Global Satellite as a Service Market Size - Analysis

Satellite as a service refers to a business model where satellite operators provide services like broadband connectivity, direct-to-home television, backhaul and trunking solutions to end users on a pay-as-you-go basis. The key advantages of this model are reduced upfront capital expenditure, flexibility, and scalability for the end users. The growth of this market can be attributed to factors like declining satellite bandwidth prices, rising penetration of mobile devices, and increased adoption in the enterprise sector.

- Declining Satellite Bandwidth Prices: The prices of satellite bandwidth have declined significantly over the past decade owing to technological advancements and market competition. The entry of high throughput satellites (HTS) has dramatically increased the supply of bandwidth and enabled operators to offer bandwidth at lower prices. For instance, bandwidth pricing has declined by over 50% for certain HTS Ka-band capacity between 2012 and 2025. The declining bandwidth prices make satellite-based solutions more affordable for end users across sectors like telecom, maritime, media and enterprises. It expands the addressable market for satellite operators and drives adoption of services like inflight connectivity, cellular backhaul and rural broadband. The competitive pricing is a key driver spurring the growth of satellite as a service model.

- Rising Demand for Satellite Services from Mobility Sector: The mobility sector including aviation, maritime and land mobile are creating substantial demand for satellite-based solutions. Satellites are being increasingly used to provide inflight connectivity for aircraft passengers. Major service providers are partnering with satellite operators to roll out inflight connectivity globally. For instance, Intelsat partnered with Panasonic Avionics to provide Ku-band and HTS capacity for inflight Wi-Fi on over 3,000 commercial aircraft. Similarly, rising digitalization of ships is driving adoption of satellite communications for crew welfare and ship operations. Satellite networks offer reliable communications and real-time navigation in seas. Further, the integration of satellite into land mobility such as trains, coaches is also gaining pace supported by technological advancements. The rising opportunities in mobility are fueling the growth of satellite as a service model.

- Uptake from Enterprise and Government Sectors: Enterprises and governments are emerging as significant users of satellite-based communication solutions. Businesses are using private enterprise networks over satellite for applications like SD-WAN, mobile backhaul and Internet access. Satellite networks provide efficient connectivity to distribute enterprise networks. Similarly, governments are relying on satellites to bridge the digital divide between rural and urban areas. Large-scale government backed programs for rural broadband connectivity in regions like India, Africa are creating demand for satellite networks. Satellites are also used for emergency response, distance education and telemedicine services catering to government needs. The growing enterprise and government demand acts as a key driver for satellite as a service market.

- Advantages over Terrestrial Networks: Satellite networks offer specific advantages compared to terrestrial networks in aspects like ubiquitous coverage, broadcast capabilities, reliability and security. Satellite footprints can extend services to geographical areas unreachable through terrestrial means. Satellite broadcasts enable content distribution across large regions. The technology is unaffected by geographical disruptions providing an alternative path for critical communications. These benefits are leading sectors like maritime, aviation, media and telecom to incorporate satellite into their connectivity infrastructure. It is leading to wider adoption of flexible consumption models like satellite as a service.

Market Size in USD Bn

CAGR34.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 34.5% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | SES, Intelsat, Eutelsat, Telesat, SKY Perfect JSAT and Among Others |

please let us know !

Global Satellite as a Service Market Trends

- High Throughput Satellites: HTS or high throughput satellites are a major technology trend shaping the market. HTS provide 10 to 100 times more capacity than conventional satellites through frequency re-use and spot beam coverage. Operators like SES, Intelsat, Telesat have launched HTS constellations focused on densely populated regions. HTS enables cost-effective delivery of high speed broadband and cellular services. Their smaller spot beams also allow reuse of limited frequency spectrum. HTS capacity has become instrumental for inflight connectivity and cellular backhaul which require high bandwidth. The growing launch of HTS by major as well as new operators signals the dominance of this technology.

- Software-Defined Satellites: Software-defined satellites allow reconfiguration of satellite payloads in orbit through software updates. Eutelsat's Quantum satellite lets users shape antennas, amplify power and change frequency/bandwidth. US-based Startup Astranis designs low-cost software-defined microGEO satellites. This allows optimizing satellites for evolving connectivity demands during lifetimes spanning 15 years. Operators can redirect capacity over high-demand areas, counter outages and dynamically serve new markets. Software-defined satellites lower costs and add flexibility for users to scale services via satellite as a service model.

