Heritage Tourism Market Size - Analysis

Market Size in USD Bn

CAGR7.17%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.17% |

| Market Concentration | High |

| Major Players | ACE Cultural Tours Ltd., Exodus Travels Ltd., Expedia Group, Inc., BCD Travel, TUI AG and Among Others |

please let us know !

Heritage Tourism Market Trends

With each passing year people's craving to broaden their horizons and seek new experiences is increasing exponentially. This rising global interest in cultural and historical exploration has majorly boosted the heritage tourism industry.

Tourists wish to delve deep by attending local arts and craft workshops, cooking cultural cuisines, interacting with artisans to gain insight into the richness of intangible cultural expressions. Authentic experiences have become the buzzword with travelers yearning to feel spiritually rejuvenated by understanding how past mankind lived and what beliefs/ideologies shaped civilizations.

With rising income levels and stable economic conditions prevalent worldwide, more individuals and families now have surplus money to spend on leisure and travel. Increase in disposable incomes has been a key driver propelling the growth of heritage tourism globally.

This phenomenon has gathered further steam in Asian countries like China and India. These are economic powerhouses with millions of new entrants every year in the income tax paying middle and upper-middle class. For them, travelling to heritage landmarks of Europe, America or other developing regions isn't just a status symbol Therefore, increased the number of heritage tourists globally is expected to emerge as the strongest driver of the heritage tourism market.

One of the key challenges faced by the heritage tourism market is the political instability and security concerns in heritage-rich regions across the world. Many countries that are home to UNESCO world heritage sites have witnessed rising political tensions, protests, unrest and in certain areas, an increase in terrorist activities in recent years. This has deterred international tourists from visiting such destinations due to law-and-order issues or threats to personal safety.

The tourism boards and local authorities need to work closely with their respective governments to restore peace and stability if they wish to revive this segment. Additional security measures also need to be implemented around popular tourist sites without compromising the visitor experience.

Market Opportunity - Integration of Digital Technologies to Enhance Visitor Experiences

Technologies such as augmented and virtual reality, 360-degree videos, mobile applications, interactive kiosks, digital touring and guidance using Bluetooth beacons can pique the interest of younger visitors in particular. These solutions present historic facts and cultural artifacts in innovative ways. They can make learning about heritage sites more fun and help combat issues like falling attention spans.

Key winning strategies adopted by key players of Heritage Tourism Market

Focus on unique experiences - Many heritage sites have started offering unique experiences centered around their cultural history and traditions. For example, many Irish castles offer medieval banquet experiences where visitors can dine and experience life from the medieval period.

Improve storytelling - Strong narrative around the cultural and historical significance is imperative to truly engage visitors. For instance, Plimoth Plantation in the US transports visitors back to the 17th century through costumed interpreters.

Partnerships and branding - Cross-promotional activities with related businesses like local restaurants, hotels, tour operators help increase visibility and occupancy. For instance, sites bearing UNESCO's heritage tag instantly attract global recognition.

Segmental Analysis of Heritage Tourism Market

In terms of type, cultural heritage tourism is projected to hold 36.5% share of the heritage tourism market in 2024. This is due to travelers’ growing interest in experiencing local cultural activities and traditions. Cultural heritage sites remain top attractions that attract tourists interested in learning about history, arts, folklore and everyday life of indigenous communities.

The recent global increase in cultural tourism has significantly contributed to the growth of cultural heritage sites as attractions. Overall, the quest for enriched cultural experiences remains a strong motivating factor that sustains the leading position of cultural heritage tourism segment.

In terms of booking channel, the online booking segment is expected to hold 63.2% share of the heritage tourism market in 2024. This is due to its unparalleled convenience compared to offline channels. Travelers today heavily rely on online platforms for heritage travel planning and bookings. What appeals to them is the ease and speed of researching options and comparing prices from the comfort of their homes.

Furthermore, seamless online payment options including net banking, mobile wallets and credit cards add to the overall hassle-free online booking experience. Increasing shift towards online convenience augments the growth prospects of online booking in the heritage tourism market.

Insights, By Age Group: Experiential Mindset Drives Millennials Towards Heritage Tourism

Social media connectivity and influence further motivates millennial travelers to visit heritage destinations for photo opportunities and content creation for networks. They commonly prefer interactive and participatory activities at heritage sites versus static sightseeing in the quest for deeper engagement.

Additional Insights of Heritage Tourism Market

- Heritage tourism constitutes a significant portion of the global tourism industry, reflecting a growing preference for culturally enriching travel experiences.

- The Asia Pacific region dominated the heritage tourism market in 2023, holding a 42% revenue share, thanks to its rich cultural heritage.

- The cultural segment accounted for 57% of the market revenue in 2023, and the natural heritage segment is expected to see faster growth through 2034.

- Collaborations between tourism companies and cultural institutions will influence heritage tourism market trends. This will help to promote sustainable practices and preserve heritage sites.

Competitive overview of Heritage Tourism Market

The major players operating in the heritage tourism market include ACE Cultural Tours Ltd., Exodus Travels Ltd., Expedia Group, Inc., BCD Travel, TUI AG ATG Travel, Kesari Tours Pvt. Ltd., Carlson Wagonlit Travel, Martin Randall Travel Ltd., and Travel Leaders Group.

Heritage Tourism Market Leaders

- ACE Cultural Tours Ltd.

- Exodus Travels Ltd.

- Expedia Group, Inc.

- BCD Travel

- TUI AG

Heritage Tourism Market - Competitive Rivalry

Heritage Tourism Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Heritage Tourism Market

- In September 2023, the Archaeological Survey of India (ASI) launched the "Adopt a Heritage 2.0" program to enhance over 3,600 monuments with corporate partnerships. The program is a revamped version of the original "Adopt a Heritage" scheme, which began in 2017, and aims to improve visitor experiences while preserving the cultural heritage of these sites.

