Surgical Mask and Respirator Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Surgical Mask and Respirator Market is segmented By Type of Surgical Mask (Basic Surgical Mask, Anti-Fog Surgical Mask, Fluid/Splash Resistant Surgica....

Surgical Mask and Respirator Market Size

Market Size in USD Bn

CAGR3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3% |

| Market Concentration | Low |

| Major Players | 3M, Honeywell International Inc., Moldex-Metric, Medline Industries Inc., Ambu A/S and Among Others |

please let us know !

Surgical Mask and Respirator Market Analysis

The Global Surgical Mask & Respirator Market is estimated to be valued at USD 9.2 Bn in 2024 and is expected to reach USD 11.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3% from 2024 to 2031. Propelled by increasing awareness regarding airborne diseases and the need for personal protection, the surgical mask and respirator market is projected to showcase substantial growth over the forecast period.

The COVID-19 pandemic has been a significant driver for the market as it increased the demand for respiratory protective equipment across the world. The pandemic boosted awareness about the role of masks in preventing airborne disease transmission. As a result, mask usage is likely to continue post the pandemic due to changed consumer behavior and work practices that emphasize personal protection. This sustained demand will aid the market in maintaining its growth trajectory over the next few years.

Surgical Mask and Respirator Market Trends

Market Driver - Increasing Number of Surgeries Due to The Prevalence of Chronic Disorders.

The number of surgeries performed globally has witnessed a steady rise over the past few decades. One of the key factors driving the growth in surgical procedures is the rising prevalence of chronic disorders across both developed and developing nations. Today, chronic diseases such as cancer, cardiovascular disorders, respiratory diseases, and diabetes have become the leading causes of mortality and disability-adjusted life years lost worldwide. Surgery almost always forms an integral part of treatment regimens for managing many late-stage chronic conditions or life-threatening complications arising from them. For instance, as per estimates, over 40% of cancer patients require some form of surgical intervention either to extract the malignant tumor or to relieve symptoms. Similarly, coronary artery bypass grafting and other open-heart surgeries have become common procedures to treat various cardiac ailments.

The growing burden of chronic disorders can be attributed to both lifestyle and demographic changes that have occurred globally. Developed countries now have aging populations with more citizens living longer. An aged body is more susceptible to various degenerative conditions. At the same time, developing economies are experiencing epidemiological transitions wherein communicable diseases are being replaced by non-communicable ones linked to urbanization and rising income levels. This has led to a surge in risk factors like smoking, physical inactivity, and consumption of energy-dense foods - all of which are major drivers of chronic diseases. Additionally, medical advances have improved the diagnosis and management of such long-term health issues, enabling patients to undergo aggressive treatment protocols involving extended hospitalization and frequent surgical interventions.

All of these factors combined have significantly driven up healthcare utilization rates. More patients are now undergoing major as well as minimally invasive surgical procedures annually across both inpatient and outpatient hospital settings worldwide.

Market Driver - Rising Demand for Protective Equipment Post-pandemic and Increasing Cases of Airborne Diseases.

The COVID-19 pandemic has brought the importance of protective equipment like surgical masks and respirators to the forefront on a global scale. As the SARS-CoV-2 virus that causes the disease spreads through airborne droplets and aerosols, healthcare workers treating infected patients require reliable facial protection. While N95 respirators offer more robust protection against tiny infectious particles compared to basic surgical masks, both found remarkably increased uptake amid the public health crisis. Post the pandemic, demand for such protective gear is expected to remain elevated owing to greater awareness about their utility in limiting the transmission of respiratory illnesses. People are also likely to stock up on masks as a precautionary measure in case future outbreaks occur.

Moreover, cases of airborne diseases have been increasing worldwide over the past few decades due to various factors including rapid urbanization, global travel, climate change, and antimicrobial resistance. Diseases like influenza, tuberculosis, pneumonia, and meningitis spread through the airborne route. The World Health Organization (WHO) estimates that respiratory infections account for over 4 million annual deaths globally, with many cases being infectious in nature. Growing incidence of airborne illnesses will require more vigilant use of facial masks and respirators in healthcare settings as a standard protocol for protecting patients as well as providers from cross-contamination. Their demand is also expected to surge during seasonal flu outbreaks.

Market Challenge - Highly Competitive Pricing of Surgical Masks and Respirators and Their Raw Materials.

