Urinary Tract Obstruction Treatment Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Urinary Tract Obstruction Treatment Devices Market is segmented By Product Type (Urinary Catheters, Urinary Stents, Shock , Wave Lithotripters, Ureter....

Urinary Tract Obstruction Treatment Devices Market Size

Market Size in USD Bn

CAGR5.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.2% |

| Market Concentration | Low |

| Major Players | B. Braun Melsungen AG, Boston Scientific Corporation, Cook Medical, Becton, Dickinson, and Company, Teleflex Incorporated and Among Others. |

please let us know !

Urinary Tract Obstruction Treatment Devices Market Analysis

The Global Urinary Tract Obstruction Treatment Devices Market is estimated to be valued at USD 1.41 billion in 2024 and is expected to reach USD 2.03 billion by 2031, growing at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2031. The aging global population that is more susceptible to urinary diseases and disorders along with the rising prevalence of prostate cancer, kidney stones and other urinary conditions are major factors driving the demand for these devices.

The market is also witnessing increased adoption of minimally invasive procedures over conventional surgery due to the benefits of minimal incision, reduced risk of infection, lesser complications, faster recovery and reduced hospital stay. Additionally, the development of advanced devices such as ureteral stents, ureterorenoscopes and stone baskets for effective removal of urinary tract obstructions is expected to provide new opportunities for market players. Growing healthcare expenditure and improved access to healthcare services in developing economies will further aid the growth of this market over the forecast period.

