Brewery Equipment Market Size - Analysis

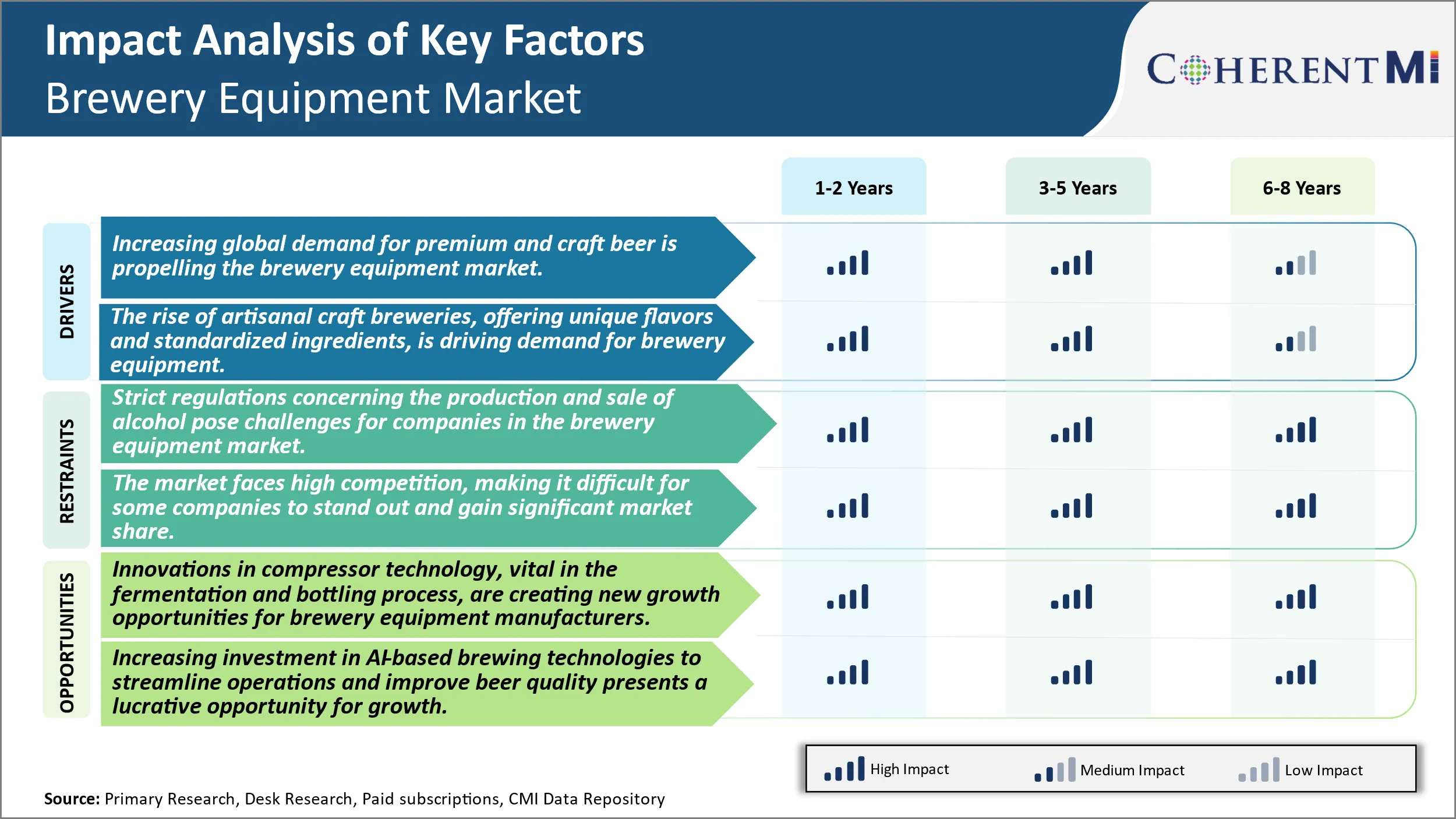

The market is witnessing positive trends such as rising automation in breweries and growing adoption of advanced equipment to produce innovative flavored beers. Manufacturers are investing in Industry 4.0 technologies like AI, IoT and machine learning to develop smart brewery equipment with monitoring and controlling capabilities. However, high initial investment and maintenance costs of commercial brewery equipment may hinder the market growth to some extent over the forecast period.

