Aseptic Filling Machines Market Size - Analysis

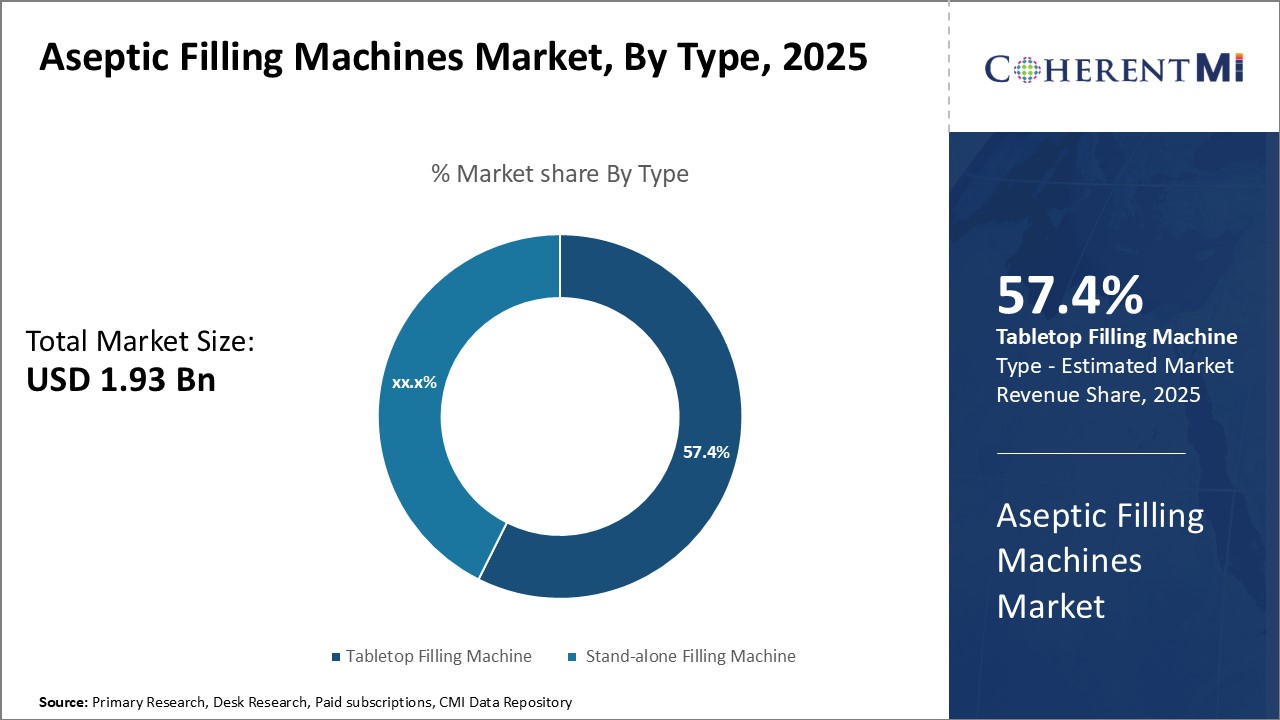

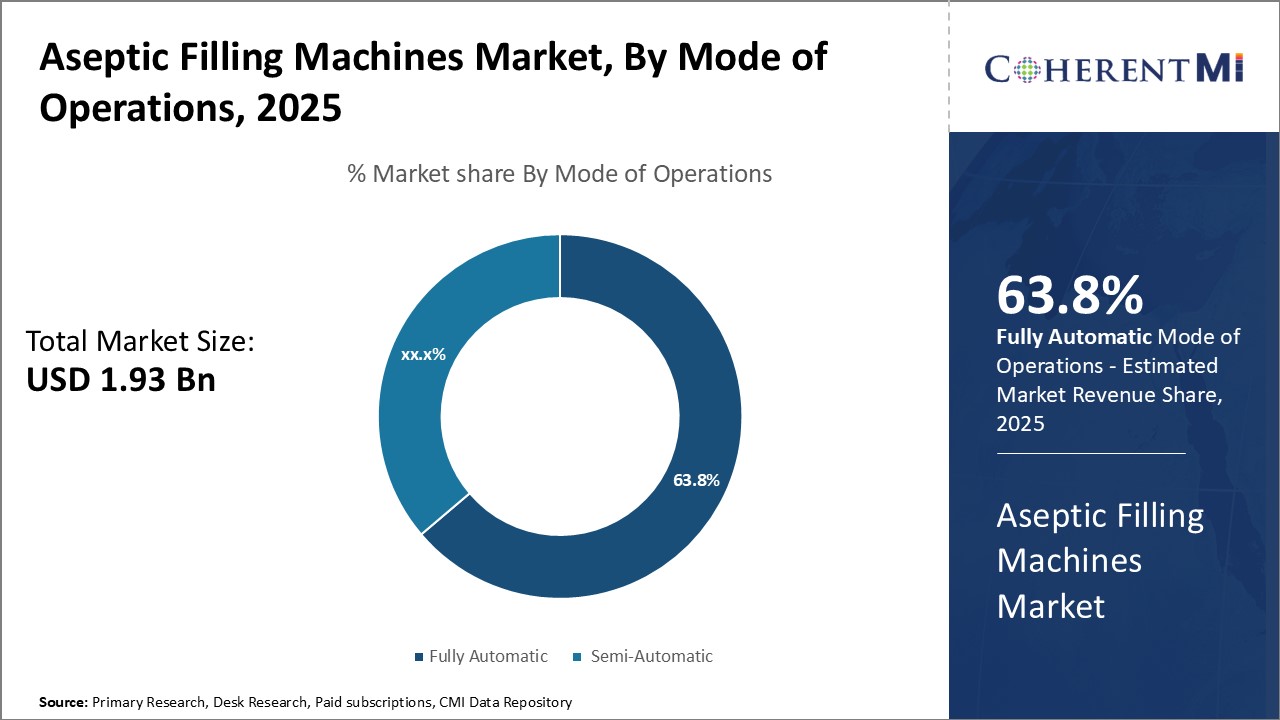

The global Aseptic Filling Machines Market is estimated to be valued at USD 1.93 Bn in 2025 and is expected to reach USD 3.10 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.00% from 2025 to 2032.

Market Size in USD Bn

CAGR7.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.00% |

| Market Concentration | Medium |

| Major Players | ALFA LAVAL, GEA Aseptic Filling, Syntegon Technology GmbH, John Bean Technologies Corp, Groninger Holding GmbH & Co. KG and Among Others |

please let us know !

Aseptic Filling Machines Market Trends

The packaging industry has been growing at a robust rate over the past decade driven primarily by the rapidly expanding food and beverage industry. Consumer preference for fresh, preservative-free and ready-to-eat food products has strengthened the business case for aseptic filling machines that can fill products in a sterile environment and seal them securely for a longer shelf life without refrigeration. Companies have recognized this consumer behavior and are extensively investing in packaging technologies that can deliver optimal product protection during storage, distribution and retail stages.

Rising investments in new product formulations tailored for convenient consumption have additionally augmented demand for sterile filling machinery. Examples include nutritious liquid meals or probiotic drinks that need contamination-free conditions from packing to usage. Moreover, with global trade increasing, packages require longer preservation capability throughout intercontinental transportation as well. Aseptic lines address this critical requirement and have stimulated wider relevance across sauces, dressings and other food categories too. All such macro factors are driving relentless packaging line modernization worldwide and propelling aseptic filling machinery uptake in the foreseeable future.

Market Driver - Rising Healthcare Needs Contributes to the Industry Growth

