Australia Smart Ports Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Australia Smart Ports Market is Segmented By Technology (Process Automation, Internet of Things, Art...

Australia Smart Ports Market Size - Analysis

The Australia Smart Ports Market is estimated to be valued at USD 1.73 Bn in 2024 and is expected to reach USD 7.46 Bn by 2031, growing at a compound annual growth rate (CAGR) of 23.22% from 2024 to 2031. The increasing need to automate port operations and leverage technologies like AI, IoT, blockchain are driving significant investments in smart ports infrastructure across major ports in Australia.

The market is witnessing positive trends with growing focus on digitization and automation of assets and resources. Adoption of smart technologies allows real-time optimization of operations and resource allocation. This is improving efficiency, reducing costs and supporting sustainable port operations. Rising maritime trade and focus on developing sustainable ports is expected to continue driving demands for smart ports solutions in Australia over the coming years.

Market Size in USD Bn

CAGR23.22%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2024 |

| CAGR | 23.22% |

| Market Concentration | Medium |

| Major Players | Port Authority of New South Wales, Port of Melbourne Corporation, Port of Brisbane Pty Ltd, Sydney Ports Corporation, Qube Holdings Limited and Among Others |

please let us know !

Australia Smart Ports Market Trends

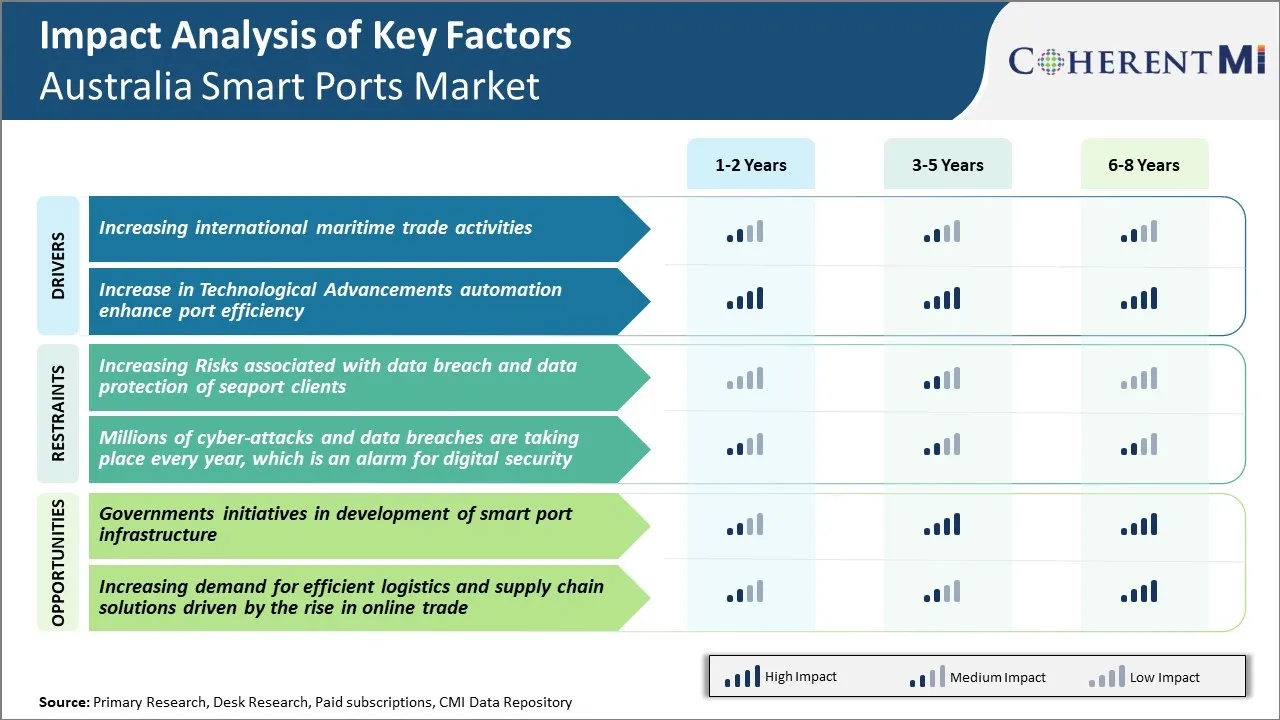

Market Driver - Increasing international maritime trade activities

Australia enjoys strategic location in terms of international trade being situated between Asia and America. This provides opportunity for Australia to serve as important transhipment hub for cargo movement between major trading economies. Over past few decades, Australia has emerged as one of leading commodity exporters with significant portion of commodities like coal and iron ore being exported via sea routes. Rising demand from countries like China and India has driven huge surge in Australia's commodity exports. Growing freight traffic has necessitated modernization of ports to handle large vessels and increased throughput efficiently. Advanced systems are being incorporated for real time cargo tracking, automated documentation and speedy clearance. This is aimed at reducing logistic costs and ensure smooth cargo movement to gain competitive advantage.

In addition, Australia has also emerged as prominent destination for container traffic. Major retail companies are establishing regional distribution centers in Australia to supply markets across Southeast Asia and Pacific nations. This has boosted container imports and exports substantially. Rising container volumes have put pressure on existing port infrastructure. There is need to expand terminal capacity and dredging of channels to accommodate larger container vessels. Advanced IT solutions are implemented for improving terminal productivity and optimal utilization of cargo handling equipment. Various projects are underway to develop inland container depots with rail connectivity to decongest major ports and ensure seamless cargo movement. Overall, significant growth in international marine trade activities is a strong driver for modernization of Australian ports with smart technologies.

