自动免疫肝炎 市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

自动免疫肝炎 市场由治疗学(免疫抑制药物、类固醇、生物学)分解, 按药物管道(早期药物、晚期药物)、疾病进展(急性自动免疫肝炎、慢性自动免疫肝炎)、地理(北美、拉丁美洲、亚太、欧洲、中东和非洲)。 本报告为上述各部分提供了价值(百万美元)。....

自动免疫肝炎 市场 规模

市场规模(美元) Mn

复合年增长率5.6%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 5.6% |

| 市场集中度 | High |

| 主要参与者 | 诺华, 基列科学, 辉瑞, Merck & Co. (美国英语)., 布里斯托尔-迈尔斯·斯基布 以及其他 |

请告诉我们!

自动免疫肝炎 市场 分析

估计自体免疫性肝炎市场价值为: 2024年127.3百万美元 预计将达到 186.9美元 2031年时 以复合年增长率增长 (CAGR)从2024年到2031年占5.6%. 全球自体免疫性肝炎的日益流行是推动市场增长的主要因素。 根据最近的研究,全世界每百万人中约有20-50人患有自体免疫性肝炎。

自动免疫肝炎 市场 趋势

市场驱动力 -- -- 自动免疫性肝炎发病率上升

近年来,由于全球人口的发病率不断上升,自体免疫性肝炎市场出现大幅增长。 根据主要医疗机构进行的各种研究,估计目前全世界约有200万人患有自体免疫性肝炎。 这种慢性炎症在妇女中比男子更为普遍。 女性对男性的流行率约为3:1。

从地理上看,北美洲和西欧等发达区域在过去20年中大幅上升。 这可归因于诊断能力提高和检查增加。 然而,即使是亚太和拉丁美洲的发展中国家,由于生活方式普遍转变,也出现了更多的情况。 儿科人口中也出现了更多的病例,因此需要适合儿童的有效治疗方案。

总体而言,随着全球人口稳步增长,环境暴露也在增加,预计自体免疫性肝炎的流行率将长期继续上升。 这一上升趋势为自体免疫性肝炎市场中满足全世界不断增长的病人的治疗需求的人提供了显著的扩大机会。

市场驱动力----生物和免疫抑制剂的进步

近年来随着新药班的到来,自体免疫性肝炎治疗景观发生了显著变化. 传统上,皮质类固醇和甲硫黄素是治疗的支柱。 但是,这些设备的使用与长期管理的若干副作用有关。 这为开发更安全和更有效的治疗办法提供了强有力的条件。

同样,最近对JAK抑制剂的批准也带来了额外的治疗选择。 通过阻断真核细胞信号传导器和转录蛋白途径的激活器,它们有助于控制肝炎并防止爆发。 与现有方案相比,它们具有较轻的不利影响和更好的可容忍性。 他们每天一次的口服药也提高了患者的治疗合规性和方便性.

此外,新颖的免疫抑制剂侧重于选择性的间游素途径,在临床试验中显示出功效。 这些目标物剂更准确地抑制免疫反应,减少对身体其他系统的伤害. 此类管道分子流预计在未来几年内会进入市场。

因此,生物和定向合成药物平台的持续演变大大加强了对自体免疫性肝炎患者的管理。 它们涉及以前的局限性,并扩大治疗的个性化。 这反过来又证明有利于加强市场增长轨迹。

市场挑战-高治疗成本

自主免疫性肝炎市场面临的主要挑战之一是现有治疗方案费用高昂。 自动免疫性肝炎需要长期治疗和管理,这大大增加了病人的总体费用负担。 标准的第一线治疗包括免疫抑制药物,如先尼松和甲硫黄素,这些药物相当有效,但也非常昂贵. 这些药物的成本在长期治疗过程中大大增加.

此外,大量患者对一线治疗反应不足,或有不良反应. 在这种情况下,使用二线治疗方法,如芽es、肌酚酸软体或复方疗法,其费用甚至更高。 长期自体免疫性肝炎管理的经济毒性给许多患者带来了严重的承受能力挑战. 这严重阻碍了治疗的遵守和遵守。

高昂的保健费用会对一部分病人获得救生疗法产生不利影响。 解决与自体免疫性肝炎治疗办法的可负担性有关的问题是推动这一市场增长需要解决的一个关键挑战。

市场机会 -- -- 生物增长

自动免疫性肝炎市场的主要机遇之一是,更加注重开发符合成本效益的生物记录系统,针对的是自动免疫性疾病所涉及的具体路径。 目前正在进行大量研究,以了解自体免疫性肝炎在分子层面的病因,以确定新的药物目标。

