India Hydrocolloids Market Size - Analysis

The India Hydrocolloids Market is estimated to be valued at USD 155.4 Mn in 2025 and is expected to reach USD 254.5 Mn by 2032, growing at a CAGR of 7.3% from 2025 to 2032.

Market Size in USD Mn

CAGR7.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.3% |

| Market Concentration | High |

| Major Players | Cargill, Inc., Koninklijke DSM N.V., International Flavors & Fragrances Inc., LUCID COLLOIDS LTD., Gujarat Enterprise and Among Others |

please let us know !

India Hydrocolloids Market Trends

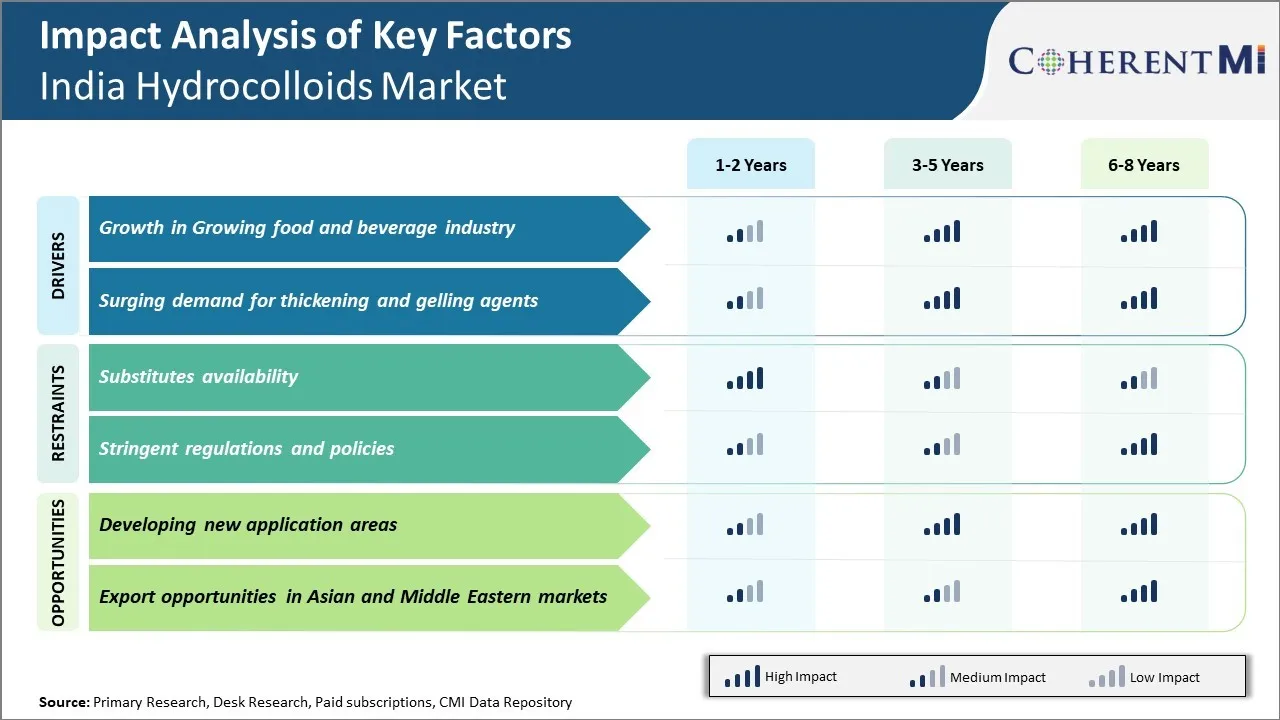

The food and beverage industry in India has seen tremendous growth in the past decade fueled by changing consumer tastes and preferences. As Indians shifted away from traditional diets to more convenience foods, it has opened up immense opportunities for food processing companies in the country. hydrocolloids have emerged as an important ingredient for these companies.

The growing food industry has also led to proliferation of branded food companies in India. Their focus on product differentiation through consistent textures, flavors and quality has boosted hydrocolloids consumption. As Indians adopt western eating habits, the market for packaged bakery and confectionery items is ballooning.