Market Size in USD Bn

CAGR5.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.3% |

| Market Concentration | High |

| Major Players | Alfa Laval, GEA Group Aktiengesellschaft, Krones AG, Paul Mueller Company, Brewbilt Manufacturing INC and Among Others |

please let us know !

Brewery Equipment Market Trends

The global appetite for craft and premium beers has been steadily rising in the last few years. Consumers today are more quality and variety-conscious when it comes to beer. They are moving away from the standard lagers and ales towards specialized craft beers featuring unique flavors, ingredients and brewing processes. This adventurous taste is translating into increasing sales and production volumes for premium and craft beers globally. As per industry estimates, the craft beer segment accounted for over 20% of the global beer market in 2021 and is expected to keep outpacing the growth of the overall beer industry.

Larger and well-established brewers are also investing in specialized craft systems to complement their existing portfolios and tap into the lucrative premium market. They need customized equipment at different brewing facilities to brew special seasonal, small-batch beers for local markets. Meanwhile, the thriving microbrewery culture has prompted the entry of many new craft brewers who rely solely on premium equipment right from their startup. With many nations also liberalizing regulations to promote local craft brewing, the demand for versatile brewery equipment enabling unique brewing capabilities continues to surge. This rising global appetite for premium and specialty craft beers is thus a major driver propelling the sales and growth of the brewery equipment industry.

Market Driver - The Rise of Artisanal Craft Breweries Fuels Demand for Brewery Equipment

Notable aspects of the artisanal brewing model include reliance on local sourcing of barley, hops and fruits, unique brewing techniques and constant innovation of new seasonal beers. Most microbreweries also highlight the provenance of ingredients and brewing process as a mark of their distinct identity. Their brews therefore possess an inherent sense of place celebrated by local communities. Besides appealing to gourmet tastes, artisanal beers also represent nostalgia for old world brewing traditions and ethically produced food and beverages. This convergence of quality, authenticity and sustainability has won craft breweries legions of loyal fans globally.

Market Challenge - Strict Regulations Concerning the Production and Sale of Alcohol Pose Challenges for Companies in the Brewery Equipment Market

Innovations in compressor technology, vital in the fermentation and bottling process, are creating new growth opportunities for brewery equipment manufacturers. Advances such as magnetic bearing compressors provide important efficiency gains for breweries. Magnetic bearing compressors consume up to 30% less energy than conventional compressors through their frictionless levitation of the central shaft. This helps reduce operating costs significantly for brewery customers. innovations have also improved the precision, speed and contaminant control delivered by compressors. Faster fermentation and bottling times allow higher volume productivity. Meanwhile tighter contaminant control upholds consistent product quality. To capitalize on demand for these solutions, equipment providers are investing in new facilities and production lines focused on magnetic bearing and other advanced compressor systems. Considering the energy and productivity benefits on offer, breweries are eager to upgrade their operations with the latest compressor technologies. This need is driving robust growth in orders and revenues for innovative brewery equipment manufacturers.

Key winning strategies adopted by key players of Brewery Equipment Market

Focused Product Innovation - Leading players like Krones AG, Della Toffola Group, Criveller Group, and GEBR. HEINEMANN BREWERY EQUIPMENT has continuously invested in R&D to develop new and innovative brewery equipment. For example, in 2020, Krones launched its MicroStar brewhouse system aimed at craft breweries producing smaller batches. This compact unit combines brewhouse, fermentation and bright beer tank functions in a footprint of only 10 sqm. Such focused innovation helps players attract new craft brewers.

