UAE Pigments Market Size - Analysis

The UAE Pigments Market is estimated to be valued at USD 50.0 Mn in 2025 and is expected to reach USD 62.8 Mn by 2032, growing at a compound annual growth rate (CAGR) of 3.3% from 2025 to 2032.

The growing construction industry and increasing disposable incomes are driving the need for various colors and pigments in different applications such as paints, coatings, plastics, construction materials and others.

Market Size in USD Mn

CAGR3.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.3% |

| Market Concentration | Medium |

| Major Players | Sensient Cosmetic Technologies, BASF FZE, The Chemours Company, LANXESS Corporation, PPG Industries, Inc. and Among Others |

please let us know !

UAE Pigments Market Trends

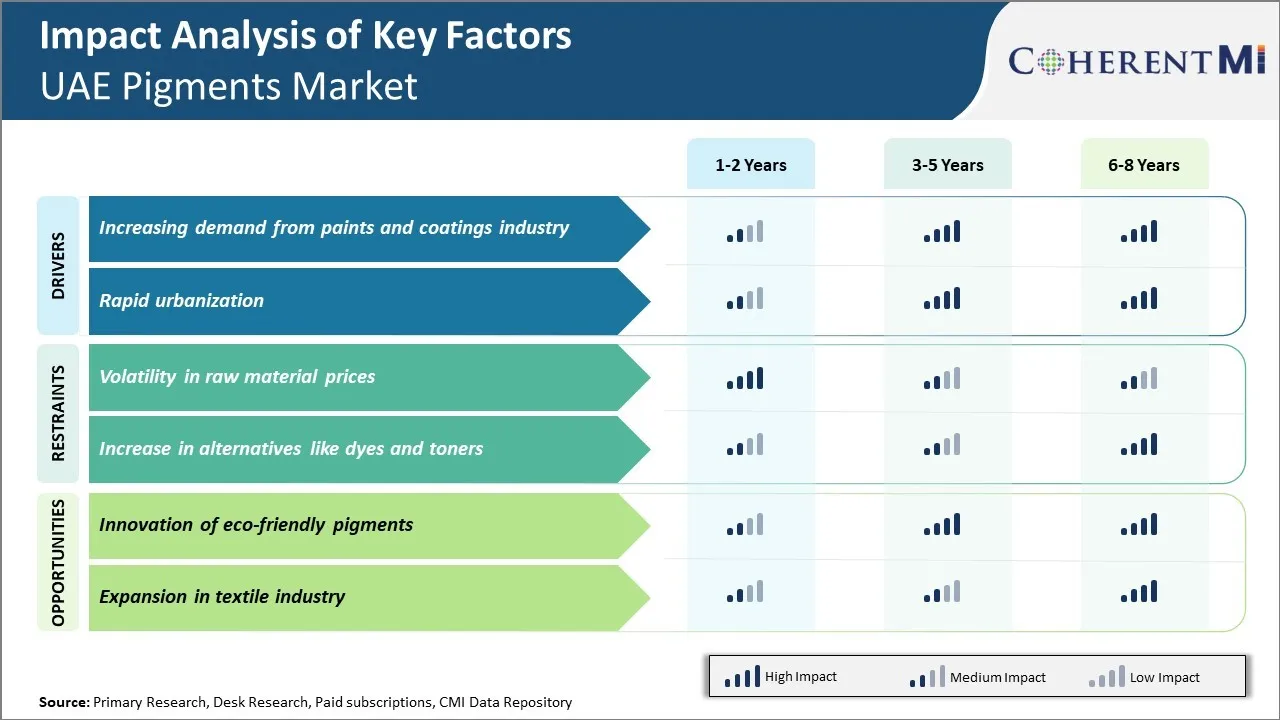

Market Driver – Increasing Demand From Paints and Coatings Industry

The paints and coatings industry in the UAE is witnessing substantial growth in recent years on account of increasing infrastructure development activities and rapid urbanization in the country. The government is heavily investing in new construction projects, commercial buildings, residential buildings, roads, airports etc. to accommodate the growing population and develop world-class infrastructure. This has created strong demand for various types of paints and coatings from the building and construction sector.

Pigments play a crucial role in manufacturing different kinds of paints and coatings used in buildings, automobiles and various industrial applications. Pigments are added to paints and coatings to provide properties like color, opacity, durability and protection from corrosion and other damages. As the construction activities are booming, demand for wall paints, enamel paints, cement paints, powder coatings and other architectural coatings has increased multifold in the UAE. Automobile industry is also growing at a steady pace in the country with rising disposable incomes, which contributes to the demand for automotive paints and coatings.