Aseptic filling machines perfectly cater to these stringent industry sterility norms as they can seal parenteral, biological and other medical products absolutely freed from microbial or external particle contamination risks. Their enclosed system design precludes any contact between the product and surrounding environment, maintaining product integrity from filling to capping. Moreover, their high-speed performance and automated operation lower processing costs of vaccines, infusions and other therapies in high demand.

In conclusion, the inexorable growth trends in both pharmaceuticals and packaging sectors are expected to consistently fuel the adoption of aseptic filling lines globally. Their superior sterility safeguarding functionality is ideally aligned to fulfill future industry and social needs surrounding health, convenience and product protection.

The aseptic filling machines market faces significant challenges due to the high costs associated with advanced aseptic filling technology. The sophisticated automated machinery and stringent validation protocols required for aseptic processing come with a substantial price tag. Established players in the market offer turnkey aseptic lines that can exceed seven-figure price points. While necessary for large pharmaceutical manufacturers to ensure sterility and shelf life of sensitive drug products, these capital expenditures place aseptic solutions out of reach for many small and medium enterprises. Cost prohibitive machinery obstructs access to new entrants in the market and hampers the ability of smaller players to scale production in a sterile environment. This disproportionately impacts developers of generic drugs, biosimilars and other smaller volume products. Achieving aseptic processing requires commitment of sizable resources that smaller companies may not have accessibility to. The high barrier of entry protects market share of existing industry giants but slows innovation and competition from startups or region-specific manufacturers.

Market Opportunity: Advancements In Aseptic Filling Machines, Such as Single-Use Systems and Automation, Streamline Production While Reducing Contamination Risks

Key winning strategies adopted by key players of Aseptic Filling Machines Market

- Companies are focused on developing advanced aseptic filling machines that integrate technologies such as automation, robotics, AI, and IoT. These advancements improve precision, productivity, and quality, while also enhancing monitoring and reducing contamination risks.