一些生物技术公司和制药巨头正在大力投资开发生物学,如单克隆抗体,聚变蛋白等,有选择地干扰了某些细胞基,细胞表面受体或信号分子被牵连导致自体免疫反应. 这些有针对性的治疗方案可能比治疗成本较低的现有非特定免疫抑制剂更有效。

这种精密生物学的成功发展可能破坏自体免疫性肝炎治疗的景观,并在未来推动强劲的增长机会。 它们进入市场可能有助于解决目前高额治疗费用在自体免疫性肝炎管理方面的局限性。

处方者偏好 自动免疫肝炎 市场

自主免疫性肝炎(AIH)一般遵循基于疾病严重程度和发展阶段的分步治疗方法. 对于没有硬化症的轻度AIH来说,偏好用葡萄球素等葡萄球素进行单治疗,作为一线治疗. 然而,对于严重的AIH或患有硬化症的人,免疫抑制剂如甲硫磷碱(Imuran)经常被添加到普尼索酮中,以更有力地抑制免疫反应。

如果疾病在第一治疗线上仍然不受控制,处方一般会转换为第二治疗线的复方疗法. 一个受青睐的药典是先尼松和麦当劳(英语:Cellception)的结合,一种时效的免疫抑制剂. 这解决了无回复者中甲硫黄素的缺陷. 也可以尝试使用Budesonide(Entocort EC),特别是在那些患有温和的疾病,希望避免甲苯酮的系统副作用的人.

对于未能通过两行免疫抑制疗法的患者,可以考虑环球孢子(Neoral),tacrolimus(Prograf)或甲硫酸盐等非标签选项. 肝脏移植是那些对医疗疗法无反应的硬化症患者的最后手段。

影响处方选择的其他因素包括:病人的体温、不利影响简介、成本考虑、通用药的可得性、以及事先的治疗反应或耐药性。 密切监测处理反应和副作用也有助于优化正在进行的管理决定。

治疗方案分析 自动免疫肝炎 市场

自动免疫性肝炎有四个阶段——轻度,中度,重度和还原/不活性. 对于新确诊的轻度疾病,一线治疗涉及使用皮质类固醇,如先尼松. 这有助于多数病人的缓解。

在皮质类固醇本身不足的情况下,它们与甲硫黄素结合。 Azathioprine是一种免疫抑制剂,通过抑制身体的免疫反应来帮助维持还原. 预尼苏酮-亚甲硫磷碱的结合已经表明,单靠预尼苏酮可以实现还原效果. 它能及早减少皮质类固醇剂量,并限制不良反应.

对于中度至重度活性疾病的患者,开具了与甲硫黄素或 mycophenolate mofetil(MMF)结合的芽es。 Budesonide是一种局部作用的皮质类固醇,它有助于快速控制肝炎,其系统性副作用的风险比普丁尼松低. 早期控制肝肾炎活动在现阶段对预防疾病发展至关重要。

在无法响应上述组合时,使用tacrolimus或obeticholic酸等最后手段治疗. 塔克罗利穆斯(英語:Tacrolimus)是一种钙氨酸抑制剂,其还原率高于单是普丁尼松. Obeticholic acid,是一种Farnesoid X受体激动剂,也诱导生化和血清还原. 由于潜在的毒性,对这些免疫抑制剂进行密切监测至关重要。

关键参与者采用的关键制胜策略 自动免疫肝炎 市场

注重早期诊断和治疗: 早期诊断和治疗是成功管理自体免疫性肝炎的关键。 辉瑞等领导人专注于提高认识方案,教育医生和病人了解疾病的征兆和症状. 这有助于及早发现患者,并开始接受免疫抑制剂等治疗,从而防止患者进入晚期。

对新药开发进行投资数字 : 市场实现重大创新,新药审批针对特定疾病机制. 例如,拦截制药公司在2016年获得了Ocaliva的FDA批准,这是第一种被具体标注为初级Biliary Cholangitis(PBC)的药物. 该药物的小说MOA帮助驱动早期吸收.

通过购置扩展:大型角色通过战略收购扩大了他们的管道和市场范围. 例如,在2018年,布里斯托尔-迈尔斯·斯基布以740亿美元收购了凯尔根,获得了一个大型投资组合,包括被批准用于刺痛性关节炎的块状药物Otezla.