Various government initiatives are fueling the growth of the overall paints industry. For example, directives to use more environment-friendly low VOC paints in buildings are prompting paint manufacturers to invest in advanced pigment technologies.

Market Driver – Rapid Urbanization

The UAE has achieved tremendous economic growth and development over the past few decades, transforming itself from a humble trading outpost to a modern metropolis. This has been possible due to strong leadership and vision of urban planning. The government has undertaken extensive urban planning to develop well-connected cities and communities with world-class infrastructure and amenities. Ambitious projects like Dubai 2020 Plan, Abu Dhabi Economic Vision 2030 and other urban development blueprints point to continued rapid urbanization in the foreseeable future.

The rising population, growing at an annual rate of over 2%, is concentrating more in urban centers of employment and livelihood. This has resulted in phenomenal demand for housing, offices, malls, hospitals and other socio-economic infrastructure. Expanding townships, residential communities and satellite cities are clearly visible on the outskirts of Dubai, Abu Dhabi and other major cities. The introduction of long-term golden visas is attracting more skilled expatriates and entrepreneurs to the UAE, further propelling the urbanization trend.

The flourishing real estate sector is the prime driver of construction activities which involves massive consumption of paints, coatings and associated pigments. Premium architectural finishes and aesthetic requirements demand specialized pigment formulations.

Market Challenge – Volatility in Raw Material Prices

One of the major challenges faced by the UAE pigments market is the volatility in raw material prices. Pigments production is highly dependent on raw materials such as iron oxide, chromium compounds, cadmium compounds, and titanium dioxide, among others. The prices of these raw materials are dependent on global commodity price fluctuations and geopolitical issues. Any increase in raw material prices leads to a rise in the overall production cost for pigments manufacturers. As the margins are already low in this commodity chemicals sector, the producers are unable to pass on the entire cost burden to the customers. This squeezes their profits.

The manufacturers usually sign annual supply contracts with raw material suppliers but they cannot shield themselves fully from price shocks. The price volatility poses financial planning difficulties for the pigment producers and makes their operations less profitable.

Market Opportunity – Innovation of Eco-friendly Pigments

One of the big opportunities for the UAE pigments market is the innovation of eco-friendly pigments. With growing environmental awareness, regulators are enforcing stringent laws regarding the use of hazardous substances. Pigments containing heavy metals like lead, chromium, and cadmium are facing bans or restrictions. This has opened up an avenue for manufacturers to develop green pigments based on non-toxic minerals and compounds.

The producers who embrace sustainable technologies will enjoy a competitive edge. Investment in R&D of natural, biodegradable and recyclable pigment formulations can help companies tap into the increasing demand for environment-friendly products across end use industries like paints, coatings, plastics and printing inks. It is also a chance for firms to enhance their brand value and differentiate their offerings.

