Bulk Food Ingredients Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Bulk Food Ingredients Market is segmented By Application (Bakery & Confectionery, Snacks & Spreads, Ready Meals), By Category (Grains, Pulses & Cereal....

Bulk Food Ingredients Market Size

Market Size in USD Bn

CAGR6.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.1% |

| Market Concentration | High |

| Major Players | Cargill, Incorporated, Archer-Daniels-Midland Company, Bunge Limited, Associated British Foods plc, Olam International, Tate & Lyle and Among Others. |

please let us know !

Bulk Food Ingredients Market Analysis

The Global Bulk Food Ingredients Market is estimated to be valued at USD 327.8 bn in 2024 and is expected to reach USD 527.6 bn by 2031, growing at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2031. Factors such as increasing demand for convenience food products and various applications in food processing industry will aid the market in achieving this revenue growth over the forecast period.

The Bulk Food Ingredients Market is expected to witness positive trends over the next few years. There is growing demand for healthier and clean label products among consumers. Many manufacturers are focusing on developing organic and non-GMO ingredients. Moreover, rising investments in product innovation and new product launches catering to dynamic consumer preferences will drive the demand for bulk food ingredients.

Bulk Food Ingredients Market Trends

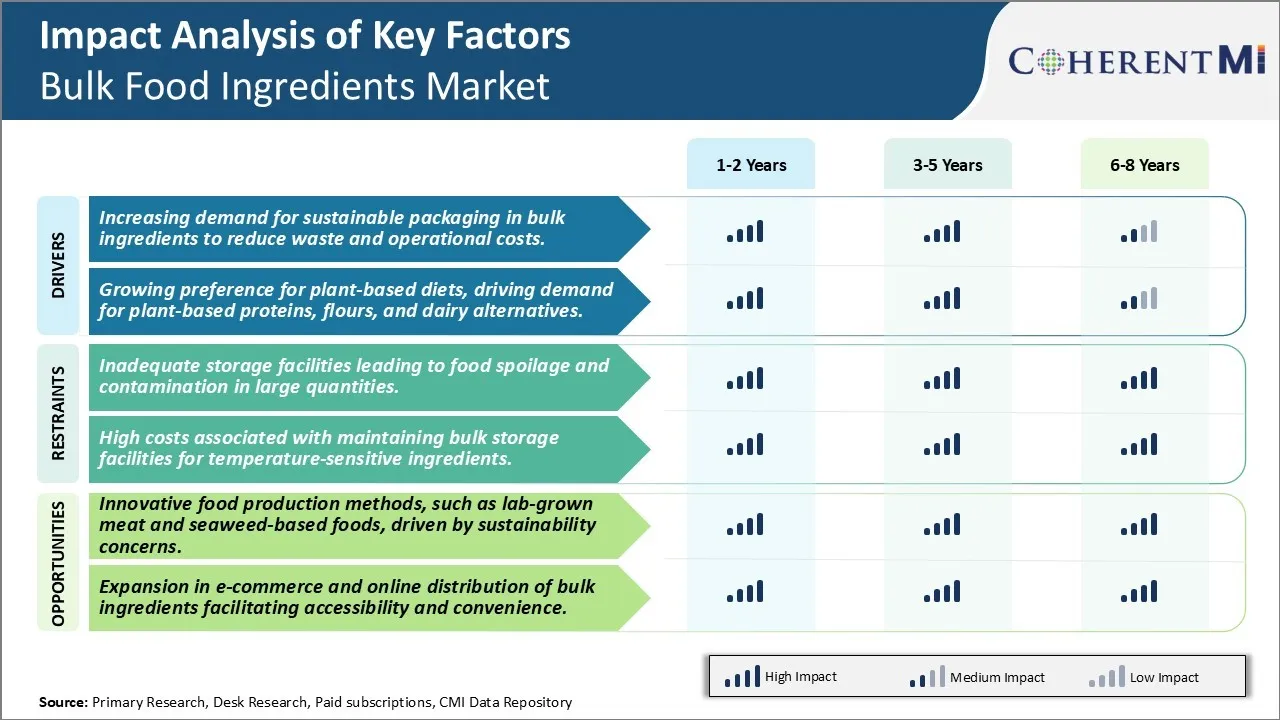

Market Driver - Increasing Demand for Sustainable Packaging in Bulk Ingredients to Reduce Waste and Operational Costs

