Рынок запчастей АНАЛИЗ РАЗМЕРОВ И ДОЛЕЙ - ТЕНДЕНЦИИ РОСТА И ПРОГНОЗЫ (2024 - 2031)

Рынок запчастей сегментирован По типу (части металлической одежды, части керамической одежды, части полимерной одежды, составные части одежды), по при....

Рынок запчастей Размер

Размер рынка в долларах США Bn

CAGR5.3%

| Период исследования | 2024 - 2031 |

| Базовый год оценки | 2023 |

| CAGR | 5.3% |

| Концентрация рынка | High |

| Основные игроки | Sandvik AB, Производитель: Outotec Corporation, Caterpillar Inc., ESCO Group LLC, Kennametal Inc. и среди других |

дайте нам знать!

Рынок запчастей Анализ

Рынок запчастей оценивается как 685,73 долларов США Bn в 2024 году Ожидается, что он достигнет 984,65 долларов США Bn к 2031 году, растущие с совокупным годовым темпом роста (CAGR) 5,3% с 2024 по 2031 год. Ожидается, что рынок запчастей будет наблюдать положительный рост в течение прогнозируемого периода с ростом развития инфраструктуры и строительной деятельности.

Рынок запчастей Тенденции

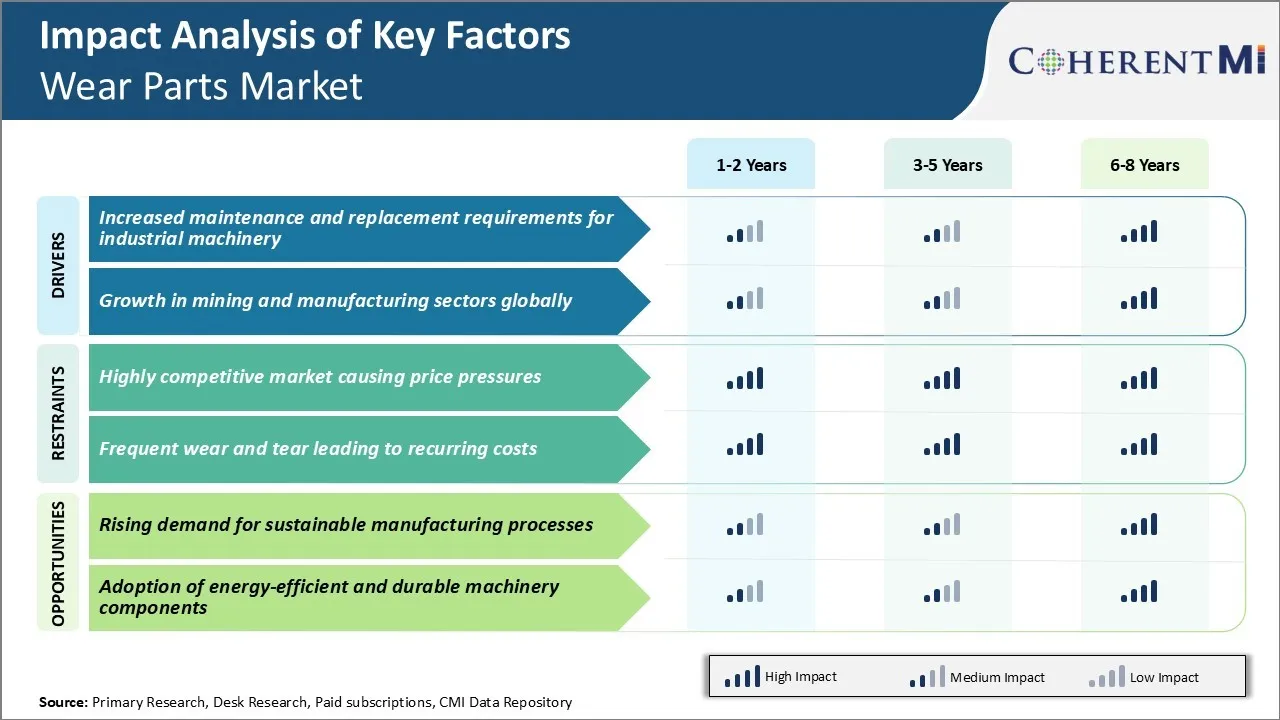

Рыночный драйвер - повышенные требования к техническому обслуживанию и замене промышленного оборудования

Поскольку индустриализация распространяется по всему миру, установка и использование различных типов промышленного оборудования значительно возросло в различных секторах. Эти сверхмощные машины подвергаются высокому износу из-за их постоянной и непрерывной работы в сложных рабочих условиях. Это вызывает спрос на рынке запчастей.

