美国 糖果市场 规模与份额分析 - 成长趋势与预测 (2024 - 2031)

美国糖果市场按产品类型划分(巧克力糖、非巧克力糖),按销售渠道划分(Convenence Stores、Hypermarkets & Supermarkets、专家、零售商、在线零售商等)。 本报告为上述部分提供了价值(10亿美元)。....

美国 糖果市场 规模

市场规模(美元) Bn

复合年增长率3.5%

| 研究期 | 2024 - 2031 |

| 估计基准年 | 2023 |

| 复合年增长率 | 3.5% |

| 市场集中度 | Medium |

| 主要参与者 | 佩菲蒂·范梅勒集团B.V., 火星公司, 蒙德莱斯国际公司., 赫希公司, 8月 斯托克 KG 以及其他 |

请告诉我们!

美国 糖果市场 分析

美国糖果公司 估计市场价值为: 24.13美元 2024年学士 预计将达到 31.01美元 到2031年时以复合年增长率增长 (CAGR)从2024年到2031年占3.5%.

美国的糖果市场在过去几年里出现了积极的趋势。 对具有令人兴奋的口味和有吸引力的包装的创新糖果产品的需求不断增加。 此外,通过领先的糖果品牌,越来越多的社交媒体营销运动正在帮助他们更有效地针对青年消费者。 一些公司还提供无糖和有机糖果的选择,以吸引有健康意识的消费者。 虽然大众商品商继续占有主要份额,但电子商务和便利商店等销售渠道正在强劲发展。 如果这一增长轨迹持续下去,到2031年,糖果市场有可能超过310亿美元。

