The United States Cold Pressed Juice Market is estimated to be valued at USD 248.3 Mn in 2025 and is expected to reach USD 422.8 Mn by 2032, growing at a compound annual growth rate (CAGR) of 7.9% from 2025 to 2032.

Consumption of cold pressed juices is increasing in the country due to rising health consciousness among consumers and growing popularity of cold pressed juices for their nutrient density and lower sugar content compared to traditionally processed juices. The cold pressed juice market in the US is expected to witness significant growth over the forecast period. Increasing awareness about the health benefits of cold pressed juices such as high vitamin, mineral and enzyme content is driving the market. Moreover, the availability of cold pressed juices across both online and retail stores along with attractive product promotion and marketing campaigns by manufacturers is also fueling the growth of the market.

Market Size in USD Mn

CAGR7.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.9% |

| Market Concentration | High |

| Major Players | The Hain Celestial Group, Inc, Evolution Fresh Inc., Suja Life, LLC, Pressed Juicery Inc., Liquiteria Inc. and Among Others |

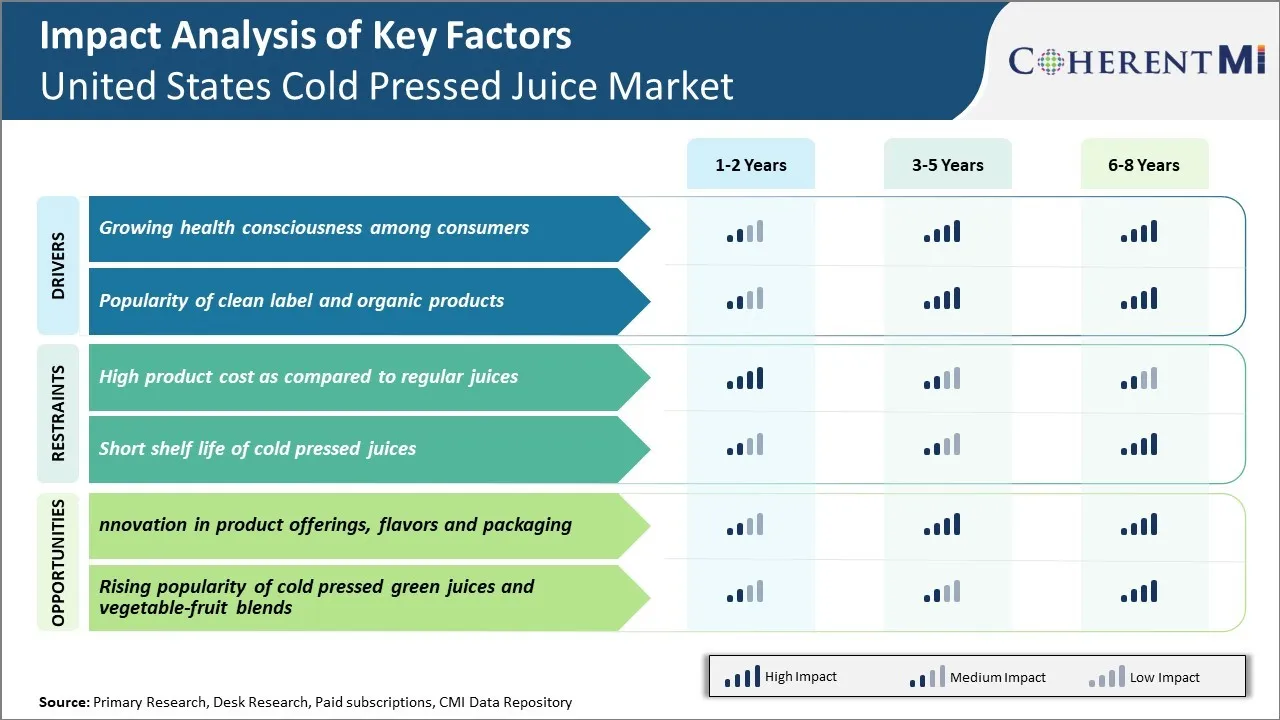

Market driver - Growing Health Consciousness Among Consumers

More and more people have started to take charge of their health seriously in the past few years. There is widespread understanding that a balanced diet and lifestyle are extremely important for overall well-being and to avoid issues like obesity and heart diseases. In this pursuit of wellness, cold pressed juices have emerged as a popular choice. Customers believe these juices are packed with nutrients from fresh fruits and vegetables that can boost energy levels and immunity. The lengthy cold pressing process is said to preserve all the natural goodness without any loss.