侵略性商业化:领导人在销售,营销和品牌宣传活动上投入大量资金. 例如,当Ocaliva启动时,截取方案进行了广泛的医生和病人教育方案,将其定位为一个重要的新选择。 这种商业举措提高了人们的知名度,并促使人们及早接受对目标人群集中的孤儿药物十分重要。

分段分析 自动免疫肝炎 市场

透视,通过治疗:有希望的管道药物驱动免疫抑制药物的生长

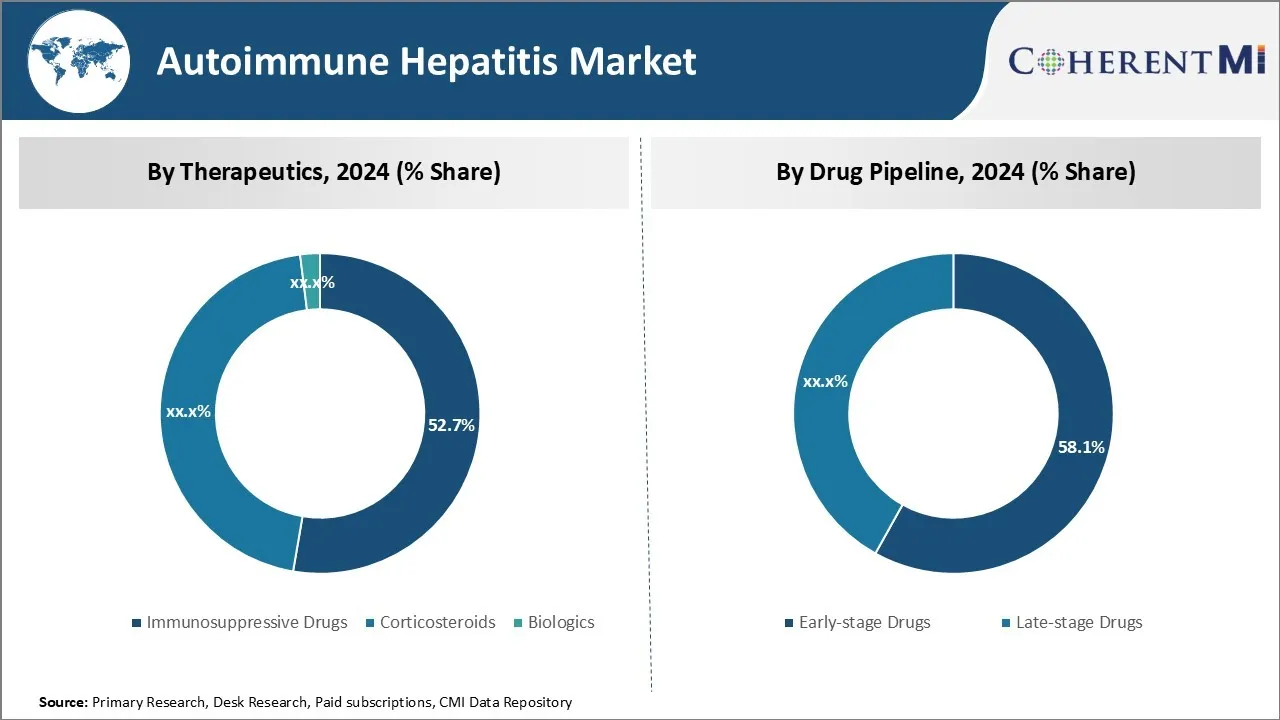

在治疗方面,免疫抑制药物预计将在2024年占有52.7%的市场份额,并拥有几种有前途的药物。 著名玩家正专注于开发新颖的免疫抑制药物,提高疗效和安全性.

例如,Roche正在评估一种叫做R0761的调查化合物,这是一种下一代钙氨酸抑制剂,具有更大的选择性,并改进了药效动力学。 在临床前的研究中,R0761显示出了提供有效的免疫抑制作用的潜力,其副作用比现有的钙氨酸抑制剂要少.

另一个关键玩家 Novartis正在开发LPN1010,一种选择性的sphingosine 1-磷酸受体调制器,已经完成. 第二阶段自体免疫性肝炎临床试验. 该药物显示出令人鼓舞的防炎活动和有利的安全情况。 有望进入后期的输油管有望在未来几年获得营销批准,这将大大促进免疫抑制药物部分.