The surgical mask and respirator market has become increasingly competitive over the past few years due to rising number of players in the market. Players are focusing on reducing the costs related to raw materials and manufacturing in order to offer highly competitive prices and gain market share. This has significantly reduced profit margins for companies. Raw material costs, especially for materials like non-woven fabric, have witnessed fluctuations over the past year. Additionally, countries like China dominate global supply for these materials and any shortages or supply issues can significantly impact input costs. Similarly, labor costs are also declining in key manufacturing countries which has intensified price wars between players. Established brands now have to deal with low-cost private label products further pressurizing realizations. The average selling price of surgical masks and respirators has declined by nearly 15-20% in the last 5 years. Maintaining a cost leadership position while investing in quality, compliance and customer service is a major challenge for players.

Market Opportunity - Increasing Awareness of Infection Control Measures and the Need for Protective Equipment.

There is growing awareness among the general public, healthcare professionals as well as organizations about the need for proper infection control practices and use of protective equipment. The threats of infectious diseases and epidemics have been on the rise globally with newer pathogens emerging frequently. This has brought the topics of hygiene, hand washing, appropriate use of PPE like masks and respirators to the mainstream. High profile disease outbreaks like H1N1, Ebola, and the ongoing Covid-19 pandemic have further highlighted the role of protective masks and breathing equipment in curbing the spread. Healthcare facilities and institutions are more cognizant about strong sanitation protocols and mandated usage of protective gear. Individuals too have become more safety conscious recognizing masks as indispensable when visiting hospitals or in areas with high disease activity. The increased attention on infection control practices is driving higher sales and demand for surgical masks as well as respirators across consumer and institutional segments.

Key winning strategies adopted by key players of Surgical Mask and Respirator Market

Increasing Manufacturing Capacity: When the COVID-19 pandemic hit in early 2020, there was a severe shortage of masks globally as demand surged exponentially. Major players like 3M, Honeywell, and Kimberly-Clark ramped up their manufacturing operations significantly. 3M doubled their global N95 production to nearly 100 million mask per month within a few months. This allowed them to meet the immense demand and secure bigger market shares.

Leveraging E-commerce Channels: Players like Amazon, Walmart partnered with mask manufacturers to supply masks directly to consumers through their robust online platforms. This helped address distribution challenges. Amazon reported mask sales growing by over 500% during the early months of the pandemic. Leveraging existing online customers and supply chains worked as a big winning strategy.

Launching New Technologies: In late 2020, Honeywell launched the N95 mask with ScanSafe technology - a filter that changes colors when it needs to be replaced. This won them large government and hospital contracts as it simplified compliance. Their medical mask sales jumped over 35% in the last quarter of 2020 alone due to this new product.

Aggressive Marketing: Kimberly Clark launched a massive multi-million-dollar branding and marketing campaign across digital, print and television media through 2020-2021 promoting their Kleenex and Scott masks. Increased brand awareness led to their consumer sales growing 45% during the period despite stiff competition.

These examples show how players adopted strategies like capacity expansion, e-commerce integration, new product launches and increased promotions to address gaps, secure bigger market shares and maximize profits.