Market Driver - Increase in Technological Advancements automation enhance port efficiency

Rapid advances in automation technologies are revolutionizing port operations globally. There is palpable pressure on ports around the world to upgrade infrastructure and incorporate latest innovations to enhance efficiency. Australian ports are witnessing increasing focus on digitization and automation cope with escalating cargo traffic and stringent performance benchmarks. Advanced technologies like internet of things, artificial intelligence and analytics are helping optimize key processes. Various projects are ongoing to automate cargo handling equipment as well as implement automated guided vehicles reduce manual intervention and improve productivity. Automated terminal operating systems aid in real time cargo tracking and optimize gate processes. Additionally, robotics applications are surging for warehouse automation and yard operations further enhance productivity as well as safety.

Australia is also witnessing considerable traction for pilot-less ship projects aimed at boosting safety and slashing fuel consumption. Cooperative autonomous vessels are being trialled along intra-Australian trade routes to establish technical and regulatory framework. This reflects potential to introduce autonomous vessel operations across supply chains involving Australian ports in future. Overall, technologies like blockchain, AI and automation are transforming port landscape by streamlining documentation filing, reducing delays and improving collaboration between stakeholders. This is critical for Australian ports to achieve operational excellence and cope with massive waterborne freight growth in coming years. Advancements in automation are surely emerging as a strong driver fostering smart and sustainable port infrastructure development across Australia.

Market Challenge: Increasing Risks associated with data breach and data protection of seaport clients

One of the key challenges currently facing the development of smart ports in Australia is the increasing risks associated with data breaches and protecting sensitive client data. As ports look to digitalise operations and leverage new technologies like IoT, big data analytics and cloud computing, the amount of valuable operational and customer data being collected, processed and stored is growing exponentially. With more data in centralized systems and devices connected to online networks, there are greater opportunities for hackers to exploit vulnerabilities and access unauthorized data. With seaports handling cargo and personal information from many different organisations, a successful cyber-attack could result in substantial financial and reputational losses. Port operators and technology providers are struggling to implement robust cybersecurity systems and processes that can detect and prevent unauthorized access across diverse IT infrastructures. Strict data privacy regulations are also increasing compliance requirements and costs. Unless these risks are adequately addressed, many shipping lines and cargo owners may be reluctant to fully embrace new digital solutions due to concerns about compromising data security.