Market Driver – Surging Demand for Thickening and Gelling Agents

In food industry, hydrocolloids act as stabilizers, emulsifiers, thickening agents, gelling agents and preservatives. They help manufacturers achieve the desirable viscosity, texture and appearance in foods. Growth of packaged bakery, dairy, meat and dressing categories imply increasing adoption of hydrocolloids during processing. Personal care segment has witnessed rapid formulation changes with hydrocolloids improving consistency and aesthetics of products. They are used in creams, lotions, shampoos, hair conditioners as well as cosmetic products.

Hydrocolloids are also replacing gelatin widely due to their superior attributes and assurance of religious safety. Applications are growing in paints, dyes, adhesives, explosives and industrial formulations as well where they confer stability and other properties.

One of the major challenges faced by the hydrocolloids market in India is the rising availability of substitutes. Being an agricultural-based industry, hydrocolloids have to compete with a plethora of alternate ingredients that can be used instead of them. For example, starches extracted from corn, potatoes and tapioca are increasingly replacing gums in various applications such as thickeners in soups, sauces and gravies. The substitutes offer cost benefits to manufacturers as they are cheaper and easily available in the country.

One of the key opportunities for the hydrocolloids market in India is to focus on developing new application areas of usage. While hydrocolloids have been used commonly in food products as thickeners, stabilizers and gelling agents; there remains headroom to increase adoption in non-food industries. For instance, hydrocolloids show promise in personal care applications such as moisturizers and hair conditioners where they can act as emulsifying and thickening agents.

