United States Car Rental Market Size - Analysis

The United States Car Rental Market is estimated to be valued at USD 35.26 Bn in 2024 and is expected to reach USD 51.12 Bn by 2031, growing at a CAGR of 5.5% from 2024 to 2031.

Market Size in USD Bn

CAGR5.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.5% |

| Market Concentration | High |

| Major Players | The Hertz Corporation, SixtSE, Avis Budget Group Inc., Alamo, National Car Rental and Among Others |

please let us know !

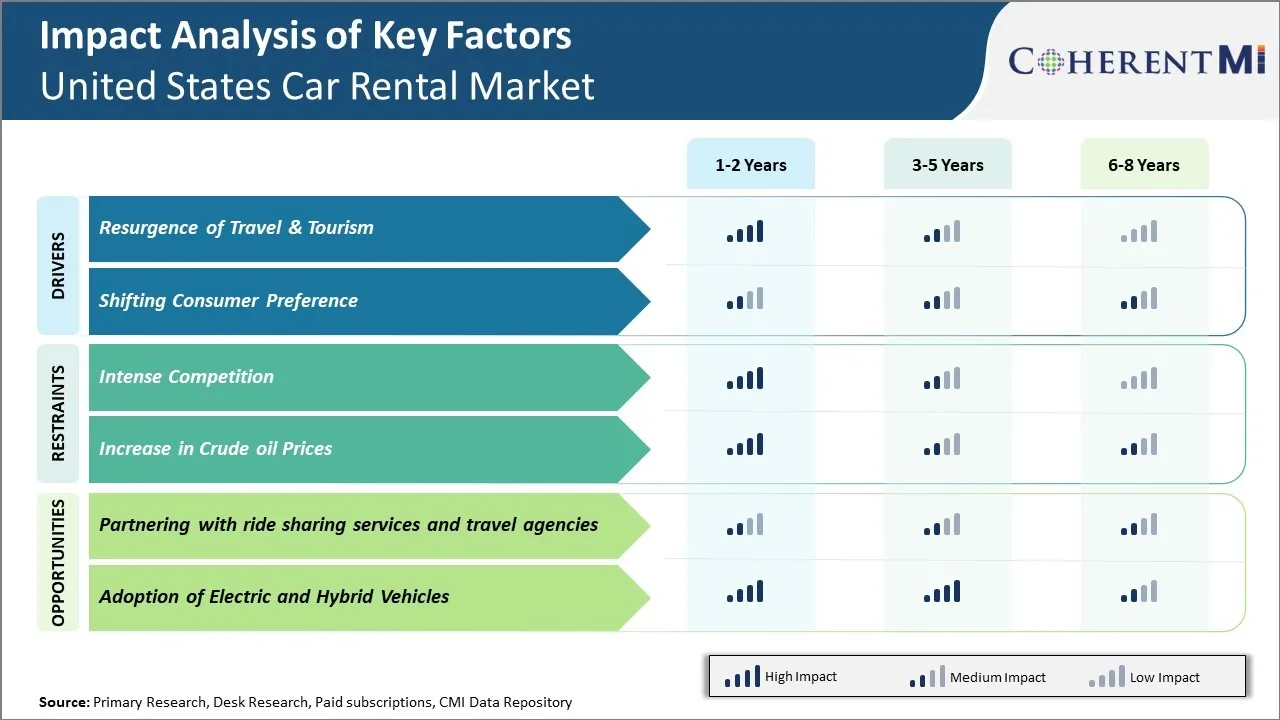

United States Car Rental Market Trends

The revival of travel and tourism has catalyzed significant growth in the United States car rental market in recent years. As the lingering impacts of the pandemic gradually fade, more travelers are venturing out for both business and leisure purposes which has increased demand for rental vehicles. Popular tourist destinations within the country such as Florida, California, New York, and Hawaii have witnessed a notable upsurge in visitors arriving by air travel in 2022 compared to 2021 levels according to data from the U.S. Travel Association. This surge has directly benefited the car rental business as a large percentage of these travelers rely on rental cars to conveniently explore various areas, destinations and landmarks spread across vast geographic regions in different states.

Shifting consumer preference towards experiences over material possessions is a major factor influencing the growth of the car rental market in the United States. Traditionally, owning a private vehicle was seen as a status symbol and necessity. However, today's consumers, especially millennials and generation Z, are more interested in spending money on life experiences rather than assets. This attitude is driven by environmental concerns about private vehicle ownership as well as a desire for flexibility and the experience of driving a variety of vehicles. As a result, consumers are turning to car rental services for short-term mobility needs rather than long-term ownership.