Market Opportunity: Governments initiatives in development of smart port infrastructure

A major opportunity for the growth of smart ports in Australia is the various initiatives by government agencies to invest in digital infrastructure and promote advanced technologies. State governments recognise that ports play a vital economic role and transforming them digitally can deliver widespread benefits. Substantial funding has been committed to develop 5G networks, autonomous vehicle test sites, renewable energy microgrids and cloud computing facilities within port precincts. For example, a $50 million program in NSW aims to install thousands of sensors networked on an IoT platform across various ports. Federal governments are also supporting collaborative R&D projects between ports, academics and startups through programs like the National Innovation and Science Agenda. Such initiatives are helping drive proofs-of-concept and commercial pilots of cutting-edge solutions. With enhanced connectivity and innovation hubs emerging, ports are well positioned to trial new applications involving automation, predictive maintenance, remote operations and blockchain technology. This government backing sends a strong signal to global technology companies and startups to prioritise the Australian maritime sector.

Key winning strategies adopted by key players of Australia Smart Ports Market

Brisbane Port Holdings (BPH) is one of the leading port operators in Queensland. In 2020, BPH launched a new Smart Port initiative to digitally transform port operations and improve efficiency. As part of this strategy, BPH deployed Internet of Things (IoT) sensors and cameras across the port to gain real-time visibility into vessel and cargo movements. An integrated control center was also set up to centrally monitor all port activities and assets. This has helped BPH optimize resource allocation, reduce waiting times, and increase throughput. The initial results have been promising with an estimated 15-20% improvement in operational efficiency.

Another major player is DP World Australia which operates ports in Sydney, Melbourne, and Fremantle. In 2018, DP World partnered with Deutsche Telekom to launch a 5G private network trial at Sydney port. This allowed testing of new smart port applications like automated guided vehicles (AGVs), remote-controlled quay cranes etc. Impressed by the results, DP World has now committed $50 million to rollout a full-fledged 5G network across its Australian ports by 2023. This positions DP World at the forefront of digitalization and will help establish Sydney as one of the world's smartest ports.

Patrick Terminals, one of the largest container terminal operators, has focused on leveraging automation and cutting-edge technologies. In 2019, Patrick deployed autonomous straddle carriers and automated stacking cranes at Fremantle port which led to a 25% improvement in equipment productivity.

Segmental Analysis of Australia Smart Ports Market

Insights by Technology - Internet of Things Drives the Market Due to Increased Digitization and Automation of Ports

The Internet of Things (IoT) segment is expected to continue dominating the technology segment in Australia's smart ports market with 37.2% share. IoT technologies are enabling increased digitization and automation of critical port operations and processes. Real-time data collection from sensors and devices across port infrastructure helps improve visibility, optimize resource utilization, and enhance efficiency. IoT solutions provide data-driven insights into asset performance, container movement tracking, energy consumption patterns, and more. This facilitates superior planning and decision making. Furthermore, IoT-enabled automation is reducing human intervention and risks of errors in handling cargo, fleet management, gate operations, and other tasks. The connected devices also help achieve continuous remote monitoring of port assets and equipment for predictive maintenance. The cost savings from improved productivity and asset uptime coupled with ability to deliver enhanced customer service through IoT is motivating more Australian ports to adopt these technologies. This widespread uptake is cementing IoT's leadership position in the technology segment.

Insights by Port Type - Seaports Segment Dominates the Market Due to Higher Throughput and Operations

The seaports segment dominates Australia's smart ports market with 62.6% share compared to inland ports due to higher cargo volumes and broader set of port operations. Seaports facilitate much larger throughput of containers, vehicles, liquids and dry bulk. They handle a diverse range of ocean-going vessels including bulk carriers, tankers, container ships and roll-on-roll-off vessels. This large scale of operations presents a compelling need as well as larger opportunities for digitization through technologies like IoT, AI and blockchain. Seaports are also involved in more complex functions such as ship berthing, cargo loading/unloading, warehousing, cargo tracking and customs clearance - creating greater scope for automation, data-driven optimization and enhanced efficiencies. Their critical role in international trade further amplifies the returns on technological investments. These advantages have resulted in seaports accounting for the lion's share of technology adoption in the Australian smart ports sector compared to inland ports with relatively smaller sized activities.

