United States Candy Market Size - Analysis

The United States Candy Market is estimated to be valued at USD 25.02 Bn in 2025 and is expected to reach USD 32.27 Bn by 2032, growing at a compound annual growth rate (CAGR) of 3.7% from 2025 to 2032.

The candy market in the United States has been witnessing positive trends over the past few years. There has been a rising demand for innovative candy products with exciting flavors and attractive packaging. Moreover, the increasing social media marketing campaigns by leading candy brands are helping them target young consumers more effectively. Several companies are also offering sugar-free and organic candy options to appeal to health-conscious consumers. While mass merchandisers continue to hold the major share, sales channels like e-commerce and convenience stores are emerging strongly. If this growth trajectory sustains, the candy market has potential to surpass $31 Billion by 2032 in the United States.

Market Size in USD Bn

CAGR3.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.7% |

| Market Concentration | Medium |

| Major Players | Perfetti Van Melle Group B.V., Mars, Incorporated, Mondelez International, Inc., The Hershey Company, August Storck KG and Among Others |

please let us know !

United States Candy Market Trends

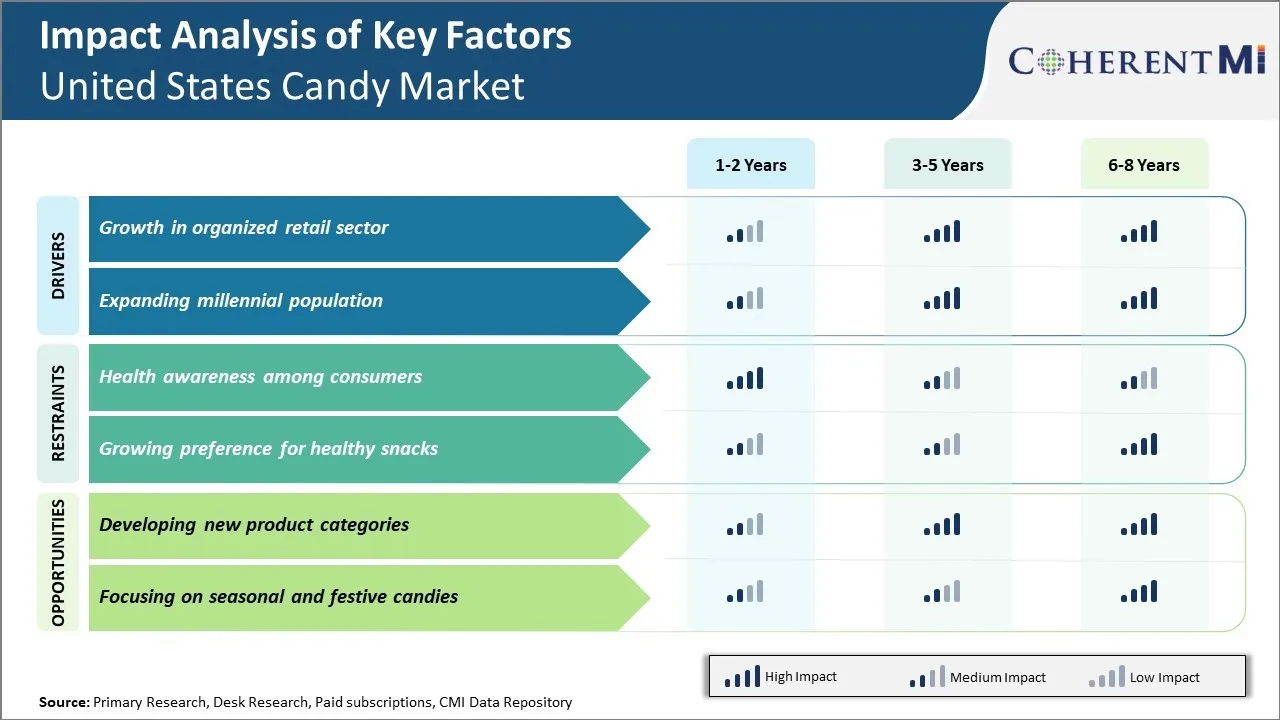

Market Driver - Growth in organized retail sector

The candy market in United States has been experiencing steady growth over the past few years driven majorly by increasing penetration of organized retail across various regions. The organized retail channels which include supermarkets, hypermarkets, discount stores etc have played a pivotal role in boosting sales of candy products by making them easily accessible to consumers. These stores stock wide variety of candy brands from different manufacturers under one roof which offers greater choice to buyers. Moreover, sophisticated merchandising strategies adopted by organized retailers such as product displays, attractive packaging and placement of candy items at taller shelves at eye level has enhanced their visibility greatly.