Segmental Analysis of Surgical Mask and Respirator Market

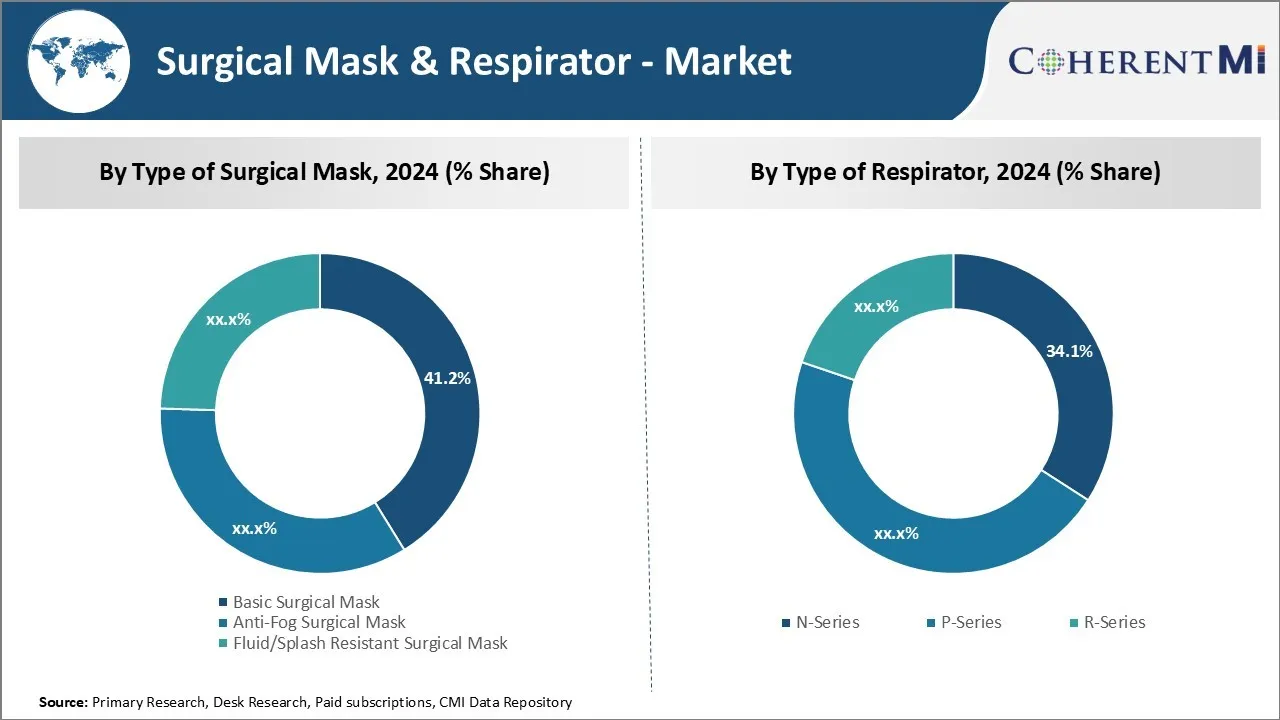

Insights, By Type of Surgical Mask, Convenience and Low-cost Drive Basic Surgical Masks Demand.

By Type of Surgical Mask, Basic Surgical Mask contributes the highest share at 41.20% in 2024 owing to its convenience and low cost. Basic surgical masks are simple, loose-fitting disposable masks that provide a physical barrier between infectious respiratory secretions and the wearer or to individuals near the mask wearer. Their minimal design allows for easy and affordable production while still serving the main purpose of blocking droplets. As the most basic option available, basic surgical masks are valued for how practical they are both for medical staff and general public use. Their light build makes them comfortable to wear for long periods without irritating skin or requiring much adjustment. Hospitals and clinics also prefer basic surgical masks as they are inexpensive and enable cost-effective infection control. With hygiene and safety top priorities during the ongoing pandemic, basic surgical masks have seen increasing demand as a go-to solution for casual public use.

Insights, By Type of Respirator, Respirators Rely on Higher Protection Performance.

In terms of By Type of Respirator, N-Series contributes the highest share 34.10% in 2024 due to its ability to provide a higher level of respiratory protection. Respirators aim to filter out airborne particles with greater efficiency than basic masks through specialized filter mediums. N-Series respirators, also called N95 masks, filter at least 95% of airborne particles when worn properly. They form a more sealed fit around the nose and mouth through an attached headband and flexible sealing material around the respirator edge. This tight-fitting design allows N95 respirators to block out smaller particulate matter compared to loose-fitting surgical masks. Occupations with higher exposure risks like healthcare, construction, and firefighting tend to require N95 respirators as part of safety protocol. Industries also prefer N95 masks for enhanced employee protection in hazardous environments. As a respiratory protective device, N95 respirators are built to a National Institute for Occupational Safety and Health standard to defend against specific airborne threats.

Insights, By Usability Type, Disposable Surgical Masks Enable One-Time Hygienic Use.

In terms of By Usability Type, Disposable Surgical Masks contribute the highest share of the market due to enabling more hygienic single-use. Disposable masks are intended to be discarded after each patient interaction or use to avoid cross-contamination. Their light material construction makes disposal simple without heavy waste. As touched upon earlier, basic and N95 surgical masks largely come in disposable form for easy infection control. The one-time nature of disposable masks helps limit exposure risks versus reusable alternatives that require cleaning between each use. Proper disposal also stops contamination spread if a used mask were to come into contact with surfaces after being worn. Disposable masks facilitate adherence to hygiene protocols within medical facilities and general public settings. As a more precautionary option, their affordability has improved widespread accessibility which remains vital during viral pandemics requiring protective measures by the masses. The clinical sensibility of disposing after every use positions disposables as a preferred usability type.

