Australia Office Furniture Market Size - Analysis

Office furniture purchases are often among the last items considered when outfitting or remodeling commercial office spaces. In recent years, there has been a trend towards flexible, ergonomic furniture that can be rearranged as team structures and workspace needs change. Height-adjustable desks and sitting/standing desks have increased in popularity as employers and employees recognize the health benefits of mobility in the workplace.

Market Size in USD Bn

CAGR2.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 2.6% |

| Market Concentration | High |

| Major Players | IKEA Pty Limited, Harvey Norman Holdings Limited, Living Edge (Aust) Pty Ltd, Fantastic Furniture, Amart Furniture Pty Limited and Among Others |

please let us know !

Australia Office Furniture Market Trends

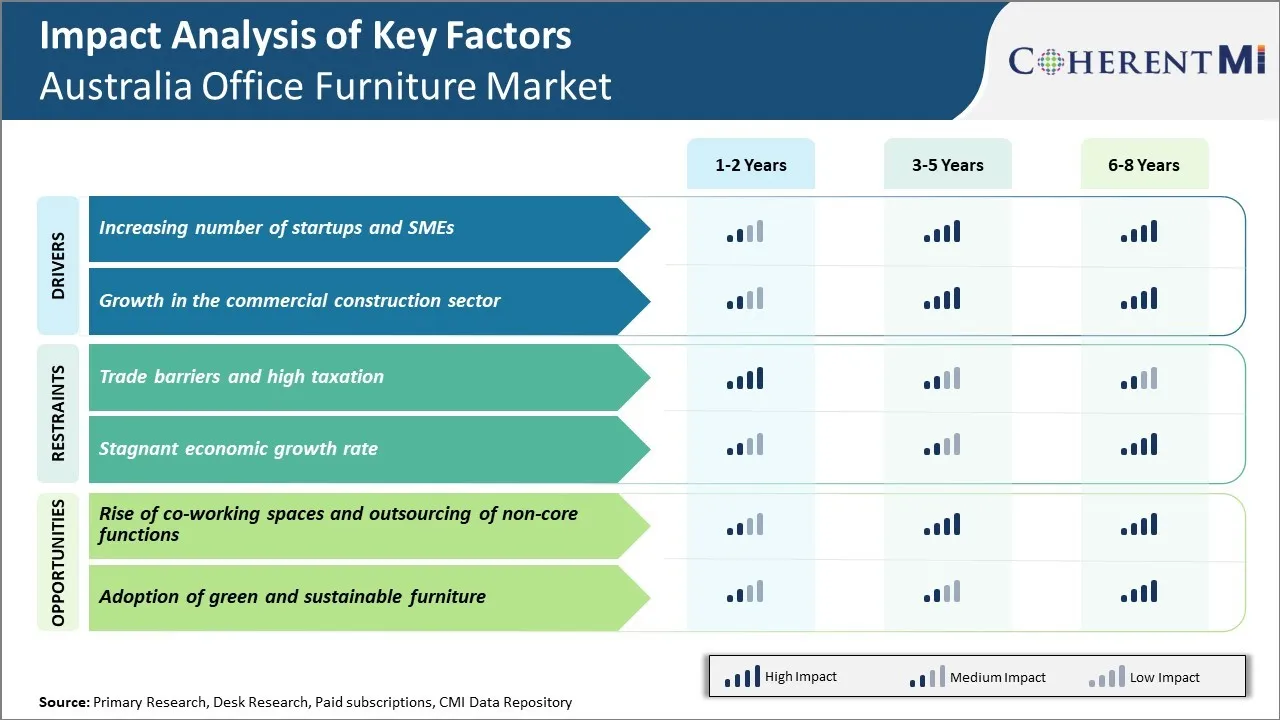

The Australian economy has seen a steady growth in the number of startups and small to medium enterprises in recent years. Ease of doing business, strong intellectual property laws and access to risk capital have made Australia an attractive destination for entrepreneurs. While many global companies have large established offices, it is these new businesses that are driving demand for flexible office furniture solutions.

As these new enterprises mature and expand, their furniture needs also evolve. Reputable furniture brands launched specialized programs to help such businesses upgrade in a phased manner. Equipment financing and professional services for space planning and logistics are part of the proposition. This ensures a smooth transition as a startup grows without large upfront capital outlays.

