Green Logistics Market Size - Analysis

Market Size in USD Tn

CAGR8.35%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.35% |

| Market Concentration | High |

| Major Players | FedEx Corporation, Deutsche Post DHL Group, United Parcel Service of America, Inc. (UPS), GEODIS, DSV and Among Others |

please let us know !

Green Logistics Market Trends

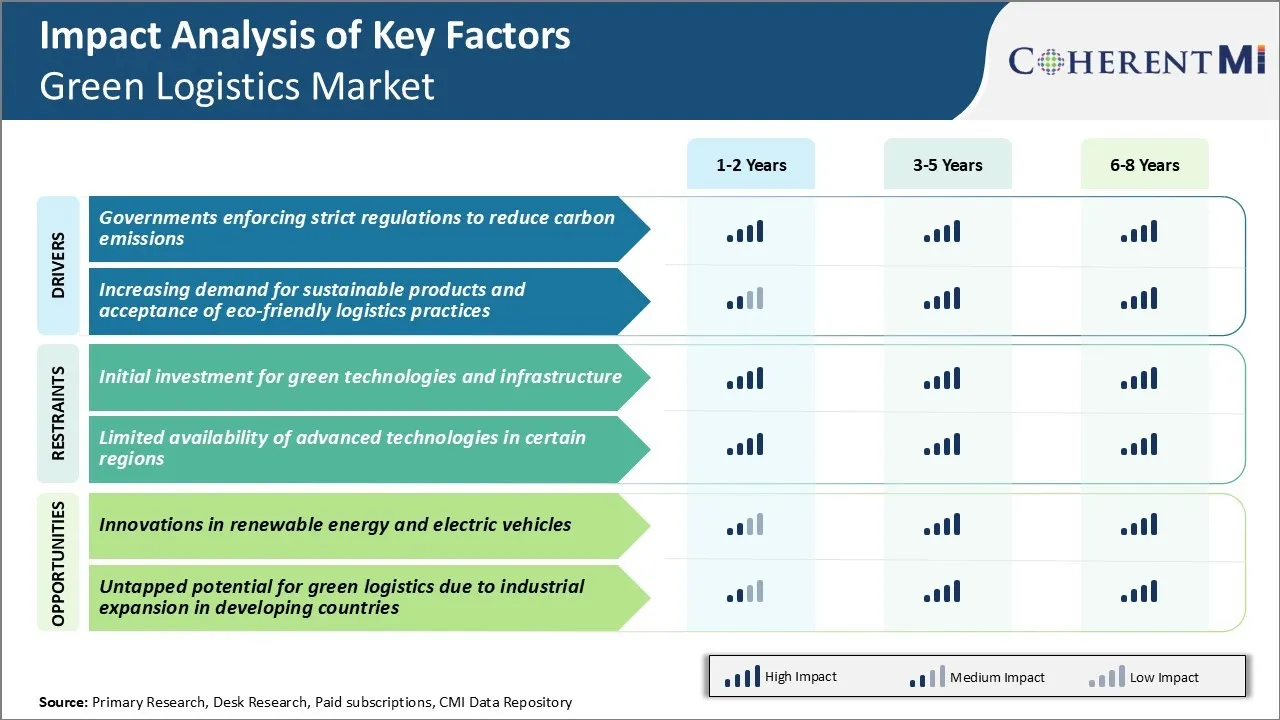

With growing environmental concerns, governments are increasingly working towards curbing carbon emissions and implementing stringent policies to promote more sustainable practices. Many countries have now set mandatory emission reduction targets and timelines to transition to eco-friendlier solutions.

Many countries in Asia, Americas, and Africa are likewise devising environmental protection laws with mandatory renewable portfolio standards and fleet modernization plans. For green logistics service providers with international operations, it is becoming imperative to build sustainability considerations into core strategies and transition to greener business models.

Environmental consciousness among consumers and corporations has been growing tremendously in recent years. More customers now want to purchase products with lesser negative impacts and are supportive of companies taking climate actions very seriously. This rising consumer demand also extends to logistics and expectations around greener delivery solutions.

Businesses recognize the need to align with shifting social values to attract and retain the talent of tomorrow. Those failing to move quickly on sustainability may lose out on future workforce as well as face disfavor from conscious investors. Thereby, adopting green strategies provides an avenue to gain competitive advantages to green logistics market players.

One of the major challenges faced by the green logistics market is the high initial investment required for transitioning to green technologies and building necessary supporting infrastructure. Adopting renewable energy sources like solar and wind for powering logistics operations and transportation requires setting up generation facilities which have a substantial capital cost.

The costs of procuring new green technologies can be a barrier for logistics companies and transportation providers to switch to sustainable practices, particularly smaller businesses with limited financial resources. High initial expenses posed challenges to large-scale adoption of clean technologies in the green logistics market.