Global Expansion into Emerging Markets - To maintain growth momentum, leaders have expanded into high potential emerging markets in Asia Pacific and Latin America over the past 5 years. For example, Della Toffola set up a new manufacturing plant in India in 2017 to cater to the fast-growing Indian brewery market. This helped double its revenue from India within 3 years.

Segmental Analysis of Brewery Equipment Market

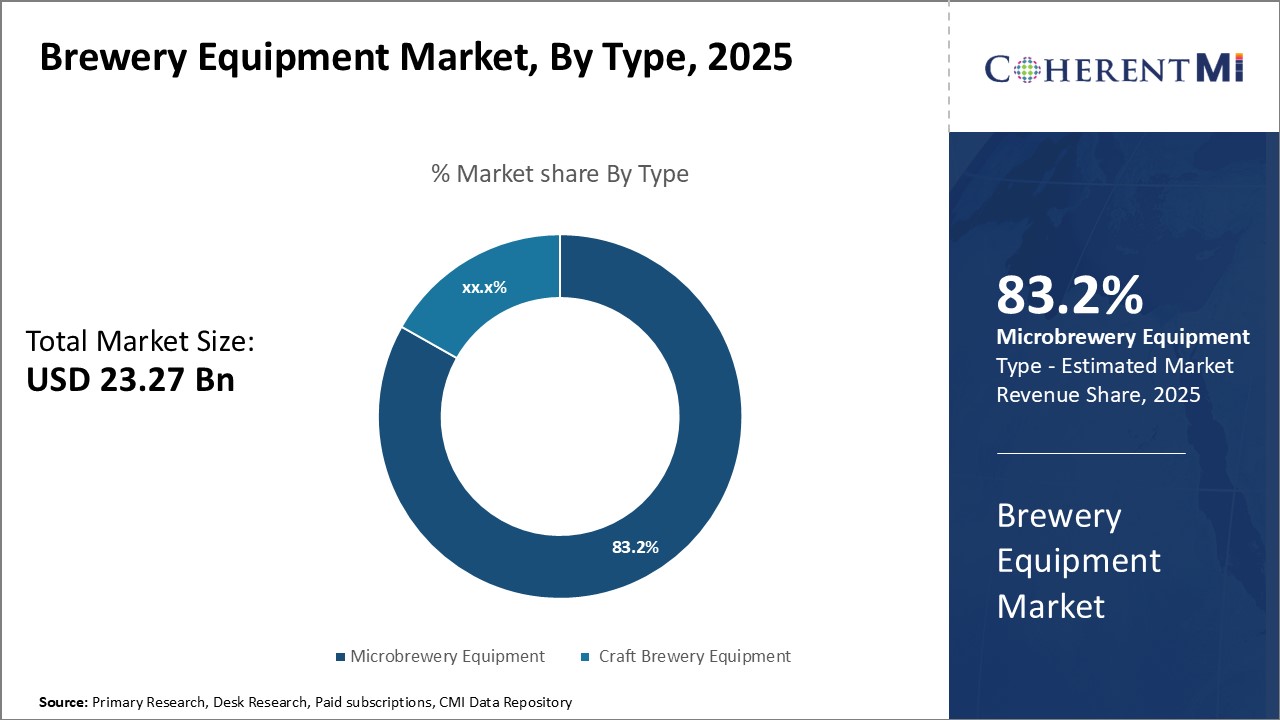

Insights, By Type, Expanding Consumer Interest in Unique, Artisanal Beers Fuels Growth of Microbrewery Equipment

Insights, By Type, Expanding Consumer Interest in Unique, Artisanal Beers Fuels Growth of Microbrewery EquipmentBy Type, the microbrewery equipment is projected to grow at 83.2% in 2025 owing to the rising popularity of craft beers among consumers has been a major driver of growth for the microbrewery equipment segment. As more drinkers take an interest in unique, locally-brewed beers with complex flavors, they are fueling demand for the specialized equipment needed to produce these beers on a small scale. Microbreweries allow passionate brewmasters to experiment with unique ingredients and brewing styles to develop distinct, artisanal beers that stand out from the mass-produced national brands.

