United States Thermoplastic Elastomer Market Size - Analysis

The United States Thermoplastic Elastomer Market is estimated to be valued at USD 1.87 Bn in 2025 and is expected to reach USD 2.76 Bn by 2032, growing at a CAGR of 5.7% from 2025 to 2032.

Thermoplastic elastomers find wide application in the automotive, medical, and construction industries which is driving the growth of this market. The increasing demand from the automotive industry is expected to be a key growth driver.

Market Size in USD Bn

CAGR5.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.7% |

| Market Concentration | Medium |

| Major Players | Girard Rubber Corp, Aero Rubber Company, Inc, Dunnage Engineering, Alliance Rubber Company, Alpine Elastomer Products, LLC and Among Others |

please let us know !

United States Thermoplastic Elastomer Market Trends

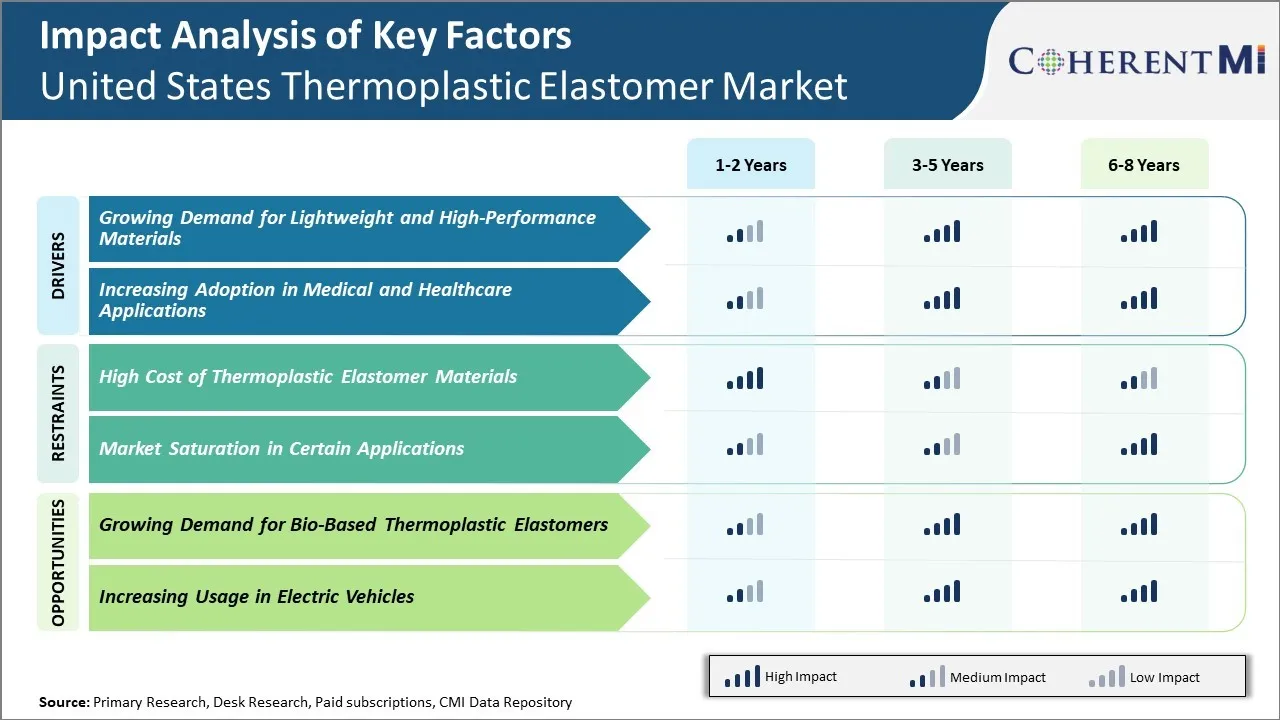

Market Driver – Growing Demand for Lightweight and High-Performance Materials

The growing demand for lightweight and high-performance materials across various industries such as automotive, construction and aerospace are one of the major factors driving the growth of thermoplastic elastomer market in the United States. Thermoplastic elastomers possess properties of both thermoplastics and elastomers which make them an ideal material for applications requiring flexibility, impact resistance and strength.

Compared to conventional materials, thermoplastic elastomers are much lighter in weight while providing equal or improved mechanical performances. For example, thermoplastic polyurethane elastomers are 25% lighter than standard rubber materials. The automotive industry has been focusing on developing lighter vehicles with improved fuel economy to meet stringent emission norms. According to the Bureau of Transportation Statistics, light weight vehicle material adoption increased by over 12% between 2020-2021 which helped improve the average fuel economy of new vehicles in the US by 6%. This rising focus on lightweight materials is driving the use of thermoplastic elastomers in various automotive component manufacturing like bumpers, door seals and grills.