Market Driver – Growth in the commercial construction sector

This high level of construction activity directly spurs demand for commercial interiors including various types of furniture. Developers work closely with specialist contractors during the outfitting of workplace interiors. Prime office spaces need to be furnished and decorated to a high standard before occupiers move in. This reliably translates to bulk orders for furniture, wall panelling, carpeting, lighting and other fit-out items. As the economy transitions out of the pandemic, corporations are also re-thinking their real estate footprint and office designs. Trends like hybrid work models and focus on employee well-being have prompted renovations and retrofitting of existing office stock. This provides opportunities for furniture and interiors retailers to work on upgrade projects. Customized solutions incorporating modern design principles and technology integrations are gaining traction.

The Australian office furniture market faces ongoing challenges owing to trade barriers and a high tax environment. Significant import tariffs on office furniture make foreign suppliers' products more expensive in the Australian market compared to locally manufactured goods. This protects local manufacturers but limits choice and affordability for customers. Tariffs as high as 5-10% on imported wooden and metal office furniture restrict access to global designs and latest trends. Additionally, Australia's corporate tax rate of 30% imposes a considerable cost burden on local manufacturers and distributors. The high business taxes eat into company profits and make Australian products less competitive globally. This discourages expansions and investments that could help build economies of scale and address rising production costs from inflation. Stricter emissions standards also drive-up overhead expenses. While trade barriers and taxation aim to shield local jobs, they ultimately make the market smaller and costlier, limiting its long-term growth potential.

Market Opportunities: Rise of co-working spaces and outsourcing of non-core functions

Key winning strategies adopted by key players of Australia Office Furniture Market

Focus on innovation and new product development: Companies like Herman Miller and Steelcase have heavily invested in R&D to develop innovative new products that meet the evolving needs of Australian workplaces. In 2021, Herman Miller launched new seating, tables and storage products with adjustable features to support hybrid workstyles. These products were well received, helping Herman Miller grow its market share by 5% that year.

Adopting a consultative sales approach: Successful companies engage clients via a consultative process to fully understand their unique furniture needs and space constraints. For example, Fern's experienced designers work with clients from design concept to installation. This customer-centric strategy has positioned Fern as Australia's trusted choice, especially among large enterprises, with annual revenues growing by an average of 15% since adopting this approach in 2015.