Advances in automation and control systems have also enabled even very small brewing operations to produce beer of high quality with precise flavor profiles in an efficient manner. Computerized systems have streamlined record-keeping and quality control for microbreweries. Meanwhile, the craft beer movement’s emphasis on sustainability has increased interest in energy-efficient and environmentally-friendly equipment designed specifically for microbreweries. Demand looks set to continue growing as brewers experiment with new styles and consumers increasingly seek out unique, local brews.

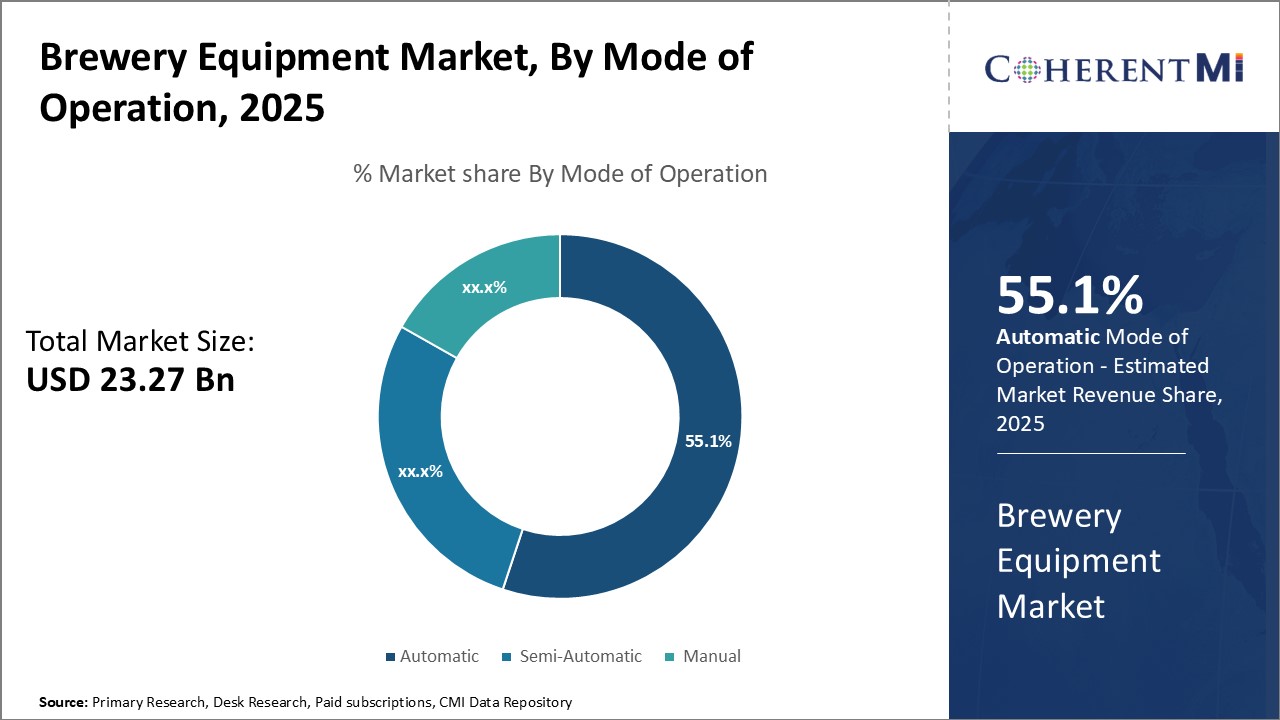

Within the mode of operation segment, the automatic brewing equipment demand has been highest due high-capacity, efficient production at larger craft and commercial breweries. The projected market share is expected to account for 55.1% in 2025. As the craft beer market has boomed, many successful breweries have expanded distribution and upscaled their operations to keep up with surging demand for their brands. However, scaling up brewing to produce larger volumes while maintaining strict quality control and consistency presents challenges.