Market Driver – Increasing Adoption in Medical and Healthcare Applications

The medical and healthcare industry in the United States has seen tremendous growth over the past few years and is expected to continue on an upward trajectory. Thermoplastic elastomers are being increasingly utilized in various medical devices and applications due to their desirable properties such as flexibility, durability and biocompatibility. Properties such as high alternated flexural endurance make TPEs suitable for applications that require repetitive flexing or compression like flexible tubing, catheters and wound care products. Their heat weldability also allows for manufacturing efficiencies and cost savings.

According to statistics from the Centers for Disease Control and Prevention, around 65 million Americans underwent medical procedures involving surgical instruments, disposable devices and implants in 2019. This demand for single-use medical supplies and devices has surged further during the COVID-19 pandemic with the increased need for ventilators, oxygen masks and other respiratory equipment. Thermoplastic elastomers played a crucial role in manufacturing these time-critical products due to their processing advantages over other materials.

Market Challenge – High Cost of Thermoplastic Elastomer Materials

The high cost of thermoplastic elastomer materials is one of the major restraining factors for the growth of the United States thermoplastic elastomer market. Thermoplastic elastomers are engineered polymers that have both thermoplastic and elastomeric properties. They have advantages like recyclability, design flexibility, durability, and ease of production over conventional thermoset rubber. However, thermoplastic elastomers are more expensive to produce as compared to normal thermoplastics due to their complex molecular structure and production processes involved.

The high costs of raw materials needed for the production of thermoplastic elastomers like styrenic block copolymers, thermoplastic polyurethanes, thermoplastic olefin etc. further drive up their prices. According to the United States International Trade Commission, import prices of US styrenic block copolymers increased from $2.12/kg in January 2020 to $2.38/kg in January 2022. Similarly, US import prices of thermoplastic polyurethanes grew from $3.78/kg to $4.23/kg during the same period. The prices of propylene, ethylene and crude oil - key feedstocks for thermoplastic production also witnessed a significant rise in the last two years due to supply chain disruptions caused by the COVID-19 pandemic further escalating thermoplastic elastomer costs.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Opportunity – Growing Demand for Bio-based Thermoplastic Elastomers

The growing demand for bio-based and sustainable materials is a major opportunity for the thermoplastic elastomer market in the United States. Traditionally, most thermoplastic elastomers have been derived from petroleum-based ingredients. However, with increased environmental awareness and sustainability goals, brands and consumers alike are seeking out alternatives that have a lower carbon footprint.

Bio-based thermoplastic elastomers, which are either partially or fully derived from renewable plant and agricultural sources, allow manufacturers to formulate more environmentally-friendly products. Several new formulations are emerging that utilize bio-based components such as corn, soy, sugarcane or cellulose within the polymer structure. As these require fewer fossil fuels during production and have reduced end-of-life emissions once discarded, they meet the criteria of being more sustainable. Many global organizations have also encouraged the development of bio-economy and circular bio-based industries. According to a report by The Organisation for Economic Co-operation and Development (OECD), bio-based economies could potentially contribute to 7-8% of global manufacturing output by 2030.

The automotive, consumer goods and medical industries have been early adopters of bio-based thermoplastic elastomers. For example, BASF has partnered with several automakers to develop bio-based TPUs that are compiled into interior trims and other automobile components.