Segmental Analysis of India Hydrocolloids Market

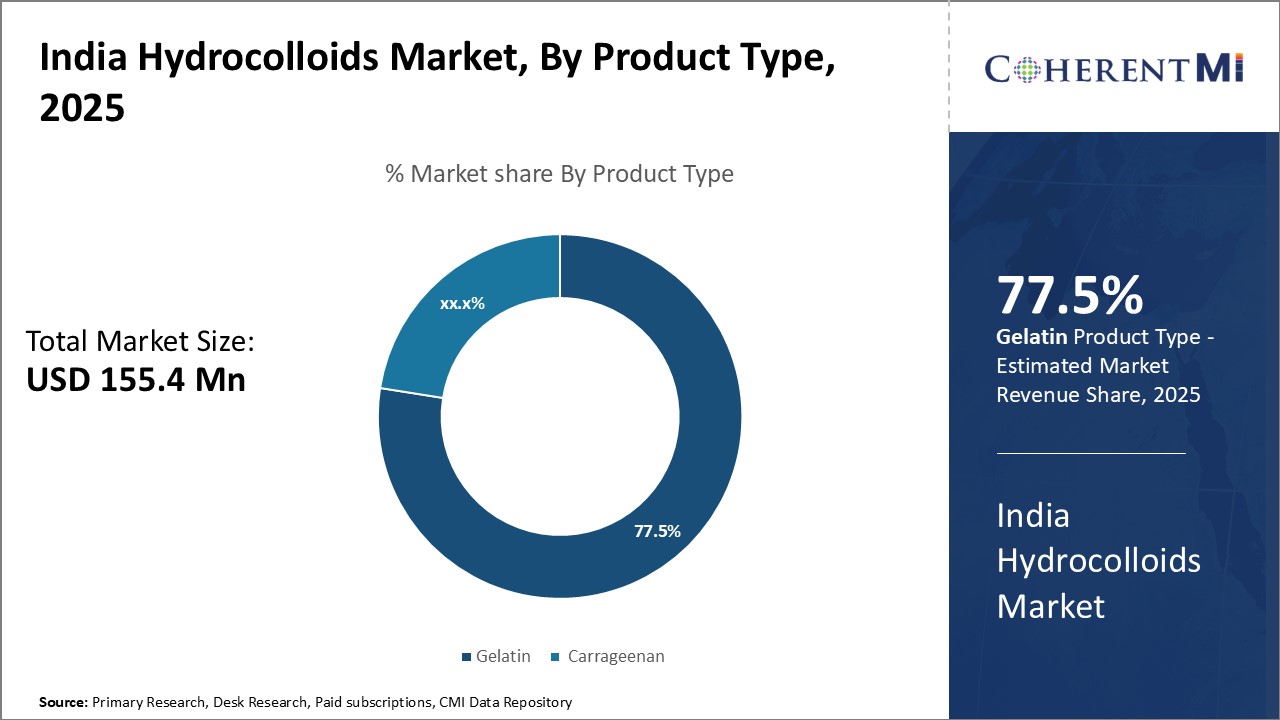

Insights, By Product Type: Gelatin Sub-segment Dominates the Product Type Segment

Insights, By Product Type: Gelatin Sub-segment Dominates the Product Type SegmentIn terms of product type, gelatin sub-segment contributes the highest share of 77.5% in the market, owning to its diverse applications and functional benefits. Gelatin has excellent gelling, stabilizing, emulsifying, and thickening properties that make it highly versatile for use in a wide variety of products. In the food industry, gelatin is commonly used to add texture to desserts, snacks, confectionaries, and other items. Its ability to form thermo-reversible gels allows foods containing gelatin to solidify upon cooling but remain easily spreadable when heated again. This unique characteristic boost consumer convenience.

The established use of gelatin in diverse applications has supported steady demand growth over the years. Manufacturers are also innovating with gelatin to launch new product variations.