The labor savings and efficiency gains of automated brewing equipment have proved vital to craft breweries expanding distribution into new markets. It allows quality and flavors to scale up along with production size without compromising the brands. With automatic systems handling complex brewing steps, larger breweries can reallocate employees to focus on sales, marketing and further innovation. Demand for advanced automation solutions will therefore continue growing as craft brewers scale their successful brands to meet swelling market demand.

Additional Insights of Brewery Equipment Market

The global brewery equipment market is experiencing robust growth, driven by increasing demand for premium and craft beer and the rise of artisanal breweries. Europe remains the dominant market due to its high beer consumption and the presence of key players, but North America is projected to witness the fastest growth, fueled by the popularity of craft breweries and innovative beer flavors. The incorporation of AI in brewing is transforming the industry, with applications in automation, fermentation control, and predictive maintenance. This technology is enabling brewers to create unique beer flavors and improve production efficiency. However, the market faces challenges due to strict regulations on alcohol production and high competition among manufacturers. Despite these challenges, the growth of craft beer consumption and advances in brewing technology are expected to drive significant demand for brewery equipment in the coming years.

Competitive overview of Brewery Equipment Market

The major players operating in the Brewery Equipment Market include Alfa Laval, GEA Group Aktiengesellschaft, Krones AG, Paul Mueller Company, Brewbilt Manufacturing INC, Praj Industries, Meura, Della Toffola SpA, LEHUI, Criveller Group and KASPAR SCHULZ.

Brewery Equipment Market Leaders

- Alfa Laval

- GEA Group Aktiengesellschaft

- Krones AG

- Paul Mueller Company

- Brewbilt Manufacturing INC

Brewery Equipment Market - Competitive Rivalry

Brewery Equipment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Brewery Equipment Market

- In February 2024, Bwanaz launched the iGulu F1 Automated Smart Home Brewer, simplifying home beer brewing for consumers through AI-powered processes.

- In October 2023, Brooklyn Brewery introduced Fonio Rising, a craft beer made with fonio, a traditional West African grain, aiming to bring underutilized African ingredients to the global market.

- In April 2022, Alfa Laval provided brewing systems to Golden Brewery, the second-largest brewery in the world, enhancing its brewing capabilities.

Brewery Equipment Market Segmentation

- By Type

- Microbrewery Equipment

- Craft Brewery Equipment

- By Mode of Operation

- Automatic

- Semi-Automatic

- Manual

Would you like to explore the option of buying individual sections of this report?

Ramprasad Bhute is a Senior Research Consultant with over 6 years of experience in market research and business consulting. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How Big is the Brewery Equipment Market?

The Global Brewery Equipment Market is estimated to be valued at USD 23.27 Bn in 2025 and is expected to reach USD 33.40 Bn by 2032.

What will be the CAGR of the Brewery Equipment Market?

The CAGR of the Brewery Equipment Market is projected to be 5.1% from 2024 to 2031.

What are the major factors driving the Brewery Equipment Market growth?

The increasing global demand for premium and craft beer is propelling the brewery equipment market and the rise of artisanal craft breweries, offering unique flavors and standardized ingredients, is driving demand for brewery equipment are the major factors driving the Brewery Equipment Market.

What are the key factors hampering the growth of the Brewery Equipment Market?

The strict regulations concerning the production and sale of alcohol pose challenges for companies in the brewery equipment market and the market faces high competition, making it difficult for some companies to stand out and gain significant market share. These are the major factors hampering the growth of the Brewery Equipment Market.

Which is the leading Type in the Brewery Equipment Market?

Microbrewery Equipment is the leading Type segment.

Which are the major players operating in the Brewery Equipment Market?

Alfa Laval, GEA Group Aktiengesellschaft, Krones AG, Paul Mueller Company, Brewbilt Manufacturing INC, Praj Industries, Meura, Della Toffola SpA, LEHUI, Criveller Group, KASPAR SCHULZ are the major players.