Segmental Analysis of United States Thermoplastic Elastomer Market

To learn more about this report, Download Free Sample Copy

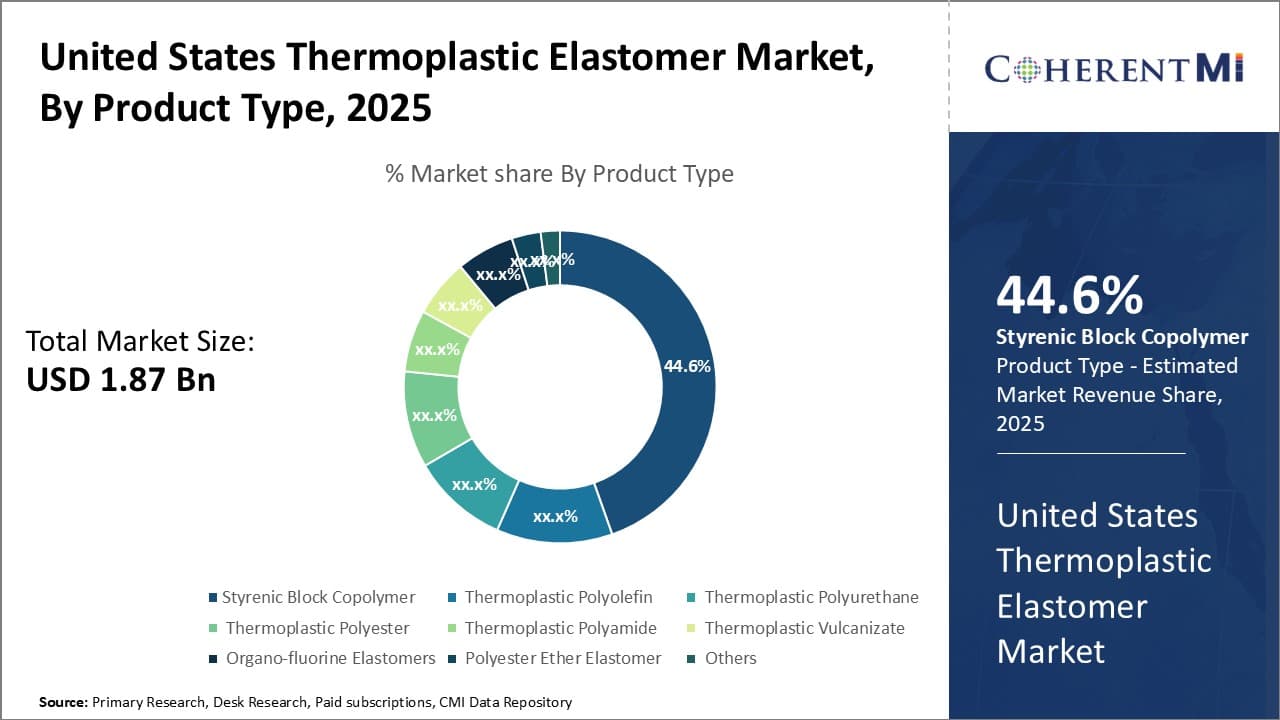

Insights, By Product Type: Versatility and Durability of Styrenic Block Copolymer

To learn more about this report, Download Free Sample Copy

Insights, By Product Type: Versatility and Durability of Styrenic Block Copolymer

In terms of product type, styrenic block copolymer sub-segment contributes the highest share of 44.6% in the market owning to its versatility and durability.

Styrenic block copolymer, commonly known as SBC, has established itself as the leading product type in the US thermoplastic elastomer market. SBC offers manufacturers superior flexibility and toughness coupled with excellent elastic properties. Its morphology consisting of hard crystalline polystyrene end blocks joined by soft amorphous polybutadiene or polyisoprene mid blocks provides a unique combination of characteristics.

SBC allows for easier processing than conventional rubber materials as it can be recycled, remolded and reshaped numerous times at higher temperatures. This recyclability property is a major driver of its popularity in the automotive sector. Automakers prefer SBC as it reduces manufacturing costs through part consolidation. Multiple plastic and rubber components can now be replaced by a single SBC part, simplifying vehicle assembly.

Another key factor propelling the demand for SBC is its superior weatherability and UV resistance compared to other thermoplastic elastomers. This enables its extensive usage in outdoor cable and wire insulation. It is also gaining traction in the footwear industry as a replacement for PVC due to its resilient mechanical properties and leather-like aesthetics.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