The bulk food ingredients industry has been witnessing a noticeable shift toward more sustainable packaging solutions in recent years. With growing environmental consciousness among both manufacturers and consumers, companies are actively seeking ways to reduce plastic and packaging waste at various stages of production and distribution. Sustainable packaging made from recycled or renewable materials allows producers to lower their carbon footprint substantially. It also helps cut costs associated with traditional packaging over the long run.

Transitioning to recyclable and compostable bulk packaging provides tangible benefits to all stakeholders involved. For instance, suppliers of ingredients such as flour, dry fruits and nuts can reduce expenditure on single-use plastic packaging by opting for reusable containers made from eco-friendly materials. This translates to significant savings considering the large volumes packaged and shipped. Moreover, sustainable packages are more durable which further decreases replacement and disposal expenses. On the customer end, sustainable packaging eliminates secondary waste at grocery stores and food processing facilities. It streamlines recycling and improves efficiency in waste management.

From a social perspective, sustainable choices in bulk packaging resonate well with the changing values of younger consumers. Many recognize their ability to drive positive change through responsible shopping habits. By promoting waste reduction and circular economy, packaging innovations help food companies strengthen their environmental and social credentials. This enhances brand loyalty in the current marketplace that is increasingly aware of the climate impact of business practices. Government regulations are also getting stricter on plastic use and carbon footprint targets. Transitioning to sustainable models early allows first movers to gain a competitive edge in the evolving policy landscape.

Market Driver - Growing Preference for Plant-Based Diets, Driving Demand for Plant-Based Proteins, Flours, And Dairy Alternatives

Rising health consciousness and concerns over sustainability have boosted interest in plant-based diets significantly in recent times. More people now wish to reduce or eliminate animal products from their nutrition. This shift in lifestyle and value system has spurred strong demand for various plant-based food ingredients that can substitute animal-based equivalents. Ingredients such as soy, pea, lentil and chickpea proteins are being widely incorporated in both packaged retail products as well as food service menus to meet the needs of flexitarians and vegans.

In parallel to protein alternatives, the demand for plant-based milks and yogurts is rising at an exponential rate. Almond, oat, coconut, cashew and soy are some of the most popular plant milks being produced and distributed in bulk formats. Rising lactose intolerance and veganism have encouraged innovators to explore native plant-based ingredients as well. Teff, millet, sorghum and amaranth are new-age grains garnering attention for their nutritional attributes and versatility in baking and cooking applications.

As the appeal of healthy, sustainable plant-based diets grows multifold, food companies are proactively expanding their range of similar ingredient options. Catering to this movement provides a lucrative business opportunity and access to the growing market segment of health-conscious flexitarians. It strengthens positioning around Corporate Social Responsibility and appeals to younger, ethically-driven consumers. With more innovative plant-based solutions emerging constantly, the bulk food ingredients industry is poised to benefit tremendously from this transformational shift in global food systems and mass buying behavior.

Market Challenge - Inadequate Storage Facilities Leading to Food Spoilage and Contamination in Large Quantities

One of the key challenges faced by the bulk food ingredients market is inadequate storage facilities that can lead to massive food spoilage and contamination. As the bulk food supply chain involves large quantities of ingredients being stored and transported over long distances, proper cold storage infrastructure becomes extremely important. However, in many developing regions and even in some developed markets, lack of suitable refrigerated warehousing remains a major problem. Improper temperature and humidity control in storage facilities can rapidly accelerate the natural spoilage process in bulk foods like grains, pulses and meat products. This poses serious food safety risks and also results in significant monetary losses for suppliers due to wastage. Meeting consistently low temperature requirements over large volumes is also challenging without state-of-the-art cold stores. Addressing cold chain gaps through strategic investments in modern warehousing infrastructure can help boost efficiency while safeguarding public health.