Большинство компаний в настоящее время сосредоточены на прогнозном обслуживании и мониторинге состояния своих промышленных активов, чтобы уменьшить неожиданные поломки. Ремонт или замена компонентов стали более сложными и требуют специальных навыков. В то же время спрос на достижение более высоких целевых показателей производительности создает дополнительную нагрузку на оборудование, что приводит к более быстрой деградации деталей.

Кроме того, в различных регионах и странах наблюдается рост инвестиций в инфраструктуру и промышленность. Это значительно увеличило спрос на строительное и землеройное оборудование, машины для выработки электроэнергии, системы обработки материалов, производственные предприятия и другие тяжелые приложения. Учитывая их интенсивное использование, цикл обслуживания и потребности в замене запасных частей также значительно возросли.

Рыночный драйвер - рост в горнодобывающем и производственном секторах во всем мире

Горнодобывающий и обрабатывающий секторы всегда находились на переднем крае промышленного роста и играли ключевую роль в формировании экономики во всем мире. Оба сектора в значительной степени полагаются на широкое использование крупного горнодобывающего и промышленного оборудования для эффективного извлечения и переработки сырья.

Такие страны, как Китай, Индия, Индонезия, Бразилия и Австралия, стали свидетелями огромных капиталовложений в уголь, железную руду и другие горнодобывающие проекты. Крупные производственные центры, такие как США, Германия, Япония и другие, постоянно наращивают свои производственные мощности, чтобы использовать новые возможности в различных секторах. Все эти разработки непосредственно способствовали объему продаж критического горного и промышленного оборудования, такого как экскаваторы, лопатки, бульдозеры, конвейерные системы, фрезерные машины и другие металлообрабатывающие инструменты.

Кроме того, передовые технологии, такие как автоматизация, робототехника, IoT и AI, широко применяются на горнодобывающих и производственных предприятиях для увеличения пропускной способности, повышения производительности и снижения затрат. Их сложные механизмы также включают сложные требования к техническому обслуживанию, где необходимы специализированные детали и навыки. Все эти факторы в совокупности подчеркивают важность получения высококачественных запасных частей от надежных поставщиков.

Конкурентоспособный рынок - высококонкурентный Рынок вызывает ценовое давление

За последнее десятилетие глобальный рынок запчастей для одежды стал все более конкурентоспособным, поскольку многие новые игроки вошли в эту отрасль, стремясь извлечь выгоду из прогнозируемых возможностей роста. Рост конкуренции оказал значительное давление на ценовую маржу для существующих производителей износостойких деталей. Игроки на рынке запчастей теперь должны поддерживать тонкую маржу прибыли, пытаясь снизить цены своих конкурентов, чтобы выиграть новый бизнес.

Кроме того, в отрасли возникли избыточные мощности, поскольку производители активно расширяют свою деятельность, чтобы увеличить долю рынка. Этот дисбаланс спроса и предложения еще больше снизил цены. Если текущая тенденция сохранится, есть опасения, что некоторые компании могут быть вынуждены покинуть рынок износостойких деталей, если они не смогут значительно сократить расходы или спрос не увеличится достаточно быстро, чтобы поглотить избыточные мощности.

Возможности рынка: растущий спрос на устойчивые производственные процессы

Одной из областей, которая представляет огромные возможности для компаний на рынке износостойких деталей, является растущий глобальный спрос на более устойчиво производимую продукцию. Растут ожидания в секторах конечного использования компонентов и износа деталей, которые накладывают меньше экологического бремени прямо через производственный процесс и последующий жизненный цикл. Организации находятся под растущим давлением со стороны заинтересованных сторон, чтобы уменьшить свой углеродный след и перейти на более экологичные альтернативы.