Competitive overview of Australia Smart Ports Market

Hutchison Ports Australia, DP World Australia, P&O Ports, Port of Newcastle, Port of Adelaide, BMT Group, Port of Darwin, Svitzer Australia, Kongsberg Maritime, Siemens Australia are the major players.

Australia Smart Ports Market Leaders

- Port Authority of New South Wales

- Port of Melbourne Corporation

- Port of Brisbane Pty Ltd

- Sydney Ports Corporation

- Qube Holdings Limited

Australia Smart Ports Market - Competitive Rivalry

Australia Smart Ports Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Australia Smart Ports Market

- In July 2022, the Port of Brisbane, a major hub for trade and logistics in Australia, announced its ambitious "Smart Port" vision aimed at integrating digital technologies and automation to enhance operational efficiency. This initiative includes the implementation of advanced port management systems and Internet of Things (IoT) solutions designed to streamline processes and improve overall productivity.

- In April 2024, the Port of Melbourne, Australia's largest container terminal and general cargo port, unveiled plans for a substantial $500 million investment aimed at enhancing automation and upgrading infrastructure. This investment is part of the port's broader strategy to improve operational efficiency and reduce congestion, ensuring it can accommodate the increasing size of modern vessels.

- In July 2023, the Port of Brisbane, a key player in Australia's logistics and trade sector, launched its Smart Port Development Program, focusing on integrating artificial intelligence (AI) and Internet of Things (IoT) technologies to enhance operational efficiency and sustainability. This initiative aims to modernize port operations by leveraging advanced technologies that can optimize resource management, improve cargo handling, and reduce environmental impact.

- In March 2024, the Port Authority of New South Wales, a leading port operator responsible for managing Sydney's ports, announced a new sustainability initiative aimed at leveraging smart technology to significantly reduce carbon emissions across its operations.

- In October 2023, Qube Holdings, Australia's largest integrated provider of import and export logistics services, revealed plans to develop a state-of-the-art intermodal terminal in Melbourne. This new facility will incorporate smart technology for cargo tracking and automated handling systems, significantly enhancing operational efficiency.

Australia Smart Ports Market Segmentation

- By Technology

- Process Automation

- Internet of Things

- Artificial Inteligence

- Blockchain

- By Port Type

- Seaports

- Inland Ports

Would you like to explore the option of buyingindividual sections of this report?

Ameya Thakkar is a seasoned management consultant with 9+ years of experience optimizing operations and driving growth for companies in the automotive and transportation sector. As a senior consultant at CMI, Ameya has led strategic initiatives that have delivered over $50M in cost savings and revenue gains for clients. Ameya specializes in supply chain optimization, process re-engineering, and identification of deep revenue pockets. He has deep expertise in the automotive industry, having worked with major OEMs and suppliers on complex challenges such as supplier analysis, demand analysis, competitive analysis, and Industry 4.0 implementation.

Frequently Asked Questions :

What are the key factors hampering the growth of the Australia Smart Ports Market?

The increasing risks associated with data breach and data protection of seaport clients and millions of cyber-attacks and data breaches are taking place every year, which is an alarm for digital security are the major factor hampering the growth of the Australia Smart Ports Market.

What are the major factors driving the Australia Smart Ports Market growth?

The increasing international maritime trade activities and increase in technological advancements automation enhance port efficiency are the major factor driving the Australia Smart Ports Market.

Which is the leading Technology in the Australia Smart Ports Market?

The leading Technology segment is Internet of Things.

Which are the major players operating in the Australia Smart Ports Market?

Hutchison Ports Australia, DP World Australia, P&O Ports, Port of Newcastle, Port of Adelaide, BMT Group, Port of Darwin, Svitzer Australia, Kongsberg Maritime, Siemens Australia are the major players.

What will be the CAGR of the Australia Smart Ports Market?

The CAGR of the Australia Smart Ports Market is projected to be 23.22% from 2024-2031.