Another important factor is the consumer experience provided by organized retail stores. Spacious ambience and easier navigation within stores compared to traditional channels encourage impulse buying of candy. During festive seasons or on weekends families tend to spend more time at supermarkets where kids actively influence parents' buying decisions. Seeing favorite candy brands on shelves tempt them to drop into basket. Also, large retail banners regularly run various promotional activities such as buy one get one, discounts, combo offers on premium candy brands to attract consumers. In busy urban centers where people have less time, organized retail serves as a one-stop shop for households to purchase candy along with other essential items in a convenient manner.

Market Driver - Expanding millennial population

The millennial population in United States has emerged as an influential cohort driving significant growth in the candy market. This generation born between early 1980s to mid-1990s is the largest population cohort and accounts for over one-fourth of the total population. Millennials grew up during the rise of social media and are highly value conscious yet open to experimentation. They seek instant gratification and a sense of nostalgia from childhood through affordable treats like candies. Due to busy lifestyles, candies are preferred over elaborate desserts as they offer portable on-the-go snacking options.

Interestingly, millennials have a much sweeter tooth compared to older generations and are willing to splurge on premium candies. They attach greater importance to ingredient quality, naturalness, sustainability and care much about ethical and environmental factors associated with candy brands. This has led to proliferation of new varieties such as sugar-free, vegan, organic and fair-trade candy lines targeted at health awareness of millennials. Peer reviews on social media also influence their purchase decisions to a large extent. Candy companies constantly engage with them through innovative social media marketing campaigns.

Due to delayed age of settling down, millennials spend proportionately more on recreational and self-indulgent items like candies. Their high disposable incomes combined with sweet eating habits translates to greater per capita candy consumption compared to past. As the millennial population expands and settles into families of their own, their affinity towards candies is likely to solidify the market growth even further over the next decade.

Market Challenge: Health Awareness Among Consumers

One of the major challenges facing the United States candy market is the growing health awareness among consumers. In recent years, there has been a significant rise in obesity and related health issues such as diabetes in the country. This has pushed consumers to become more cautious about the food products they intake. Many consumers are now carefully reading nutrition labels and ingredients lists of products to minimize sugar, calories and fat consumption. This change in attitude and buying behavior poses a tough challenge for candy manufacturers.

The negative perception around candy being an unhealthy snack has been strengthened. Manufacturers will have to find innovative ways to address consumers' health concerns and make their products appear more nutritious to some degree without compromising on the taste. They may have to consider reducing portion sizes, using natural sweeteners and highlighting other nutritional aspects to appeal to health-conscious buyers. However, delivering on taste also remains important to not alienate loyal customers. It will be a difficult balancing act for candy makers to cater to both aspects of health and indulgence.

Market Opportunity: Developing New Product Categories

The growing health awareness provides a major market opportunity for candy manufacturers to develop new product categories. Instead of seeing health trends as a threat, they can leverage it to their advantage by expanding into categories aligned with consumer needs such as sugar-free, protein-rich or snack bites. Entering new occasions of consumption outside the traditional candy aisle can also open up untapped market potential. For instance, offering candy bars with protein could attract athletes and gym-goers.

Developing candy with lower sugar content may win over parents looking for healthier options for children. Manufacturers innovating snack bites made from natural ingredients can gain traction among millennials who favor on-the-go convenient eating options. Introducing new categories will allow candy companies to stay relevant amid changing preferences and attract both existing as well as new customers who seek wellness-oriented offerings. It is an opportunity for candy makers to expand their market reach and appeal to a wider audience while future-proofing against health trends.

Key winning strategies adopted by key players of United States Candy Market

Innovation has been one of the most successful strategies for candy companies in the US market. For example, Mars, the largest candy producer, launched its chocolate brand Twix in 1967 with its unique dual cookie design. It became hugely popular and helped Mars increase its market share significantly. In the 1980s, Hershey's launched new flavors under its classic Hershey's Kisses brand like coffee, chocolate mints etc. These innovations boosted sales of the Kisses brand that had been declining previously.

