Bird Toys Market Size - Analysis

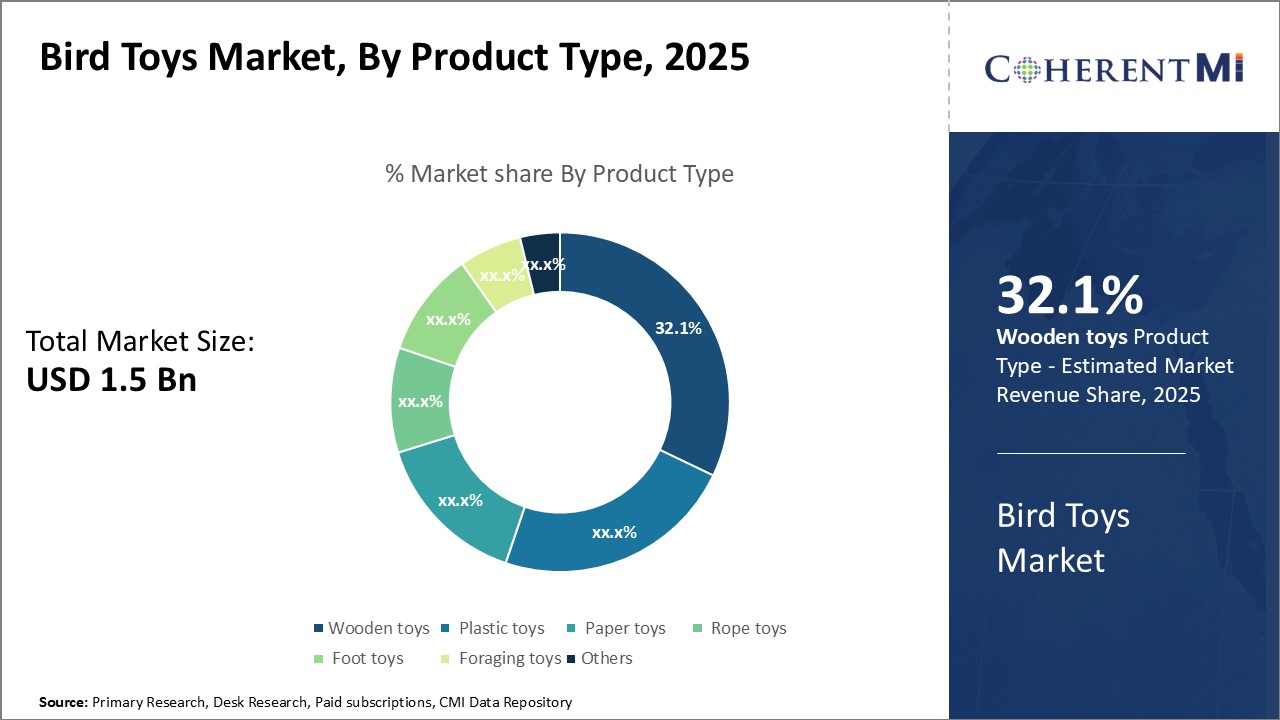

The bird toys market is segmented based on product type, bird type, distribution channel, and region. By product type, the wooden toys segment is expected to dominate the market share during the forecast period. Wooden bird toys are popular as they are safe, durable, and allow birds to satisfy chewing urges. The natural wood materials also aid beak conditioning.

Bird Toys Market Drivers

- Increasing Pet Bird Population and Rising Pet Ownership: The global pet bird population has been rising steadily, driven by the increasing ownership of birds like parrots, parakeets, and canaries as companion pets. Birds are viewed as relatively easier pets to care for versus dogs or cats. The growing emotional attachment of owners with their pet birds is leading to higher attention to their enrichment. Owners are more perceptive of the mental stimulation and activity needs of their pet birds today. This is creating a significant demand for specialized bird toys. The rise of nuclear families and dual-income households are also contributing to the growth of pet birds for companionship.

- Premiumization of Pet Care and Accessories: Today's pet owners are far more lavish and compassionate toward their companion animals, investing more money in high-quality pet food, veterinary treatment, accessories, and enrichment items like toys. The premium pet care market has entered the mainstream. With birds viewed as family members, owners are willing to spend more on engaging and safe bird toy products. Premium bird toy brands that are made from natural, sustainable materials are witnessing high adoption. Pet specialty retailers are also stocking more innovative and upscale bird toy options. The premiumization trend caters well to the natural foraging and chewing instincts of pet birds.