Given their hectic schedules, many prefer buying cold pressed juices rather than spending time juicing at home. The variety available makes it a more convenient way to get daily doses of antioxidants, vitamins and other health-promoting compounds. Rather than a meal replacement, cold pressed juices are now commonly consumed as a nutritious snack between meals or early in the morning. The appeal is that they are simple to carry and consuming on-the-go fulfills the health objective. What's more, cold pressed juices are seen as a way of adding more color to the diet which is important psychologically in staying motivated with wellness goals.

With abundant information available online and the influence of health and fitness bloggers/influencers, people have become quite aware of optimal diets and lifestyles. They also increasingly want transparency in whatever they consume on a daily basis. Cold pressed juices are attracting consumers looking for minimal processing and maximum nutrition without any additives, preservatives or sugars. Companies highlight the natural cold-pressing process retaining nutritional value as a unique selling proposition to cater to this growing demand. Overall, the desire to take proactive measures in preventive healthcare through diet is a big driver for the growth in popularity of cold pressed juices.

Market driver - Popularity of Clean Label and Organic Products

In the recent past, concerns around food safety, chemicals used in mass production and authenticity of product claims have gained prominence among American consumers. They want transparency into how and where their food is grown, processed as well as its complete ingredients list. This has led to huge popularity for so-called 'clean label' and organic products promising no harsh artificial preservatives, colors or sweeteners. Cold pressed juices fit neatly in this niche addressing various consumer concerns, thereby gaining significant traction.

Shoppers are willing to pay extra for juices made from ingredients that are chemical-free as well as locally sourced and seasonal. Organic certification gives them confidence regarding environmental sustainability of farming practices used. For health-conscious parents, it is also a consideration while buying juices for kids. Companies actively advertise their clean and organic credentials on packaging as well as through blogs, articles to build brand trust in this highly discerning market. Furthermore, growing demand has spurred many new entrant cold pressing brands solely focusing on natural, preservative-free juices without any additives.

The popularity of natural food movement and health and wellness trends over social media further elevates organic cold pressed juices. Clean eating, veganism and environmental protection have become mainstream talking points. Therefore, products aligning with these ideals and ethics gain automatic preference. For overall health, nutrition as well as ideological reasons, Americans seem ready to embrace cleaner, organic label options which benefits this particular segment. It will continue attracting consumers moving forward as well due to strong organic values associated with the category.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenges: High Product Cost as a Challenge

The high cost of production for cold pressed juices as compared to regular fruit juices poses a major challenge for the US cold pressed juice market. Cold pressing requires high quality, fresh fruits and vegetables as raw materials. It is a labor-intensive process that does not involve any heat pasteurization. This makes cold pressed juices more expensive to produce. The average 8oz bottle of cold pressed juice ranges between $4-6, almost twice the price of regular refrigerated or shelf-stable juices. This high price point acts as a deterrent for many consumers who look for value for money options. It restricts the market to only health-conscious consumers who are willing to pay a premium. For the market to grow at a faster pace, cold pressed juice producers will need to find ways to drive down costs through innovations in supply chain and manufacturing processes that can make these juices more affordable to the mass market.