Segmental Analysis of Australia Office Furniture Market

Insights by product type: Comfort and Ergonomics Drive Demand for Office Seating

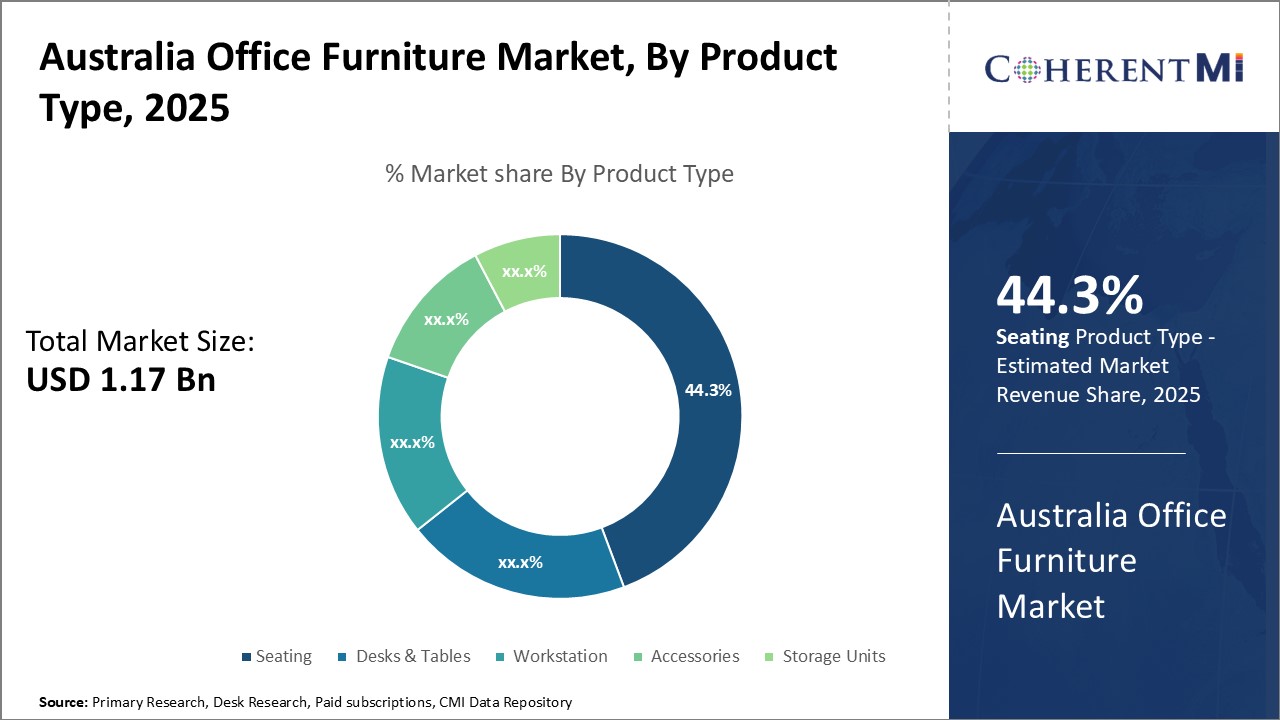

Insights by product type: Comfort and Ergonomics Drive Demand for Office Seating Seating contributes the 44.3% share of the Australia office furniture market in 2025, due to the importance companies place on employee comfort. Sitting for long periods at work can cause physical strain and reduce productivity if proper ergonomic seating is not provided. Companies understand the need to prioritize their employees' physical well-being and comfort in order to boost morale and retention.

Collaboration and meeting spaces also drive demand for different types of seating. In addition to traditional office desk chairs, there is a growing market for sofas, armchairs and ottomans suited to more relaxed discussions. As open floor plans and activity-based working become more prevalent, comfortable, flexible seating suitable to both informal and formal discussions is key. Companies outfit huddle spaces and break areas with inviting seating to encourage interaction between employees. Meeting increasing demand for ergonomic health and customized comfort, Australian manufacturers continue developing innovative new seating technologies and materials. Their focus on user experience and wellness keeps office seating the highest share of the country's office furniture market. Attention to comfort and well-being will remain paramount as workstyles evolve in the years ahead.