美国 糖果市场 趋势

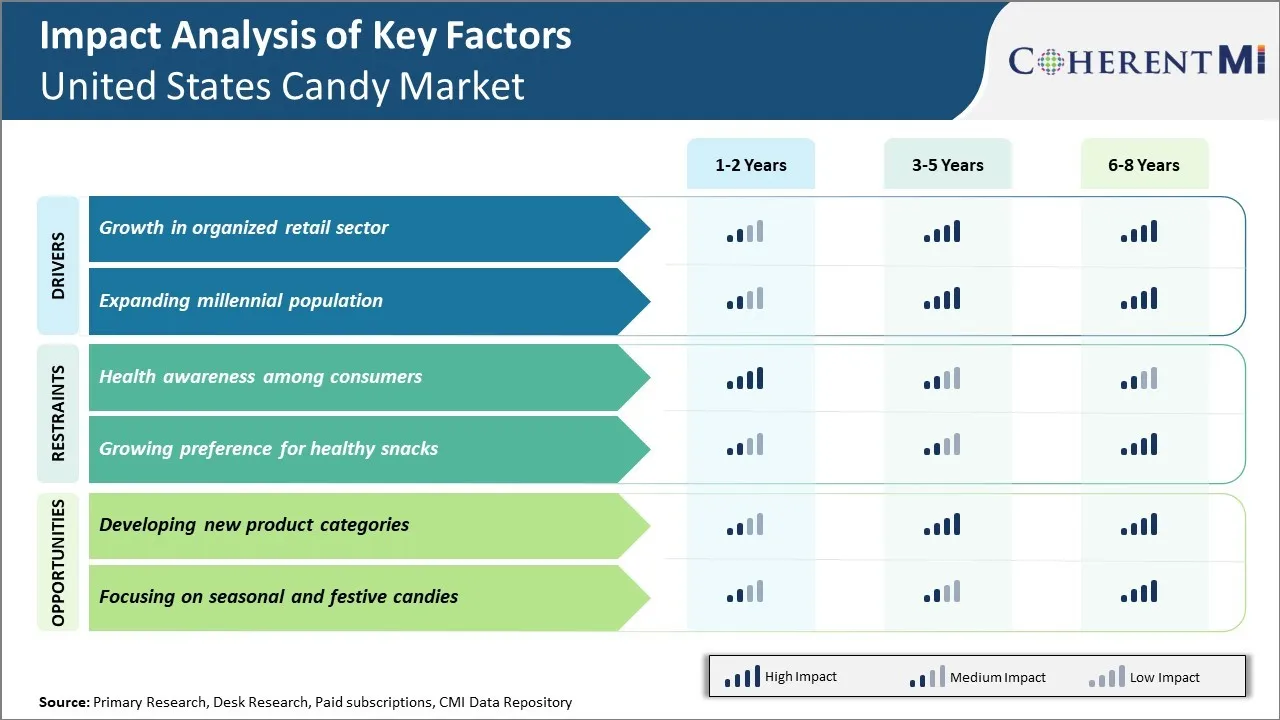

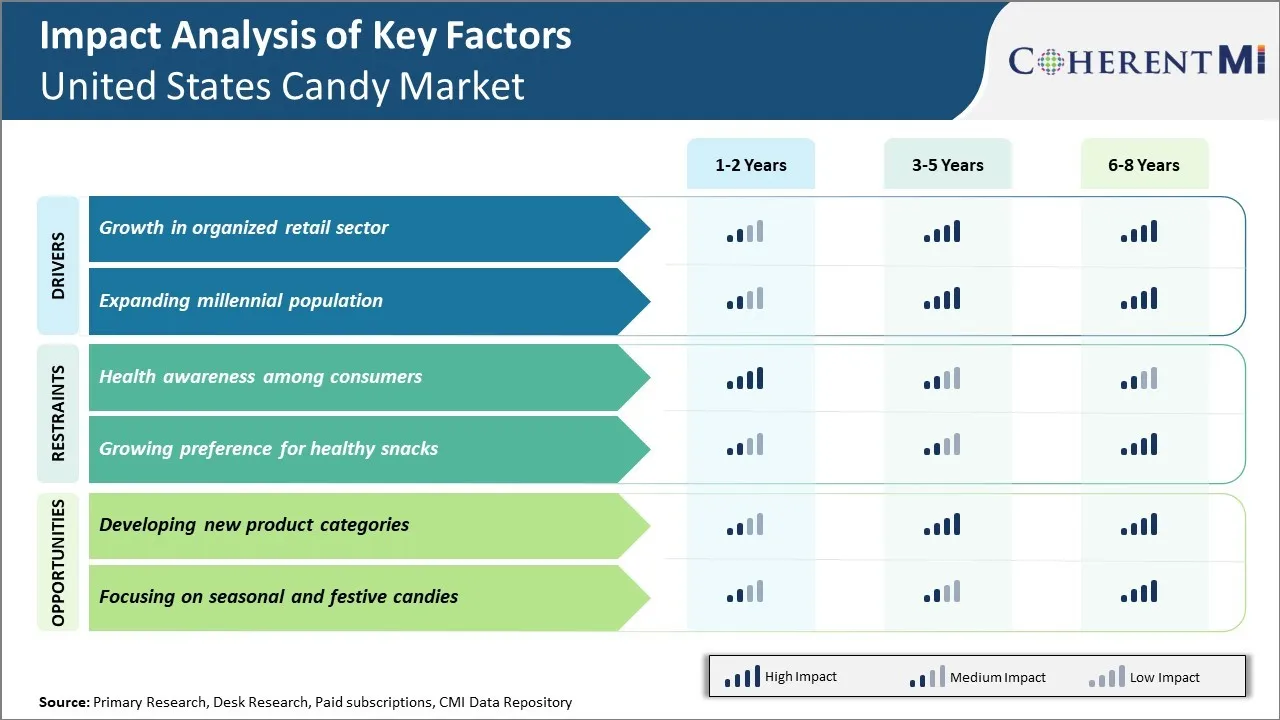

市场驱动力 -- -- 有组织零售部门的增长

美国的糖果市场在过去几年里一直稳步增长,主要原因是各个区域有组织零售的渗透率不断提高。 有组织的零售渠道,包括超市、超市、折扣店等,通过方便消费者使用,在推动糖果产品的销售方面发挥了关键作用。 这些商店将来自不同制造商的各种各样的糖果品牌储存在一个屋顶下,为购买者提供了更大的选择。 此外,有组织的零售商所采取的精密的商品交易战略,如产品展示、有吸引力的包装和将糖果放在更高的货架上的眼睛,大大提高了它们的能见度。

另一个重要因素是有组织的零售店提供的消费者经验。 与传统渠道相比,商店内部的宽敞气氛和更容易的导航鼓励冲动购买糖果。 在节日季节或周末,家庭往往在超市花更多的时间,孩子们会积极地影响父母的购买决定。 在货架上看到最爱的糖果品牌会诱导他们投篮. 另外,大型零售旗下还经常开展各种促销活动,例如购买一个获得一个,折扣,在溢价糖果品牌上的组合报价,以吸引消费者. 在人们时间较少的繁忙城市中心,有组织的零售成为家庭以方便的方式购买糖果和其他必需品的一站式商店。

市场驱动力-扩大千年人口

美国的千年人口已成为一个有影响力的群体,推动了糖果市场的显著增长。 这一代人出生于1980年代初至1990年代中期,是人口最多的群体,占总人口的四分之一以上。 千年在社交媒体兴起期间成长, 他们寻求即时的满足和童年的怀旧感,通过像糖果这样的负担得起的治疗. 由于繁忙的生活方式,糖果比精心配制的甜点更受青睐,因为它们提供了便携的即时小吃选择.