- Expanding E-commerce and Omnichannel Retail: The proliferation of online and omnichannel pet care retail is providing greater access to specialized bird toys for owners globally. Leading online retailers like Amazon stock a vast range of bird toy products, catering to diverse bird species and enrichment needs. Pet specialty retailers are also bolstering their digital presence through acquisitions of e-tailers and digital-first strategies. The convenience and discounts offered by online shopping provides flexibility to owners. E-commerce sales of pet products are forecast to account for over 25% of the overall sales by 2025. Omnichannel shopping journeys also allow owners to research online and purchase offline.

- Product Innovation and Customization: To increase novelty value and pique pet bird interest, bird toy producers are always coming up with new materials, shapes, textures, colors, and features to offer. Interactive electronic toys, treat dispensing puzzles, floral and planetary designs, and Do it yourself (DIY) bird toy kits are gaining popularity. Custom-built bird toys are also emerging as a trend, with startups providing tailored products based on bird breed, size, personality, and behavioral profile. Custom bird toys cater closely to the individual stimulation needs of pet birds versus mass manufactured products. Product innovation and customization are thus strong drivers.

Bird Toys Market Restraints

- Perception as Discretionary Purchase: Pet bird toys are becoming more and more common, yet many owners still consider them to be optional, non-essential purchases. The lack of awareness on the enrichment and developmental benefits quality toys provide limits market size. Owners may compensate with DIY solutions or suboptimal toys. Budget constraints may also restrict demand among lower and middle income demographics. There is need for greater education by veterinarians and retailers on the role of toys in responsible bird ownership. Effective communication of health and behavioral benefits can help establish toys as an essential accessory.

- Dominance of the Unorganized Sector: The unorganized sector including online marketplaces, independent retailers, and hobbyists crafting homemade bird toys hold a significant share of sales in developing markets. These limit the reach of larger branded manufacturers given lower prices despite questionable quality and safety standards. The presence of counterfeit products also hinders growth of the organized sector. Brands need to emphasize durability, safety, and innovation to counter competition from the unorganized space and sensitize consumers.

- Seasonal Demand Fluctuations: Bird toy sales are subject to periodic fluctuations depending on the time of year. Demand tends to peak during the holiday gifting season in winter when toys are commonly purchased as pet presents. Sales taper for most of the year before rising again around the holiday season. Seasonal drops can affect business performance and production planning. Companies need to account for seasonality through promotional strategies like holiday gift guides and loyalty programs to drive repeat sales.

Bird Toys Market Opportunities

- Untapped Potential in Emerging Markets: Regions like Asia Pacific, Middle East, and Latin America represent massive untapped opportunities for bird toy companies, given the fairly nascent growth stage. Rising disposable incomes in these markets coupled with increasing awareness of pet care is conducive for growth. As small pet birds become popular, demand for engaging toys will rise. Tropical regions also have greater prevalence of bird species. Developing habit of purchasing specialized pet products versus makeshift homemade options also favors growth. Strategic collaborations with local distributors can help gain distribution footprint and consumer mindshare in emerging markets.

- Mainstreaming Through Veterinary Channels: The veterinary channel remains an under-penetrated opportunity for bird toy companies. Avian veterinarians and clinics deal closely with pet bird owners and can be influential in driving toy purchase decisions. Displaying bird toys in clinic retail areas and collaborating with veterinarians to prescribe toys as part of treatment plans can expand mainstream reach. Veterinarians can also educate owners on selecting toys aligned to pet birds' health needs and behavior. There is potential for prescription bird toys targeted at medical conditions like obesity and arthritis. Overall, the veterinary channel provides a means to push premium products and specialized knowledge.

- Private Label Offerings: Developing exclusive bird toy collections for leading pet specialty retailers under private label arrangements provides an attractive growth opportunity. Petco, PetSmart, and Pet Supplies Plus have significant brick-and-mortar and online distribution footprint. Private labels allow retailers to differentiate through unique products while being affordable. It also builds stronger supplier relationships and loyalty. Tapping the private label segment can aid premium positioning given retailers' focus on upgrading in-house brands. Walmart and Target also represent mass retail opportunities for affordable private label bird toys.

- Licensing and Brand Partnerships: Partnering with popular entertainment franchises, movies and brands like Star Wars, Marvel, and Disney for licensed bird toys can provide freshness while leveraging existing brand equity. Such toys enjoy strong appeal given the pre-existing fan following for brands. Collaborations with zoos, aquariums and conservation groups are other licensing opportunities to build credibility and purpose-driven products. Even partnering with influencers popular in the pet space can provide visibility. Overall, strategic brand partnerships and licensing agreements open cross-promotional possibilities to attract new consumers.

Market Size in USD Bn

CAGR7.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.8% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Petsmart Inc., Petco Animal Supplies Inc., PetEdge Dealer Services, Paradise Pet Company, Cardinal Gates and Among Others |

please let us know !