- In July 2023, Saudi Arabia's Public Investment Fund (PIF) established the Saudi Tourism Investment Company, known as Asfar, to enhance the country's tourism sector. The initiative aims to foster private-sector partnerships and attract investments for new heritage tourism projects, focusing on developing destinations that include hospitality, retail, and food and beverage offerings.

- In June 2023, Expedia Group announced the integration of virtual tours of heritage sites into its platform. This initiative allows users to preview various destinations, enhancing their travel planning experience and encouraging increased bookings.

- In April 2023, Booking.com announced a partnership with Google to enhance its offerings on Google's search platform. This collaboration allows users to book hotels and flights directly through Google Search. The integration is part of Booking.com's broader strategy to create a more seamless travel experience, referred to as the "connected trip," which aims to streamline various travel components, including accommodations and flights.

- In April 2023, TUI Group did indeed launch new heritage tour packages that focus on lesser-known historical sites in Europe. This initiative is part of TUI's broader strategy to attract niche travelers seeking unique and authentic experiences.

Heritage Tourism Market Segmentation

- By Type

- Cultural Heritage Tourism

- Historical Heritage Tourism

- Religious Tourism

- Ethnic Tourism

- By Booking Channel

- Online Booking

- Offline Booking

- By Age Group

- Millennials

- Generation X

- Baby Boomers

- Seniors

Would you like to explore the option of buying individual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.

Frequently Asked Questions :

How big is the heritage tourism market?

The heritage tourism market is estimated to be valued at USD 709.25 Bn in 2024 and is expected to reach USD 1151.3 Bn by 2031.

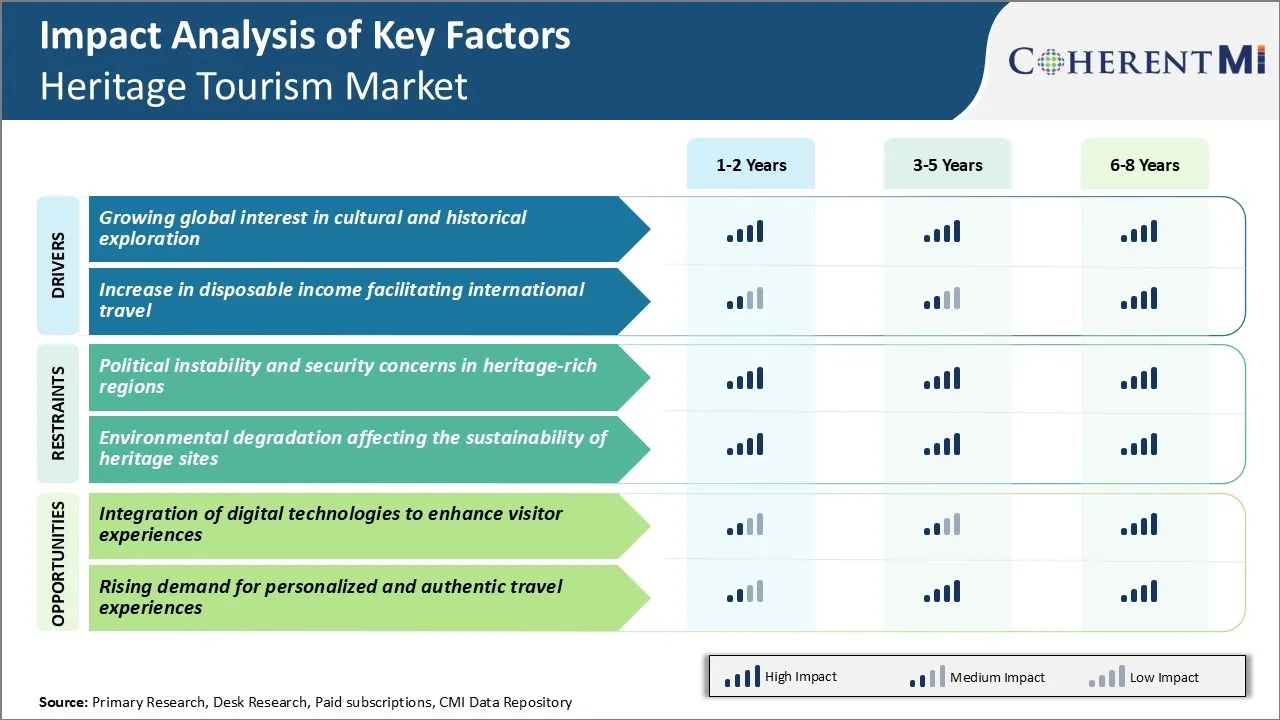

What are the key factors hampering the growth of the heritage tourism market?

Political instability and security concerns in heritage-rich regions and environmental degradation affecting the sustainability of heritage sites are the major factors hampering growth of the heritage tourism market.

What are the major factors driving the heritage tourism market growth?

Growing global interest in cultural and historical exploration and increase in disposable income facilitating international travel are the major factors driving the heritage tourism market.

Which is the leading type in the heritage tourism market?

The leading type segment is cultural heritage tourism.

Which are the major players operating in the heritage tourism market?

ACE Cultural Tours Ltd., Exodus Travels Ltd., Expedia Group, Inc., BCD Travel, TUI AG ATG Travel, Kesari Tours Pvt. Ltd., Carlson Wagonlit Travel, Martin Randall Travel Ltd., and Travel Leaders Group are the major players.

What will be the CAGR of the heritage tourism market?

The CAGR of the heritage tourism market is projected to be 7.17% from 2024-2031.