透视,按药物管道:有希望的早期临床 数据驱动对早期管道的兴趣

在药物管道方面,由于第一阶段和第二阶段试验药物所显示的有希望的早期临床数据,早期药物预计在2024年占市场的58.1%。 大多数公司正在集中力量制定治疗自体免疫性肝炎的新目标和创新机制。

例如,Bristol-Myers Squibb正在评估BMS-986165,这是一种选择性细胞内STAT3抑制剂,它在第二阶段试验中表现出了正面的概念证明数据。 STAT3在调节炎症方面发挥着关键作用,其抑制可能提供临床利益. 同样,Cytocom Inc.正在开发CYT-107,这是一个非炎症囊活化的口服调制器,目前正在第二阶段临床试验中。

精心设计的安全简介和鼓励初步病人的生物标记数据引起了研究组织的极大兴趣。 这些早期输油管药物所显示的有希望的早期临床功效和安全性正在吸引着高额投资和协作,推动了该部分的增长。

观察、疾病进展:有利的诊断和治疗准则

在疾病发展方面,急性自体免疫性肝炎占最高比例,原因是主要医学协会发布了有利的诊断和治疗准则。 美国肝病研究协会(AASLD)和欧洲肝病研究协会(EASL)为急性自体免疫性肝炎的诊断标准和标准化治疗规程提供了明确的指导. 这有助于及早准确地识别病人。

一旦诊断出来,治疗通常涉及高剂量皮质类固醇和甲硫黄素,作为准则建议的第一线治疗。 明确界定的诊断和管理办法确保了急性病例的高求诊率。

此外,急性病例往往需要紧急住院,从而改进监测。 这些因素共同推动了急性自体免疫性肝炎的药物市场增长。

附加见解 自动免疫肝炎 市场

- 自动免疫性肝炎影响成人和儿童,女性的发病率较高。 全球研究工作目前的重点是改进免疫抑制治疗方案,减少与长期使用皮质类固醇有关的副作用。

- 自动免疫性肝炎在妇女中更为普遍,占全球病例的80%。 这种疾病影响到所有年龄的人,尽管大多数诊断发生在40至60岁之间。 这是一种罕见但严重的疾病,如果不治疗,会导致肝衰竭.

- 自动免疫性肝炎由于症状与病毒性肝炎重叠,可被误诊,使肝活检成为区分的关键工具. 治疗涉及皮质类固醇,在更为严重的情况下,如果疾病在医疗干预的情况下有所进展,则进行肝移植。

- 吉列德和普菲泽尔领导电荷进行创新治疗,减少了对具有长期副作用的传统皮质类固醇的需求.

竞争概览 自动免疫肝炎 市场

在自体免疫性肝炎市场运营的主要球员包括诺华,吉列德科学,辉瑞,默克公司(Merck & Co.),布里斯托尔-迈尔斯公司(Bristol-Myers Squibb)和台湾J制药公司.

自动免疫肝炎 市场 领导者

- 诺华

- 基列科学

- 辉瑞

- Merck & Co. (美国英语).

- 布里斯托尔-迈尔斯·斯基布

自动免疫肝炎 市场 - 竞争对手

自动免疫肝炎 市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 自动免疫肝炎 市场

- 2024年5月,Gilead Sciences宣布完成一个针对自体免疫性肝炎的生物学实验成功第二阶段试验,肝炎明显减少. Gilead最近于2024年开展的活动更侧重于肝脏疾病组合,特别是Seladelpar,一种治疗初级双胞胎胆炎(PBC)的方法。 通过Gilead购买CymaBay治疗药物获得的这种药物,在减少肝炎和诸如在建设和平委员会患者体内的Pruritus等症状方面显示出了有希望的结果。 第三阶段的审判。

- 2024年5月,诺华发起 VAY736的第三阶段试验是一种B细胞激活因子受体(BAFF-R)抗体,旨在治疗自体免疫性肝炎. 这一进步可以大大改善治疗环境,并针对特定疾病的途径,减少对广谱免疫抑制剂的依赖。 临床试验的目的是评估其对不响应常规治疗的自体免疫性肝炎患者的疗效. 该药物仍处于临床发育阶段,预计今后几年将进行中的试验结果.

- 2023年8月,辉瑞公司在第三阶段试验中披露了一种新的免疫抑制药物,显示出治疗可逆性自体免疫性肝炎的希望,目标是到2025年实现监管批准. 2023年辉瑞的焦点一直是第三阶段试验中的各种其他药物,如不同条件的治疗,包括血友病,镰状细胞病,以及炎症性肠道病.