Market Opportunities: Innovation in Product Offerings, Flavors and Packaging as an Opportunity

The US cold pressed juice market presents massive untapped opportunities for brands that innovate in product offerings, flavors and packaging formats. Juice aficionados are always looking to experiment with new flavor combinations prepared from novel ingredients. Brands that continuously launch seasonally trending and exotic flavor profiles can capture consumer interest and drive repeat purchases. Similarly, convenient package sizes targeted towards on-the-go consumption provide opportunity for greater market penetration. Ready-to-drink cold pressed juices in bottle or carton packs suit the fast-paced American lifestyle. Innovation multipacks, mixer bottles and flavor boost drops can make these juices an integral part of everyday snacking and health routines. Personalized cold-pressed juice programs tailored to specific health goals like weight management, immunity or gut health also present lucrative opportunities. Innovation thus holds the key for industry players to appeal to evolving consumer preferences and unlock the true market potential.

Focus on health and wellness: Many companies have adopted the strategy of marketing their cold pressed juices as natural, healthy and nutritious beverages that provide vital vitamins, minerals and nutrients. For example, Suja Life positioned itself as a "clean" juice brand that avoids additives and preservatives. This helped Suja become one of the top brands in the market.

Partner with gyms and yoga studios: Companies like PepsiCo's O.N.E. Coconut Water partnered with gyms and yoga studios across US cities in 2016 to place their cold pressed juices in these establishments. This helped target the health-conscious demographic frequenting these places and drive trials. Research showed 59% of cold pressed juice buyers were gym-goers and yoga practitioners.

Offer variety and innovation: Leaders like Bolthouse Farms invested in R&D to regularly launch new flavors like Butterfly Pea Tea and Golden Beet to keep customers engaged. Data from 2017 showed innovation and variety helped Bolthouse capture 23% market share. Small brands also found success by specializing in unique juice blends versus multiple SKUs.

Focus on natural positioning: Companies avoid terms like 'diet' or 'low cal' and instead promote the natural composition and ingredients of their juices. For example, Simple Truth organic juices positioned itself as an "honest" alternative without additives and saw sales grow 35% in 2018 versus previous year by appealing to health-focused customers.

Build authentic brand image: Brands sponsor health blogs and influencers on Instagram to promote their product story and values. This helps build an authentic brand identity among followers. For example, Suja partnered with wellness influencers in 2015 like Amelia Freer that contributed to 3X growth within a year for the brand.