Market Opportunity - Innovations in Renewable Energy and Electric Vehicles

Furthermore, rapid product development is occurring in the electric vehicle industry. Major automakers are launching new models of commercial electric trucks and vans for cargo transportation. The driving range of EVs is also enhancing continuously, alleviating range anxiety issues.

Key winning strategies adopted by key players of Green Logistics Market

Adopting automation and latest technologies was another dominant strategy. Automated sorting systems, route optimization software, telematics etc. helped improve efficiency while reducing fuel and time wastage. Deutsche Post DHL implemented intelligent transport management software in 2020 that reduced truck journeys by 100 million km per year.

Promoting multimodal shipments and shifting freight from road to rail helped lower emissions. In 2018, over 25% of FedEx's shipments in Europe utilized multiple transport modes like road-rail combinations.

Segmental Analysis of Green Logistics Market

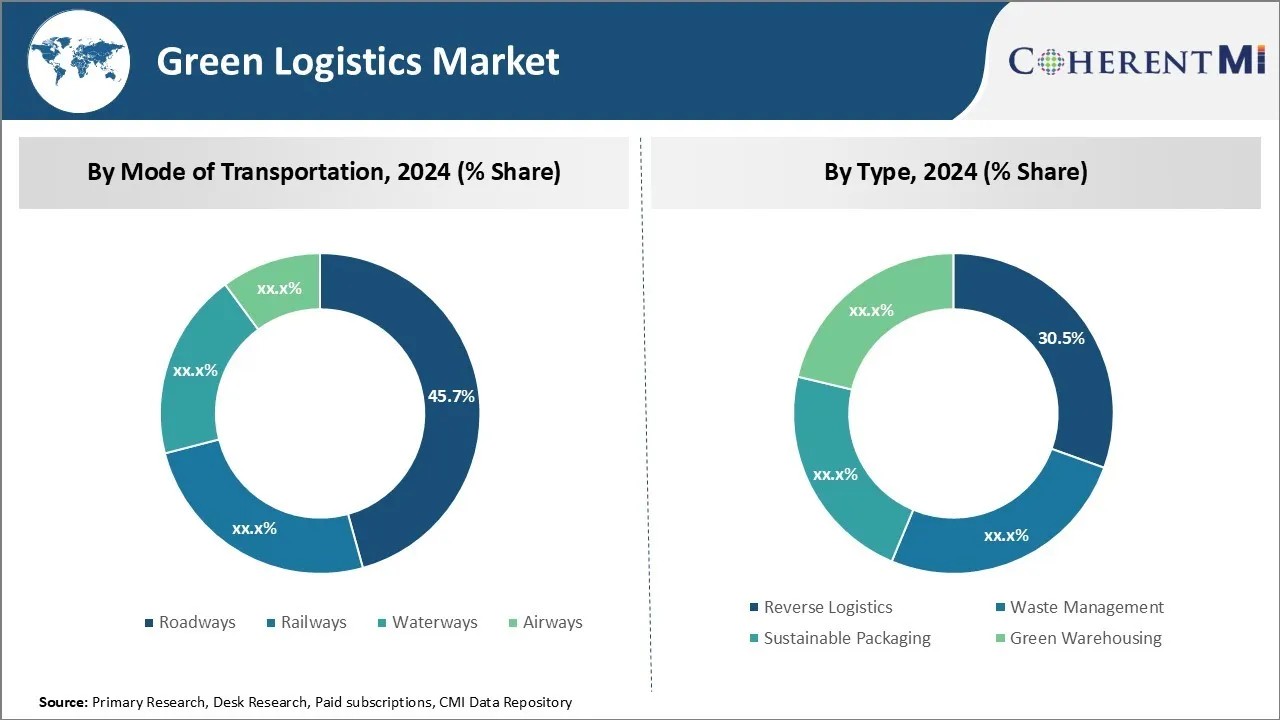

In terms of mode of transportation, roadways segment is expected to account for 45.7% share of the green logistics market in 2024. This is due to its ubiquitous presence and flexibility for last mile delivery. Road transportation remains the backbone for delivery of goods across both long and short distances.

Various pilot projects demonstrate the viability of electric vehicles for ensuring last mile reach within cities. Subsidies and falling battery prices may accelerate their wider adoption going forward. This drives the growth of green road logistics solutions.

In terms of type, reverse logistics is projected to hold 30.7% share of the green logistics market in 2024. Reverse logistics services are high in demand due to the rising recirculation of returned or excess goods. As online purchases increase, so do product returns which hold value if properly managed through reverse logistics.

Sophisticated reverse logistics involve core activities like selection of appropriate recovery channels, sale of refurbished goods, material recycling, and regulated waste disposal. Growing sustainability concerns and a push for circular business models mean reverse green logistics assume greater importance going forward to reduce resource wastage.

Insights, By Application: Manufacturing Leads Green Logistics Adoption

Further, minimizing transportation’s carbon footprint holds relevance as manufacturers rely on extensive inbound and outbound freight movements. Investments in clean vehicles, route optimization and modal shifts to low-carbon transport go a long way in advancing factories’ sustainability mandates.