Market Challenge – Intense Competition

Some of the major players dominating the market include Enterprise Holdings, Hertz Global Holdings, Avis Budget Group and Sixt Rent a Car. These top four control over 70% of the overall market. With such high concentration among a few major players, there is very little room for new competitors to make notable inroads. The established players are aggressively targeting each other's customers by lowering prices, offering attractive discounts and tying up with various travel companies and airlines for bundled packages. This intense price war is negatively impacting revenues.

Partnering with ride sharing services and travel agencies could provide car rental companies with significant opportunities in the evolving United States car rental market. With evolving mobility solutions and preferences of customers towards connectivity, flexibility and sustainability - the car rental industry is witnessing seismic shifts. By offering integrated solutions through strategic partnerships, car rental companies can provide one-stop solutions to customers and gain competitive edge in the market.

Collaborating with prominent travel agencies will help car rental companies to bundle their offerings as a part of the tourism packages. Travel agencies have large database of both domestic and international travelers. This will open up untapped segments for rental firms.

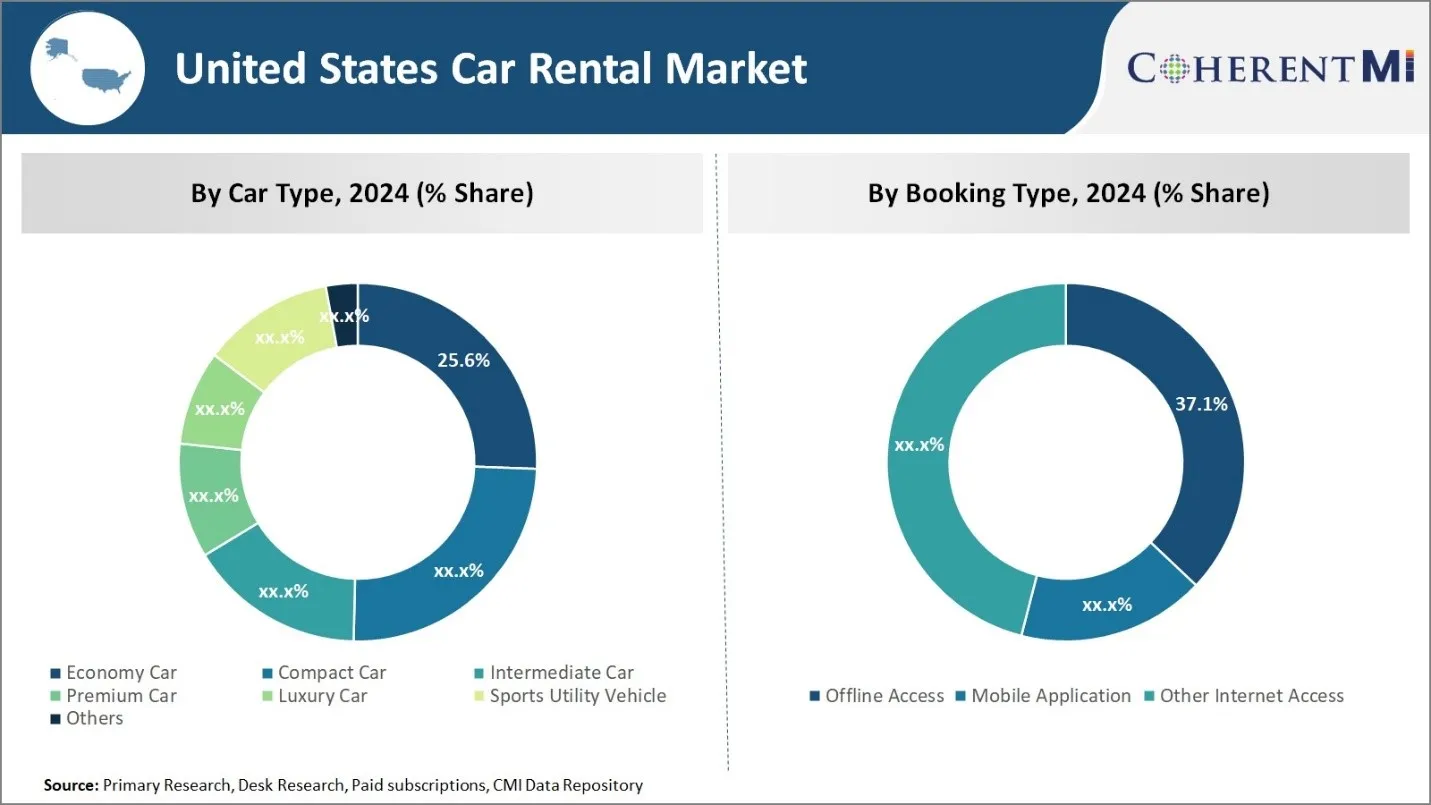

Segmental Analysis of United States Car Rental Market

In terms of car type, the economy car sub-segment contributes the highest share of 25.6% in the United States car rental market, owing to convenience and strong value proposition. Renters seeking affordable yet reliable transportation for business or leisure trips favor economy cars. Their compact size makes them easy to navigate crowded urban areas and parking lots. As the most affordable option, Economy Cars are particularly attractive to cost-conscious customers like families on vacations or recent graduates taking a road trip.