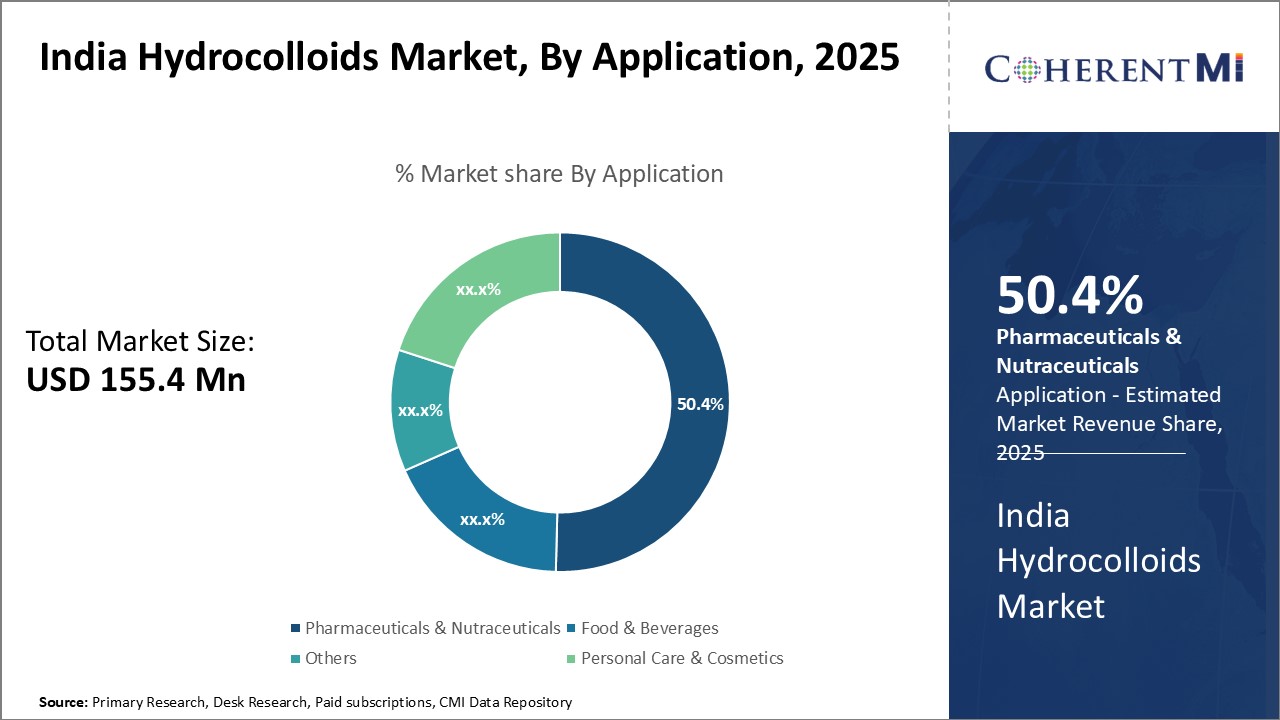

Insights, By Application: Pharmaceuticals and Nutraceuticals Sub-segment Lead the Application Segment

Hydrocolloids find extensive usage in pharmaceuticals and nutraceuticals owing to their ability to effectively encapsulate, protect, and deliver active compounds in the body. They are frequently used as excipients - substances apart from the active drug that aid processing or patient compliance. Hydrocolloids like carrageenan, pectin, and xanthan gum help formulate diverse oral dosage forms like tablets, capsules, suspensions and emulsions by providing viscosity, stability and release modulation.

The Indian pharmaceutical industry's stable growth prospects support continued demand from this segment. As healthcare expenditures rise with growing incomes, more consumers utilize OTC drugs and supplements for general wellness needs. Hydrocolloids facilitate delivery of active compounds in these products.

Competitive overview of India Hydrocolloids Market

The major players operating in the India Hydrocolloids Market include Cargill, Inc., Koninklijke DSM N.V., International Flavors & Fragrances Inc., LUCID COLLOIDS LTD., United Group of Food Consultants, Altrafine Gums, Gujarat Enterprise, and Indian Hydrocolloids.

India Hydrocolloids Market Leaders

- Cargill, Inc.

- Koninklijke DSM N.V.

- International Flavors & Fragrances Inc.

- LUCID COLLOIDS LTD.

- Gujarat Enterprise

India Hydrocolloids Market - Competitive Rivalry

India Hydrocolloids Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in India Hydrocolloids Market

- On January 4, 2021, Ingredion Incorporated expanded its specialty ingredient portfolio with acquisition of KaTech Ingredion Incorporated, a leading global provider of ingredient solutions to the food and beverage industry. KaTech has a strong focus on plant-based, dairy and dairy alternatives, meat and fish, savory, and bakery products providing a high level of technical expertise and formulation capabilities for texturization and stabilization and clean and simple formulations.

- In September 2021, Cargill announced the opening of its new, pectin production facility, located in Bebedouro, Brazil. The plant, which represents a $150 million investment, significantly expands the company’s ability to meet growing global demand for the label-friendly texturizing ingredient.

- In July 2021, DSM Hydrocolloids unveiled new branding for its gellan gum and xanthan gum portfolios. The new brands are Gellaneer for gellan gum, ClariXan for xanthan gum used in food and personal care, and XanTreme for xanthan gum used in industrial applications.

India Hydrocolloids Market Segmentation

- By Product Type

- Gelatin

- Carrageenan

- By Application

- Pharmaceuticals & Nutraceuticals

- Food & Beverages

- Others

- Personal Care & Cosmetics

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the India Hydrocolloids Market?

The India Hydrocolloids Market is estimated to be valued at USD 155.4 in 2025 and is expected to reach USD 254.5 Million by 2032.

What are the major factors driving the India Hydrocolloids Market growth?

The growth in growing food and beverage industry and surging demand for thickening and gelling agents are the major factors driving the India Hydrocolloids Market.

Which is the leading Product Type in the India Hydrocolloids Market?

The leading Product Type segment is Gelatin.

Which are the major players operating in the India Hydrocolloids Market?

Cargill, Inc., Koninklijke DSM N.V., International Flavors & Fragrances Inc., LUCID COLLOIDS LTD., United Group of Food Consultants., Altrafine Gums, Gujarat Enterprise, and Indian Hydrocolloids are the major players.

What will be the CAGR of the India Hydrocolloids Market?

The CAGR of the India Hydrocolloids Market is projected to be 7.3% from 2025-2032.