Powdered Fats Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Powdered Fats Market is segmented By Source (Palm and Palm Kernel, Coconut, Milk, Sunflower, Others), By Processing (Spray Drying, Drum Drying, Freeze....

Powdered Fats Market Size

Market Size in USD Bn

CAGR4.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.4% |

| Market Concentration | Medium |

| Major Players | Kerry Group plc, Royal FrieslandCampina N.V., Zeon Lifesciences Ltd., LUS Health Ingredients BV, Castle Dairy s.a. and Among Others. |

please let us know !

Powdered Fats Market Analysis

The Global Powdered Fats Market is estimated to be valued at USD 2.8 Bn in 2024 and is expected to reach USD 4.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2031. Powdered fats have wide applications in bakery, confectionery and other food products for improving texture and taste. Rising demand for convenience food items is also driving the market.

The powdered fats market is expected to witness positive growth over the forecast period. Key factors such as increasing demand for plant-based and high-fiber foods, growing consumption of bakery and confectionary products as well as rising health-consciousness among consumers are expected to support the demand for powdered fats. Additionally, innovations with respect to offerings of powdered fats with various functional benefits will provide new opportunities for market expansion.

Powdered Fats Market Trends

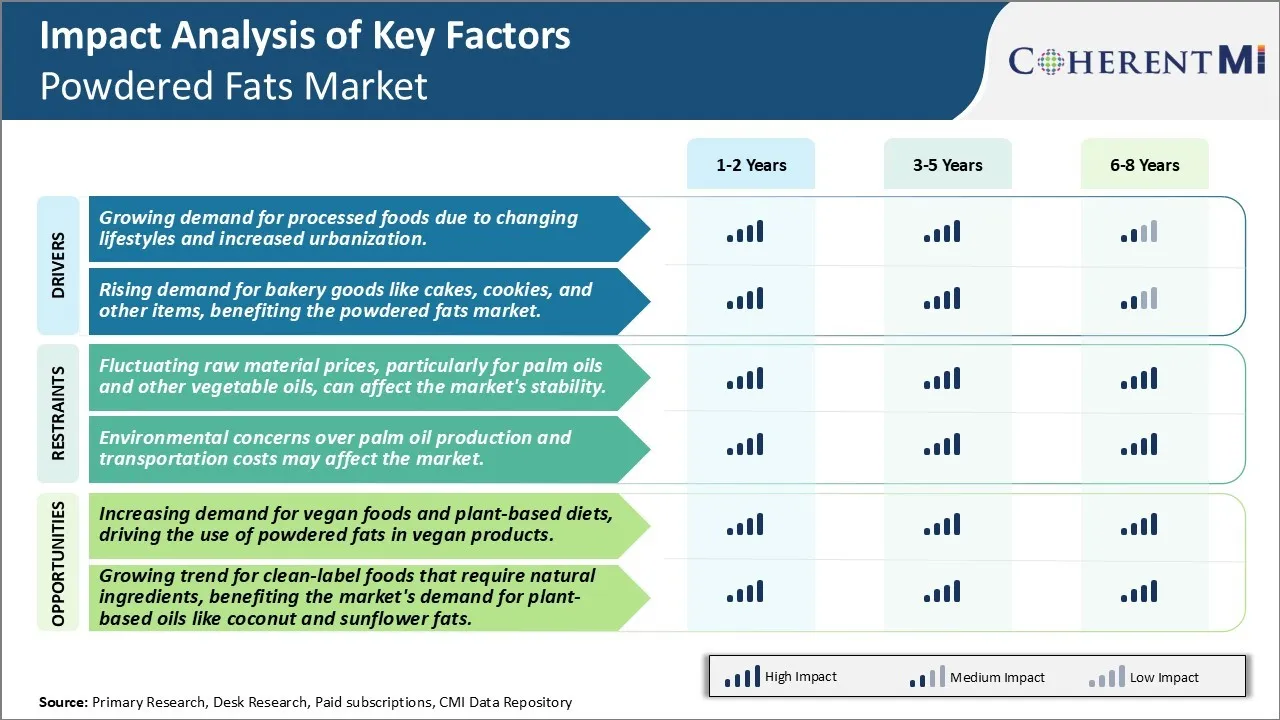

Market Driver - Growing Demand for Processed Foods Due to Changing Lifestyles and Increased Urbanization

The fast-paced urban lifestyles that many people now lead has significantly impacted dietary habits and food preferences. Long work hours, traffic jams, and the appeal of convenience are fueling demand for packaged, ready-to-eat foods that save on preparation time. Powdered fats are increasingly used by food processors as a versatile ingredient to produce many types of processed snacks, frozen foods, and other packaged meals.