В результате рынок износостойких деталей, производимых с помощью устойчивых технологий и возобновляемых ресурсов, быстро расширяется. Производители износостойких деталей могут позиционировать себя, чтобы использовать эту потребность, инвестируя в экологически чистые методы производства. Принятие таких подходов, как сокращение отходов, использование чистой энергии, внедрение систем утилизации материалов замкнутого цикла и использование биоматериалов, открывает широкие возможности для инноваций и бизнес-преимуществ.

Компании, принимающие решения на ранней стадии, могут найти себе место для соблюдения более строгих экологических стандартов. Они берут львиную долю на рынке запчастей от опоздавших через свои более зеленые корпоративные учетные данные.

Ключевые выигрышные стратегии, принятые ключевыми игроками Рынок запчастей

Сосредоточьтесь на инновациях продуктов через НИОКР: В 2020 году Metso представила свою концепцию износа деталей Metso Life, в которой используются передовые композиционные материалы, которые служат в 4-5 раз дольше, чем традиционные износостойкие детали. Это помогло горнодобывающим компаниям значительно сократить эксплуатационные расходы.

Установление долгосрочных партнерских отношений: В 2018 году Sandvik подписала 5-летнее глобальное соглашение о поставках с BHP для доставки мельничных лайнеров, кормовых желобов и других деталей для дробилки для всех своих майнинговых площадок по всему миру. Это стратегически ставит их впереди конкурентов.

Использование цифровых технологийСистема Multotec TONTRAK отслеживает жизнь различных компонентов в режиме реального времени с помощью аналитики. Это помогло Vale, крупной горнодобывающей компании, сократить время простоя на 20% и сэкономить более 5 миллионов долларов в год на износе.

Сосредоточьтесь на приобретениях для расширения портфеляВ 2021 году Weir Group приобрела активы компании Atlas Copco по обслуживанию буровых установок, чтобы укрепить свои позиции в сегменте буровых и взрывных инструментов.