有趣的是,与年长的几代人相比,千年人的牙齿更加甜美,并愿意用溢价的糖果进行挤压。 它们更加重视成分质量、自然性、可持续性,并十分关注与糖果品牌有关的道德和环境因素。 这导致了针对千年健康意识的无糖、素食、有机和公平贸易糖果等新品种的扩散。 对社交媒体的同行评审也在很大程度上影响其购买决定. 糖果公司通过创新的社交媒体营销运动不断与它们接触。

由于定居年龄推迟,千年者在诸如糖果等娱乐和自食其力的物品上花费的资金按比例增加。 她们可支配收入高,加上甜食习惯,与过去相比,人均糖果消费量更高。 随着千年人口的扩大和定居成为自己的家庭,他们与糖果的亲缘关系很可能在未来十年进一步巩固市场增长。

市场挑战:消费者的健康意识

美国糖果市场面临的主要挑战之一是消费者的健康意识不断提高。 近年来,我国肥胖症和糖尿病等相关健康问题显著上升. 这促使消费者对其摄入的食品更加谨慎. 许多消费者现在正在仔细阅读营养标签和产品成分清单,以尽量减少糖、卡路里和脂肪消费。 这种态度和购买行为的变化,对糖果制造商构成了严峻的挑战. 人们对糖果作为不健康的点心的负面看法得到加强。 制造商必须找到创新方法来解决消费者的健康关切,使其产品在某种程度上显得更有营养,同时又不损害口味。 它们可能必须考虑减少部分尺寸,使用天然甜味剂,并强调其他营养方面,以吸引有健康意识的购买者。 然而,提供口味对于不疏远忠诚的顾客也仍然很重要。 糖果制造商很难兼顾健康和宽容两方面。

市场机会:发展新产品类别

日益提高的健康意识为糖果制造商开发新产品类别提供了重大的市场机会。 与其将健康趋势视为一种威胁,不如将其扩大为符合消费者需求的类别,如无糖、富含蛋白质或小吃咬食,从而发挥自身优势。 在传统糖果过道之外进入新的消费场合也可开拓未开发的市场潜力。 例如,提供含蛋白质的糖果棒可以吸引运动员和体育运动员。 开发糖含量较低的糖果可能会战胜父母为儿童寻找更健康的选择。 制造商用天然原料制造的革新小吃,在支持方便的饮食选择的千年人中可以获得牵引力。 采用新的类别将使糖果公司能够在不断变化的偏好中保持相关性,并吸引现有的和新的客户寻求以健康为导向的报价。 这是糖果制造商扩大市场范围和吸引更多受众的机会,同时防止未来出现健康趋势。

关键参与者采用的关键制胜策略 美国 糖果市场

创新一直是美国市场上糖果公司最成功的策略之一. 例如,最大的糖果生产商Mars于1967年以其独特的双饼干设计推出了其巧克力品牌Twix. 它变得非常受欢迎,帮助火星大幅提升市场份额. 1980年代,赫希在其经典的"赫希之吻"品牌下推出了新的口味,如咖啡,巧克力薄荷等. 这些创新刺激了Kisses品牌的销售,该品牌此前一直在下降.

对新产品部分的关注也取得了良好效果。 例如,在2000年代,口香糖和糖果制造商Wrigley推出了一种名为Extra gum的新产品类别,其商标"Extra"咀嚼的感觉来自methol和冷却剂. 在十年之内,Extra口香糖成为了他们最畅销的品牌之一,在嚼口香糖类别中占有超过15%的市场份额.

向节假日大量推销已经收效。 例如,围绕万圣节,复活节和圣诞节,火星,赫希等玩家关注季节性主题糖果和包裹. 万圣节季节糖果在美国每年的糖果销售量中占20%以上。 通过提前2-3个月以节假日产品主导货架空间,这些公司能够带动销量.

利用伙伴关系也提高了销售量。 例如2010年,赫希与迪士尼合作开发并营销了"星球大战"和玛维尔超级英雄主题曲,围绕大电影发行. 这些有限的可收集物品吸引了新的消费者,增加了人均糖果消费。

注重电子商务是一项较新的战略。 例如,2015年,Sugarfina等在线第一品牌与主要在线零售商合作,并利用有针对性的数字广告和影响力营销来获得新客户. 它们每年增长300%,3年完全靠强势驱动。

分段分析 美国 糖果市场

按产品类型划分的透视:美国最喜爱的甜食

在产品类型方面,巧克力糖果贡献了2024年美国糖果市场64.2%的份额,这是由于美国人强烈喜欢巧克力. 巧克力糖由于其丰富的口味和舒适因素,吸引了所有年龄的消费者。 有几个特性有助于巧克力糖的分块领先位置.

巧克力作为免罪的宽恕 具有广泛的吸引力 与其他糖果不同,巧克力有时因其可可含量而被认为具有营养价值. 对可可的抗氧化剂的信仰鼓励了更频繁、社会上可接受的巧克力消费。 传统上以巧克力礼物为特色的主要节日也推动了需求。 季节性庆祝活动,如情人节,复活节,万圣节和圣诞节尖刺巧克力糖果每年销售.