As more people are leaving their villages and small towns for the crowded cities in search of employment and improved standards of living, they are adopting Western eating patterns. The tradition-bound home-cooked meals are being replaced by fast foods, noodles, frozen pizzas, pasta dishes, and other international cuisines that can be quickly made or purchased. Adding powdered fats to breads, pastries and snacks extends their shelf life, improving logistics for food companies catering to metro areas. It also enhances taste and texture without adding excess calories compared to regular fats. This has made powdered fats very appealing as a substitute for bakeries and snack makers.

The shift to a sedentary urban population has led to increasing instances of lifestyle diseases. While health awareness is growing, the demand for convenient, tasty indulgences remains strong. Powdered fats allow manufacturers to develop lower-fat versions of popular snacks with sustained mouthfeel and flavor, meeting the dual desires of health consciousness and taste. This has further spurred the sales of powdered fats to s and fast-food chains.

Market Driver - Rising Demand for Bakery Goods Encourages Industry Growth

The global appetite for baked goods continues to expand driven by changing dietary patterns, the rise of cafe culture and celebratory occasions. Cakes, cookies, pastries and related bakery products have become an integral part of social interactions as well as festivities across cultures. Busy work schedules have also boosted the popularity of bakery snacks and grab-and-go items that can be easily consumed on the go. Meanwhile, people are indulging more often in sweet treats as a mood booster in increasingly stressful times.

Artisanal bakeries as well as major baked goods brands are continually experimenting with new flavors, formats and premiumized varieties of cookies, cakes and biscuits to attract customers. Powdered fats allow innovative textures to be created while maintaining moistness and freshness. They add flavor and taste without adding excess calories when used judiciously by bakeries. This has encouraged many large-scale bakeries and biscuit manufacturers to adopt powdered fats for selected products.

Evolving dietary trends that emphasize natural, clean-label and low-sugar foods are also benefiting powdered fat sales. By developing confections and bakery snacks made with powdered fats instead of solid fats or oils, brands are able to market items as lower in saturated fats or sugar. Powdered fats are a versatile solution that allows reformulation without compromising mouthfeel or shelf life. This has spurred many bakeries experimenting with powdered fats as a way to expand into the sizable health-conscious segment.

Market Challenge - Fluctuating Raw Material Prices, Particularly for Palm Oils and Other Vegetable Oils, Can Affect the Market's Stability.

Fluctuating raw material prices, particularly for palm oils and other vegetable oils, can affect the market's stability. The powdered fats market is heavily reliant on palm and vegetable oils as key raw materials. However, the prices of these commodities tend to fluctuate frequently depending on various demand and supply dynamics in the global market. Any sudden spike in palm oil or soybean prices pushes up production costs for powdered fat manufacturers. With declining margins, companies may be forced to periodically revise their powdered fat prices to compensate for increased input costs. Frequent price hikes can disrupt the established price points in the powdered fats market and reduce desirability for end-use products. It can also discourage innovation and investments toward new product development. Additionally, increased commodity prices often cut household budgets and lower per capita consumption of packaged foods containing powdered fats. This volatility in raw material availability and pricing poses significant planning challenges for powdered fat producers and hampers the overall steadiness of market revenues.

Market Opportunity- Increasing Demand for Vegan Foods and Plant-Based Diets, Driving the Use of Powdered Fats in Vegan Products.

With health and environmental concerns compelling more people to reduce or avoid animal products, the vegan food market has been gaining considerable momentum globally. According to statistics, vegan food sales rose by 33% between 2018 to 2020. Powdered fats have emerged as a popular alternative to butter, cream, and ghee in vegan substitutes for traditionally dairy-based products. Powdered coconut, palm, and avocado fats are widely used in vegan baking mixes, sauces, frozen desserts and more. Their ability to impart similar mouthfeel as dairy fats makes them suitable for mimicking textures in vegan cheese, yogurt and ice cream. The rising vegan demographic presents lucrative opportunities for powdered fat producers to expand their portfolios with specialized oil-powder blends targeted for the free-from and plant-based foods market. It also allows companies to achieve more price-points and premium positioning compared to conventional powdered fats used in regular foodstuffs.

