Refractory Epilepsy Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Refractory Epilepsy Market is segmented By Drug Class (First-Generation, Second-Generation, Third-Generation), By Distribution Channel (Hospitals, Cli....

Refractory Epilepsy Market Size

Market Size in USD Bn

CAGR4.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.2% |

| Market Concentration | High |

| Major Players | Pfizer, Novartis, Abbott, Neurelis Inc, GSK Plc and Among Others. |

please let us know !

Refractory Epilepsy Market Analysis

The Global Refractory Epilepsy Market is estimated to be valued at USD 1.2 Bn in 2024 and is expected to reach USD 3.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2031. New treatments in the pipeline and increasing prevalence of drug-resistant epilepsy is contributing to the growth of this market.

The refractory epilepsy market iswitnessing positive trend with increasing research and development activities in this field. Many pharmaceutical companies are actively working on developing novel treatment options to target the underlying cause of epilepsy. Additionally, the growing geriatric population worldwide who are more prone to develop drug-resistant epilepsy will further drive the demand in this market during the forecast period.

Refractory Epilepsy Market Trends

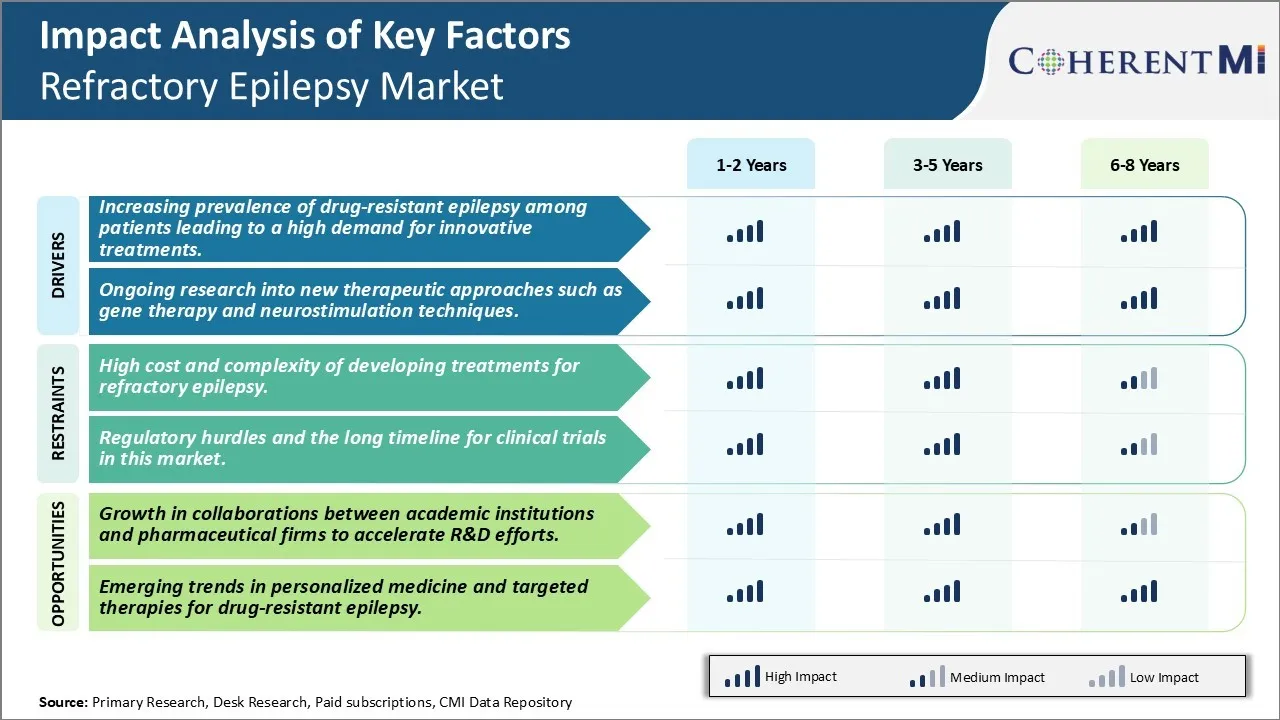

Market Driver - Increasing Prevalence of Drug-Resistant Epilepsy Among Patients Leading to a High Demand for Innovative Treatments