品牌认可和产品创新推动了持续的需求。 象样的巧克力糖果品牌如M&M,Reese's,以及Hershey根据熟悉度,质量和新产品的扩展而主导糖果过道. 这些公司在研究中投入大量资金,以开发新颖的风味,填料,以及保持消费者兴趣的格式. 与流行电影,电视剧或运动员相关的新糖果品种保持了巧克力的顶尖销量.

巧克力糖继续发展到 零食场合 超过治疗。 被定位为营养能量增强或午后接送的产品正在弥合将巧克力视为偶尔放纵的观念。 巧克力条、包裹和咬伤会鼓励日常的巧克力消费, 这种扩大的使用环境保护巧克力糖果免受竞争压力,因为美国更喜欢甜.

透视按发行频道: 超市和超市: 购物店的一站店

在美国糖果市场的分销渠道中,超市和超市在2024年占有33.9%的份额. 它们的主导地位主要源于消费者购物行为,这种行为有利于在一个屋檐下一站式购买杂货和杂货。 Hypermarkets和超市根据客户的周支出比例,调整了广泛的糖果选择和冲动购货安排。

由于每周夜餐时间有限,许多美国人把杂货店的杂货店合并成一个大型杂货店,涵盖所有家庭必需品。 超市和超市是这些不可或缺的规定以及包括糖果在内的次要物品的合理第一选择。 在登记册和高流量地区展示的著名糖果为已经装满的货车提供了自发的糖果添加。 作为日常目的地,是推动购买冲动的因素。

随着大宗购货杂货的储蓄增加,超市和超市获得了对特产店的定价权。 它们利用节约成本和品种来削弱竞争对手对多用品糖果包的依赖。 专有的私人标签品牌同样提升了价值,加强了对以核心预算为主的购买者的商店忠诚度。 由于顾客出于必要已经来访,糖果为通过低成本的加价增加收入和扩大篮子提供了机会。

超市和超市通过有选择的品种表现出能够适应不断变化的消费者需求。 从方便项目到家庭大小品种和光环健康品牌等形式,使该频道成为多样化口味的一站式服务站. 产品深度大,战略位置大,每项交易的捕获率最大化。 这种优势是水泥超市和超市在美国糖果销售中所占的顶级份额。

竞争概览 美国 糖果市场

Perfetti Van Melle集团,火星公司,Mondelez国际公司,Hershey公司,August Storck KG

美国 糖果市场 领导者

- 佩菲蒂·范梅勒集团B.V.

- 火星公司

- 蒙德莱斯国际公司.

- 赫希公司

- 8月 斯托克 KG

美国 糖果市场 - 竞争对手

美国 糖果市场

(主要参与者主导)

(竞争激烈,参与者众多。)

最新发展 美国 糖果市场

- 2022年5月,巴佐冈糖果 Brands宣布推出名为Push Pop Gummy Pop-its的新Gummy创新.

- N 2022年3月,HARIBO为复活节宴会揭幕,并声称它肯定会取悦任何喜欢甜甜的粉丝. 公司宣布将带回"以前最喜爱的",同时推出两款新产品. 推出的产品包括Jelly Bunnies和Chick 'n' Mix.

- 2022年6月,马尔斯, 公司与Perfect Day公司合作,推出了有史以来首条无动物和爱土巧克力线,以CO2COA为品牌

- 2022年11月,费雷罗透露了自己的节日产品系列,并推出了从饼干到糖果到薄荷的产品. 公司通过从它的饼干品牌Keebler和Royal Dansk中添加季节性供货,扩大了供货范围.

美国 糖果市场 细分

- 按产品类型

- 巧克力糖( 巧克力糖 )

- 非巧克力糖类

- 按分发频道

- 便利储存

- 超市和超级市场

- 专家零售商

- 在线零售商

- 其他人员

您想要了解购买选项吗?本报告的各个部分?

常见问题 :

阻碍美国糖果市场增长的关键因素是什么?

消费者的保健意识和对健康小吃越来越偏好是阻碍美国糖果市场增长的主要因素。

驱动美国糖果市场增长的主要因素是什么?

有组织的零售部门的增长和千年人口的扩大是推动美国糖果市场的主要因素。

美国糖果市场的主要产品类型是什么?

主要产品类型部分是巧克力糖.

在美国糖果市场运营的主要角色是哪些?

Perfetti Van Melle集团、Mondelez国际公司、火星公司、Hershey公司、Ferrero、August Storck KG、Jelly Belly糖果公司、Spangler糖果公司、Ste's Candy 商店股份有限公司是主要角色.

美国糖果市场的CAGR是什么?

美国糖果市场的CAGR预计将在2024-2031年达到3.5%.