Key winning strategies adopted by key players of Powdered Fats Market

Product Innovation: Players have consistently focused on innovating their product portfolio to cater to changing consumer preferences. For example, in 2019, Bunge launched a new non-hydrogenated powdered fat called Bunge Ultra Gran. It has zero trans-fat and the granulated powder melts easily. This helped Bunge gain market share as consumers are increasingly demanding healthier products.

Mergers and Acquisitions: M&A activity has been high as larger players look to expand their portfolio and global production footprint. In 2020, ADM acquired Sojaprotein, a leading European provider of non-GMO soy ingredients. This strengthened ADM's position in Europe and allowed it to offer a wider range of non-GMO soy options to customers.

Strategic Partnerships: Companies partner with food producers, farm cooperatives, and ingredient suppliers to gain strength in sourcing, R&D and distribution. For example, Bunge partnered with various farm cooperatives in North America to secure supply of non-GMO soy and canola crops. This stable supply chain helped Bunge lower raw material costs and prices, giving it an edge.

Focus on Emerging Markets: Emerging countries like India, Brazil, Indonesia are expected to drive future growth.

These strategic moves have helped leading players gain market share over the past 5 years. Innovation, regional expansion and consolidation activities are likely to remain core strategies to succeed in the growing powdered fats industry.

Segmental Analysis of Powdered Fats Market

Insights, By Source, Availability of Raw Materials Leads to Palm and Palm Kernel Dominance

By Source, Palm and Palm Kernel is set to contribute 36.4% in 2024 owing to the widespread availability and low production costs of palm oil. As the world's largest vegetable oil crop, palm oil is grown commercially in many tropical countries such as Indonesia, Malaysia, Thailand and Nigeria which have ideal growing conditions. This abundant supply of palm fruit ensures a continuous and affordable source of raw material for powdered fats manufacturers. Palm oil also has desirable properties for food processing due to its high melting point and oxidative stability at room temperatures. These characteristics allow powdered palm fat to be used across a variety of applications without risk of melting or spoilage.

In contrast, sources like coconut, milk and sunflower have more limited geographical growing areas and harvesting seasons. Coconut production is concentrated in Southeast Asia and parts of South America, making sourcing more challenging on a large scale. Sunflower cultivation depends on climatic conditions and crop yields can vary annually. While coconut and sunflower oils offer certain nutritional benefits, their constrained supply chains drive up production costs compared to palm. As a result, palm and palm kernel remains the most widely and economically sourced option for powdered fats producers.

Insights, By Processing, Spray Drying Efficiency Drives its Popularity in Processing

By Processing, Spray Drying is expected to account for 76.2% in 2024 due to its advantages over alternative methods. Spray drying involves mixing liquid fat with hot air currents to form fine, dry powder particles quickly and consistently. This single-step process is highly efficient as it achieves rapid moisture removal while minimally degrading heat-sensitive nutrients. Spray drying can also be easily scaled up or down depending on production needs.

Compared to drum drying which relies on rollers to spread out thin fat layers, spray drying achieves a more uniform particle size distribution without risk of clumping. Freeze drying is even slower and energy intensive, involving freezing followed by sublimation under vacuum conditions. Other specialized methods like fluidized bed drying are more complex to setup and operate.

For powdered fats manufacturers seeking high processing throughput, spray drying presents a cost-effective and simple solution. Its ability to quickly convert liquid oil into a free-flowing, dry powder with minimal effects on fat quality has made spray drying the standardized processing technique across the industry. This wide acceptance and optimization over time sustains its leading market share position.

Insights, By Application, Wide Compatibility Boosts Dairy and Non-Dairy Applications

In terms of By Application, Dairy and Non-Dairy Products contributes the highest share driven by the diverse options powdered fats provide. Being shelf-stable yet possessing characteristics similar to plastic fats and shortening upon melting, powdered fats can replace or enhance the texture, mouthfeel and flavor release in various products.