Сегментарный анализ Рынок запчастей

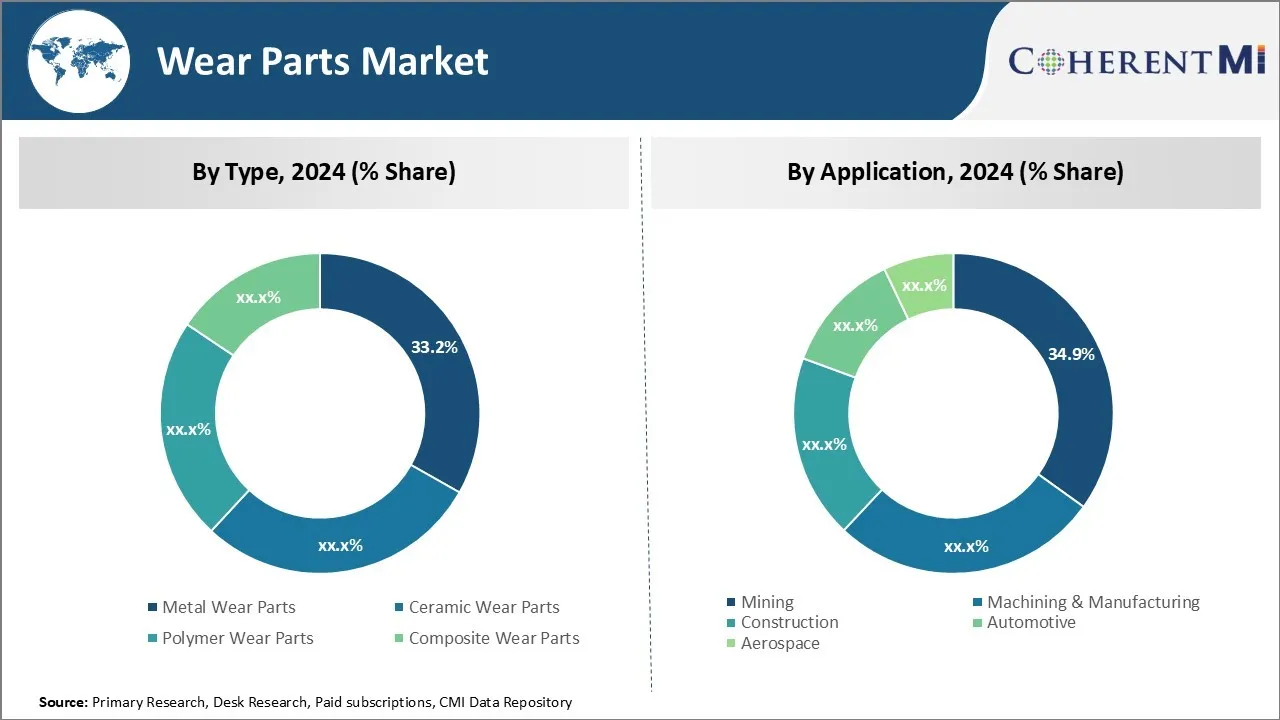

Оригинальное название: Metal Wear Parts: Рост за счет долговечности и надежности

Металлические элементы одежды способствуют 33,2% рынка износостойких деталей в 2024 году, благодаря их исключительной долговечности и надежности в тяжелых условиях эксплуатации. Металлические детали рассчитаны на долговечность, срок службы часто составляет 10 лет и более. Их низкие потребности в обслуживании экономят время простоя и затраты на замену по сравнению с менее прочными альтернативами. Металлы могут быть подвергнуты термической обработке и легированы для достижения еще большей прочности, твердости и коррозионной стойкости, с учетом конкретных требований применения. Ремонт металлических деталей также прост с помощью таких процедур, как заплатка, жесткая облицовка или сварка.

Производители металлов имеют большой опыт и производственные возможности для сложных конструкций деталей из металлического износа. Компьютерное производство позволяет точно обрабатывать, в то время как литье создает сложные внутренние проходы. Металлические детали обычно настраиваются с помощью процессов термообработки, покрытия или облицовки для оптимизации производительности. Комплексные услуги от проектирования до установки помогают свести к минимуму общую стоимость владения.

Insights, по применению: Добыча полезных ископаемых: лучший драйвер доходов в сложных операционных условиях

Доля горнодобывающей промышленности на рынке износоустойчивых деталей в 2024 году составляет 34,9% из-за исключительно суровых условий эксплуатации в шахтах. Носите детали для горнодобывающего оборудования, такого как экскаваторы, грузовые автомобили и сверла, выдерживайте круглосуточное использование в абразивной породе и руде. Неисправности компонентов могут останавливать работу, поэтому операторы шахт отдают приоритет сверхпрочным решениям, чтобы максимизировать время безотказной работы оборудования. Карбид вольфрама, керамика и металлические композиционные материалы лучше всего подходят для разрушительной среды добычи благодаря их самосмазывающимся свойствам, ультратвердости и коррозионной стойкости.

Авторитетные поставщики запчастей тщательно тестируют продукты с помощью моделирования реальных условий добычи. Прикладная инженерия обеспечивает оптимальную спецификацию материала, геометрию, термообработку и покрытия для конкретных рабочих циклов OEM-производителя и характеристик материала. Поддержка на местах сокращает время замены, чтобы поддерживать работу шахт. По мере увеличения масштабов добычи и пропускной способности для удовлетворения растущего спроса на сырьевые товары растет потребность в надежных решениях для борьбы с простоями оборудования из-за преждевременного износа деталей.

Дополнительные идеи Рынок запчастей

- Использование износостойких деталей в секторе возобновляемых источников энергии растет, особенно в ветряных турбинах, где долговечность имеет решающее значение.

- Технология 3D-печати используется для производства индивидуальных деталей износа, сокращая время и затраты на производство.

- Доминирование Азиатско-Тихоокеанского региона: На регион приходится более 35% мирового рынка износостойких деталей, что обусловлено промышленным ростом.