Segmental Analysis of UAE Pigments Market

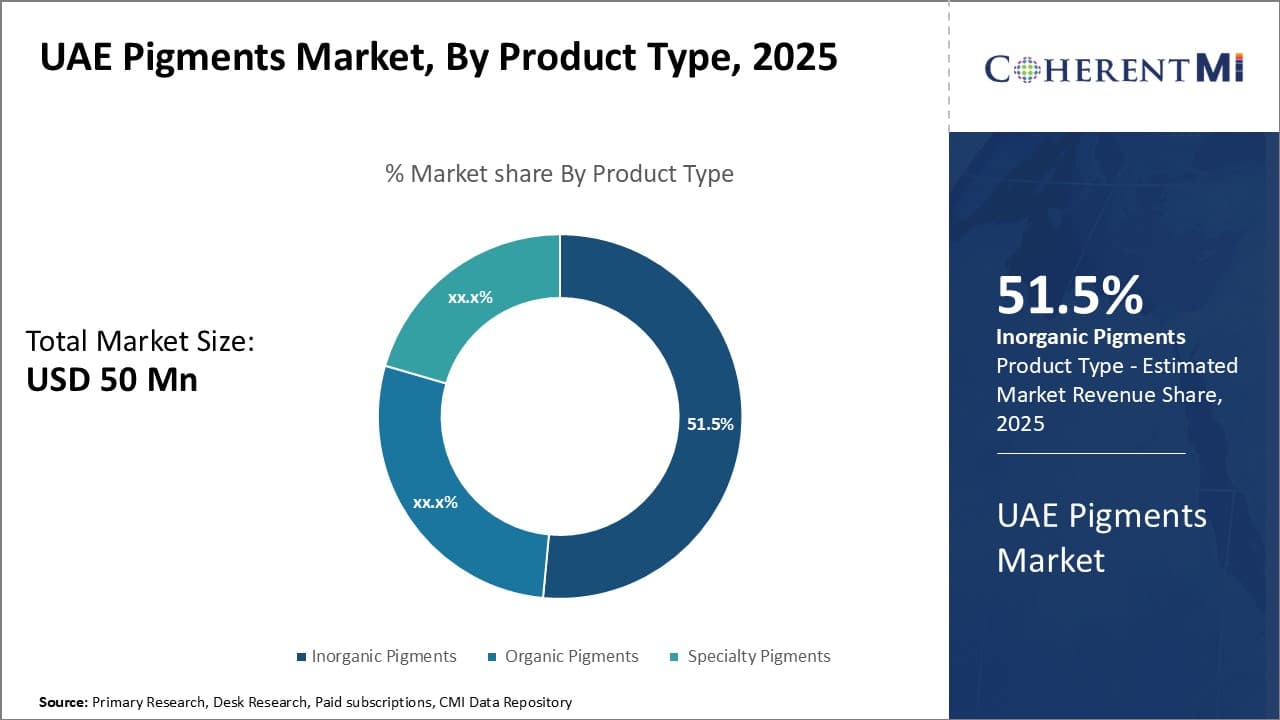

Insights, By Product Type: Wide Applications And Properties of Inorganic Pigments

Insights, By Product Type: Wide Applications And Properties of Inorganic Pigments

In terms of product type, inorganic pigments sub-segment contributes the highest share of 51.5% in the market owning to its wide applications and properties.

Inorganic pigments contribute the largest share in the UAE pigments market due to their favorable properties and wide use across many industries. These pigments are derived from mineral sources and are highly durable, lightfast and have excellent tinting strength. Since they are resistant to heat and are non-combustible, inorganic pigments see extensive usage in industries like construction where heat resistance is a crucial requirement.

Titanium dioxide pigment, which provides opacity and brightness, accounts for over 50% of inorganic pigment consumption globally. It is widely used in architectural and decorative coatings due to its high hiding power, brightness and UV resistance. Rapid infrastructure development and growth of the construction industry in the UAE has significantly boosted demand for titanium dioxide pigments.

Iron oxide pigments which impart various shades of red, yellow and brown colors are also commonly utilized. Growing plastic and packaging industries favor iron oxides for their color stability against weathering.