Additional Insights of Green Logistics Market

- Asia-Pacific is the dominant region in the green logistics market, driven by government policies promoting renewable energy and sustainable development.

- In North America, food waste contributes significantly to the waste stream. The logistics sector is addressing this through sustainable practices, such as local sourcing and greener transportation methods.

- Japan's Commitment to EVs: Japanese automakers lead in developing efficient and aesthetically pleasing electric vehicles, aligning with trends in the global green logistics market.

- India's ULIP Program: The Indian government’s Unified Logistics Interface Platform (ULIP) is a strategic initiative to reduce emissions in the logistics sector by encouraging collaboration and innovation in green practices.

- The use of electric vehicles in logistics is expected to grow by 25% annually over the next five years. Renewable green logistics facilities powered by renewable energy sources have increased by 30% since 2020. Companies implementing green logistics have reported a 20% reduction in operational waste.

Competitive overview of Green Logistics Market

The major players operating in the green logistics market include FedEx Corporation, Deutsche Post DHL Group, United Parcel Service of America, Inc. (UPS), GEODIS, DSV, CEVA Logistics, Bolloré SE, YUSEN LOGISTICS CO., LTD., Agility Public Warehousing Company K.S.C.P., XPO Logistics, Inc., Kuehne + Nagel International AG, DB Schenker, C.H. Robinson Worldwide, Inc., Nippon Express Co., Ltd., and Panalpina World Transport Ltd.

Green Logistics Market Leaders

- FedEx Corporation

- Deutsche Post DHL Group

- United Parcel Service of America, Inc. (UPS)

- GEODIS

- DSV

Green Logistics Market - Competitive Rivalry

Green Logistics Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Green Logistics Market

- In December 2023, Yusen Logistics announced its commitment to reducing CO2 emissions by 45% by 2030, using fiscal year 2022 as the baseline. This initiative specifically targets Scope 1 and 2 emissions, aiming to enhance sustainability efforts and address climate change. The company plans to expand its focus to include Scope 3 emissions in the future.

- In October 2023, UPS announced its agreement to acquire Happy Returns from PayPal. This acquisition aims to enhance UPS's reverse logistics services, providing customers with a streamlined return process. It will allow UPS to expand its returns footprint, combining Happy Returns' technology and established drop-off points with UPS's existing logistics capabilities, creating a more efficient and sustainable supply chain.

- In July 2023, FedEx announced a partnership with a leading biofuel supplier to utilize sustainable aviation fuel (SAF) for its aircraft. This initiative is expected to reduce aviation emissions by up to 20%, contributing significantly to FedEx's sustainability goals and enhancing its eco-friendly operations. Additionally, this move is intended to set a higher standard for industry practices in sustainable aviation

- In March 2023, DHL announced a significant step in its sustainability efforts by adding 100 electric delivery vans to its fleet in the U.S. This initiative aims to enhance their green logistics capabilities and reduce carbon emissions by 15% annually. The new vans are part of DHL's broader commitment to electrify its delivery fleet, with a target of having 60% of its last-mile vehicles powered by electricity by 2030.

Green Logistics Market Segmentation

- By Mode of Transportation

- Roadways

- Railways

- Waterways

- Airways

- By Type

- Reverse Logistics

- Waste Management

- Sustainable Packaging

- Green Warehousing

- By Application

- Manufacturing

- Healthcare

- Automotive

- Banking and Financial Services

- Retail and E-Commerce

- Others

Would you like to explore the option of buyingindividual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.

Frequently Asked Questions :

How big is the green logistics market?

The green logistics market is estimated to be valued at USD 1.54 Tn in 2024 and is expected to reach USD 2.7 Tn by 2031.

What are the key factors hampering the growth of the green logistics market?

Initial investment for green technologies and infrastructure and limited availability of advanced technologies in certain regions are the major factors hampering the growth of the green logistics market.

What are the major factors driving the green logistics market growth?

Governments enforcing strict regulations to reduce carbon emissions and increasing demand for sustainable products and eco-friendly logistics practices are the major factors driving the green logistics market.

Which is the leading mode of transportation in the green logistics market?

The leading mode of transportation segment is roadways.

Which are the major players operating in the green logistics market?

FedEx Corporation, Deutsche Post DHL Group, United Parcel Service of America, Inc. (UPS), GEODIS, DSV, CEVA Logistics, Bolloré SE, YUSEN LOGISTICS CO., LTD., Agility Public Warehousing Company K.S.C.P., XPO Logistics, Inc., Kuehne + Nagel International AG, DB Schenker, C.H. Robinson Worldwide, Inc., Nippon Express Co., Ltd., and Panalpina World Transport Ltd. are the major players.

What will be the CAGR of the green logistics market?

The CAGR of the green logistics market is projected to be 8.35% from 2024-2031.