Bird Toys Market Trends

- Natural and Sustainable Materials: Sustainability consciousness and humanization of pets is driving the demand for natural, eco-friendly materials in bird toys. Manufacturers are utilizing renewable materials like wood, cotton rope, sisal, loofah, coconut husk, bamboo, and palm fronds more extensively. Recycled rubbers, papers and textiles are also gaining traction. Companies are being transparent about sourcing and production through sustainability certifications and reporting. Consumers are more discerning of toy safety and environmental impact. The shift toward natural toys provides both ethical appeal and benefit of enabling natural bird behaviors.

- Technology-enabled Smart Toys: Incorporating technology features into interactive smart bird toys is an emerging trend. These include toys with inbuilt sensors, cameras, microphone and speakers enabled by AI, Bluetooth and apps. Smart toys allow pet owners to observe, interact with and track their birds remotely, providing mental stimulation when alone at home. Smart bird toys can also detect and analyze bird noises and behaviors to provide insights. Digital connectivity and gamification drive greater engagement and bonding. Voice command features for control add convenience. While currently niche, tech-enabled bird toys have significant room for growth in future.

- Subscription Boxes: Subscription box services that deliver monthly packages of assorted bird toy samples, treats, and accessories to owners have gained popularity as an element of surprise, discovery and convenience. Monthly subscriptions take away the effort of selecting new toys to beat boredom. Subscription boxes also allow exposure to new, innovative toy styles and brands while being affordable. They provide rotating variety tailored to bird needs. Leading pet box subscriptions like BarkBox, Super Chewer, and Bullymake have entered the bird segment given its lucrative potential. The recurring revenue model benefits businesses as well through developing loyalty.

- Humanization and Personalization: The humanization of pets is extending the desire for more personalized and identity-defining bird toys. Custom naming, accessories that match human styles, made-to-order shapes based on breeds, and even customization for individual birds is rising. Personalized toys enable deeper emotional bonding. Some services allow inputting the bird's name, personality traits and color preferences to receive tailored recommendations. The niche custom bird toy segment is likely to gain wider popularity as owners treat pets like family. Humanization also sparks demand for bird toys that mirror real-life human objects.