- Single-use systems, real-time monitoring, and automated process controls are being added to new models, minimizing cross-contamination and maintenance costs. For example, Syntegon’s Settle Plate Changer (SPC) enhances sterility by automating viable monitoring, while SIG introduced an in-line pouch sterilization system to improve cost efficiency and supply chain management.

Geographic Expansion and Market Penetration

- Many companies are expanding into Asia Pacific and North America, where demand for aseptic filling solutions is high due to rapid industrialization, a growing pharmaceutical sector, and advancements in the packaging industry.

- Partnerships with local firms and participation in regional events, like live demonstrations or exhibitions, help brands establish a foothold in these lucrative markets.

- Leading players are partnering with technology providers or local firms to enhance product offerings and increase market penetration. For instance, SIG’s collaboration with Bergland milch for their SmileBig 24 Aseptic machine highlights a strategic alliance that aids in scaling capabilities and adoption.

- These partnerships allow companies to leverage local expertise, broaden distribution channels, and deliver customized solutions for specific industries.

Focus on Sustainable and Energy-Efficient Solutions

- Many companies are innovating towards environmentally friendly and energy-efficient aseptic solutions to meet the rising demand for sustainability.

- Energy-efficient systems with lower carbon footprints, such as Haier’s Solar Hybrid AC which runs on solar power, appeal to eco-conscious customers, helping companies align with global sustainability goals and gain a competitive edge.

- Companies are investing in robust after-sales support to improve customer satisfaction and retention, often providing technical training, remote monitoring, and predictive maintenance options.

- This support can reduce downtime for customers, extending the machine's operational life and reinforcing trust in the brand’s long-term reliability.

Segmental Analysis of Aseptic Filling Machines Market

Insights, By Type, Tabletop Filling Machine Accounted for a Leading Share in 2024

Their space-saving feature enables processors to optimize floor space utilization. This is especially crucial for companies with limited production area. Tabletop machines also offer cost benefits through compact automation and reduced idle time compared to standalone machines. Processors prefer them to fulfill varying production needs and launch new products quickly. Their user-friendly and programmable interfaces facilitate setups by operators with minimal training. The plug-and-play functionality of tabletop variants further enhances their usefulness across multiple filling procedures.

Insights, By Mode of Operation, Fully Automatic Resorts to Leading Share

Insights, By Mode of Operation, Fully Automatic Resorts to Leading Share

Compared to semi-automatic machines, the fully automatic variants have higher operating speeds of up to 60,000 units/hour and handle greater volumes effectively. This scale and consistency help processors to achieve significant cost savings from optimized utilization of floor space, raw materials, water, and energy over time. Fully automatic aseptic filling equipment also ensures stringent hygienic conditions through aseptic zones isolated from external contamination risks. Their self-cleaning features maintain sterility between product changeovers for multiple formulations.

Additional Insights of Aseptic Filling Machines Market

The Aseptic Filling Machines Market is expanding rapidly due to increased demand for contamination-free packaging solutions in food, beverages, and pharmaceuticals. As consumer demand grows for long-lasting and safe products, aseptic filling technologies are being adopted widely across regions, particularly in Asia Pacific and North America. Technological advancements, including robotics, automation, and single-use systems, are revolutionizing aseptic filling by enhancing efficiency, reducing cross-contamination risks, and lowering costs. The pharmaceutical industry, with its stringent requirements for sterile packaging, is a major growth driver in this market. As automation and AI continue to improve operational efficiencies, the aseptic filling machines market is expected to witness robust growth through 2034.

Competitive overview of Aseptic Filling Machines Market

The major players operating in the Aseptic Filling Machines Market include ALFA LAVAL, GEA Aseptic Filling, Syntegon Technology GmbH, John Bean Technologies Corp, Groninger Holding GmbH & Co. KG, Dara Pharma, Saini Industries, Bausch + Ströbel SE & Co. KG, Serac Group and Krones AG.

Aseptic Filling Machines Market Leaders

- ALFA LAVAL

- GEA Aseptic Filling

- Syntegon Technology GmbH

- John Bean Technologies Corp

- Groninger Holding GmbH & Co. KG

Aseptic Filling Machines Market - Competitive Rivalry

Aseptic Filling Machines Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Aseptic Filling Machines Market

- In September 2024, Austria’s Bergland milch extended collaboration with SIG by installing the first SIG SmileBig 24 Aseptic filling machine, enhancing aseptic packaging capabilities.

- In April 2024, SIG launched an in-line pouch sterilization system designed to reduce production costs and simplify the supply chain for aseptic pouches.

- In June 2024, Syntegon introduced the Settle Plate Changer (SPC) for automated viable monitoring, improving sterility in aseptic filling processes.