Market Opportunity- Innovative Food Production Methods, Such as Lab-Grown Meat and Seaweed-Based Foods, Driven by Sustainability Concerns

One of the major opportunities for the bulk food ingredients market lies in innovative production methods that are being driven by sustainability and ethical considerations. For instance, the development of lab-grown or cultured meat using cell biology techniques provides an alternative to conventional livestock farming. If produced at commercial scale, cultured meat could reduce dependence on resource-intensive animal agriculture while satisfying growing demand for meat. There is also rising interest in alternative plant-based and algae-derived ingredients. The mass cultivation of seaweeds and microalgae offers scope for producing protein-rich and nutritious foods with a much lower environmental footprint than traditional meat proteins. While commercialization challenges remain, these novel food technologies have the potential to revolutionize future food systems and open up new revenue streams within the bulk ingredients sector if successfully developed and adopted by manufacturers and consumers.

Key winning strategies adopted by key players of Bulk Food Ingredients Market

Strategic Acquisitions and Mergers: One of the most effective strategies adopted by leading players has been strategic acquisitions and mergers. This allows companies to expand their product portfolio and geographical reach. For example, in 2022, Ingredion acquired KaTech, a leading producer of potato starch and potato protein. This strengthened Ingredion's position in Europe and expanded its plant-based protein capabilities. Such acquisitions provide access to new markets, customers, and manufacturing capabilities.

Focus on Clean Label and Organic Ingredients: With increasing consumer demand for clean label and organic products, players have focused their new product development and marketing efforts in this area. For example, Cargill launched an organic certified tapioca starch in 2020 to capitalize on growing demand for clean label starches. Tate & Lyle also emphasizes its line of organic and non-GMO specialty food ingredients. This focus helps companies attract health-conscious consumers and command a premium.

Investments in Processing Technologies: Leading players have made sizable investments in advanced processing technologies to drive efficiencies and develop differentiated ingredient solutions. For example, Ingredion invested USD 40 million in a pea protein processing facility in South Sioux City in 2021. This state-of-the-art facility is designed for consistent quality and tailored protein solutions. Similarly, ADM partnered with Pantheryx in 2020 to commercialize an enzyme technology for efficient production of plant-based meat analogs. Such investments establish technical leadership and the ability to meet evolving customer needs. These strategies have significantly strengthened competitive positioning and market share for companies like Ingredion and ADM. The acquisitions expanded their geographic footprint and product range.

Segmental Analysis of Bulk Food Ingredients Market

Insights, By Application, Bakery & Confectionery Dominance Driven by Staple Ingredient Dependence

The bakery and confectionery segment is projected to account for 36.1% in 2024 due to its reliance on bulk staple ingredients. Baking and confectioneries require large volumes of ingredients like flour, sugar, cocoa, and oils/fats to produce their wide range of breads, pastries, chocolates and candies. The formulation of most bakery and confectionery products depends heavily on using these core bulk ingredients in standard recipes. With bread and baked goods still making up a significant part of daily diets globally, there is consistent demand for the wheat flour and other grains that serve as the foundation for these products. Confectioneries similarly rely on ingredients such as cocoa, sugar and nuts/dried fruits to produce chocolate bars, candies and desserts. The need for baking/confectionery companies to maintain consistent product recipes drives continued bulk purchasing of ingredients. Additionally, the cost-effectiveness of bulk purchasing allows bakeries and confectioners to keep their product costs low in a competitive market. The stability in demand and dependence on bulk staples has helped establish the bakery/confectionery segment as the leading application for bulk food ingredient suppliers.

Insights, By Category, Grains, Pulses and Cereals Anchor the Categories due to Agro Industry Integration

The grain, pulse and cereal category is expected to register 37.4% in 2024 owing to the prominence of integrated agro industry players. Staple crops like wheat, rice and maize form the basis of diets globally and have thriving cultivation and processing industries. Large agro companies with multi-national supply chain networks are ideally positioned to source and deliver these commodities in bulk. Their vertical integration allows for efficient procurement of harvests directly from farmers and processing into millable bulk ingredients. The scale of agricultural operations translates to vast cultivated land areas and crop yields handled by these agricorp giants. In turn, the category depends on their marketing networks to distribute grains, pulses and cereals on a massive bulk scale. Additionally, many food manufacturers producing staples like flour, breads and snacks, rely on established agricorps as guaranteed suppliers. The category’s tight coupling with agricultural heavyweights like Cargill and Archer Daniels Midland ensures a stable supply infrastructure and bulk delivery capability not matched across other ingredient types. This links the grains, pulses and cereals category intrinsically to the global agro industry value chain.