Additional Insights of Surgical Mask and Respirator Market

The surgical mask and respirator market is experiencing sustained growth driven by increasing surgical procedures, rising cases of airborne and respiratory disorders, and heightened awareness of protective measures post-pandemic. The market dynamics are significantly influenced by the COVID-19 pandemic, which underscored the critical need for effective respiratory protection in healthcare and industrial settings. The market's expansion is further propelled by technological innovations, new product approvals, and the growing use of protective gear among the general population. However, the market faces challenges related to competitive pricing and supply chain disruptions, particularly during the initial phases of the pandemic. Despite these challenges, the market's outlook remains positive, with significant opportunities for growth, especially in regions like North America where high awareness and advanced healthcare infrastructure support increased demand.

Competitive overview of Surgical Mask and Respirator Market

The major players operating in the Surgical Mask & Respirator Market include 3M, Honeywell International Inc., Moldex-Metric, Medline Industries Inc., Ambu A/S, Kwalitex Healthcare Pvt Ltd, Cartel Healthcare Pvt. Ltd., Magnum Health And Safety Pvt. Ltd, Mediblue Healthcare Private Limited, Plasti Surge Industries Pvt. Ltd, Premium Health Care Disposables Private Limited, Thea-Tex Healthcare (India) Pvt. Ltd, ALPHAPROTECH, Teleflex Incorporated, Detmold Group, uvex group, MSA, RZ Industries, Makrite and SHIGEMATSU WORKS CO., LTD..

Surgical Mask and Respirator Market Leaders

- 3M

- Honeywell International Inc.

- Moldex-Metric

- Medline Industries Inc.

- Ambu A/S

Surgical Mask and Respirator Market - Competitive Rivalry

Surgical Mask and Respirator Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Surgical Mask and Respirator Market

- March 2020: Honeywell International Inc expanded production capacity for N95 masks at a new operation in Phoenix in response to government demand during the COVID-19 pandemic.

- August 2020: Cardinal Health, in collaboration with ClearMask, introduced the world’s first fully transparent surgical mask approved by FDA, enhancing communication during surgical procedures.

Surgical Mask and Respirator Market Segmentation

- By Type of Surgical Mask

- Basic Surgical Mask

- Anti-Fog Surgical Mask

- Fluid/Splash Resistant Surgical Mask

- By Type of Respirator

- N-Series

- P-Series

- R-Series

- By Usability Type

- Disposable

- Reusable

- By Distribution Channel

- Hospital & Clinic Pharmacy

- E-commerce

- Others

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How Big is the Surgical Mask & Respirator Market?

The Global Surgical Mask & Respirator Market is estimated to be valued at USD 9.2 Bn in 2024 and is expected to reach USD 11.3 Bn by 2031.

What are the key factors hampering the growth of the Surgical Mask & Respirator Market?

The highly competitive pricing of surgical masks and respirators and their raw materials and supply chain disruptions during initial COVID-19 lockdown period affected availability and pricing are the major factor hampering the growth of the Surgical Mask & Respirator Market.

What are the major factors driving the Surgical Mask & Respirator Market growth?

The increasing number of surgeries due to the prevalence of chronic disorders and rising demand for protective equipment post-pandemic and increasing cases of airborne diseases are the major factor driving the Surgical Mask & Respirator Market.

Which is the leading Type of Surgical Mask in the Surgical Mask & Respirator Market?

Basic surgical mask is the leading type.

Which are the major players operating in the Surgical Mask & Respirator Market?

3M, Honeywell International Inc., Moldex-Metric, Medline Industries Inc., Ambu A/S, Kwalitex Healthcare Pvt Ltd, Cartel Healthcare Pvt. Ltd., Magnum Health and Safety Pvt. Ltd, Mediblue Healthcare Private Limited, Plasti Surge Industries Pvt. Ltd, Premium Health Care Disposables Private Limited, Thea-Tex Healthcare (India) Pvt. Ltd, ALPHAPROTECH, Teleflex Incorporated, Detmold Group, uvex group, MSA, RZ Industries, Makrite, SHIGEMATSU WORKS CO., LTD. are the major players.

What will be the CAGR of the Surgical Mask & Respirator Market?

The CAGR of the Surgical Mask & Respirator Market is projected to be 3% from 2024-2031.