- Electronically Steered Satellite Antennas: Electronically steered antennas allow tracking satellites without any moving parts, enabling their deployment over platforms like aircrafts, vessels, land mobility. Kymeta, Phasor, Isotropic Systems make low-profile antennas for mobility applications. Panasonic Avionics uses Kymeta antennas in its inflight connectivity system. Intelsat qualified Phasor ESA antennas for use with its mobility network. Isotropic’s optical beamforming antennas will empower high-throughput mobile satellite links for defense, first responders. The availability of reliable, high-performance antennas spurs adoption across verticals driving market growth.

- Satellite Production Automation: Satellite manufacturers are adopting technologies like robotics, augmented reality (AR) and AI to automate production. Airbus uses AR glasses for its assembly technicians to improve quality and productivity. Thales Alenia Space uses AI-optimized software to analyze antenna radiofrequency patterns and thermal control systems. Northrop Grumman uses drones to scan parts and tools in factories and smartphones to guide workers through processes. Satellite production automation is enabling companies to build and launch satellites faster and cost-effectively to meet rising connectivity demands.

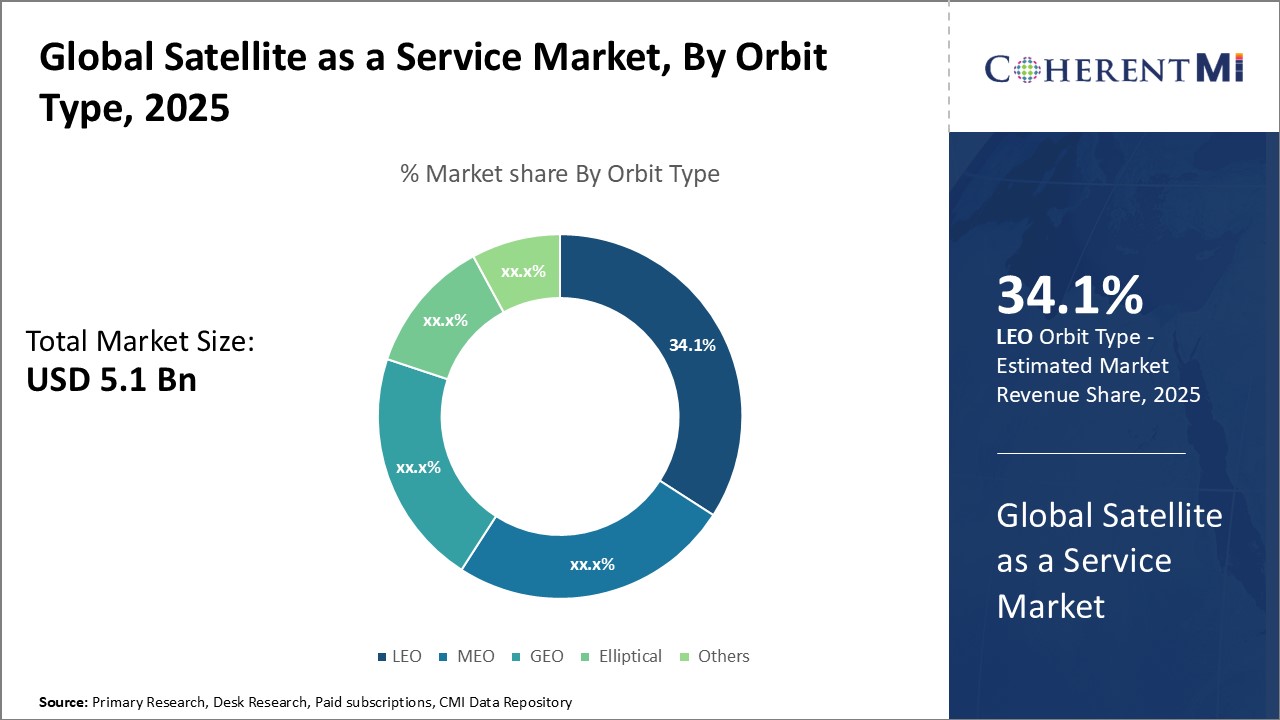

The Global Satellite as a Service Market is segmented by Orbit Type, into LEO, MEO, GEO, Elliptical and Others. LEO segment dominate the market. LEO is seeing growing demand due to the miniaturization of satellite components which has made smaller, lower-cost satellites viable. This has boosted the demand for situational awareness, disaster management and connectivity services that require frequent revisits over locations.

Satellite as a Service Market Regional Insights:

- North America is expected to be the largest market for Satellite as a Service Market during the forecast period, accounting for over 38.5% of the market share in 2025. The growth of the market in North America is attributed to early adoption of satellite services and presence of major service providers in the region.