In dairy, powdered fats help improve creaminess when added to products like coffee creamers, whipped toppings and processed cheeses. They also extend shelf life by counteracting fat separation. For non-dairy alternatives seeking dairy-like qualities, powdered fats are frequently used as stabilizers, emulsifiers and bulking agents.

Powdered fats are also highly compatible ingredients for bakery goods and desserts. They enhance flavor conductivity in chocolate formulations while preventing greasiness. As all-purpose shortenings, they aerates batters and doughs while adding tenderness to baked goods. Supplement and nutritional product manufacturers also utilize powdered fats as carriers for fat-soluble vitamins and minerals.

Owing to its wide functional versatility across both savory and sweet applications, dairy and non-dairy remains the dominant segment driving powdered fats demand. Manufacturers continue exploring new solutions based on its compatibility, stability and texturizing attributes.

Additional Insights of Powdered Fats Market

Powdered fats are favored in processed foods, bakery products, and plant-based food alternatives due to their ability to enhance texture, flavor, and shelf life. The market is also seeing rising demand for dairy and non-dairy products, driven by a growing preference for plant-based diets and veganism. Technological advancements in spray drying and freeze-drying techniques have made it easier for manufacturers to produce powdered fats at scale while maintaining the nutritional value of the products. The market faces challenges related to fluctuating raw material costs, especially for palm and coconut oils, but opportunities lie in the increasing demand for clean-label, natural, and vegan food products.

Competitive overview of Powdered Fats Market

The major players operating in the Powdered Fats Market include Kerry Group plc, Royal Friesland Campina N.V., Zeon Lifesciences Ltd., LUS Health Ingredients BV, Castle Dairy s.a., Hill Natural Extract, Tiba Starch and Glucose Manufacturing Co. S.A.E, Aarkay Food Products Ltd., Insta Foods and Tiba Starch & Glucose Manufacturing Co. S.A.E.

Powdered Fats Market Leaders

- Kerry Group plc

- Royal FrieslandCampina N.V.

- Zeon Lifesciences Ltd.

- LUS Health Ingredients BV

- Castle Dairy s.a.

Powdered Fats Market - Competitive Rivalry, 2024

Powdered Fats Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Powdered Fats Market

- In September 2024, EUR 70 million investment was announced by a major player in its Seinäjoki plant to modernize production of specialty milk powders and fats, enhancing capacity by 2026.

- In August 2024, Nestlé developed a method to reduce fat content in milk powder by 60% without compromising taste or texture, addressing the demand for lower-calorie products.

Powdered Fats Market Segmentation

- By Source

- Palm and Palm Kernel

- Coconut

- Milk

- Sunflower

- Others

- By Processing

- Spray Drying

- Drum Drying

- Freeze Drying

- Others

- By Application

- Dairy and Non-Dairy Products

- Bakery and Confectionery

- Froze Desserts

- Supplements and Nutritional Products

- Beverages

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Powdered Fats Market?

The Global Powdered Fats Market is estimated to be valued at USD 2.8 Bn in 2024 and is expected to reach USD 4.1 Bn by 2031.

What will be the CAGR of the Powdered Fats Market?

The CAGR of the Powdered Fats Market is projected to be 4.4% from 2024 to 2031.

What are the key factors hampering the growth of the Powdered Fats Market?

The fluctuating raw material prices, particularly for palm oils and other vegetable oils, can affect the market's stability, environmental concerns over palm oil production and transportation costs may affect the market further hampering the growth of the Powdered Fats Market.

What are the major factors driving the Powdered Fats Market growth?

The growing demand for processed foods due to changing lifestyles and increased urbanization, rising demand for bakery goods like cakes, cookies, and other items, benefiting the powdered fats market are the major factors driving the Powdered Fats Market.

Which is the leading Source in the Powdered Fats Market?

The leading Source segment is Palm and Palm Kernel.

Which are the major players operating in the Powdered Fats Market?

Kerry Group plc, Royal FrieslandCampina N.V., Zeon Lifesciences Ltd., LUS Health Ingredients BV, Castle Dairy s.a., Hill Natural Extract, Tiba Starch and Glucose Manufacturing Co. S.A.E, Aarkay Food Products Ltd., Insta Foods, Tiba Starch & Glucose Manufacturing Co. S.A.E are the major players.