Insights, By Booking Type: Online Convenience Dominates Bookings in the US Car Rental Market

Websites of online travel agencies and meta-search engines give a "one-stop-shop" to efficiently scan options from multiple suppliers. Review websites provide social proof to inform decisions. Direct bookings on rental company sites or mobile apps are also gaining traction through added perks like loyalty programs and expedited pick-ups. However, alternative sites remain dominant due to the breadth of options presented and streamlined booking process in just a few clicks from any device.

Competitive overview of United States Car Rental Market

The major players operating in the United States Car Rental Market include The Hertz Corporation, SixtSE, Avis Budget Group Inc., Alamo, National Car Rental, EuropcarGroup S.A., MEX Rent a Car, Budget Rent A Car System, Inc., Fox Rent A Car, and Thrifty Car Rental, Inc.

United States Car Rental Market Leaders

- The Hertz Corporation

- SixtSE

- Avis Budget Group Inc.

- Alamo

- National Car Rental

United States Car Rental Market - Competitive Rivalry

United States Car Rental Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Car Rental Market

- On January 17, 2024, a German startup called Vay launched a new remote-controlled rental car service in Las Vegas. This service lets users rent cars by the minute, providing a convenient and affordable transportation option.

- On January 11, 2024, Hertz announced that it is selling about 20,000 electric vehicles, including Tesla, from its U.S. fleet. This decision comes about two years after starting a deal to rent out these EVs, indicating a drop in demand. Hertz will now focus on gas-powered vehicles due to the higher costs of collision and damage for EVs, even though it had planned to have 25% of its fleet be electric by the end of 2024.

- In January 2023, National Car Rental launched a new mobile app designed for busy professionals.

- In December 2022, SIXT, a top global mobility provider, launched a new marketing campaign in the U.S. called “Rent-THE-Car.” This campaign highlights the premium experience and high-quality fleet SIXT offers, setting it apart from typical rental car services. Known for its strong presence at major European travel hubs, SIXT is now investing more in U.S. advertising, moving from targeted programs to a bigger, more comprehensive campaign for the first time in nearly 12 years.

- In May 2021, Uber introduced a new car rental service called Uber Rent in Washington DC. They also announced that their Uber Reserve option would be expanded to several major airports in the US.

United States Car Rental Market Segmentation

- By Car Type

- Economy Car

- Compact Car

- Intermediate Car

- Premium Car

- Luxury Car

- Sports Utility Vehicle

- Others

- By Booking Type

- Offline Access

- Mobile Application

- Other Internet Access

- By Age

- 18-29 Years Old

- 30-59 Years Old

- 60 Years Old and Above

Would you like to explore the option of buying individual sections of this report?

Ameya Thakkar is a seasoned management consultant with 9+ years of experience optimizing operations and driving growth for companies in the automotive and transportation sector. As a senior consultant at CMI, Ameya has led strategic initiatives that have delivered over $50M in cost savings and revenue gains for clients. Ameya specializes in supply chain optimization, process re-engineering, and identification of deep revenue pockets. He has deep expertise in the automotive industry, having worked with major OEMs and suppliers on complex challenges such as supplier analysis, demand analysis, competitive analysis, and Industry 4.0 implementation.

Frequently Asked Questions :

What are the key factors hampering the growth of the United States Car Rental Market?

The intense competition and increase in crude oil prices are the major factors hampering the growth of the United States Car Rental Market.

What are the major factors driving the United States Car Rental Market growth?

The resurgence of travel & tourism and shifting consumer preference are the major factors driving the United States Car Rental Market.

Which is the leading Car Type in the United States Car Rental Market?

The leading Car Type segment is Economy Car.

Which are the major players operating in the United States Car Rental Market?

The Hertz Corporation, SixtSE, Avis Budget Group Inc., Alamo, National Car Rental, EuropcarGroup S.A., MEX Rent a Car, Budget Rent A Car System, Inc., Fox Rent A Car, and Thrifty Car Rental, Inc. are the major players.

What will be the CAGR of the United States Car Rental Market?

The CAGR of the United States Car Rental Market is projected to be 5.5% from 2024-2031.