- The Europe market is expected to be the second-largest market for Satellite as a Service Market, accounting for over 26.7% of the market share in 2025. The growth of the market in is attributed to increasing demand for satellite services from sectors like maritime, aerospace and defense in the region.

- The Asia Pacific market is expected to be the fastest-growing market for Satellite as a Service Market, with a CAGR of over 14.2% during the forecast period. The growth of the market in Asia Pacific is attributed to rising penetration of satellite TV and growth of cellular backhaul networks in developing countries.

Segmental Analysis of Global Satellite as a Service Market

Competitive overview of Global Satellite as a Service Market

SES, Intelsat, Eutelsat, Telesat, SKY Perfect JSAT, SingTel, Optus, Star One, Arabsat, Hispasat.

Global Satellite as a Service Market Leaders

- SES

- Intelsat

- Eutelsat

- Telesat

- SKY Perfect JSAT

Global Satellite as a Service Market - Competitive Rivalry

Global Satellite as a Service Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Satellite as a Service Market

The Global Satellite as a Service Market refers to the comprehensive ecosystem where satellites are used to provide various services such as communication, earth observation, navigation, and others. These services are offered on a subscription basis, similar to other 'as a service' models, allowing businesses to leverage satellite technology without the need for significant upfront investment in infrastructure. The market has been witnessing significant growth due to the increasing demand for cost-effective and efficient satellite services across various sectors such as defense, agriculture, logistics, and telecommunications..

However, the market faces challenges such as regulatory issues related to the launch and operation of satellites, and the risk of space debris. Despite these challenges, the market is expected to witness significant growth in the coming years, driven by the increasing demand for satellite services and the advent of new technologies.

Despite these challenges, Global Satellite as a Service Market presents vast opportunities. Governments across the world are increasingly partnering with private companies for space exploration and satellite services. This presents an opportunity for Satellite as a Service providers to collaborate with government agencies and leverage their resources and capabilities.

- In March 2022, SES announced the launch of Astra 1P, a new satellite to provide broadcast services across Europe. The satellite will support the growth of HD and UHD TV in the region.

- In June 2020, Eutelsat launched EUTELSAT QUANTUM, the first European reprogrammable commercial satellite. It can be reprogramed in orbit and adapts its coverage, bandwidth and power to meet changing demands.

Global Satellite as a Service Market Segmentation

- By Orbit Type

-

- LEO

- MEO

- GEO

- Elliptical

- Others

- By Solution

-

- Satellite TV Service

- Satellite Fixed Voice Solutions

- Satellite Mobile Voice Solutions

- Satellite Internet/VSAT Service

- Satellite Radio Service

- Satellite Backhaul & Trunking

- Others (Inflight Connectivity, M2M, IoT etc)

- By End Use Industry

-

- Media & Entertainment

- Government

- Aviation

- Defense

- Transportation & Logistics

- Energy & Utilities

- Others (Enterprises, Retail, Mining etc)

- By Frequency Band

-

- C Band

- K/KU/KA Band

- S & L Band

- X & HTS Band

- Others

- By Geography

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Would you like to explore the option of buying individual sections of this report?

Monica Shevgan has 9+ years of experience in market research and business consulting driving client-centric product delivery of the Information and Communication Technology (ICT) team, enhancing client experiences, and shaping business strategy for optimal outcomes. Passionate about client success.

Frequently Asked Questions :

How big is the Global Satellite as a Service Market?

The Global Satellite as a Service Market is estimated to be valued at USD 5.1 in 2025 and is expected to reach USD 40.6 Billion by 2032.

What are the key factors hampering growth of the Satellite as a Service Market?

The regulatory environment and legal considerations related to copyright and intellectual property rights pose challenges for content creators and platforms alike.

What are the major factors driving the Satellite as a Service Market growth?

Declining satellite bandwidth prices, growing demand for UHDTV and HDTV, rising penetration of mobile devices, increased adoption in enterprise sector.

Which is the leading component segment in the Satellite as a Service Market?

The LEO orbit type segment is expected to lead the Satellite as a Service Market owing to rising deployment of LEO satellites.

Which are the major players operating in the Satellite as a Service Market?

SES, Intelsat, Eutelsat, Telesat, SKY Perfect JSAT, SingTel, Optus, Star One, Arabsat, Hispasat.

What will be the CAGR of Satellite as a Service Market?

The CAGR of Satellite as a Service Market is expected to be 34.5% from 2025-2032.