the Surgical Energy Generators Market include Medtronic, Olympus, CONMED Corporation, Symmetry Surgical Inc., Applied Medical Resources Corporation, ERBE GmbH, Kirwan Surgical Products, LLC, KARL STORZ GmbH, Sutter Medizintechnik GmbH, Johnson & Johnson Medical N.V., STARmed Co., Ltd., CooperSurgical, Inc., MEDGYN PRODUCTS, INC, Stryker, Boston Scientific Corporation, Bramsys, RF Medical Co., Ltd., OSYPKA AG, Avanos Medical, Inc. and AngioDynamics.

Surgical Energy Generators Market Leaders

- Medtronic

- Olympus

- CONMED Corporation

- Symmetry Surgical Inc.

- Applied Medical Resources Corporation

Surgical Energy Generators Market - Competitive Rivalry, 2024

Surgical Energy Generators Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Surgical Energy Generators Market

In October 2021: Boston Scientific Corporation acquired Baylis Medical Company Inc, enhancing its electrophysiology and structural heart portfolio.

Surgical Energy Generators Market Segmentation

- By Product Type

- Monopolar Generators

- Bipolar Generators

- Combination Generators

- By Application

- Cardiology

- Gynecology

- ENT

- Bariatric

- Orthopedic

- By End User

- Hospitals

- Specialty Clinics

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Surgical Energy Generators Market?

The Global Surgical Energy Generators Market is estimated to be valued at USD 490.1 million in 2024 and is expected to reach USD 735.6 million by 2031.

What will be the CAGR of the Surgical Energy Generators Market?

The CAGR of the Surgical Energy Generators Market is projected to be 4.9% from 2024-2031.

What are the major factors driving the Surgical Energy Generators Market growth?

The rising prevalence of chronic diseases such as benign prostatic hyperplasia and cancers and increasing geriatric population contributing to higher demand for surgical procedures are the major factor driving the Surgical Energy Generators Market.

What are the key factors hampering the growth of the Surgical Energy Generators Market?

The electrosurgery procedure-related risks and knowledge gaps in safe usage and limited applicability of electrosurgery in patients with implanted electronic devices are the major factor hampering the growth of the Surgical Energy Generators Market.

Which is the leading Product Type in the Surgical Energy Generators Market?

Monopolar Generators leads the product segment.

Which are the major players operating in the Surgical Energy Generators Market?

Medtronic, Olympus, CONMED Corporation, Symmetry Surgical Inc., Applied Medical Resources Corporation, ERBE GmbH, Kirwan Surgical Products, LLC, KARL STORZ GmbH, Sutter Medizintechnik GmbH, Johnson & Johnson Medical N.V., STARmed Co., Ltd., CooperSurgical, Inc., MEDGYN PRODUCTS, INC, Stryker, Boston Scientific Corporation, Bramsys, RF Medical Co., Ltd., OSYPKA AG, Avanos Medical, Inc., AngioDynamics are the major players.