Additional Insights of Bulk Food Ingredients Market

The bulk food ingredients market is driven by the demand for sustainable and cost-effective food solutions. Bulk ingredients are essential in large-scale food production, from bakery items to ready meals, and play a crucial role in reducing packaging waste and cost. As consumer preferences shift toward plant-based diets and clean labels, bulk ingredients like grains, pulses, and plant proteins are seeing increased demand. Innovative storage solutions and processing technologies, alongside the rise of e-commerce, are reshaping how bulk food ingredients are sourced, stored, and distributed, enhancing accessibility and efficiency in the market. With the growth of nutraceutical and functional foods, bulk ingredients are increasingly valuable for manufacturers aiming to meet health-focused consumer demands.

Competitive overview of Bulk Food Ingredients Market

The major players operating in the Bulk Food Ingredients Market include Cargill, Incorporated, Archer-Daniels-Midland Company, Bunge Limited, Associated British Foods plc, Olam International, Tate & Lyle, DuPont de Nemours, Inc, Essex Food Ingredients, Ingredients Inc., Corbion, Koninklijke DSM N.V, EHL Ingredients, McCormick & Company, Inc, GCL Food Ingredients and Dmh Ingredients, Inc.

Bulk Food Ingredients Market Leaders

- Cargill, Incorporated

- Archer-Daniels-Midland Company

- Bunge Limited

- Associated British Foods plc

- Olam International

- Tate & Lyle

Bulk Food Ingredients Market - Competitive Rivalry, 2024

Bulk Food Ingredients Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Bulk Food Ingredients Market

- In June 2024, CP Kelco and Tate & Lyle merged to enhance global food and beverage product development, combining resources for innovation in ingredient solutions.

- In May 2022, Cargill invested USD 5.75 million in Cubiq Foods, a Spanish start-up, to scale up its production of cultivated fat-based ingredients for plant-based meat alternatives, meeting the rising demand for sustainable fats.

Bulk Food Ingredients Market Segmentation

- By Application

- Bakery & Confectionery

- Snacks & Spreads

- Ready Meals

- By Category

- Grains, Pulses & Cereals

- Tea, Coffee & Cocoa

- Dry Fruits & Nuts

- Sugars & Sweeteners

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Bulk Food Ingredients Market?

The Global Bulk Food Ingredients Market is estimated to be valued at USD 327.8 bn in 2024 and is expected to reach USD 527.6 bn by 2031.

What will be the CAGR of the Bulk Food Ingredients Market?

The CAGR of the Bulk Food Ingredients Market is projected to be 6.1% from 2024 to 2031.

What are the major factors driving the Bulk Food Ingredients Market growth?

The increasing demand for sustainable packaging in bulk ingredients to reduce waste and operational costs and growing preference for plant-based diets, driving demand for plant-based proteins, flours, and dairy alternatives are the major factors driving the Bulk Food Ingredients Market.

What are the key factors hampering the growth of the Bulk Food Ingredients Market?

The inadequate storage facilities leading to food spoilage and contamination in large quantities and high costs associated with maintaining bulk storage facilities for temperature-sensitive ingredients are the major factors hampering the growth of the Bulk Food Ingredients Market.

Which is the leading Application in the Bulk Food Ingredients Market?

Ready Meals is the leading Application segment.

Which are the major players operating in the Bulk Food Ingredients Market?

Cargill, Incorporated, Archer-Daniels-Midland Company, Bunge Limited, Associated British Foods plc, Olam International, Tate & Lyle, DuPont de Nemours, Inc, Essex Food Ingredients, Ingredients Inc., Corbion, Koninklijke DSM N.V., EHL Ingredients, McCormick & Company, Inc, GCL Food Ingredients, Dmh Ingredients, Inc. are the major players.