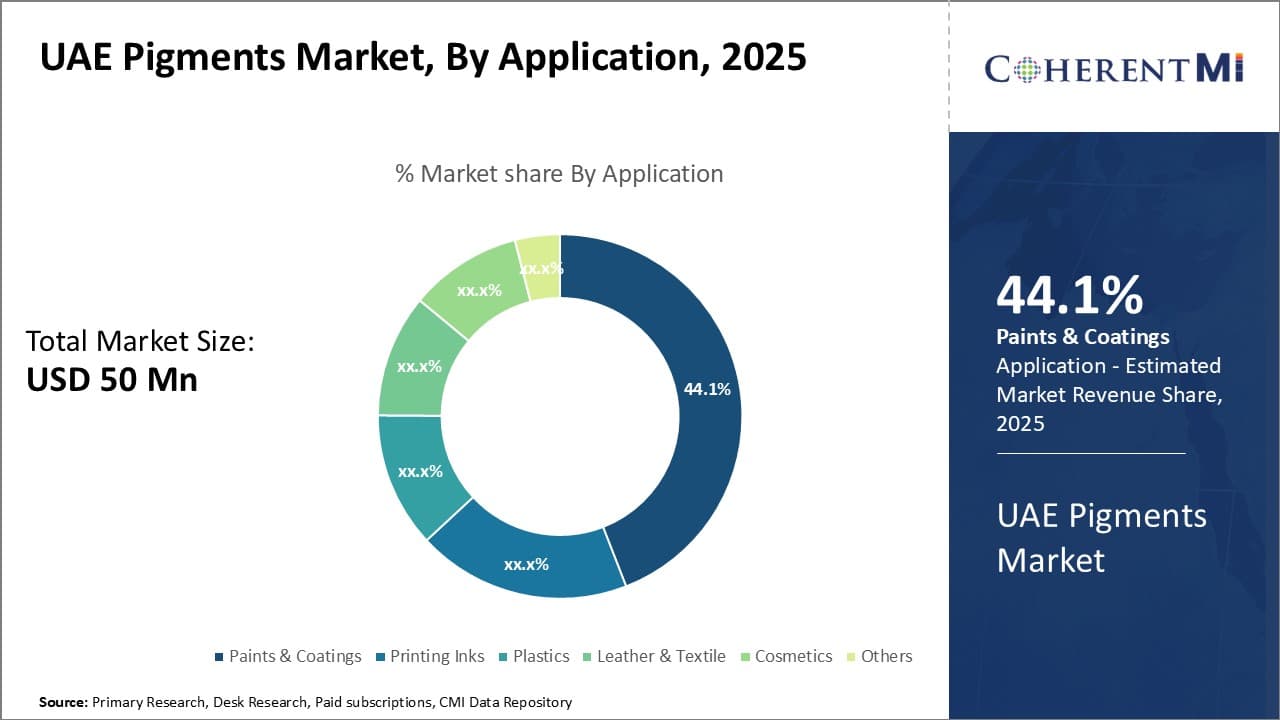

Insights, By Application: Widespread Infrastructure Development Activity in the UAE

Paints and coatings sub-segment capture the highest share of 44.1% in the UAE Pigments market, owing to widespread infrastructure development activity. Pigments play a key role in determining the color, opacity and durability of paints. In the UAE, construction activity has grown rapidly to accommodate a swelling population and developing economy. Mega infrastructure projects like the Dubai Metro, airports and various structures require huge volumes of architectural, decorative and industrial coatings.

Robust government spending on expansive real estate development boosts demand for premium and customizable residential and commercial paints. Pigments help provide the widest possible color range for external and internal architectural applications. Growing popularity of powder and solvent-borne coatings over water-borne favors pigments like iron oxides for their elevated properties under extreme weather conditions like heat, sunlight and sand abrasion.

Ongoing infrastructure works underway for Expo 2020 and ambitious projects under Vision 2030 will bolster consumption of protective and decorative industrial coatings. Requirements include specialized anticorrosive and UV resistant coatings for bridges, tunnels, oil and gas facilities. Inorganic and organic pigments suited for these applications see high demand.

Competitive overview of UAE Pigments Market

The major players operating in the UAE Pigments Market include Sensient Cosmetic Technologies, BASF FZE, The Chemours Company, LANXESS Corporation, PPG Industries, Inc., BROSOLUTIONS, Fortune Emirates General Trading LLC., and Al Lamaan Trading LLC.

UAE Pigments Market Leaders

- Sensient Cosmetic Technologies

- BASF FZE

- The Chemours Company

- LANXESS Corporation

- PPG Industries, Inc.

UAE Pigments Market - Competitive Rivalry

UAE Pigments Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in UAE Pigments Market

- On January 26, 2023, The Chemours Company, a global chemistry company, unveiled Ti-Pure TS-1510, a highly efficient rutile titanium dioxide (TiO2) pigment designed to enhance processing performance in plastics applications.

- On January 3, 2022, Clariant, a focused, sustainable and innovative specialty chemical company, completed the sale of its Pigments business to a consortium of Heubach Group (“Heubach”) and SK Capital Partners (“SK Capital”).

UAE Pigments Market Segmentation

- By Product Type

- Inorganic Pigments

- Organic Pigments

- Specialty Pigments

- By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Leather & Textile

- Cosmetics

- Others

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How big is the UAE Pigments Market?

The UAE Pigments Market is estimated to be valued at USD 50.0 in 2025 and is expected to reach USD 62.8 Million by 2032.

What are the major factors driving the UAE Pigments Market growth?

The increasing demand from paints and coatings industry and rapid urbanization are the major factors driving the UAE Pigments Market.

Which is the leading Product Type in the UAE Pigments Market?

The leading Product Type segment is Inorganic Pigments.

Which are the major players operating in the UAE Pigments Market?

Sensient Cosmetic Technologies, BASF FZE, The Chemours Company, LANXESS Corporation, PPG Industries, Inc., BROSOLUTIONS, Fortune Emirates General Trading LLC., and Al Lamaan Trading LLC are the major players.

What will be the CAGR of the UAE Pigments Market?

The CAGR of the UAE Pigments Market is projected to be 3.3% from 2025-2032.