Urinary Tract Obstruction Treatment Devices Market Trends

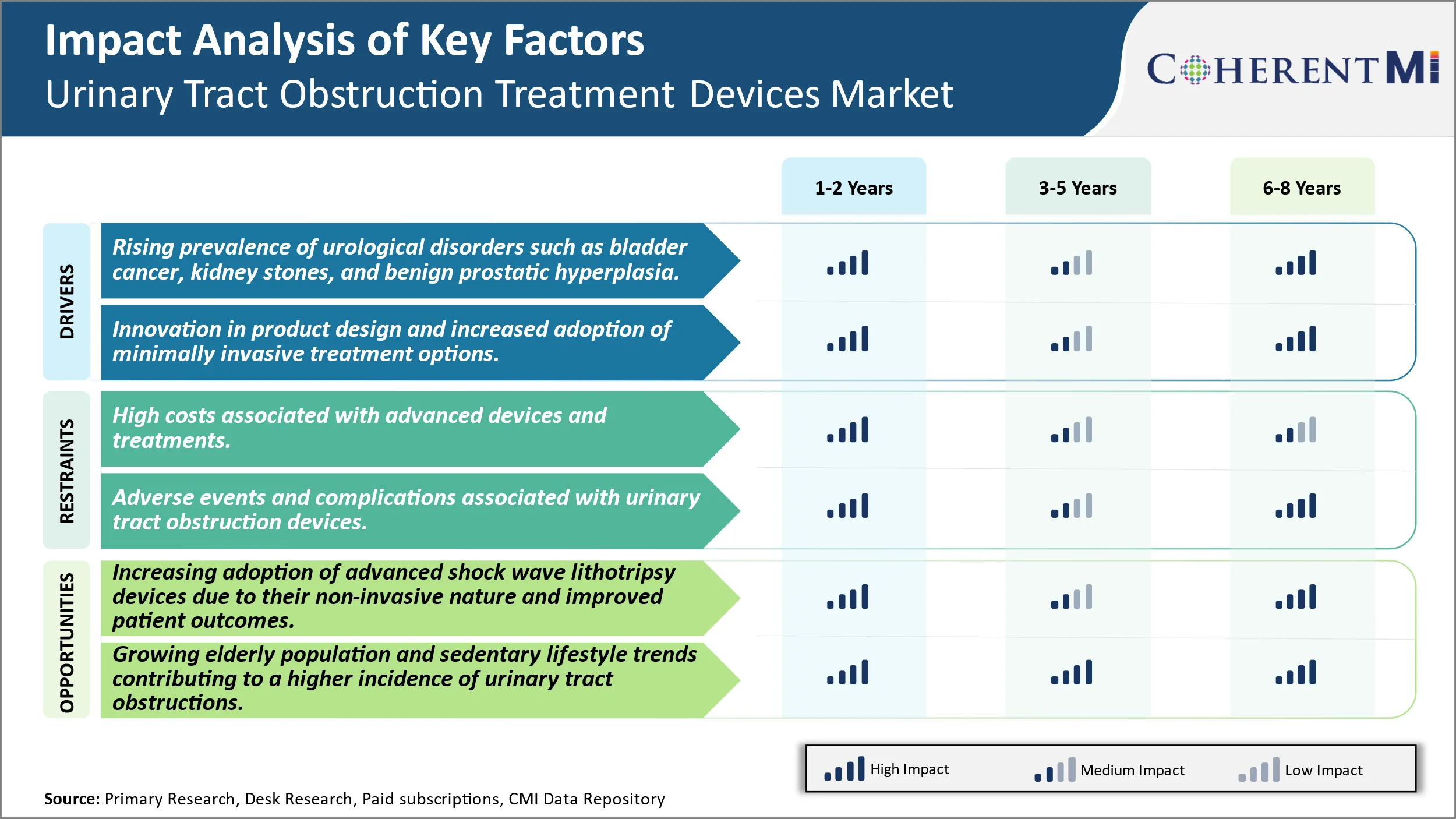

Market Driver - Rising Prevalence of Urological Disorders Such as Bladder Cancer, Kidney Stones, and Benign Prostatic Hyperplasia.

There has been rising prevalence of various urological disorders such as bladder cancer, kidney stones, and benign prostatic hyperplasia. Bladder cancer is one of the most common cancers, with high recurrence rates. According to some studies, the global incidence of bladder cancer is projected to rise by 11% in the next decade. Similarly, the prevalence of kidney stones is also increasing worldwide mainly due to changing dietary habits, lifestyle factors and growing prevalence of obesity and metabolic disorders. However, benign prostatic hyperplasia (BPH) remains the most common prostate problem in aging males, especially in developed countries with rising geriatric population. As men age, the prostate may continue to grow in size and can irritate the bladder and urethra causing various lower urinary tract symptoms. With an increasing emphasis on early diagnosis and management of these disorders, the use of urinary tract obstruction treatment devices is likely to gain widespread adoption. These devices help in removing obstructions in the urinary tract, thus improving urine flow and relieving symptoms. If left untreated, these obstructions can cause several other complications and deteriorate the quality of life. Various minimally-invasive procedures using devices are now the standard of care for managing bladder outlet obstruction and upper tract obstructions.

Market Driver - Innovation in Product Design Encourages Market Growth in the Forecast Period.

Over the past few years, there have been major advancements in the design of urinary tract obstruction treatment devices with an increasing focus on patient comfort and experience. Companies are continuously innovating and introducing less invasive devices with improved efficacy. For instance, new laser technologies, resection techniques and altered designs of ureteral stents and nephrostomy catheters have allowed interventions as outpatient procedures with quicker recovery times. Similarly, various modified TURP (transurethral resection of the prostate) devices now use advanced laser, water vapor or other energy sources instead of traditional electrosurgery. This enables targeted removal of prostatic tissue with reduced risks of complications such as bleeding. Likewise, newer lithotripters and navigate systems have streamlined the treatment processes for kidney stone management. Miniaturization of equipment size has also facilitated office-based procedures. With positive clinical outcomes, reduced hospital stays and faster return to normal activities, these new minimally-invasive options are gaining widespread popularity among both patients and physicians. Overall, innovations expanding the range of treatment choices while improving safety, efficacy and experience are likely to drive the future demand for cutting-edge urinary tract obstruction treatment devices.

Market Challenge - High Costs Associated with Advanced Devices and Treatments.

The urinary tract obstruction treatment devices market face significant challenges due to the high costs associated with advanced treatment options. Devices used for complex urinary tract obstruction treatments such as ureterorenoscopes, lithotripsy devices, and baskets and forceps require substantial capital investment, which places significant financial burden on healthcare providers. Additionally, new and innovative devices often come with high price tags in the initial years due to costs associated with research and development. This passes additional costs to the patients and insurers. The high overall treatment costs often discourage widespread adoption of new, advanced technologies. For many patients in underdeveloped or developing countries, the steep costs of newer minimally invasive and robot-assisted procedures make them inaccessible. Even in developed markets, high deductibles and co-insurance requirements deter patients from opting for expensive treatments. Given the budget constraints faced by most healthcare systems worldwide, high treatment costs pose a major barrier to the growth of the urinary tract obstruction treatment devices market.