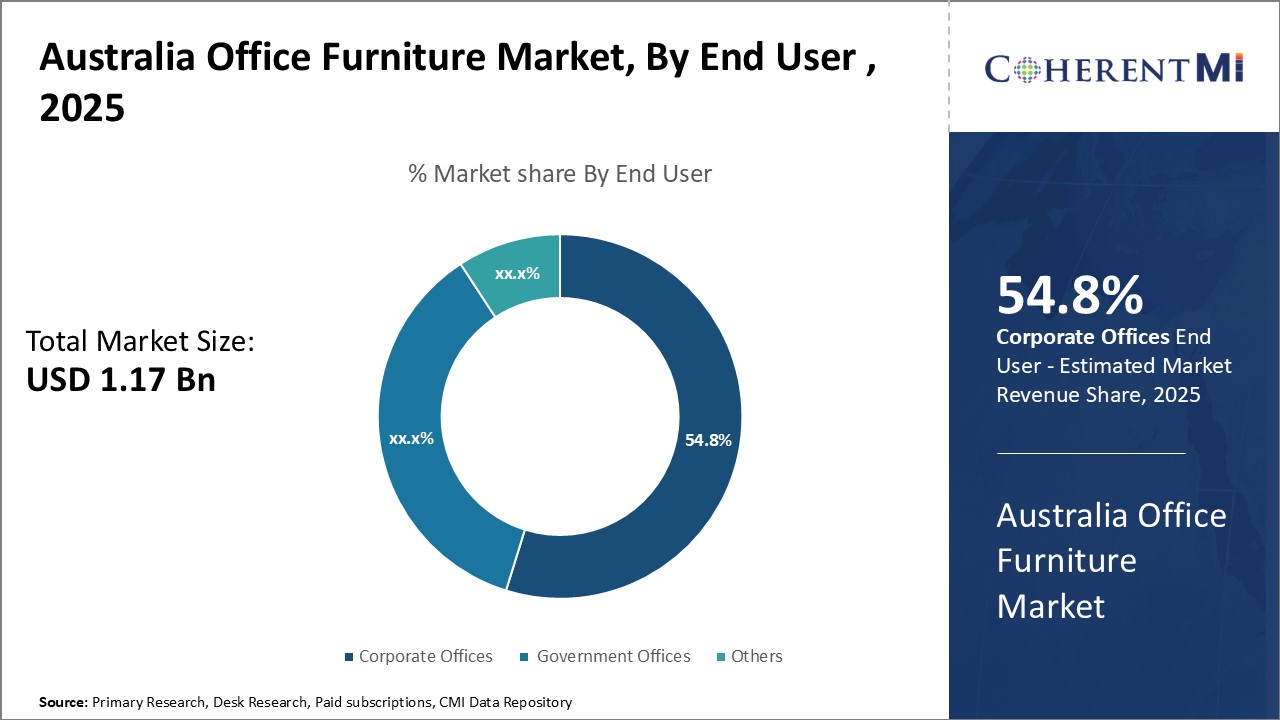

The corporate offices end-user segment generates the 54.80% share of demand in the Australia office furniture market in 2025. Large corporations have significant real estate footprints and undertake frequent refurbishment projects requiring new furnishings. They also have ample capital and specialized procurement teams focused on outfitting office spaces. A key driver of demand is corporate real estate strategies increasingly prioritizing employees, collaboration, and brand image. Forward-thinking companies design workplaces not just for function but also to attract and engage talent. They view office design, technology and furnishings as a competitive differentiator. Comfortable, innovative workspaces are seen as investments in company culture and worker productivity.

Competitive overview of Australia Office Furniture Market

The major players operating in the Australia Office Furniture Market include IKEA Pty Limited,Harvey Norman Holdings Limited,Living Edge (Aust) Pty Ltd,Fantastic Furniture ,Amart Furniture Pty Limited,King Furniture Australia Pty Ltd,Saveba Pty Ltd trading as Coco Republic,Kogan Australia Pty Ltd

Australia Office Furniture Market Leaders

- IKEA Pty Limited

- Harvey Norman Holdings Limited

- Living Edge (Aust) Pty Ltd

- Fantastic Furniture

- Amart Furniture Pty Limited

Australia Office Furniture Market - Competitive Rivalry

Australia Office Furniture Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Australia Office Furniture Market

- In May 2024, the family of the late Australian architect Roy Grounds revealed a new collaborative furniture collection with K5 Furniture.This collection showcases classic silhouettes infused with modern sensibilities, presenting a limited-edition range in vibrant hues for a contemporary twist.

- In July 2023, Australian design firm Derlot launched its Strap collection, comprising 11 distinct seating types inspired by vintage pool furniture adorned with fabric slings. The collection includes stools, chairs, benches, and loungers, all characterized by minimalist frames and robust aluminum strips. These elements combine to offer durable seating options suitable for various public and private settings.

Australia Office Furniture Market Segmentation

- By Product Type

- Seating

- Desks & Tables

- Workstation

- Accessories

- Storage Units

- By End User

- Corporate Offices

- Others

- Government Offices

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the Australia Office Furniture Market?

The Australia Office Furniture Market is estimated to be valued at USD 1.17 in 2025 and is expected to reach USD 1.40 Billion by 2032.

What are the major factors driving the Australia Office Furniture Market growth?

The increasing number of startups and smes and growth in the commercial construction sector are the major factor driving the Australia Office Furniture Market.

Which is the leading Product Type in the Australia Office Furniture Market?

The leading Product Type segment is Seating.

Which are the major players operating in the Australia Office Furniture Market?

IKEA Pty Limited, Harvey Norman Holdings Limited, Living Edge (Aust) Pty Ltd, Fantastic Furniture, Amart Furniture Pty Limited, King Furniture Australia Pty Ltd, Saveba Pty Ltd trading as Coco Republic, Kogan Australia Pty Ltd are the major players.

What will be the CAGR of the Australia Office Furniture Market?

The CAGR of the Australia Office Furniture Market is projected to be 2.6% from 2025-2032.