A major driver for the refractory epilepsy market is the rising prevalence of patients who do not respond to conventional antiepileptic drug treatment options. Approximately one third of all epilepsy patients suffer from drug-resistant forms of the condition where seizures are not adequately controlled by two or more tolerated, appropriately chosen and administered antiepileptic drug regimens. If a patient's epilepsy continues to be uncontrolled or cannot be managed by pharmacological interventions, they are classified as having refractory or drug-resistant epilepsy. The underlying causes behind treatment failure vary between patients and can be due to genetic predispositions or structural abnormalities in the brain that prevent drugs from taking full effect. As physicians exhaust conventional treatment options, there is a growing need for novel disease-modifying therapies that target the specific pathophysiological mechanisms responsible for medically intractable seizures in different patient cohorts. Some patients with severe epilepsy that is not controlled with medications may be offered alternative treatment options like neurostimulation therapies or neuromodulation devices which help relieve seizures by delivering electrical signals to specific areas of the brain. The high unmet need to control seizures and improve quality of life for those living with uncontrolled epilepsy is a major factor driving investment into innovative drug and device-based approaches.

Market Driver: Ongoing Research into New Therapeutic Approaches Such as Gene Therapy and Neurostimulation Techniques

Continued research efforts into the development of next-generation therapeutic approaches for refractory epilepsy also serves as an important driver for market growth. Gene therapy is an emerging area of focus that seeks to introduce genetic material into brain cells through viral vectors in order to compensate for genetic mutations linked to certain epilepsies or restore normal neuronal functioning. Early clinical evidence suggests this may help reduce seizure frequency over time. Another avenue being explored is personalized brain stimulation techniques like responsive neurostimulation which monitors brain activity to detect abnormal patterns that precede seizures and then delivers electrical pulses preemptively to interrupt seizures. Device manufacturers are conducting trials of closed-loop stimulation systems that can actively sense seizure onset and intervene appropriately in a closed feedback loop. In addition, transcranial magnetic stimulation is an non-invasive modality gaining ground as a potential treatment for refractory epilepsy either as a stand-alone therapy or complementary intervention used alongside drug regimens. Continued advancements in elucidating disease pathways combined with the commitment of industry players and research organizations to translate findings into scalable therapies will expand available treatment options beyond conventional regimens in the foreseeable future.

Market Challenge - High Cost and Complexity of Developing Treatments for Refractory Epilepsy

High cost and complexity of developing treatments for refractory epilepsy. Developing new treatments for refractory epilepsy poses significant challenges for pharmaceutical companies. Refractory epilepsy is a complex condition with multiple underlying causes and manifestations. This complexity makes it incredibly difficult for researchers to determine the exact pathological mechanisms and identify effective molecular targets for new drug therapies. Extensive clinical trials are required to test new compounds on refractory epilepsy patients whose conditions may vary dramatically. With each trial costing hundreds of millions of dollars, the financial investment required to bring a new refractory epilepsy treatment to market is extremely high. Additionally, the failure rate of epilepsy drug trials is disproportionately high compared to other therapeutic areas. This increased risk means pharmaceutical companies must accurately assess whether a potential new treatment is likely to succeed before committing massive resources to its development. The molecular heterogeneity of refractory epilepsy combined with the costs and failure risks make developing new therapies an arduous and uncertain endeavour.

Market Opportunity: Partnerships and Collaborations to Create New Avenues for Market

Growth in collaborations between academic institutions and pharmaceutical firms to accelerate R&D efforts. There are signs that this challenging landscape may be improving through innovative partnerships between different sectors. Pharmaceutical companies increasingly recognize that they cannot tackle the complexity of refractory epilepsy alone and are actively collaborating with academic experts. These collaborations pair the pharmaceutical industry's development expertise and financial resources with the basic science knowledge held within academic neurology departments and epilepsy research centres. By combining complementary strengths, collaborations aim to advance understanding of disease mechanisms, identify promising biomarkers and molecular targets, design smarter clinical trials, and translate cutting-edge research into new treatment options more efficiently. If successful, these multi-sector partnerships have the potential to dramatically reduce both the time and costs required to progress refractory epilepsy drug development. Increased collaboration across industry and academia may help address the market's historical difficulties and thus represents an opportunity for accelerated progress towards improved refractory epilepsy treatments.

Prescribers preferences of Refractory Epilepsy Market

Refractory Epilepsy is a severe form of the disease characterized by frequent seizures that do not adequately respond to antiepileptic drug (AED) treatment. It is classified into three main stages based on treatment response.

In the first line of treatment, prescribers predominantly use single AEDs like Vimpat (lacosamide) or Briviact (brivaracetam). If seizures are not controlled, patients enter the second line of treatment. Here, prescribers typically prescribe combinations of two AEDs, most commonly lamotrigine (Lamictal) or levetiracetam (Keppra) added to existing medication.