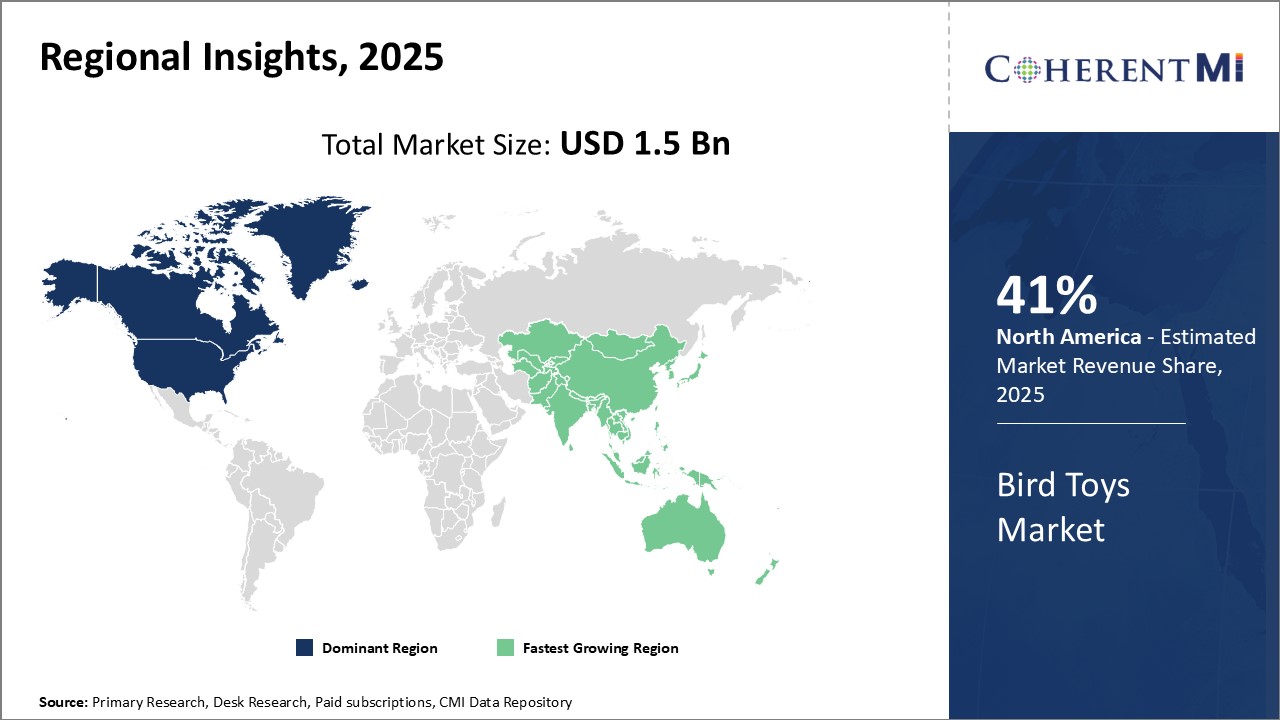

Bird Toys Market Regional Insights

- North America is expected to be the largest market for bird toys during the forecast period, accounting for over 41% of the market share in 2025. The growth of the market in North America is attributed to the high adoption of pet birds, high spending on pet care, and presence of major pet retail chains in the region.

- Europe is expected to be the second-largest market for bird toys, accounting for over 22% of the market share in 2025. The growth of the market in Europe is attributed to rising pet humanization and increasing awareness about pet health and enrichment.

- Asia Pacific market is expected to be the fastest-growing market for bird toys, which is expected to grow at a CAGR of over 18% during the forecast period. The growth of the market in Asia Pacific is attributed to the growing disposable income and rising pet ownership in the region.

Segmental Analysis of Bird Toys Market

Competitive overview of Bird Toys Market

The major players operating in the bird toys market include Petsmart Inc., Petco Animal Supplies Inc., PetEdge Dealer Services, Paradise Pet Company, Cardinal Gates, Prevue Pet Products, Hagen Avicultural Research Institute, Caitec Corporation, Super Bird Creations, and The Bird Toy Company.

Bird Toys Market Leaders

- Petsmart Inc.

- Petco Animal Supplies Inc.

- PetEdge Dealer Services

- Paradise Pet Company

- Cardinal Gates

Bird Toys Market - Competitive Rivalry

Bird Toys Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Bird Toys Market

New product launches

- In March 2021, Caitec Corporation has been leading the way in pet product innovation by offering pet owners a wide range of high-quality, affordable pet launched the Gizmo Bird Toy line featuring interactive electronic modules. The toys provide auditory, visual, and tactile stimulation for pet birds.

- In January 2022, Prevue Pet Products is Designing & Manufacturing quality Homes, Toys and Accessories for Family Pet announced its Astro Parrot toy collection with brightly colored planetary and spaceship themed toys. The toys promote discovery, chewing, and foot toy play.

- In June 2020, Super Bird Creations introduced the Cozy Cabin play set plush toy for small to medium sized birds. It provides a hideaway space and promotes natural chewing behavior.

Acquisition and partnerships

- In October 2021, Petco is for pet supplies, food, treats, & in-store services acquired PetSmart's U.K.-based business to expand its pet care services and products in Europe. The acquisition strengthened Petco's footprint in the pet care industry globally.

- In June 2022, PetEdge is supplier to pet care professionals and independent retailers announced an exclusive distribution deal with Suffolk Animal Products to make its pet grooming tools available to independent retailers in the U.S. The partnership expanded PetEdge's portfolio.

- In May 2020, Cardinal Gates (supplier of quality baby gates, pet gates and safety products sold online in stores across the country) partnered with the U.S.-based pet store chain, Pet Supplies Plus to make its pet products available in over 500 stores across the country. The deal helped Cardinal Gates expand its offline distribution.

Bird Toys Market Segmentation

- By Product Type

-

- Wooden toys

- Plastic toys

- Paper toys

- Rope toys

- Foot toys

- Foraging toys

- Others (bells, chains, mirrors etc.)

- By Bird Type

-

- Parrots

- Canaries

- Finches

- Parakeets

- Cockatiels

- Lovebirds

- Others (macaws, cockatoos etc.)

- By Distribution Channel

-

- Online

- Offline

- By Region

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the Bird Toys Market?

The Bird Toys Market is estimated to be valued at USD 1.5 in 2025 and is expected to reach USD 2.5 Billion by 2032.

What are the major factors driving the bird toys market growth?

The major factors driving the bird toys market growth are rising pet ownership, pet humanization, growing e-commerce, product innovation and launches.

Which is the leading component segment in the bird toys market?

The leading component segment is wooden toys due to durability, safety, and beak conditioning properties.

Which are the major players operating in the bird toys market?

The major players operating in the bird toys market are Petsmart, Petco, PetEdge, Paradise Pet, Cardinal Gates, Prevue Pet, Hagen, Caitec, Super Bird Creations, and The Bird Toy Company.

Which region will lead the bird toys market?

North America is expected to lead the bird toys market.

What will be the CAGR of the bird toys market?

The CAGR of the bird toys market is 7.8%.