Market Opportunity: Increasing Adoption of Advanced Shock Wave Lithotripsy Devices Due to Their Non-Invasive Nature and Improved Patient Outcomes.

The urinary tract obstruction treatment devices market possesses significant growth opportunities arising from increasing adoption of advanced shock wave lithotripsy (SWL) devices. SWL provides a non-invasive option for the treatment of urinary tract stones and obstructions. The procedure causes significantly less post-operative pain and recovery time for patients as compared to traditional invasive surgeries such as ureteroscopy and percutaneous nephrolithotomy. Advanced SWL systems also offer higher success rates and require fewer repeat treatments than traditional lithotripters due to improved imaging, targeting accuracy, and pulse control. Driven by their compelling clinical benefits over alternative treatments, newer generation lithotripters with advanced features have been witnessing rising installation base across healthcare facilities. As patient awareness increases regarding advantages of SWL such as shorter hospital stay and quicker return to regular activities, its adoption rate is expected to climb further over the forecast period. This will likely propel the sales revenues of urinary tract obstruction treatment devices producers.

Key winning strategies adopted by key players of Urinary Tract Obstruction Treatment Devices Market

Product Innovation: Continuous innovation to bring novel products has helped players gain an edge. For example, in 2019, Boston Scientific launched the LithoVue Single-Use Digital Flexible Ureteroscope to enable efficient diagnosis and treatment of upper urinary tract stones. This built on its Acclarent AXS Catalyst MAX Sinus Dilation System launched in 2018 for treatment of chronic sinusitis. Such innovative new products allow companies to penetrate new therapy areas and better serve customers.

Strategic Acquisitions: Making strategic acquisitions is a key strategy used to enhance portfolios and pipelines.

Aggressive Marketing: Large players spend significantly on marketing and promotion to generate brand awareness and increase sales. Heavy marketing translates to higher reach and dominance.

Geographic Expansion: Targeting high-growth emerging markets has proven beneficial. Larger organizations are penetrating into untapped markets with huge investments. This creates novel opportunities for destined markets.

The above examples demonstrate how continuous innovation, strategic acquisitions, heavy marketing investments and geographic targeting of new high-potential areas have unveiled novel markets for big players.

Segmental Analysis of Urinary Tract Obstruction Treatment Devices Market

Insights, By Product Type, Affordability Drives Urinary Catheters Dominance.

By Product Type, Urinary Catheters contributes the highest share 38.70% in 2024 owing to its affordability. As the most basic and inexpensive device for drainage of urine, catheters see widespread usage. They are typically made of silicone or red rubber latex and do not require complex procedures for placement. This makes them an economical solution for patients suffering from urinary retention or incontinence. The easy accessibility and low costs associated with catheters have made them the default first-line treatment for urinary obstruction issues in many cases. Although more advanced products like stents and lithotripters provide better outcomes, catheters dominate usage in cost-sensitive contexts.

Insights, By Application, Prevalence of Cancers Boosts the Cancers Segment.

By Application, cancer contributes the highest share 41.30% in 2024 due to rising incidence rates. Malignancies of the prostate, bladder, and kidneys are leading drivers of urinary obstruction worldwide. As such, oncology represents a major application area for drainage and relief devices. Early diagnosis and improved cancer care have enhanced survival periods in recent decades. However, neoplastic involvement often impairs normal urinary flow long-term. This creates sustained demand for catheters, stents and other aids among cancer patients managing obstruction symptoms. Moreover, palliative use near the end of life also contributes significantly to the cancer segment's market prominence.

Insights, By End User, Hospitals are Preferred Point of Urinary Care.

In terms of By End User, Hospitals contribute the highest share in 2024 owing to preferences for hospital-based care. Many urinary conditions warranting device interventions like ureteral stones or ureteral strictures are managed via surgical treatments in hospitals. This makes hospitals the primary end-user segment. They possess advanced infrastructure and a multidisciplinary team of urologists, radiologists, oncologists and nurses facilitating comprehensive urinary tract care. Moreover, favorable reimbursement for device implantation procedures in hospitals has attracted patients as well as physicians. The availability of inpatient procedures and 24/7 access to experts have further established hospitals as the go-to choices for managing severe or complex cases of urinary obstruction.