For patients whose seizures remain uncontrolled even with optimized two-AED combinations, the disease has progressed to the refractory stage. At this point, prescribers have multiple treatment options - they could try alternative AED combinations, pursue epilepsy surgery if a focal area can be identified, or consider new-generation AEDs like Banzel (rufinamide), Fycompa (perampanel), or Epidiolex (cannabidiol). Of these, Fycompa seems to be gaining more popularity due to its novel mechanism of action targeting glutamate release. It has demonstrated efficacy as an adjunct even in truly refractory patient populations.

Other important factors influencing prescribing choices include a drug's side effect profile, availability of financial assistance programs, and familiarity through representative education. Maintaining an open dialogue helps establish better understanding between patients, neurologists, and the pharmaceutical industry.

Treatment Option Analysis of Refractory Epilepsy Market

Refractory epilepsy is classified as uncontrolled seizures despite treatment with two or more anti-seizure medications. Based on disease progression and treatment response, there are different lines of potential therapy.

First Line Treatment: Initial medications commonly used as mono- or polytherapy include levetiracetam, lamotrigine, lacosamide, carbamazepine and topiramate. Levetiracetam and lamotrigine are preferred choices due to their relatively mild side effect profiles.

Second Line Treatment: If seizures are still uncontrolled, adding on a second or third anti-seizure medication is recommended. Often prescribed drug combinations at this stage include levetiracetam or lamotrigine paired with lacosamide, topiramate, or perampanel. These combinations provide synergistic effects with differing mechanisms of action to better control seizures.

Third Line Treatment: For patients with persistent seizures, more invasive treatment options are considered. Surgical resection of epileptic foci can potentially cure seizures, if localized abnormalities are found. Vagus nerve stimulation involves implantation of a device that electrically stimulates the vagus nerve. Ketogenic diet is also sometimes recommended to reduce seizure frequency.

Overall, treatment selection is guided by seizure type, patient factors, medication tolerability, and level of seizure control achieved. A team-based care approach individualizes therapy while balancing efficacy and quality of life improvements for people living with refractory epilepsy.

Key winning strategies adopted by key players of Refractory Epilepsy Market

The refractory epilepsy market has seen significant developments over the past decade due to increased research activities focused on developing newer treatment options for patients. Here are some of the key strategies adopted by leading players that have helped them achieve success in this space:

Acquisitions and Partnerships for Novel Therapy Development: In 2021, Zogenix acquired Modis Therapeutics to gain access to their gene therapy programs targeting epilepsy. This acquisition gave Zogenix a pipeline of potential treatments for refractory epilepsy. Similarly, Takeda partnered with GW Pharmaceuticals in 2020 to co-develop Epidiolex (cannabidiol).

Focus on Orphan Drug Designations: Companies like Biogen, GW Pharmaceuticals and Zogenix obtained orphan drug designations from the FDA for their lead candidates targeting rare epilepsies like Dravet syndrome and Lennox-Gastaut syndrome.

Investments in real-world evidence generation: Players are increasingly conducting long-term patient registries and outcome studies to demonstrate broader experience and effectiveness of newer drugs in diverse real-world settings. This helps expand approved labels and clinician confidence over time. For example, Supernus conducted multiple Phase 3 and Phase 4 studies to demonstrate efficacy and safety profile of Trokendi XR in treatment-resistant partial-onset seizures.

Aggressive Patient Awareness Initiatives: Leading companies spend heavily on campaigns and advocacy partnerships to raise disease understanding and promote newer treatment options to both providers

Segmental Analysis of Refractory Epilepsy Market

Insights, By Drug Class, First-Generation Drugs Dominate Due to Established Efficacy and Low Costs

By Drug Class, the first-generation drug class makes up the largest share of the refractory epilepsy drug market due to several key advantages. These drugs have been available and in clinical use the longest of the three generations, allowing for extensive real-world evidence supporting their efficacy. Numerous clinical trials over the past few decades have proven their ability to effectively control seizures for many refractory epilepsy patients. As the first drugs approved to treat epilepsy, first-generation medications established the clinical standards that all subsequent drugs are measured against.

In addition, first-generation drugs face minimal competition from newer drug classes since they have long been off-patent. This allows manufacturers to sell them at much lower prices than second- and third-generation options. For individuals and health systems aiming to control treatment costs, low-cost first-generation drugs remain very attractive options, especially for patients whose epilepsy has proven responsive to these treatments over time. Even generic versions provide significant cost savings compared to newly-approved branded drugs.

Widespread clinical familiarity among physicians also boosts first-generation drug uptake. Most neurologists and epileptologists received their initial training when these were the primary treatment options available. They continue to be comfortable starting patients on medications they have prescribed safely for decades. This prescribing inertia and brand loyalty sustains first-generation drugs' market dominance despite newer entrants. With extensive savings, efficacy and acceptance, first-generation treatments are likely to retain the largest segment share for the foreseeable future.