- Сдвиг в сторону Автоматизация: Существуют значительные инвестиции в автоматизированное оборудование, требующее специализированных деталей износа.

- Стальные детали износа менее долговечны, чем керамика, но широко используются благодаря своей универсальности. Части карбида вольфрама служат в 10 раз дольше, чем сталь, что подчеркивает экономическую эффективность.

Обзор конкурентов Рынок запчастей

Основными игроками, работающими на рынке запчастей, являются Sandvik AB, Metso Outotec Corporation, Caterpillar Inc., ESCO Group LLC, Kennametal Inc., Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., Atlas Copco AB, Castolin Eutectic, Pilot Precision, Hensley Industries, Redexim, Spokane Industries, Pacific Coast Borax Company, Miller Carbide и Columbia Steel.

Рынок запчастей Лидеры

- Sandvik AB

- Производитель: Outotec Corporation

- Caterpillar Inc.

- ESCO Group LLC

- Kennametal Inc.

Рынок запчастей - Конкурентное соперничество

Рынок запчастей

(Доминируют крупные игроки)

(Высококонкурентный с большим количеством игроков.)

Последние разработки в Рынок запчастей

- 1 июля 2024 года Sandvik завершила приобретение контрольного пакета акций Suzhou Ahno Precision Cutting Tool Technology Co., Ltd., ведущей китайской компании. Это приобретение было направлено на улучшение продуктового портфеля Sandvik и укрепление ее рыночных позиций в Азии.

- В ноябре 2023 года Metso представила SkegaTM Life, инновационный резиновый материал для мельничных накладок, предлагающий до 25% более длительный срок службы по сравнению с премиальной резиной SkegaTM Classic. Это продвижение предназначено для повышения устойчивости и безопасности, оптимизации пропускной способности и увеличения времени безотказной работы из-за улучшенной износостойкости и снижения потребностей в обслуживании.

- В марте 2023 года Caterpillar Inc. представила свои новейшие продукты, услуги и технологии на мероприятии CONEXPO-CON/AGG в Лас-Вегасе, штат Невада. Компания подчеркнула достижения в сфере услуг, технологий и устойчивого развития, в том числе презентацию платформы двигателя Cat C13D, предназначенной для использования на дорогах большой грузоподъемности.

Рынок запчастей Сегментация

- По типу

- Металлические части одежды

- Керамические части одежды

- Полимерные носки

- Композитные части одежды

- С помощью приложения

- Минирование

- Обработка и производство

- Строительство

- автомобильный

- аэрокосмический

Хотите изучить возможность покупкиотдельные разделы этого отчета?

Часто задаваемые вопросы :

Насколько велик рынок запчастей?

Рынок запчастей оценивается в 685,73 долларов США. Bn в 2024 году и, как ожидается, достигнет 984,65 млрд долларов США к 2031 году.

Каковы ключевые факторы, препятствующие росту рынка запчастей?

Высококонкурентный рынок, вызывающий ценовое давление и частый износ, приводящий к повторяющимся затратам, являются основными факторами, препятствующими росту рынка запчастей для износа.

Каковы основные факторы, влияющие на рост рынка запчастей?

Увеличение требований к техническому обслуживанию и замене промышленного оборудования и рост в горнодобывающем и обрабатывающем секторах во всем мире являются основными факторами, влияющими на рынок износоустойчивых деталей.

Какой тип является ведущим на рынке запчастей?

Ведущим сегментом типа являются металлические износостойкие детали.

Какие основные игроки работают на рынке запчастей?

Sandvik AB, Metso Outotec Corporation, Caterpillar Inc., ESCO Group LLC, Kennametal Inc., Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., Atlas Copco AB, Castolin Eutectic, Pilot Precision, Hensley Industries, Redexim, Spokane Industries, Pacific Coast Borax Company, Miller Carbide и Columbia Сталь – главные игроки.

Каким будет CAGR рынка запчастей?

Прогнозируется, что CAGR рынка износных деталей составит 5,3% с 2024 по 31 год.