Additional Insights of Urinary Tract Obstruction Treatment Devices Market

The urinary tract obstruction treatment devices market is experiencing steady growth, driven by the increasing prevalence of urological disorders, particularly among the aging population. Key drivers include the rising incidence of kidney stones, benign prostatic hyperplasia, and bladder cancers, which necessitate effective management using advanced medical devices. Technological advancements such as shock wave lithotripsy and minimally invasive ureteroscopes are gaining traction due to their ability to improve patient outcomes with reduced recovery times and fewer complications compared to traditional surgical methods. Market players are heavily investing in research and development to introduce innovative solutions that cater to the growing demand for non-invasive and effective treatment options. However, the market faces challenges related to the high costs of advanced devices and potential complications associated with their use. The North American region dominates the market due to a higher prevalence of urological conditions and supportive healthcare infrastructure, but significant growth opportunities also exist in emerging markets where the burden of urological disorders is rising.

Competitive overview of Urinary Tract Obstruction Treatment Devices Market

The major players operating in the Urinary Tract Obstruction Treatment Devices market include B. Braun Melsungen AG, Boston Scientific Corporation, Cook Medical, Becton, Dickinson, and Company, Teleflex Incorporated, Olympus, Dornier Medtech, EMS Urology, Advin Health Care and Inceler Medikal Co. Ltd.

Urinary Tract Obstruction Treatment Devices Market Leaders

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Cook Medical

- Becton, Dickinson, and Company

- Teleflex Incorporated

Urinary Tract Obstruction Treatment Devices Market - Competitive Rivalry, 2024

Urinary Tract Obstruction Treatment Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Urinary Tract Obstruction Treatment Devices Market

- March 2021: Boston Scientific acquired Lumenis in a USD 1.07 billion deal, enhancing its portfolio of lithotripsy devices and strengthening its position in the urinary tract obstruction market.

- March 2021: Dornier MedTech GmbH became the first integrated urology company certified by the European Union’s MDR for its lithotripsy devices, including the Dornier Delta® III.

Urinary Tract Obstruction Treatment Devices Market Segmentation

- By Product Type

- Urinary Catheters

- Urinary Stents, Shock

- Wave Lithotripters

- Ureteroscopes

- By Application

- Cancers

- Stones

- Benign Prostatic Hyperplasia (BPH)

- Hydronephrosis

- By End User

- Hospitals

- Ambulatory Surgical Centers

- Surgical Centers

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Urinary Tract Obstruction Treatment Devices Market?

The Global Urinary Tract Obstruction Treatment Devices market is estimated to be valued at USD 1.41 billion in 2024 and is expected to reach USD 2.03 billion by 2031.

What will be the CAGR of the Urinary Tract Obstruction Treatment Devices Market?

The CAGR of the Urinary Tract Obstruction Treatment Devices Market is projected to be 5.2% from 2024-2031.

What are the key factors hampering the growth of the Urinary Tract Obstruction Treatment Devices Market?

The high costs associated with advanced devices and treatments and adverse events and complications associated with urinary tract obstruction devices are the major factor hampering the growth of the Urinary Tract Obstruction Treatment Devices Market.

What are the major factors driving the Urinary Tract Obstruction Treatment Devices Market growth?

The rising prevalence of urological disorders such as bladder cancer, kidney stones, and benign prostatic hyperplasia. and innovation in product design and increased adoption of minimally invasive treatment options are the major factor driving the Urinary Tract Obstruction Treatment Devices Market.

Which is the leading Product Type in the Urinary Tract Obstruction Treatment Devices Market?

Urinary Catheters is the leading product type segment.

Which are the major players operating in the Urinary Tract Obstruction Treatment Devices Market?

- Braun Melsungen AG, Boston Scientific Corporation, Cook Medical, Becton, Dickinson, and Company, Teleflex Incorporated, Olympus, Dornier Medtech, EMS Urology, Advin Health Care, Inceler Medikal Co. Ltd. are the major players.