Insights, By Drug Distribution Channel, Hospitals Lead Distribution Due to Complex Cases and New Drug Availability

The hospital segment accounts for the highest share of the refractory epilepsy drug distribution channel. This is largely because hospitals manage the most severe and complex cases, which often require innovative or high-risk treatment plans including newer drug options. Many refractory epilepsy patients have failed multiple medication regimens or face significant medical or psychiatric comorbidities. Hospitals can provide the multidisciplinary teams and ongoing monitoring needed for these complex cases that other channels cannot match.

Hospitals also have earliest access to newly approved medications given their role in pivotal clinical trials. Once drugs are indicated for refractory epilepsy, neurologists can continue prescribing them to appropriate patients—benefiting hospitals in the early uptake period while distribution expands. The availability of the broadest range of approved treatment alternatives helps hospitals provide the most tailored care plans based on individual patient factors, clinical history, and disease severity or progression. This personalized approach relies on the widest formulary, which hospital pharmacies can accommodate in a way other channels cannot due to infrastructure or purchasing agreements. For these reasons, hospitals have established their primacy in serving refractory epilepsy patients with the most innovative and complex care needs.

Additional Insights of Refractory Epilepsy Market

The refractory epilepsy market is evolving rapidly with new therapeutic options emerging to address the unmet need for drug-resistant patients. PTC Therapeutics’ Vatiquinone, currently in Phase III trials, represents a major advancement, targeting oxidative stress pathways to potentially reduce seizure activity. Refractory epilepsy significantly impacts the quality of life for patients, and many have exhausted conventional treatment options, including anti-seizure medications. Emerging therapies, such as nerve stimulation techniques and resective surgery, are being explored in conjunction with traditional treatments. The market is likely to see a shift toward more personalized and targeted approaches in managing epilepsy, with several pipeline products showing promise. Collaborations between industry and academia will continue to play a pivotal role in accelerating drug development. The market holds substantial opportunities, particularly as more advanced therapies move through clinical trials and reach commercialization stages.

Competitive overview of Refractory Epilepsy Market

The major players operating in the Refractory Epilepsy Market include Pfizer, Novartis, Abbott, Neurelis Inc, GSK Plc, Johnson & Johnson Services Inc, Teva Pharmaceutical Industries Ltd, Bausch Health Companies, Sanofi, Takeda Pharmaceutical Company and Marinus Pharmaceuticals Inc.

Refractory Epilepsy Market Leaders

- Pfizer

- Novartis

- Abbott

- Neurelis Inc

- GSK Plc

Refractory Epilepsy Market - Competitive Rivalry, 2024

Refractory Epilepsy Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Refractory Epilepsy Market

In May 2024, PTC Therapeutics has progressed its investigational drug Vatiquinone into Phase III trials for refractory epilepsy. This drug targets oxidative stress pathways to reduce seizures in patients unresponsive to other treatments. The trial aims to validate the efficacy and safety of the therapy in managing drug-resistant epilepsy, potentially offering new hope to patients.

Refractory Epilepsy Market Segmentation

- By Drug Class

- First-Generation

- Second-Generation

- Third-Generation

- By Distribution Channel

- Hospitals

- Clinics

- Retail Pharmacies

- Online Pharmacies

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Refractory Epilepsy Market?

The Global Refractory Epilepsy Market is estimated to be valued at USD 1.2 bn in 2024 and is expected to reach USD 3.1 bn by 2031.

What are the major factors driving the Refractory Epilepsy Market growth?

The increasing prevalence of drug-resistant epilepsy among patients leading to a high demand for innovative treatments. and ongoing research into new therapeutic approaches such as gene therapy and neurostimulation techniques are the major factors driving the Refractory Epilepsy Market.

What are the key factors hampering the growth of the Refractory Epilepsy Market?

The high cost and complexity of developing treatments for refractory epilepsy and regulatory hurdles and the long timeline for clinical trials in this market are the major factor hampering the growth of the Refractory Epilepsy Market.

Which is the leading Drug Class in the Refractory Epilepsy Market?

First-Generation are the leading Drug Class segment.

Which are the major players operating in the Refractory Epilepsy Market?

Pfizer, Novartis, Abbott, Neurelis Inc, GSK Plc, Johnson & Johnson Services Inc, Teva Pharmaceutical Industries Ltd, Bausch Health Companies, Sanofi, Takeda Pharmaceutical Company, Marinus Pharmaceuticals Inc are the major players.

What will be the CAGR of the Refractory Epilepsy Market?

The CAGR of the Refractory Epilepsy Market is projected to be 4.2% from 2024 to 2031.