To learn more about this report, Download Free Sample Copy

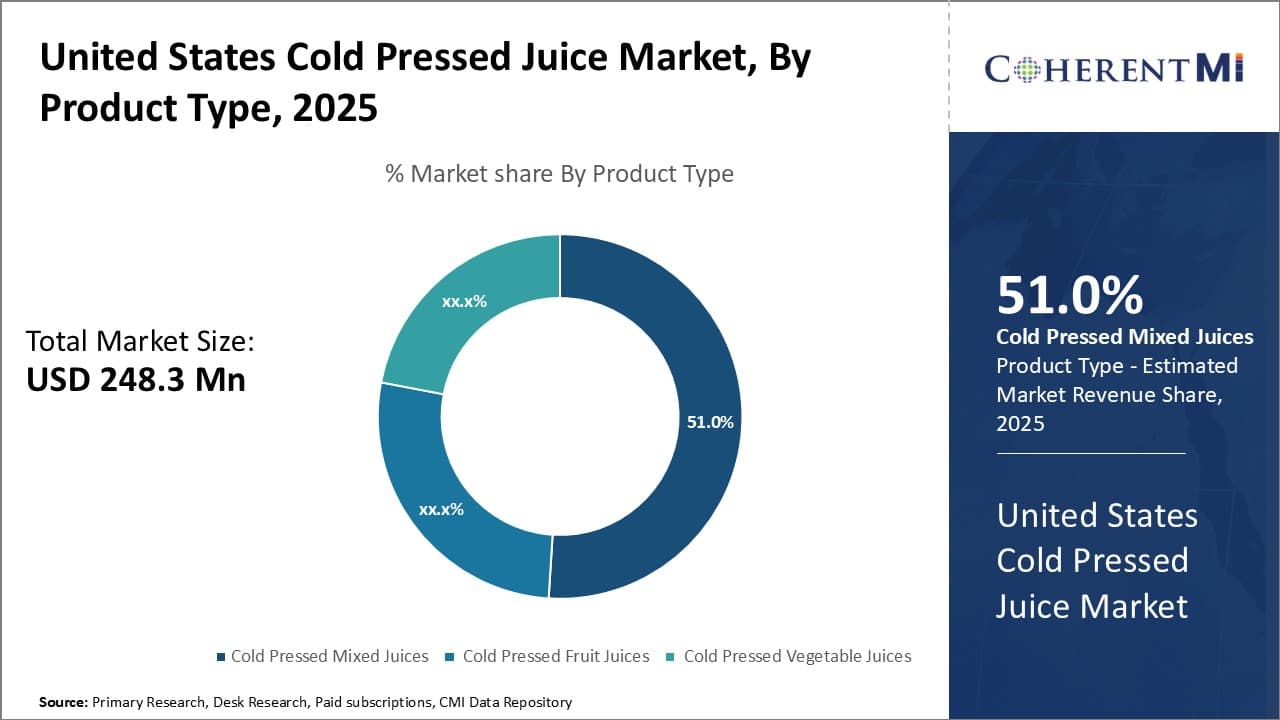

Insights by product type: Growing consumer demand for variety and convenience

To learn more about this report, Download Free Sample Copy

Insights by product type: Growing consumer demand for variety and convenience

In terms of Product Type, Cold Pressed Mixed Juices contributes the 51.00% share of the market in 2025. Cold pressed mixed juices have seen tremendous growth in the United States cold pressed juice market due to rising consumer demand for variety and convenience. Unlike single-fruit juices, mixed juices allow consumers to get the nutritional benefits of multiple fruits and vegetables in a single bottle. This is appealing to health-conscious consumers who want an easy way to incorporate a variety of produce into their diet.

Mixed juices cater to changing lifestyles and busy schedules. People are increasingly looking for on-the-go beverages that provide balance and nutrition without compromising on taste. Cold pressed mixed juices fit this need perfectly as they can be consumed quickly yet offer nutrients from different sources. The versatility of mixed juices also means companies can continuously innovate and come up with novel flavor combinations to keep consumers engaged. This sustains interest and trial among users.

Mixed juices are also popular due to their sensory attributes. Blending multiple ingredients results in complex flavors that are more interesting and satiating than single-fruit beverages. The mingling of flavors in mixed varieties allows companies to mask stronger or tangier tastes from certain ingredients like kale or celery. This makes mixed cold pressed juices more palatable for the average consumer.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