Focus on new product segments has also worked well. For example, in the 2000s, gum and candy maker Wrigley launched a new product category called Extra gum with its trademark "Extra" chewing feeling from menthol and cooling agents. Within a decade, Extra gum became one of their best-selling brands capturing over 15% market share in the chewing gum category.

Marketing heavily towards holidays has paid off. For example, around Halloween, Easter and Christmas, Mars, Hershey's and other players focus on seasonally themed candies and packages. Halloween season candies contribute over 20% of yearly candy sales in the US. By dominating shelf space with holiday products 2-3 months in advance, these companies are able to drive volume sales.

Leveraging partnerships has also boosted sales volumes. For example, in 2010, Hershey's partnered with Disney to develop and market Star Wars and Marvel superhero themed chocolates around big movie releases. These limited-edition collectible items attracted new consumers and increased per capita candy consumption.

Focus on e-commerce is a more recent strategy. For example, online-first brands like Sugarfina partnered with major online retailers in 2015 and leveraged targeted digital ads and influencer marketing to get new customers. They grew 300% annually for 3 years driven solely by strong.

Segmental Analysis of United States Candy Market

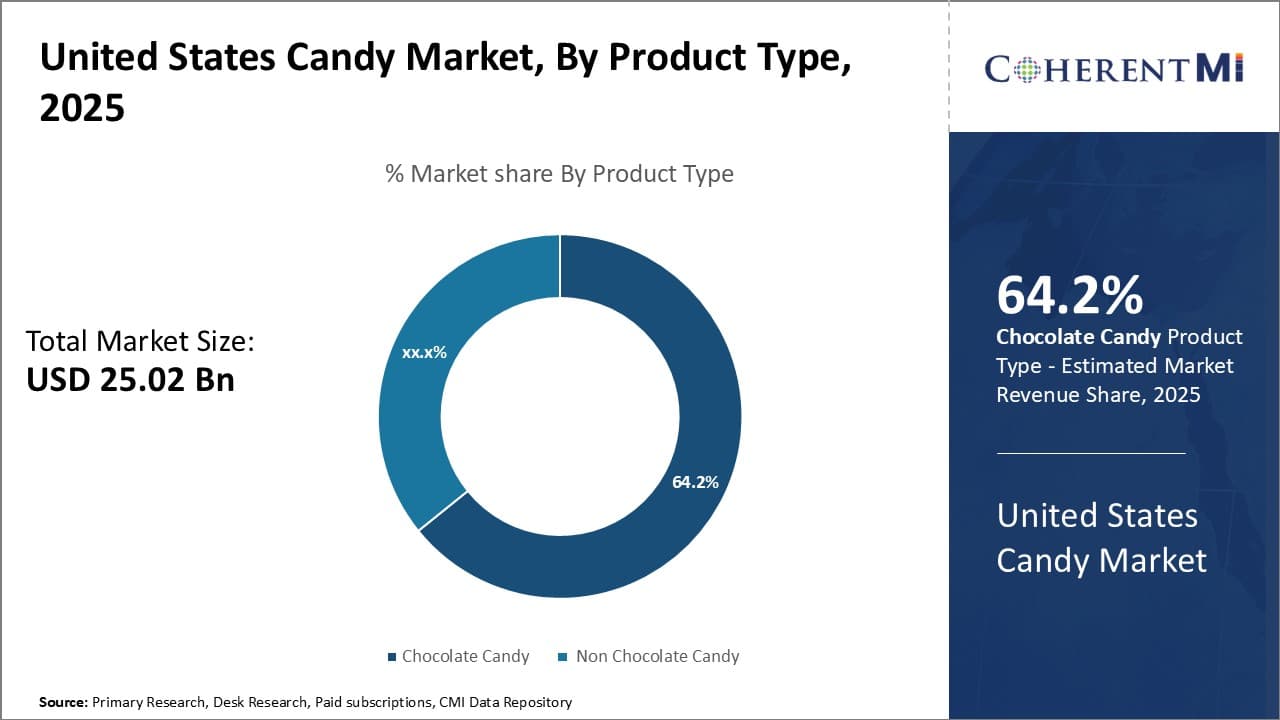

Insights by product type: America's Favorite Sweet Treat

Insights by product type: America's Favorite Sweet Treat

In terms of product type, chocolate candy contributes the 64.2% share of the United States candy market in 2025, owing to Americans' strong preference for chocolate. Chocolate candy appeals to consumers of all ages due to its rich flavor and comfort factor. Several characteristics contribute to chocolate candy's segment-leading position.