- 2019年1月,TaiwanJ制药公司报告了对TLR4对抗剂JKB-122进行第二阶段试验的积极成果,显示出其在减少肝纤维化,改善自体免疫性肝炎患者肝功能方面的潜力. 该药物是长期作用的TLR4对抗剂,显示出肝功能的改善和肝纤维化相关关键生物标记的减少. 试验成功达到了主要终点,

自动免疫肝炎 市场 细分

- 治疗

- 免疫抑制药物

- 类固醇

- 生物学

- 按药物管道

- 早期药物

- 晚期毒品

- 按疾病进展

- 急性自动免疫肝炎

- 慢性自动免疫肝炎

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

免疫性肝炎市场有多大?

免疫性肝炎市场价值估计为127.3美元。 Mn在2024年,预计到2031年将达到186.9Mn.

哪些关键因素阻碍自体免疫性肝炎市场的发展?

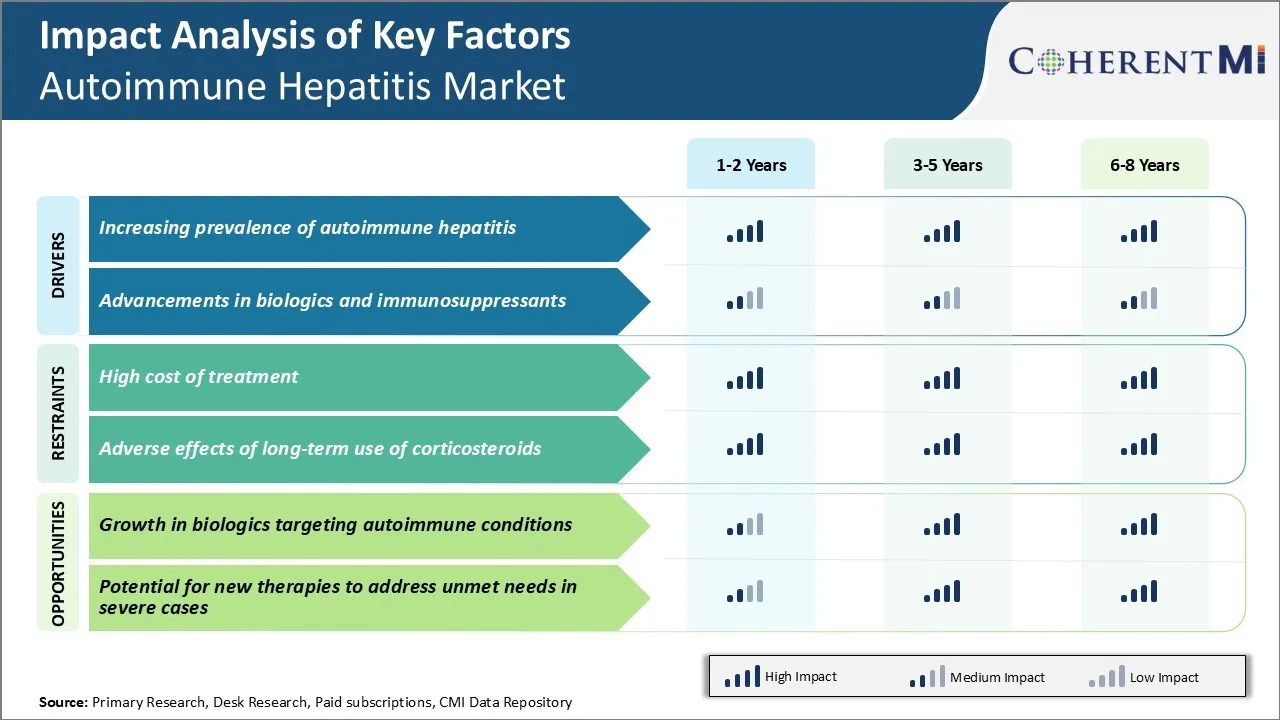

长期使用皮质类固醇治疗成本高和不利影响是阻碍自体免疫性肝炎市场增长的主要因素。

哪些主要因素推动自体免疫性肝炎市场增长?

自主免疫性肝炎发病率不断上升,生物学和免疫抑制剂的进步,是推动自主免疫性肝炎市场的主要因素.

哪个是自体免疫性肝炎市场的主要治疗部门?

主要治疗部分是免疫抑制药物.

在自体免疫性肝炎市场运营的主要角色是谁?

诺华,吉列德科学,辉瑞,默克 & Co.,布里斯托尔-迈尔斯·斯基布,台湾J制药公司是主要球员.

自动免疫性肝炎市场的CAGR是什么?

预计自体免疫性肝炎市场的CAGR在2024-2031年间为5.6%.