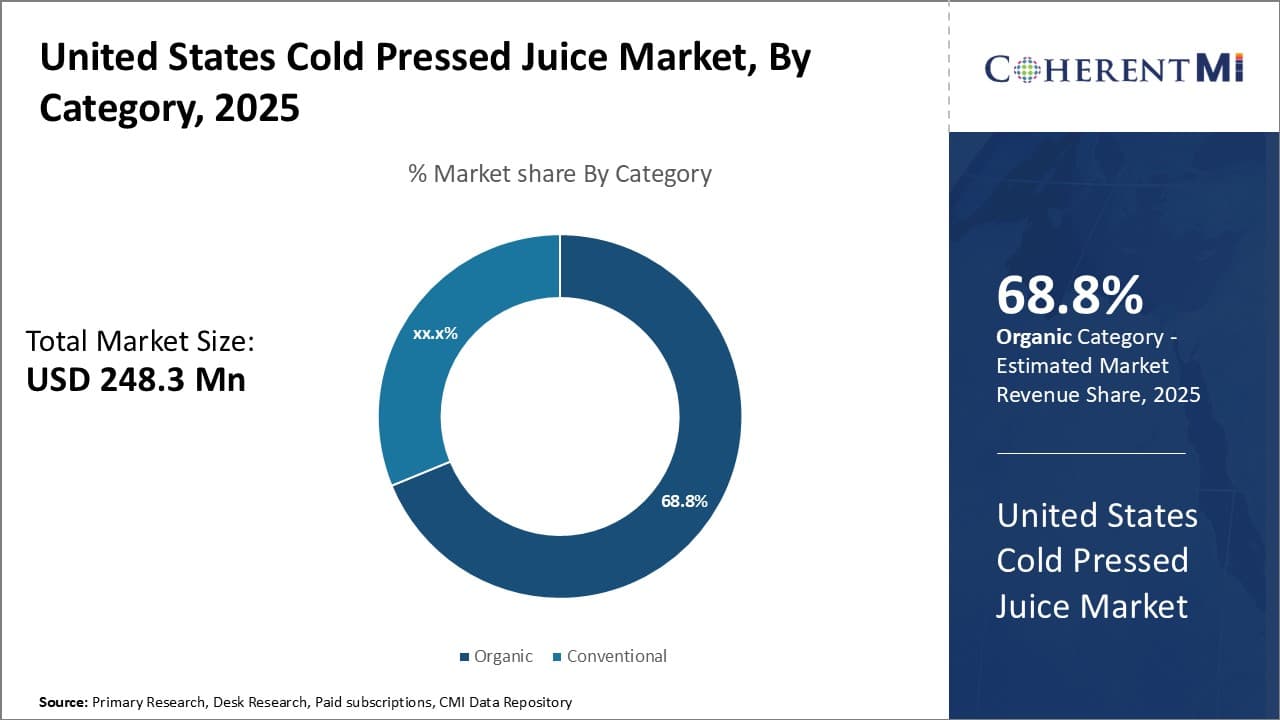

Insights by category: Perceived health benefits and clean labels

In terms of Category, Organic contributes the 68.80% share of the market in 2025. Within the United States cold pressed juice market, the organic category claims the largest share due to several factors contributing to higher consumer demand. Firstly, organic produce is perceived to have superior health benefits by many buyers. Free from synthetic pesticides, herbicides and fertilizers, organic fruits and vegetables are considered "purer" sources of nutrients.

Secondly, clean labels are highly valued in today's market. Consumers carefully scrutinize ingredients lists and prefer minimal, understandable components. Organic cold pressed juices address this need by offering simple, all-natural formulations without additives or preservatives. This peace of mind regarding exactly what people are consuming boosts organic juice popularity.

Sustainability is another organic advantage that resonates strongly. Concerns about environment protection and responsible farming practices influence purchase decisions. Opting for organic juices allows consumers to mitigate ecological impact through their daily beverage choices.

Finally, disposable income growth enables more people to pay premium price tags on organic products. While costlier than conventional juices initially, organic varieties are perceived as investments in health worthy of slightly higher costs. As such, the organic segment continues gaining market share through deeper connections with customer values around health, transparency and sustainability. Changing demographics favor its ongoing leadership in the United States cold pressed juice space.

The Hain Celestial Group, Inc, Evolution Fresh Inc., Suja Life, LLC, Pressed Juicery, Inc.Pressed Juicery, Inc., Liquiteria Inc.

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

United States Cold Pressed Juice Market is Segmented By Product Type (Cold Pressed Mixed Juices, Col...

United States Cold Pressed Juice Market

How big is the United States Cold Pressed Juice Market?

The United States Cold Pressed Juice Market is estimated to be valued at USD 248.3 in 2025 and is expected to reach USD 422.8 Million by 2032.

What are the major factors driving the United States Cold Pressed Juice Market growth?

The growing health consciousness among consumers and popularity of clean label and organic products are the major factor driving the United States Cold Pressed Juice Market.

Which is the leading Product Type in the United States Cold Pressed Juice Market?

The leading Product Type segment is Cold Pressed Mixed Juices.

Which are the major players operating in the United States Cold Pressed Juice Market?

The Hain Celestial Group, Inc, Evolution Fresh Inc. , Suja Life, LLC , , Liquiteria Inc., Greenhouse Juice Co., AllWellO, SO GOOD SO YOU are the major players.

What will be the CAGR of the United States Cold Pressed Juice Market?

The CAGR of the United States Cold Pressed Juice Market is projected to be 7.9% from 2025-2032.