Chocolate has widespread appeal as a guilt-free indulgence. Unlike other candies, chocolate is sometimes perceived as holding nutritional value due to its cocoa content. Beliefs about cocoa's antioxidants encourage more frequent and socially acceptable chocolate consumption. Demand is bolstered by major holidays that traditionally feature chocolate gifts. Seasonal celebrations like Valentine's Day, Easter, Halloween and Christmas spike chocolate candy sales each year.

Brand recognition and product innovation fuel ongoing demand. Iconic chocolate candy brands like M&Ms, Reese's, and Hershey's dominate candy aisles based on familiarity, quality and new product extensions. These companies invest heavily in research to develop novel flavors, fillings, and formats that maintain consumers' interest. New candy varieties tied to popular movies, TV shows or athletes keep chocolate top-of-mind.

Chocolate candy continues advancing into snacking occasions beyond treats. Products positioned as nutritional energy boosts or midday pick-me-ups are bridging perceptions of chocolate as an occasional indulgence. On-the-go chocolate bars, packets and bites encourage habitual, everyday chocolate consumption unrelated to holidays. This widening of use contexts protects chocolate candy from competitive pressures as America's preferred sweet.

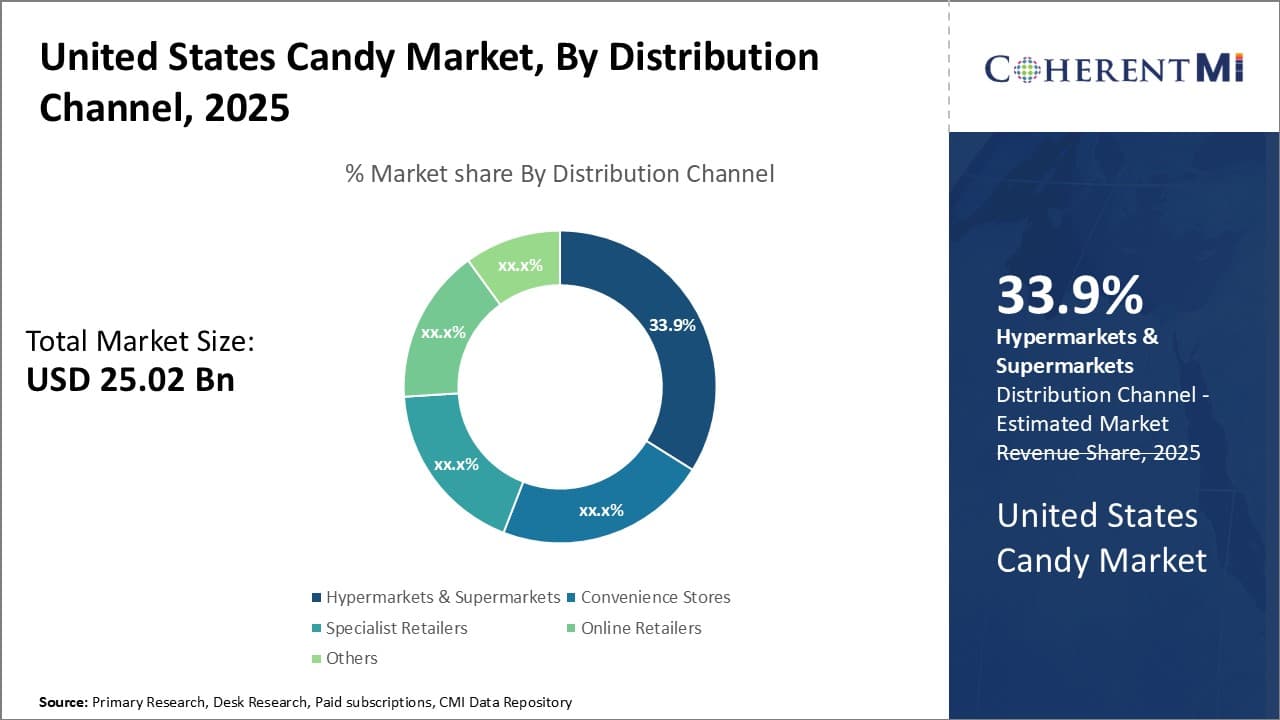

Insights by distribution channel: Hypermarkets & Supermarkets: Grocery Shopping's One-Stop Shop