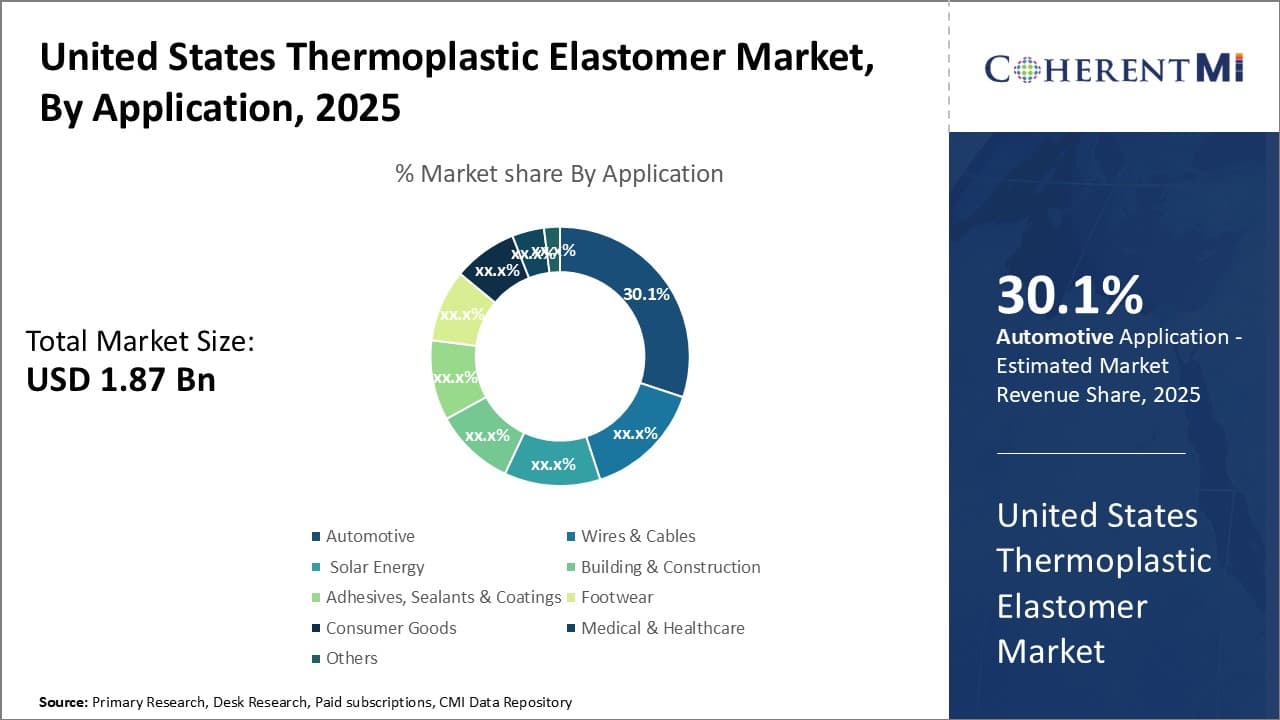

Insights, By Application: Large Scale Adoption of Advanced Elastomers

In terms of application, automotive sub-segment dominates by 30.1% owing to the sector's large scale adoption of advanced elastomers.

The automotive segment holds the dominant share of the US thermoplastic elastomer market. This is attributed to the extensive usage of TPEs in automotive interiors, exteriors and components that demand high performance at reduced cost. Modern vehicles contain over 20 kg of various elastomeric materials on average to provide comfort, safety and ease of assembly.

TPEs are increasingly replacing thermosets like EPDM and styrenic rubbers in automotive applications due to advantages such as improved recycling, lower tooling costs, faster processing cycles and superior aesthetic properties. Manufacturers favor TPEs to consolidate separate rubber and plastic parts into unified, lightweight components. This meets stringent requirements for fuel efficiency and carbon emissions reduction.

SBCs have found widespread implementation in automotive sealing, weather-stripping and anti-vibration applications due to their rubber-like elasticity and resistance to oils, chemicals and temperature fluctuations. TPUs are utilized in hoses, O-rings, gaskets and seals to provide leak-proof barriers against fluids.

Additionally, growing consumer inclination towards luxury, comfort and connectivity features is propelling carmakers to employ advanced TPEs in interior trims, dashes, door panels and consoles.

Competitive overview of United States Thermoplastic Elastomer Market

The major players operating in the United States Thermoplastic Elastomer Market include Girard Rubber Corp, Aero Rubber Company, Inc, Dunnage Engineering, Alliance Rubber Company, Alpine Elastomer Products, LLC, CS Hyde Company, Ames Rubber Manufacturing Company, VIP Rubber and Plastic, and WARCO.

United States Thermoplastic Elastomer Market Leaders

- Girard Rubber Corp

- Aero Rubber Company, Inc

- Dunnage Engineering

- Alliance Rubber Company

- Alpine Elastomer Products, LLC

Recent Developments in United States Thermoplastic Elastomer Market

- In August 2023, Covestro AG announced plans to build a new elastomer plant at the Verbund site in Shanghai, China. This expansion is expected to increase the company's production capacity and meet growing demand for thermoplastic elastomers in the region.

- In July 2020, Asahi Kasei Corporation launched Plastic North America (APNA) and a new engineered resin series called Soform, as part of its Thermylene family portfolio. This expansion aims to provide customers with a wider range of thermoplastic elastomer products.

- In January 2021, Huntsman Corporation acquired Gabriel Performance Products, a North American specialty chemical manufacturer, for USD 1.53 billion. This acquisition broadened BASF’s polyamide capabilities with innovative and well-known products such as Technyl.

United States Thermoplastic Elastomer Market Segmentation

- By Product Type

- Styrenic Block Copolymer

- Thermoplastic Polyolefin

- Thermoplastic Polyurethane

- Thermoplastic Polyester

- Thermoplastic Polyamide

- Thermoplastic Vulcanizate

- Organo-fluorine Elastomers

- Polyester Ether Elastomer

- Others

- By Application

- Automotive

- Wires & Cables

- Solar Energy (Photovoltaic Applications)

- Building & Construction

- Adhesives, Sealants & Coatings

- Footwear

- Consumer Goods

- Medical & Healthcare

- Others

Would you like to explore the option of buying individual sections of this report?

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.