Aseptic Filling Machines Market Segmentation

- By Type

- Tabletop Filling Machine

- Stand-alone Filling Machine

- By Mode of Operations

- Fully Automatic

- Semi-Automatic

Would you like to explore the option of buying individual sections of this report?

Ramprasad Bhute is a Senior Research Consultant with over 6 years of experience in market research and business consulting. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How big is the Aseptic Filling Machines Market?

The global Aseptic Filling Machines Market is estimated to be valued at USD 1.93 Bn in 2025 and is expected to reach USD 3.10 Bn by 2032.

What will be the CAGR of the Aseptic Filling Machines Market?

The CAGR of the Aseptic Filling Machines Market is projected to be 6.8% from 2024 to 2031.

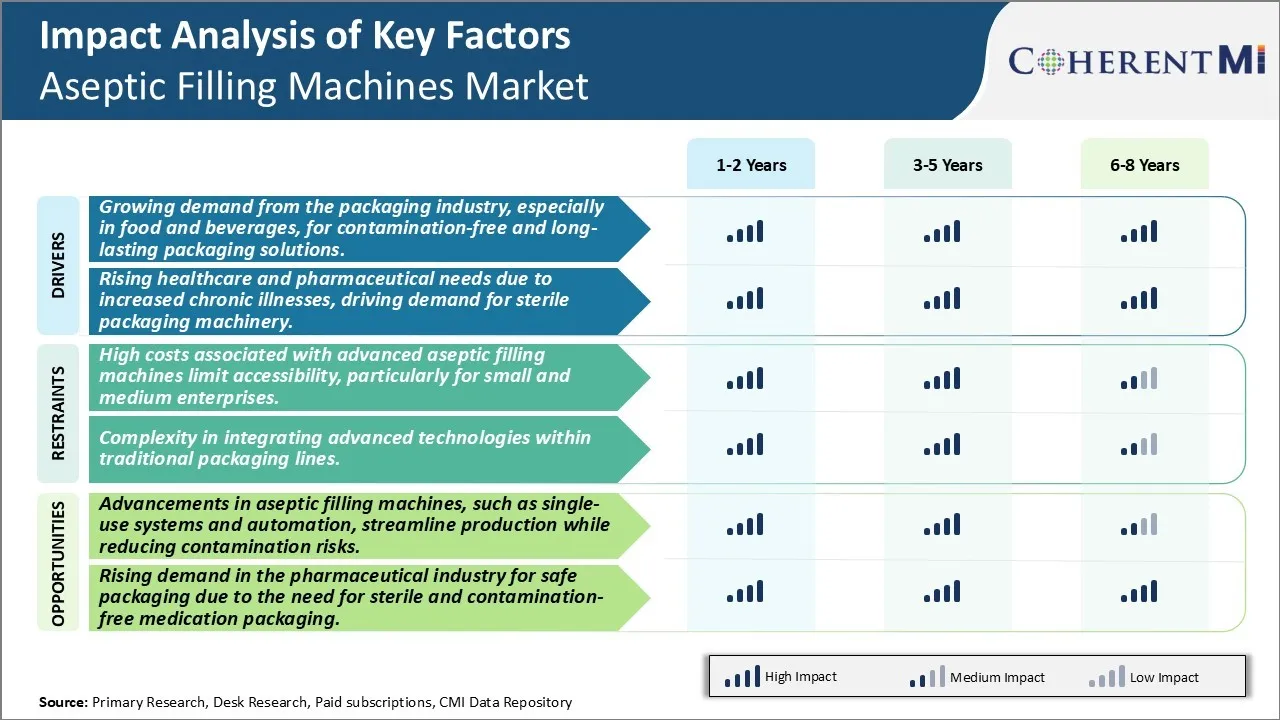

What are the major factors driving the Aseptic Filling Machines Market growth?

The growing demand from the packaging industry, especially in food and beverages, for contamination-free and long-lasting packaging solutions and rising healthcare and pharmaceutical needs due to increased chronic illnesses, driving demand for sterile packaging machinery are the major factors driving the Aseptic Filling Machines Market.

What are the key factors hampering the growth of the Aseptic Filling Machines Market?

The high costs associated with advanced aseptic filling machines limit accessibility, particularly for small and medium enterprises and complexity in integrating advanced technologies within traditional packaging lines are the major factors hampering the growth of the Aseptic Filling Machines Market.

Which is the leading Type in the Aseptic Filling Machines Market?

Stand-alone filling machine is the leading Type segment.

Which are the major players operating in the Aseptic Filling Machines Market?

ALFA LAVAL, GEA Aseptic Filling, Syntegon Technology GmbH, John Bean Technologies Corp, Groninger Holding GmbH & Co. KG, Dara Pharma, Saini Industries, Bausch + Ströbel SE & Co. KG, Serac Group, Krones AG are the major players.