Among distribution channels in the United States candy market, hypermarkets and supermarkets hold the 33.9% share in 2025. Their dominance stems primarily from consumer shopping behaviors that favor one-stop purchases of both groceries and incidental items under one roof. Hypermarkets and supermarkets tailor their extensive candy selections and impulse-buy placements to capture a share of customers' weekly spend.

Due to time constraints on weeknight meals, many Americans consolidate errands into one major grocery trip covering all household essentials. Hypermarkets and supermarkets establish themselves as the logical first choice for these indispensable provisions as well as secondary items including candy. Prominent candy displays at registers and high-traffic areas offer spontaneous candy additions to already-filled carts. Being a daily destination addresses push factors driving impulse purchases.

As the savings of bulk buying groceries grows, hypermarkets and supermarkets gain pricing power over specialty outlets. They leverage cost-savings and variety to undercut competitors on multi-item candy packs. Proprietary private label brands likewise boost value and reinforce store loyalty for core budget-minded shoppers. With customers already visiting out of necessity, candy presents an opportunity to increase revenue and expand baskets through low-cost additions.

Hypermarkets and supermarkets demonstrate able adaptation to evolving consumer demands through selective assortments. Formats ranging from convenience items to family-size varieties and halo health brands make the channel a one-stop-shop for a diversity of tastes. Extensive product depth and strategic placement maximize capture rates on each transaction. Such advantages cement hypermarkets and supermarkets' top share in United States candy distribution.

Competitive overview of United States Candy Market

Perfetti Van Melle Group B.V., Mars, Incorporated, Mondelez International, Inc., The Hershey Company, August Storck KG

United States Candy Market Leaders

- Perfetti Van Melle Group B.V.

- Mars, Incorporated

- Mondelez International, Inc.

- The Hershey Company

- August Storck KG

United States Candy Market - Competitive Rivalry

United States Candy Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Candy Market

- In May 2022, Bazooka Candy Brands announced the launch of a new gummy innovation called Push Pop Gummy Pop-its.

- n March 2022, HARIBO unveiled a line-up of Easter treats and claimed that it is sure to please any fan of gummy candy. The company announced that it was bringing back 'previous favourites', along with debuting two new products. The launched products include Jelly Bunnies and Chick 'n' Mix.

- In June 2022, Mars, Incorporated, in partnership with Perfect Day, Inc., launched its first-ever line of animal-free and earth-friendly chocolate, branded as CO2COA

- In November 2022, Ferrero revealed its holiday product lineup and launched products ranging from cookies to confectionery to mints. The company expanded its offerings with the addition of seasonal offerings from its cookie brands Keebler and Royal Dansk.

United States Candy Market Segmentation

- By Product Type

- Chocolate Candy

- Non Chocolate Candy

- By Distribution Channel

- Convenience Stores

- Hypermarkets & Supermarkets

- Specialist Retailers

- Online Retailers

- Others

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.

Frequently Asked Questions :

How big is the United States Candy Market?

The United States Candy Market is estimated to be valued at USD 25.02 in 2025 and is expected to reach USD 32.27 Billion by 2032.

What are the major factors driving the United States Candy Market growth?

The growth in organized retail sector and expanding millennial population are the major factor driving the United States Candy Market.

Which is the leading Product Type in the United States Candy Market?

The leading Product Type segment is Chocolate Candy.

Which are the major players operating in the United States Candy Market?

Perfetti Van Melle Group B.V., Mondelez International, Inc., Mars, Incorporated, The Hershey Company, Ferrero, August Storck KG , Jelly Belly Candy Company, Spangler Candy Company, See's Candy Shops, Inc. are the major players.

What will be the CAGR of the United States Candy Market?

The CAGR of the United States Candy Market is projected to be 3.7% from 2025-2032.